[ad_1]

Zeek Rewards’ Robert Craddock has reemerged because the proprietor, CEO and President of NFT Rewards.

Zeek Rewards’ Robert Craddock has reemerged because the proprietor, CEO and President of NFT Rewards.

NFT Rewards Crew is an MLM crypto Ponzi mixed with promoting of digital shares. Earlier than we dive deeper into that although, it’s vital to recap on who Robert Craddock is.

Robert Craddock (proper) made a reputation for himself as a part of Zeek Rewards’ “Zeek Squad”.

Robert Craddock (proper) made a reputation for himself as a part of Zeek Rewards’ “Zeek Squad”.

Zeek Squad was a part of Zeek Rewards’ compliance efforts, headed up by Gregory Caldwell.

With Zeek Rewards after all being a $900 million Ponzi scheme, what “compliance” boiled right down to was threatening to sue anybody who didn’t take down incriminating proof.

Ultimately the Zeek Squad’s shenanigans would develop to anybody who criticized Zeek Rewards.

Craddock additionally ran ZTeamBiz and used it to promote bogus results in Zeek Rewards buyers.

Leads have been required to dump penny public sale bids onto as a part of Zeek Rewards’ Ponzi mannequin.

After the SEC shut down Zeek Rewards in 2012, Craddock repurposed ZTeamBiz to spearhead the standard “however it could’t be a rip-off!” denials.

Craddock made an honest grift of it to, convincing buyers handy over hundreds of {dollars}. This cash was alleged to go in the direction of authorized protection fund however wound up solely defending a bunch of 12 prime net-winners.

Whereas all of this was happening, Craddock was planning to funnel Zeek Rewards victims into a brand new Ponzi scheme. Seems the ZTeamBiz authorized fund ruse allowed Craddock to gather the e-mail addresses of numerous buyers.

Sadly for Craddock, the plans got here to an finish in November 2013 after the Zeek Rewards Receivership obtained in contact.

A 12 months later particulars of Craddock trying to promote the e-mail addresses he’d collected to different Ponzi schemes emerged.

In March 2015 Craddock was indicted for wire fraud. Sadly the costs had nothing to do along with his Zeek Rewards Ponzi scamming.

The fees associated to Craddock submitting bogus invoices, to assist claims submitted to the Deepwater Horizon rig explosion compensation fund.

In June 2015 Craddock pled responsible. He was sentenced to 6 months in jail in October 2015.

As a net-winner of the Zeek Rewards Ponzi scheme, Craddock is believed to have quietly settled with the Zeek Rewards Receivership. Apart from that, Craddock was by no means held accountable for his Zeek Rewards associated conduct.

So what’s NFT Rewards?

NFT Rewards’ main web site area (“nftrewards.biz”), was privately registered on August sixth, 2022.

In early Could, presumably late April, Robert Craddock started sending out communications pertaining to NFT Rewards and NFT Pay Professional. Observe that insiders have been doubtless onboarded effectively prematurely.

On the advertising aspect of issues, NFT Rewards and NFT Pay Professional are being pitched as a mixture of penny auctions, NFTs and the Metaverse.

Yeah, that’s the identical penny public sale mannequin Zeek Rewards used a decade in the past.

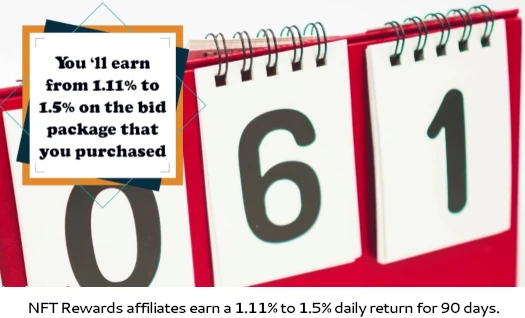

Prefer it was in Zeek Rewards, penny auctions are only a entrance for an “as much as” 1.5% a day funding scheme:

NFT Rewards associates put money into $50 to $10,000 bid packages:

To qualify for the each day 1.1% to 1.5% ROI, NFT Rewards associates should place a sure variety of bids within the firm’s penny auctions every day.

NFT Rewards’ penny auctions are for NFTs. Initially bought by the corporate, they are often relisted by affiliate buyers if received at public sale.

NFT Rewards market demonstrates a novel platform that promotes customers to successfully purchase, promote, bid, and create NFTs.

It’s a place the place consumers and sellers meet and contain within the buying and selling of crypto property.

NFT Rewards’ bid packages expire after 90 days, after which reinvestment is required to proceed incomes.

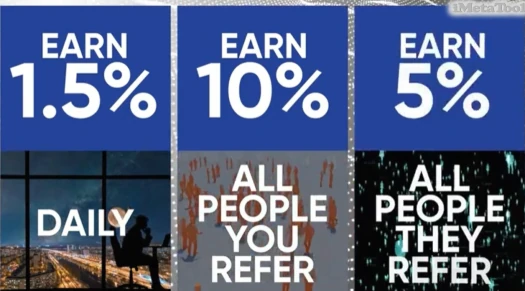

NFT Rewards pays out referral commissions on invested funds throughout two ranges:

- degree 1 (personally recruited associates) – 10%

- degree 2 – 5%

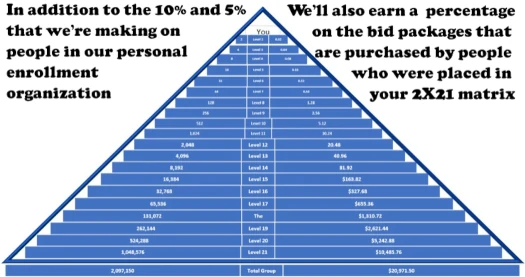

There’s additionally a company-wide matrix, which pays out further percentages on NFT Rewards bid bundle funding:

Particular payouts throughout every matrix degree should not supplied.

NFT Rewards solicits funding and runs its MLM alternative within the cryptocurrency tether (USDT).

The cash aspect of NFT Rewards is dealt with by means of NFT Pay Professional (“nftpaypro.com”), arrange on January twenty fifth, 2023.

NFT Rewards has a each day earnings cap of 20,000 USDT, though it’s unclear whether or not that is simply the MLM commissions or if it contains the each day ROI.

Clearly so far as a securities providing goes, NFT Rewards is a spin on Zeek Rewards’ penny public sale Ponzi mannequin.

Whereas in Zeek Rewards bids needed to be dumped on bogus accounts to qualify for returns, in NFT Rewards Craddock has buyers use the bids to drive up public sale costs.

NFT Rewards’ bids are prone to be out there to buy by retail clients, however as we noticed with Zeek Rewards, that quantity is dwarfed by affiliate funding quantity.

This corresponds with NFT Rewards’ each day return withdrawals being funded by affiliate invested, creating the identical closed-loop funding scheme Zeek Rewards was shut down for.

In an try to deceive shoppers concerning the Zeek Rewards Ponzi scheme, thus inferring it and NFT Rewards’ Ponzi mannequin is reputable, Zeek Rewards is referenced in NFT Rewards’ advertising materials.

In a single such video, believed to be narrated by Jeff Evers, Evers states;

(Craddock) knew all about that penny public sale program of 2011.

In truth he informed me he mounted the issues they’d. He mentioned one of many points that they’d was, they’d a lot cash going by means of their checking account, that it attracted the eye of sure regulators who labeled it a Ponzi scheme, with the intention to seize their cash.

Robert mentioned, “Due to superior know-how that didn’t exist again then, NFT Rewards is programmed as a sensible contract on the blockchain.” Which signifies that there aren’t any financial institution accounts to grab.

This ominous warning shouldn’t be taken frivolously by potential NFT Rewards’ buyers. It’s additionally baloney.

US regulators are definitely capable of claw again funds stolen by means of MLM cryptocurrency scams.

NFT Rewards advertising additionally instantly references the SEC:

NFT Rewards is doing every thing by the e-book. The very first thing Robert did was, he registered the corporate with the SEC.

A search of the SEC’s Edgar database reveals Robert Craddock has included NFT Rewards Biz in Florida.

Then, on January twentieth, 2023, Craddock filed a Type D Discover of Exempt Providing of Securities for NFT Rewards Biz with the SEC.

Within the submitting, Craddock cites Guidelines 506(c) as the rationale behind NFT Rewards Biz being exempt from US securities legislation.

Rule 506(c) states;

Rule 506(c) permits issuers to broadly solicit and usually promote an providing, supplied that:

-all purchasers within the providing are accredited buyers

-the issuer takes cheap steps to confirm purchasers’ accredited investor standing and

-certain different circumstances in Regulation D are glad

The issue right here is NFT Rewards is pitching a passive 1.5% a day ROI to most people. The exemptions in Rule 506(c) clearly don’t apply.

In abstract, NFT Rewards’ advertising declare that it’s “registered with the SEC” is deceptive in that its securities providing is in actual fact not registered with the SEC.

Craddock is attempting to drag a quick one on the SEC, by claiming NFT Rewards’ securities providing is exempt from US securities legislation. This declare is thru a rule NFT Rewards’ securities providing doesn’t qualify for an exemption underneath.

Moreover, Craddock’s SEC submitting pertains to fairness – which I consider corresponds to the digital shares scheme. It has nothing to do with the core of NFT Rewards’ enterprise – the 1.5% a day passive funding scheme.

NFT Rewards’ 1.5% a day passive funding scheme hasn’t been registered with or disclosed to the SEC.

As per a communication despatched out to NFT Rewards buyers on Could eighth, 2023, Craddock claims he’s pitching his Ponzi scheme at “an older age bracket”.

With NFT Rewards about able to launch, we’re closing in on about 20,000 individuals, most of whom are in an older age bracket. As soon as we go reside, we count on that quantity to extend to effectively over 200,000 individuals inside a 60-day time interval.

Within the communication, Craddock additionally makes an attempt to handle unregistered securities;

We’re creating a possibility for you and we would like it to be long run.

If we didn’t register with the Securities and Trade Fee, we might be topic to promoting unregistered securities, and we don’t need to do something fallacious or be accused of doing so.

As beforehand mentioned, Craddock’s SEC submitting doesn’t disclose NFT Rewards’ each day returns passive funding scheme to the SEC.

That is NFT Rewards’ mentioned funding scheme, as disclosed in Craddock’s Could eighth investor communication;

While you purchase a bid bundle and the public sale is reside, we require you to make bids every day.

For instance, when you have a $1,000 bid bundle, you’re required to make use of the bids over a 90-day interval.

When utilizing the bids on the each day auctions you earn as much as 1.5% each day based mostly on the Bid bundle worth, for a 90-day interval.

And such to the extent Craddock has requested an exemption for NFT Rewards’ share scheme, the utilized for exemption doesn’t apply.

If you’re one of many people that can obtain shares as a participant in one in every of our contests, or you’ve gotten bought shares as a part of our non-public placement providing, otherwise you intend to buy shares earlier than this provide expires, you may really feel assured the shares ought to exceed $375.00 per share someday this 12 months.

For somebody having 2,000 shares, that may be an estimated $750,000 US {Dollars}.

Somebody paying $1,000 for shares now may doubtlessly see as a lot as $150,000 earlier than the top of this 12 months.

In an try to get round US securities legislation, Craddock trots out baloney concerning the metaverse.

What will not be clear to some is how this platform will resolve plenty of points as it’s acquired and merged into the Metaverse.

The Metaverse is an unregulated platform, which protects towards unwarranted assaults by regulators.

To be clear, securities fraud stays securities fraud whatever the platform its dedicated on.

I don’t have an NFT Rewards launch date however as per Craddock’s cited Could eighth investor communication;

Shortly after launch, we can be asserting a Submit Launch Gathering in Las Vegas, Nevada this 12 months.

Paul Burks, founder and CEO of Zeek Rewards, was sentenced to 14 years in jail in 2017.

Via NFT Rewards, it appears Craddock is eager to observe in Burks’ footsteps.

[ad_2]

Supply hyperlink