In case your financial institution lately contacted you to let you know that your account has been closed or your utility for a checking account has been denied, that is normally a results of a unfavourable report coming from an organization known as ChexSystems.

A big majority of banks within the U.S. use ChexSystems to trace their prospects’ banking exercise. Shoppers who’ve made banking errors, like bounced checks, extreme returned verify fees, or too many transfers or withdrawals, may find yourself of their system. This implies you’re mainly blacklisted by most if not all banks that use ChexSystems.

Fortunately there are some nice banks that don’t use ChexSystems in any respect! These banks supply the identical companies as conventional monetary establishments and have excessive acceptance charges for brand new prospects.

The High No ChexSystems Banks

Open an account at present!

Discovered Enterprise Banking | Our Favourite Enterprise Account

One of many largest challenges for small companies, entrepreneurs, and gig staff is discovering the best checking account for his or her rising enterprise.

One of many largest challenges for small companies, entrepreneurs, and gig staff is discovering the best checking account for his or her rising enterprise.

The Discovered Enterprise Banking Account solves that downside by simplifying your monetary journey. Out there solely to sole proprietors and single-owner companies, the sign-up course of takes just a few minutes. There’s no credit score verify or ChexSystems.

Discovered Enterprise Banking at a Look

- No opening deposit required

- No minimal steadiness

- No required month-to-month charges

- Free limitless ACH funds

- Free limitless invoicing

- Free cellular verify deposits

- Free built-in expense administration instruments

- Settle for financial institution transfers and card funds

- Simply connect with Quickbooks, Stripe, Venmo, PayPal, Etsy, and many others.

- Receives a commission as much as 2 days early with direct deposit1

- Ship cash to anybody throughout the U.S. utilizing their telephone quantity or e-mail deal with

- Deposit money at over 79,000 places

- Entry your account on-line or on the free app

- Discovered’s core options are free. In addition they supply a paid product, FoundPlus

Quick Approval Course of

Time is cash and Discovered respects each. Apply for your corporation account on-line and the streamlined approval course of ensures you’re up and working rapidly. No prolonged paperwork wanted to get swift entry to your monetary hub.

Straightforward Bookkeeping and Tax Administration Instruments

Managing your corporation funds shouldn’t be a headache. You get intuitive instruments corresponding to automated expense monitoring, receipt seize, limitless customized invoices, and the flexibility to handle 1099 contractor funds. Plus, you get the flexibility to auto-save for tax funds and routinely generate tax types.

No Hidden Charges, No Surprises

Say goodbye to sudden fees. Discovered.com believes in transparency. They’ve stripped away pointless charges, leaving you with an easy banking expertise. No hidden prices—simply readability and peace of thoughts.

Discovered is a monetary know-how firm, not a financial institution. Enterprise banking companies are supplied by Piermont Financial institution, Member FDIC.2

Open a Discovered account now!

U.S. Financial institution | Earn Up To $700 Money Bonus

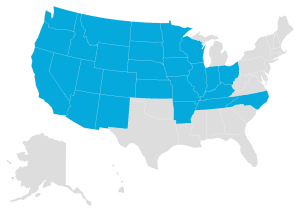

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches situated in 26 states principally situated within the west and midwest.

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches situated in 26 states principally situated within the west and midwest.

You may earn as much as $700 if you open a brand new U.S. Financial institution Well® Checking account and a Commonplace Financial savings account and full qualifying actions. The supply is topic to sure phrases and limitations and is legitimate via June 27, 2024. Member FDIC. Provide might not be accessible if you happen to dwell outdoors of the U.S. Financial institution footprint or are usually not an current consumer of U.S. Financial institution or State Farm.

U.S. Financial institution Well® Checking at a Look

- A U.S. Financial institution Visa debit card

- On-line banking and invoice pay

- Cell banking with cellular verify deposit

- Ship cash with Zelle®

- Entry to U.S. Financial institution Good Rewards® to reap extra advantages

- No charges at U.S. Financial institution ATMs

- No surcharge charges at 40,000 MoneyPass ATMs

The U.S. Financial institution Footprint

Should you dwell in one of many following 26 states or are an current consumer, you’ll be able to apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Should you dwell in one of many following 26 states or are an current consumer, you’ll be able to apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Account Particulars and Prices

To get an account, you’ll have to make a gap deposit of $25. The month-to-month service charge is $6.95 however may be waived if you happen to keep a mean steadiness of $1,500 or by having a mixed month-to-month direct deposit totaling $1,000. You may as well keep away from the month-to-month charge if you’re 24 and below, 65 and over, or a member of the navy (should self-disclose) or qualify for one of many 4 Good Rewards® tiers (Main, Plus, Premium, or Pinnacle).

Banking Made Straightforward

The U.S. Financial institution Well® Checking account comes with among the best cellular apps available on the market. Over a million prospects have given the app an general ranking of 5 stars. You may handle your complete account from a pc or your smartphone.

And there’s extra to U.S. Financial institution than an excellent smartphone app: 24/7 customer support, Zelle® immediate transfers, free budgeting and automatic instruments, overdraft leniency, and Good Rewards®. Maybe that’s why U.S. Financial institution repeatedly makes the checklist of among the best banks within the nation.

Get a U.S. Financial institution Account Immediately!

Present | Construct Credit score Whereas You Financial institution

Present gives an modern account to customers who need all of it with out the prices and hassles.

Present gives an modern account to customers who need all of it with out the prices and hassles.

The Present Construct account works similar to a checking account but in addition helps you construct credit score each time you employ the cardboard. Signal-up takes about 2 minutes and Present has extraordinarily excessive acceptance charges.

Present at a Look

- NO credit score verify

- NO minimal steadiness

- NO deposit required to open an account

- NO charges at over 40,000 ATMs within the U.S.

- Get your paycheck as much as 2 days early with direct deposit

- Earn 4.0% APY in your steadiness as much as $6,000 with direct deposit; earn 0.25% APY with out

- Earn factors for limitless cashback at collaborating retailers

- Ship cash immediately without spending a dime

- A chic however easy smartphone app

- 24/7 member assist

- FDIC insured account as much as $250,000

Swipe The Card and Construct Credit score

Utilizing your Present Construct account to BUILD your credit score is easy. Right here’s the way it works:

- You add cash to your account

- Swipe your card to make purchases, pay payments, or get cash from an ATM machine

- The funds in your account pay for these transactions

- Present stories your fee to construct your credit score historical past

Present Works Onerous for You

Present gives a extremely distinctive service it calls Gasoline Maintain Removals. What’s a fuel maintain? Some fuel stations could apply a maintain from $50 to $100 if you use your card to pump fuel. Should you solely pumped $10 of fuel, however the fuel station locations a $100 maintain in your funds, you gained’t have entry to the $90 distinction for as much as 3 enterprise days! The Present Construct card will instantly refund the maintain so you have got entry to all of your funds. We haven’t discovered that profit anyplace within the market.

We love the options, we love the smartphone app, and we love Present. That makes us assume you’ll love them too.

Get a Present Account Now!

Chase Safe Banking | $100 New Account Bonus

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is perhaps a great match for a second likelihood checking account.

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is perhaps a great match for a second likelihood checking account.

Chase Safe Banking at a Look

- NO credit score verify

- NO ChexSystems

- NO minimal deposit to open

- NO overdraft charges

- FREE entry to over 15,000 Chase ATMs

- FREE Chase On-lineSM Invoice Pay

- FREE cash orders and cashier’s checks

- Rapidly ship and obtain cash with Zelle®

- Paper checks are usually not provided with the account

Incomes the $100 Bonus

To earn the $100 bonus, you’ll want to finish 10 qualifying transactions inside 60 days of account enrollment. Qualifying transactions embody debit card purchases, on-line invoice funds, Chase QuickDepositSM, utilizing Zelle®, or receiving ACH credit.

What to Know In regards to the Approval Course of

Chase Safe Banking is the one account provided by Chase that doesn’t use ChexSystems however does use Early Warning Providers (EWS). Moreover, if you happen to’ve had an account closed by Chase previously, your utility won’t be accredited. Previous account closures can embody missteps corresponding to non-payment of charges, extreme overdrafts, or suspected fraud.

Charges

Chase doesn’t supply overdraft companies with this account as you’ll be able to solely spend the cash you have got accessible. You also needs to know that utilizing non-Chase ATMs can price from $3.00 to $5.00 per transaction. Surcharges from the ATM proprietor/community could apply.

Chase Safe Banking carries a $4.95 month-to-month service charge, however it may be waived when you have got digital deposits made into the account totaling $250 or extra throughout every month-to-month assertion interval.

Different Account Options

Chase Safe Banking gives a number of different options we like. This consists of:

- Zero Legal responsibility Safety. Get reimbursed for unauthorized debit card transactions when reported promptly.

- Budgeting Instruments. Handle your spending and get each day spending insights with Snapshot within the Chase Cell® app.

- Credit score and Id Monitoring. Monitor your credit score rating, get a customized motion plan supplied by Experian™ to assist enhance your rating and obtain id monitoring without spending a dime via Chase Credit score Journey®.

- Early Direct Deposit. Get that “simply paid” feeling as much as two enterprise days sooner with early direct deposit.

Should you’ve wished to financial institution with Chase and puzzled if you happen to’d qualify, we predict you’ll be pleased with the Chase Safe Banking account.

Get a Chase Account Now!

Chime | Over 32 Million Account Holders

Chime® is considered one of our favorites for a second likelihood banking account. Chime accepts virtually all prospects who apply, even you probably have unhealthy or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Chime® is considered one of our favorites for a second likelihood banking account. Chime accepts virtually all prospects who apply, even you probably have unhealthy or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Chime at a Look

- NO credit score verify or ChexSystems

- NO preliminary deposit required

- NO minimal steadiness required

- NO month-to-month or annual charges

- NO NSF/overdraft charges1

- NO overseas transaction charges

- NO charges at over 60,000 ATMs2

- NO charges for cellular and on-line invoice pay

- FREE money deposits at 8,500+ Walgreens

- Get your paycheck as much as 2 days early with direct deposit3

- FDIC insured account as much as $250,000

Deposit Money for FREE at Over 8,500 Walgreens

Chime has made depositing money straightforward. All it’s a must to do is go right into a Walgreens retailer, hand the cashier the money you need to deposit alongside along with your Chime card, and the deposit will present up in your account instantly. This gives Chime members extra walk-in places than another financial institution within the U.S.4

Immediately Switch Funds

You may switch funds to family and friends, Chime members or not… they usually can declare their cash immediately5 with none extra apps.

The Chime app additionally has a collection of notifications that you could activate or flip off so that you keep in full management. Misplaced or misplaced your card? You may instantaneously flip off your card utilizing the app. No surprise over 400,000 prospects have given the app a 5-star evaluation.

Financial savings Made Straightforward

Chime was one of many first to supply a “round-up” choice. Should you use your Chime card on a purchase order of $10.65, Chime provides you the choice of routinely rounding as much as $11.00 and placing the remaining $.35 in your free Chime financial savings account. And that provides up over time! Plus, Chime pays 2.00% Annual Proportion Yield (APY)6 in curiosity on that financial savings account.

Prospects First

Should you use direct deposit along with your Chime account, you may get your paycheck as much as 2 days early7. And Chime is simply saying no to massive financial institution NSF fees with a fee-free overdraft program as much as $200 for eligible members.

We don’t assume there may be one other firm innovating for his or her prospects like Chime.

Get a Chime Account Immediately!

Fifth Third Financial institution | Get $200 Bonus

The Momentum® Checking account from Fifth Third Financial institution gives a really engaging new account bonus. And with no month-to-month upkeep charge, no minimal deposit, and no minimal steadiness required, banking is easy.

The Momentum® Checking account from Fifth Third Financial institution gives a really engaging new account bonus. And with no month-to-month upkeep charge, no minimal deposit, and no minimal steadiness required, banking is easy.

Fifth Third Momentum® Checking at a Look

- No preliminary deposit required

- No minimal steadiness required

- No month-to-month upkeep charges

- Ship and obtain cash with Zelle®

- Additional Time overdraft avoidance

- Cell alerts for transactions

- Receives a commission as much as 2 days early if you enroll in Early Pay

- Entry to greater than 40,000 fee-free ATMs nationwide

- 1,200 department places

- Take pleasure in limitless verify writing

- Cell and on-line invoice pay and verify deposit

Keep away from Overdraft Charges

Fifth Third has an “Additional Time” overdraft characteristic the place they supply an additional day for purchasers to cowl any overdraft purchases which have hit their account. This characteristic offers you with some additional time to keep away from overdraft charges and handle your account successfully.

Financial institution a $200 Bonus

Fifth Third will add $200 to your account if you make direct deposits totaling $500 or extra inside 90 days of opening your new account. Qualifying direct deposits embody payroll, pension, or authorities funds corresponding to Social Safety. To obtain the money bonus, your checking account have to be open and in good standing. Provide ends June 30, 2024. Member FDIC.

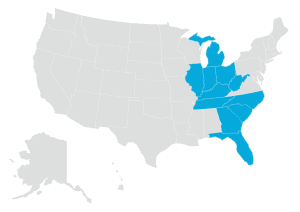

States The place Fifth Third Financial institution is Out there

You may apply on-line if you happen to dwell in one of many following 11 states: Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, South Carolina, Tennessee, or West Virginia.

You may apply on-line if you happen to dwell in one of many following 11 states: Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, South Carolina, Tennessee, or West Virginia.

Paycheck Advances Via MyAdvance

MyAdvance is a money advance service provided by Fifth Third Momentum that permits you to borrow a sure amount of cash in opposition to your upcoming direct deposit. The charges for this service are primarily based in your account’s age, and the quantity you borrow will likely be deducted out of your subsequent direct deposit. This could be a helpful choice for overlaying sudden bills rapidly and simply.

Opening a Fifth Third Momentum® Checking account is simple and takes just a few minutes. The mix of on-line banking instruments, checking account options, and department places makes this a robust alternative.

Open an account at present!

SoFi Checking & Financial savings | Earn a $325 Welcome Bonus

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

SoFi Checking & Financial savings at a Look

- FREE SoFi debit MasterCard

- FREE smartphone app. Handle your account on-line, too

- No opening deposit required

- No month-to-month minimal steadiness requirement

- No month-to-month upkeep charges

- No charges at 55,000+ ATMs

- Receives a commission as much as two days early with direct deposit

The best way to Earn the $325 Bonus

As quickly as you get your SoFi Checking & Financial savings account and deposit $10 or extra, you’ll earn $25. Once you arrange direct deposit from an employer, SoFi will credit score your account as much as an extra $300 (relying on the quantity of your direct deposit).

Utilizing the SoFi direct deposit choice unlocks extra advantages, too. First, if you happen to overspend a bit, SoFi will cowl as much as $50 with no overdraft charges. Second, you’ll obtain a a lot greater curiosity quantity of 4.60% APY on financial savings account balances and .50% APY on checking account balances. Should you resolve to not make the most of direct deposit, you’ll obtain 1.20% APY on financial savings balances.

The sign-up course of can take lower than 60 seconds. With over 6 million members, SoFi is a financial institution you’ll be able to rely on!

SoFi has been nice! The account was straightforward to open and I received my debit card a couple of days later. The smartphone app is simple to make use of and I can verify all the things from my pc, too. SoFi appears to be the proper financial institution.

Claire M., SoFi Buyer

Get a SoFi Account Now!

Improve Rewards Checking Plus

Improve is a on-line banking platform offering a variety of monetary companies, together with checking accounts, private loans, and bank cards with out annual charges.

Improve is a on-line banking platform offering a variety of monetary companies, together with checking accounts, private loans, and bank cards with out annual charges.

Improve Rewards Checking Plus at a Look

- As much as 2% money again on purchases

- NO opening deposit required

- NO month-to-month upkeep charges

- NO minimal steadiness requirement

- NO NSF or overdraft charges

- Receives a commission as much as 2 days early with direct deposit

- 10%-20% decrease rates of interest on loans & bank cards via Improve

- Earn as much as 5.21% APY with a free Efficiency Financial savings Account

- FDIC insured account as much as $250,000

Incomes 2% Money Again

The Improve Rewards Checking Plus permits you to earn 2% money again rewards with debit card purchases. Eligible bills embody:

- Comfort and drug shops

- Gasoline stations

- Month-to-month subscriptions, together with streaming companies

- Eating places

- Utilities and cellphone companies

All different purchases will earn 1% money again. To earn the reward your account have to be “lively”. An lively account is one which has a month-to-month direct deposit of $1,000 or extra.

However if you happen to select to not or can not meet the month-to-month direct deposit requirement, the account cashback program is diminished from 2% to 1%. In our view, that’s nonetheless a really robust providing with only a few charges.

Shoppers Love Improve

Managing your transactions is easy, facilitated via both an intuitive on-line dashboard or the handy Improve cellular app, accessible for each iOS (4.8 out of 5 ranking) and Android (4.7 out of 5 ranking) customers. You’ll even have free entry to your credit score rating and will likely be notified of any adjustments.

Not solely is the Improve Rewards Checking Plus considered one of our favorites, however the account additionally has very excessive approval charges.

Get an Improve Account Now!

GO2bank

One important disadvantage to many online-only financial institution accounts is that they don’t have any solution to settle for money deposits. However GO2bank accepts money deposits at over 90,000 Inexperienced Dot places nationwide. Nevertheless, collaborating retailers could cost you a charge.

Should you direct deposit over $500, your month-to-month upkeep charge of $5.00 is waived. And, they provide a reasonably candy overdraft safety program, but it surely has a gotcha cost of $15 if you happen to don’t substitute the funds inside 24 hours. Should you open an account on-line, there is no such thing as a opening deposit requirement.

Account holders will recognize the flexibility to price range their cash with the assistance of a cellular app, budgeting instruments, and a financial savings vault. Actually, they pay 4.50% on all cash within the financial savings vault as much as $5,000.

Get a GO2bank Account Immediately!

Walmart MoneyCard

Wish to earn money again on Walmart purchases – as much as $75 every year? Then you definitely may love the Walmart MoneyCard. It’s a debit card that has some robust options corresponding to cashback on Walmart purchases, overdraft safety, curiosity in your financial savings, and a cellular app that permits you to observe your purchases and deposit funds into your account.

Wish to earn money again on Walmart purchases – as much as $75 every year? Then you definitely may love the Walmart MoneyCard. It’s a debit card that has some robust options corresponding to cashback on Walmart purchases, overdraft safety, curiosity in your financial savings, and a cellular app that permits you to observe your purchases and deposit funds into your account.

Walmart MoneyCard at a Look

- Straightforward approval: no ChexSystems or credit score verify

- No preliminary deposit is required and there are not any month-to-month minimums

- Deposit money without spending a dime at any Walmart retailer and it reveals up 10 minutes later

- Deposit checks utilizing the Walmart MoneyCard smartphone app

- Simply request a number of playing cards for household use1

- Handle your account out of your pc or the smartphone app

- 3% cashback on Walmart.com purchases, 2% cashback for Walmart gasoline stations, and 1% money again to be used in-store2

- Earn 2.00% APY on cash you put aside in a free financial savings account3

- With qualifying direct deposits4, you’ll be able to opt-in and luxuriate in overdraft safety of as much as $200 on eligible purchases5

- No month-to-month charge if you direct deposit $500+ within the earlier month-to-month interval. In any other case, there’s a $5.94 month-to-month charge.6

The Walmart MoneyCard is obtainable in all 50 states, Washington D.C., and Puerto Rico.

Get a Walmart MoneyCard Account Immediately!

mph.financial institution Contemporary Account

It’s a tall order to “Make Individuals Joyful” in the case of banking, however that’s the said mission behind mph.financial institution.

It’s a tall order to “Make Individuals Joyful” in the case of banking, however that’s the said mission behind mph.financial institution.

Powered by Liberty Financial savings Financial institution (established in 1889!), the mph.financial institution Contemporary account does use ChexSystems, however so long as you don’t have greater than 3 charge-offs totaling $1,000 or stories of fraud approval charges are very excessive. Charges for the account embody a $9 month-to-month service charge and a $10 overdraft charge.

mph.financial institution Contemporary Account at a Look

- $0 preliminary deposit to open account

- Ship and obtain cash with Zelle®

- Entry your account along with your telephone or pc

- When coupled with a free financial savings account, earn as much as 5.00% APY

- Optionally available potential to spherical up fees and stash the money into financial savings

- Receives a commission as much as 2 days early with direct deposit

- Entry to over 55,000 fee-free ATMs

Apply for a Contemporary Account Immediately!

What Is ChexSystems?

When you have acquired a telephone name out of your financial institution telling you your account has been terminated, otherwise you have been lately denied a brand new checking account, you have got most likely heard of ChexSystems. But when this hasn’t occurred, you’ve almost definitely by no means heard of ChexSystems.

In brief, ChexSystems is a shopper reporting company that tracks your checking and financial savings account exercise.

The way in which it really works is thru banks offering knowledge to the company. This knowledge consists of the account holder’s Social Safety quantity in addition to the present account well being. Prospects who’ve bounced checks or have unpaid charges may be reported to ChexSystems, leading to a unfavourable itemizing in your banking exercise report.

It’s estimated that greater than 85 p.c of banks within the U.S. use ChexSystems and the company has knowledge on almost 300 million American customers.

Each unfavourable itemizing on a banking exercise report is made accessible to each financial institution and credit score union that subscribes to the ChexSystems database, which may make getting a brand new account after being banned out of your present financial institution extraordinarily troublesome.

Info That Seems on Your ChexSystems Report

Here’s a checklist of six completely different items of data that may be present in your ChexSystems report:

- Any sort of fraud

- Uncollected overdraft charges, ATM transactions, or computerized funds the financial institution paid

- Abuse of debit card, financial savings account, or ATM card

- Violation of any banking guidelines and laws

- Opening an account with false info

- Paid and unpaid non-sufficient funds (NSF) objects

Whereas banks that don’t use ChexSystems don’t entry knowledge related to the ChexSystems database, they are going to usually seek the advice of different banking exercise knowledge businesses like Early Warning Providers (EWS) and TeleCheck.

Shoppers who’ve unfavourable listings with these corporations might need their checking account purposes rejected. Nevertheless, most individuals listed in ChexSystems are normally not in EWS or TeleCheck.

What Are My Choices if I’m Listed in ChexSystems?

Not gaining access to a checking account could make it troublesome to handle your cash effectively. Research have proven that these with no checking account waste almost 5 p.c of their earnings on charges charged by payday mortgage suppliers and verify cashing corporations.

Open an Account at No ChexSystems Banks

Should you’ve been reported to ChexSystems, among the best choices you have got is to financial institution elsewhere at one of many many banks that don’t use ChexSystems through the utility course of.

When you’re accredited, it is possible for you to to take pleasure in all the advantages of getting a checking account with out having to fret about your unfavourable document with ChexSystems.

Use a Pay as you go Debit Card if You’re in a Pinch (Not Really useful!)

Another choice individuals usually flip to is pay as you go debit playing cards. With a pay as you go debit card, you can also make digital funds with the cash you’ve loaded onto your card. Visa and MasterCard supply a few of the hottest pay as you go choices. Nevertheless, it is very important know that these playing cards aren’t all they’re cracked as much as be.

One main drawback of those playing cards is that they’ve many charges related to their use that may add up over time. The prices of loading cash onto your card, together with the final problem of getting to do it each time you need to spend cash, make an everyday debit card that’s related to a checking account a way more engaging choice.

With this in thoughts, opening a checking account goes to be the easiest way to go if you happen to’re trying to set up your funds successfully.

Why No ChexSystems Banks Are the Greatest Alternative

Should you’ve been turned away from different monetary establishments, no ChexSystems banks are nice as a result of they give you the very same services. With most accounts really helpful on this article, you’ll be able to take pleasure in:

- No minimal steadiness requirement

- Low or no month-to-month charge

- Means to put in writing checks

- On-line and cellular banking

- Debit card entry

- FDIC-insured accounts as much as $250,000

- Entry to a big (and oftentimes free) ATM community

- Purchases along with your financial institution card carry a zero legal responsibility for fraudulent transactions

With so many accessible advantages and federal insurance coverage, it’s best to by no means accept any financial institution that provides lower than the advantages listed above. No ChexSystems banks with too many restrictions together with excessive charges must be prevented.

Whereas it is perhaps tempting to go along with the primary financial institution that approves you for a brand new account after having misplaced your outdated one, it is very important contemplate all of the choices you have got accessible to you and go along with a no ChexSystems financial institution that provides you nice banking companies with low to zero charges.

What’s the Distinction Between No ChexSystems Banks and Second Probability Banks?

It is a frequent and essential query. In the end, there are some main variations between no ChexSystems financial institution accounts and second likelihood financial institution accounts.

Some banks and credit score unions supply second likelihood financial institution accounts to customers who’ve made some banking errors previously or to those that have poor credit score. Oftentimes these banks will take a look at your ChexSystems report and decide your eligibility relying on the severity of your report. Second likelihood accounts normally include guidelines and restrictions to assist the buyer handle their cash correctly.

No ChexSystems banks, alternatively, supply conventional checking accounts to anybody who qualifies. As an alternative of providing a specialty account like a second likelihood account, these banks merely don’t use ChexSystems in any respect through the utility course of.

The Greatest Second Probability Banks by State

Most main banks fail to supply second likelihood checking accounts. Nevertheless, many group banks and credit score unions achieve this below completely different names like “Alternative Checking” or “Contemporary Begin Checking.”

Our sister web site, CheckingExpert.com, frequently updates the checklist of banks providing second likelihood checking accounts in each state and places it multi functional place. Right here’s an outline of those accounts and the place yow will discover them in your space.

Conclusion

Should you’re like one of many hundreds of thousands of People who’ve skilled points with previous banking errors, you’re positively not alone. Our complete guides to second likelihood accounts and no ChexSystems banks will certainly level you in the best route and allow you to re-establish your self within the banking system.

Chime is a monetary know-how firm, not a financial institution. Banking companies and debit card issued by The Bancorp Financial institution, N.A. or Stride Financial institution, N.A.; Members FDIC. Credit score Builder card issued by Stride Financial institution, N.A.

1Eligibility necessities apply. Overdraft solely applies to debit card purchases and money withdrawals. Limits begin at $20 and could also be elevated as much as $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal charges could apply besides at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Money deposit or different third-party charges could apply.

3Early entry to direct deposit funds is dependent upon the timing of the submission of the fee file from the payer. We typically make these funds accessible on the day the fee file is acquired, which can be as much as 2 days sooner than the scheduled fee date.

4Prospects are restricted to a few $1,000 money deposits at Walgreens every day and $10,000 every month.

5Typically immediate transfers may be delayed. The recipient should use a sound debit card to assert funds. As soon as you’re accredited for a Chime Checking Account, see your issuing financial institution’s Deposit Account Settlement for full Pay Anybody Transfers particulars. Please see the again of your Chime debit card to your issuing financial institution. See Phrases and Circumstances.

6The Annual Proportion Yield (“APY”) for the Chime Financial savings Account is variable and should change at any time. The disclosed APY is efficient as of September 20, 2023. No minimal steadiness required. Will need to have $0.01 in financial savings to earn curiosity.

7Early entry to direct deposit funds is dependent upon the timing of the submission of the fee file from the payer. We typically make these funds accessible on the day the fee file is acquired, which can be as much as 2 days sooner than the scheduled fee date.

1Direct deposit funds could also be accessible to be used for as much as two days earlier than the scheduled fee date. Early availability isn’t assured.

2Discovered is a monetary know-how firm, not a financial institution. Enterprise banking companies are supplied by Piermont Financial institution, Member FDIC. The funds in your account are FDIC-insured as much as $250,000 per depositor for every account possession class. The Discovered Mastercard Enterprise debit card is issued by Piermont Financial institution pursuant to a license from Mastercard Inc. and could also be used in every single place Mastercard debit playing cards are accepted.

1Household Accounts: Activated, customized card required. Different charges apply to the extra account. Relations age 13 years and over are eligible. Restrict 4 playing cards per account. See Deposit Account Settlement for particulars.

2Money again, as much as $75 per 12 months, is credited to card steadiness at finish of reward 12 months and is topic to profitable activation and different eligibility necessities. Redeem rewards utilizing our web site or app. You’ll earn money again of three p.c (3%) on qualifying purchases made at Walmart.com and within the Walmart app utilizing your card or your card quantity, two p.c (2%) at Walmart gasoline stations, and one p.c (1%) on qualifying purchases at Walmart shops in the USA (much less returns and credit) posted to your Card throughout every reward 12 months. Grocery supply and pickup purchases made on Walmart.com or the Walmart app earn 1%. For the needs of money again rewards, a “reward 12 months” is twelve (12) month-to-month durations through which you have got paid your month-to-month charge or had it waived. See account settlement for particulars.

3Curiosity is paid yearly on every enrollment anniversary primarily based on the common each day steadiness of the prior twelve months, as much as a most common each day steadiness of $1,000, if the account is in good standing and has a optimistic steadiness. 2.00% Annual Proportion Yield could change at any time earlier than or after account is opened. Annual Proportion Yield is correct as of 5/15/23.

4Direct Deposit: Early availability of direct deposit is dependent upon timing of payroll’s fee directions and fraud prevention restrictions could apply. As such, the provision or timing of early direct deposit could differ from pay interval to pay interval. Make certain the identify and social safety quantity on file along with your employer or advantages supplier matches what’s in your Walmart MoneyCard account precisely. We will be unable to deposit your fee if we’re unable to match recipients.

5Choose-in required. $15 charge could apply to every eligible buy transaction that brings your account unfavourable. Stability have to be dropped at a minimum of $0 inside 24 hours of authorization of the primary transaction that overdraws your account to keep away from the charge. We require instant fee of every overdraft and overdraft charge. Overdrafts paid at our discretion, and we don’t assure that we’ll authorize and pay any transaction. Be taught extra about overdraft safety.

6No month-to-month charge with qualifying direct deposit, in any other case $5.94 a month. Waived when $500+ is loaded within the earlier month-to-month interval. First month-to-month charge happens upon first use, the day after card activation or 90 days after card buy, whichever is earlier.

Acorns was constructed to present everybody the instruments to handle their funds which makes it considered one of our high picks.

Acorns was constructed to present everybody the instruments to handle their funds which makes it considered one of our high picks.

Wells Fargo modified their Alternative Checking account to Clear Entry Banking. And we like one change, particularly. Wells Fargo has achieved away with overdraft and non-sufficient funds (NSF) charges. Clear Entry Banking is a debit card-only account (no paper checks accessible) and if you happen to try and buy one thing with out enough funds, the transaction will likely be denied. That’s lots higher than having the transaction accredited after which discovering you’ve been hit with a $35 overdraft charge.

Wells Fargo modified their Alternative Checking account to Clear Entry Banking. And we like one change, particularly. Wells Fargo has achieved away with overdraft and non-sufficient funds (NSF) charges. Clear Entry Banking is a debit card-only account (no paper checks accessible) and if you happen to try and buy one thing with out enough funds, the transaction will likely be denied. That’s lots higher than having the transaction accredited after which discovering you’ve been hit with a $35 overdraft charge.

No. Charges. Interval. That’s how Uncover Financial institution promotes its Cashback Debit Checking Account. And, after conducting our analysis, we will say that’s principally true. Actually, the one charges you’ll ever incur are for outgoing wire transfers and repair cost charges if you happen to use a non-Uncover ATM if it’s not a part of the 60,000+ ATMs of their no-fee community.

No. Charges. Interval. That’s how Uncover Financial institution promotes its Cashback Debit Checking Account. And, after conducting our analysis, we will say that’s principally true. Actually, the one charges you’ll ever incur are for outgoing wire transfers and repair cost charges if you happen to use a non-Uncover ATM if it’s not a part of the 60,000+ ATMs of their no-fee community.

Ally Financial institution has been one of the extremely rated on-line banks for the previous a number of years. It’s not as a result of they’ve essentially the most options, however as a result of they constantly make their prospects delighted with the options the financial institution gives.

Ally Financial institution has been one of the extremely rated on-line banks for the previous a number of years. It’s not as a result of they’ve essentially the most options, however as a result of they constantly make their prospects delighted with the options the financial institution gives.

Irrespective of your banking previous, Navy Federal Credit score Union gives conventional checking for all members throughout the US. With no evaluation necessities of your banking historical past, NFCU is a wonderful alternative for lively responsibility or retired US navy, members of the family, and authorities contractors. There are a number of account choices, however we suggest the Free EveryDay Checking account.

Irrespective of your banking previous, Navy Federal Credit score Union gives conventional checking for all members throughout the US. With no evaluation necessities of your banking historical past, NFCU is a wonderful alternative for lively responsibility or retired US navy, members of the family, and authorities contractors. There are a number of account choices, however we suggest the Free EveryDay Checking account.

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. Should you don’t qualify for a standard account, the Go Additional account will allow you to get there in as little as 12 months.

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. Should you don’t qualify for a standard account, the Go Additional account will allow you to get there in as little as 12 months.

The BMO Good Cash checking account is perhaps a terrific match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.

The BMO Good Cash checking account is perhaps a terrific match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.