[ad_1]

Blockchain Capital operates within the cryptocurrency MLM area of interest.

Blockchain Capital operates within the cryptocurrency MLM area of interest.

The corporate gives a company deal with in St. Vincent and the Grenadines on its web site.

The deal with belongs to Wilfred Worldwide Providers, who present “Worldwide Enterprise Formation” (shell corporations) and a digital workplace deal with service.

Evidently Blockchain Capital exists in St. Vincent and the Gernadines in title solely.

Blockchain Capital truly seems to be run from Russia.

Supporting that is Kazan, Russia offered as a posting location on Blockchain Capital’s official Twitter profile (lit: Казань, Россия).

Blockchain Capital has a VK profile. vKontakte is a Russian social media Fb clone.

Advertising and marketing movies on Blockchain Capital’s official YouTube channel are primarily in… you guessed it, Russian:

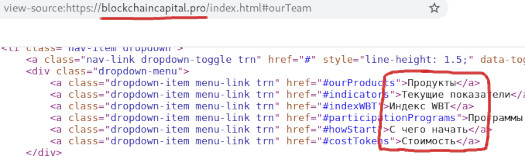

Blockchain Capital’s web site source-code can also be riddled with Russian:

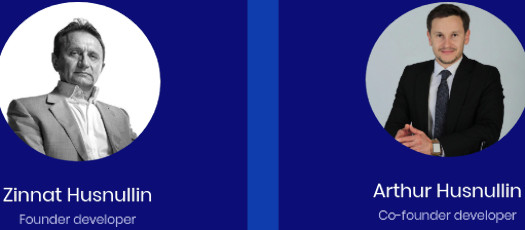

Heading up Blockchain Capital are co-founders Zinnat and Arthur Husnullin.

No details about both Husnullin is offered on Blockchain Capital’s web site.

I went searching for impartial data and got here up clean. This could possibly be a language barrier however neither Zinnat or Arthur Husnullin seem to exist exterior of Blockchain Capital.

Each Husnullins function in Blockchain Capital’s advertising and marketing movies.

Arthur appears to know what he’s speaking about however Zinnat comes throughout as a Boris CEO.

Blockchain Capital’s web site area (“blockchaincapital.professional”), was privately registered in October 2017.

As all the time, if an MLM firm will not be overtly upfront about who’s working or owns it, assume lengthy and onerous about becoming a member of and/or handing over any cash.

Blockchain Capital’s Merchandise

Blockchain Capital has no retailable services or products, with associates solely capable of market Blockchain Capital affiliate membership itself.

Blockchain Capital’s Compensation Plan

Blockchain Capital associates put money into WBT and BCT tokens on the expectation of a passive return.

Funds may be invested one-time or periodically over fifteen particular person deposits.

Commissions are paid when Blockchain Capital associates recruit new associates who additionally make investments.

Blockchain Capital Affiliate Ranks

There are eight affiliate ranks inside Blockchain Capital’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Agent – join and put money into WBT and/or BCT tokens

- Silver Agent – persuade others to take a position $5000

- Supervisor – persuade others to take a position $35,000

- Group Supervisor – persuade others to take a position $150,000

- Area Supervisor – persuade others to take a position $500,000

- Director – persuade others to take a position $2,500,000

- Group Director – persuade others to take a position $5,000,000

- Area Director – persuade others to take a position $10,000,000

Direct Commissions

Blockchain Capital pays a 12.67% fee on funds invested in WBT and BCT tokens.

That is both paid upfront if a single-deposit funding is used, or tiered down with the fifteen deposit cost mannequin.

Commissions paid if the fifteen deposit mannequin is used are as follows:

- Brokers obtain 12% on the primary deposit, 8% on the second deposit, 5% on the third deposit, 2% on the fourth deposit and 1% on the fifth deposit

- Silver Brokers obtain 16% on the primary deposit, 10% on the second deposit, 6% on the third deposit, 3% on the fourth deposit and a pair of% on the fifth deposit

- Managers obtain 20% on the primary deposit, 12% on the second deposit, 8% on the third deposit, 4% on the fourth deposit and a pair of.5% on the fifth deposit

- Group Managers obtain 25% on the primary deposit, 15% on the second deposit, 10% on the third deposit, 5% on the fourth deposit and three% on the fifth deposit

- Area Managers obtain 30% on the primary deposit, 18% on the second deposit, 12% on the third deposit, 6% on the fourth deposit and three.5% on the fifth deposit

- Administrators obtain obtain 35% on the primary deposit, 21% on the second deposit, 14% on the third deposit, 7% on the fourth deposit and 4% on the fifth deposit

- Group Administrators obtain 40% on the primary deposit, 24% on the second deposit, 16% on the third deposit, 8% on the fourth deposit and 4.5% on the fifth deposit

- Area Administrators obtain 50% on the primary deposit, 30% on the second deposit, 20% on the third deposit, 10% on the fourth deposit and 5% on the fifth deposit

Notice that no referral commissions are paid from the sixth deposit onward.

The MLM aspect of the compensation sees Blockchain Capital pay out the Area Director fee on all periodic commissions paid out.

That is paid out because the distinction between the referring affiliate’s rank and that of their upline.

E.g. a Area Director will earn a 15% override on the primary cost fee a Director generates (50% – 35% = 15%).

There doesn’t seem like an override paid on the one cost 12.5% fee. If there’s one, it’s not talked about in Blockchain Capital’s compensation materials.

Becoming a member of Blockchain Capital

Blockchain Capital affiliate membership prices aren’t disclosed.

Blockchain Capital fail to supply the present WBT or BCT token worth on their web site.

Examples within the firm’s whitepaper cite funding funds of $100 made periodically.

Conclusion

Blockchain Capital markets itself as

a subsequent era banking & funding companies platform.

Blockchain Capital essentially is a straightforward Ponzi factors scheme, buried in mountains of crypto waffle (aren’t all of them).

WBT and BCT are ERC-20 shit tokens that took 5 minutes to arrange at little to no value.

Blockchain Capital represents the worth of WBT is pegged to the worth of different cryptocurrencies.

Wealth Builder Token (WBT) is an index token that repeats the motion (volatility) of the TOP 20 (by capitalization) of altcoins within the cryptocurrency market. The WBT token displays the price of every cryptocurrency included in it and averages the entire value.

The worth of the WBT token is expressed in {dollars} and modifications each day.

A speculative token the worth of which is decided by the worth of different speculative tokens.

Why does this must exist?

As a result of blockchain. Now hand over your cash please.

Supposedly WBT’s inner worth is about by way of a smart-contract algorithm, which is senseless seeing because the “TOP 20” altcoins are topic to vary at any time.

You’ll be able to see this in motion on Blockchain Capital’s web site, the place a “portfolio” of altcoins is offered:

A variety of the listed cryptocurrencies might need been high 20 when the chart was drawn up, however that’s not the case.

But that is the data Blockchain Capital are presenting to potential buyers.

Not withstanding there is no such thing as a proof of WBT’s inner worth being truly primarily based on something apart from what Blockchain Capital units it at.

Oh and a smart-contract can also be used to subject commissions:

Blockchain Capital LTD maintains relationships with clients on the premise of a sensible contract for the Ethereum blockchain.

All operations with belongings develop into completely clear: every consumer of the platform sees how funds are distributed.

Aside from permitting Blockchain Capital to rattle off some extra crypto bro buzzwords, that is meaningless with respect to due-diligence.

As to BCT, I don’t know why it exists. Ditto TSA, which is one other token talked about in Blockchain Capital’s advertising and marketing materials.

**crypto bro converse suicide set off warning**

The corporate was included within the record of profitable ICO, as a result of it was actually capable of promote the product on the collected funds and fulfilled all guarantees to buyers.

After the ICO, the Blockchain Capital staff launched a service for automated administration of digital belongings of its shoppers and developed applicable applied sciences primarily based on a sensible contract.

On the identical time, an index token WBT appeared, which features a portfolio of the primary crypto-currencies. In July 2018, the undertaking staff launched SCO (secondary coin providing) as a way to increase into worldwide markets and obtain excessive liquidity of TSA tokens.

On August 1, 2018, 20.8 million BT 2.0 tokens had been issued to draw new non-borrowed funds.

Customers who purchased BCT tokens earlier than August 31, 2018, obtained as a bonus the chance to double the variety of their tokens.

The price of TSA 2.0 tokens till August 31, 2018 was $ 2.1, then from September to October $ 5, at present, TSA 2.0 tokens are traded at a value of $ 7.5.

After the withdrawal of the BCT 2.0 token on the nationwide inventory exchanges, a pointy improve of 3-5 occasions is forecasted, and with well timed withdrawal to the worldwide inventory alternate, the worth can improve tenfold from the preliminary value.

Should you’re questioning in regards to the “2.0”, it’s as a result of WBT has already collapsed as soon as.

Within the interval from October 2017 to February 2018, ICO was efficiently applied to launch the platform. Throughout the ICO, the primary BCT funding tokens (within the quantity of 200,000) had been issued, which gave the suitable to a share within the firm’s earnings.

On August 1, 2018, the discharge of 20.8 million BCT 2.0 tokens to draw new funds came about.

To show any of what they’re saying with respect to exterior worth, Blockchain Capital wants to supply regulators and buyers with audited monetary studies.

They don’t do that, which is a significant crimson flag in and of itself.

One other crimson flag is new funding being the one verifiable income coming into Blockchain Capital.

No matter how the inner worth of WBT and BCT is about, withdrawals by way of the corporate’s inner alternate are funded by way of new funding.

This makes Blockchain Capital a Ponzi scheme.

Referral commissions are additionally tied to new funding, including a pyramid layer to the scheme.

Indicative of not desirous to be pursued by the SEC, probably the most energetic securities regulator on the planet, right here’s Blockchain Capital’s ultimate crimson flag:

You aren’t allowed to buy BCT / WBT tokens if you’re a US citizen or a everlasting US resident.

By buying BCT / WBT tokens, you acknowledge and warrant that you’re not a certified worker of an organization that’s owned by US residents or US everlasting residents.

Learn that as “We’re working a Ponzi scheme and don’t need the regulatory warmth scamming People brings with it”.

Russia for his or her half doesn’t care about MLM crypto Ponzi schemes, as long as Russians aren’t getting scammed. And even then the percentages of Russian authorities doing something is fairly low.

Know of any Russian regulatory efforts to curb MLM cryptocurrency fraud? Yeah, me neither.

As with all MLM Ponzi schemes as soon as affiliate recruitment dries up so too will new funding.

This may go away Blockchain Capital unable to pay withdrawal requests by way of their inner alternate.

Wanting launching WBT 3.0 and restarting their Ponzi as soon as once more (infinite forks as a result of blockchain), in the end the vast majority of Blockchain Capital buyers can be left with a loss.

The title “Blockchain Capital” additionally belongs to an current US agency, who haven’t taken kindly to imitators.

Late final 12 months Blockchain Capital, a Californian firm, went after Blockchain Capital Advertising and marketing, a Florida firm, for trademark infringement.

Blockchain Capital Advertising and marketing responded by dissolving itself, thus ending the lawsuit.

Will Blockchain Capital go after a Russian Ponzi scheme bearing the identical title? Most likely not.

The US Blockchain Capital has been round since 2013. The Russian Ponzi scheme claims it was launched in late 2017.

Like MLM crypto fraud, its not like Russian authorities give a crap about trademark infringement both.

[ad_2]

Supply hyperlink