In case you have not too long ago pulled your credit score report and seen a charge-off there, you could be questioning the right way to take away it out of your report. First, know {that a} charge-off in your credit score historical past is a main deal. It would most certainly trigger a big lower in your credit score rating. So should you don’t take any steps to dispute it, the charge-off will keep in your credit score report for as much as seven years.

Listed below are 3 confirmed strategies to take away a charge-off out of your credit score report:

1. Supply To Pay The Creditor To Delete The Cost-Off

One of the efficient methods to get unfavorable gadgets eliminated out of your credit score report is to pay the debt, in alternate for the creditor eradicating the charge-off out of your credit score report. With this technique, you’d use your fee as leverage to persuade the debt collector to assist restore your credit score. However this solely works on an unpaid charge-off. If you happen to’ve already paid the charge-off but it surely’s nonetheless in your credit score report, you actually don’t have any leverage to barter its removing.

Earlier than You Pay the Cost-Off

Earlier than you resolve to do that “pay for deletion” route, there are some things you want to remember.

- If it’s an previous charge-off, don’t supply to pay the complete quantity due. Moderately, it is best to attempt to negotiate for lower than what they’re asking. Begin with 50 % and go from there.

- Some collectors will declare they will’t legally take away the charge-off. This isn’t true. Proceed to barter till a deal will be made.

- You’ll be able to negotiate over the cellphone, however at all times get the fee association in writing earlier than sending them a verify or making a web based fee.

- By no means give a debt collector entry to your checking account.

2. Use The Superior Methodology to Dispute the Cost-Off

If you happen to don’t have the cash to pay the steadiness in full, or should you can’t get the unique creditor to take away the charge-off out of your credit score report, it’s time to dispute the unfavorable entry utilizing a extra superior technique. To dispute the entry you’ll first want a replica of your present credit score report. Due to the coronavirus pandemic, you may get a free copy of your credit score report every week as a substitute of simply every year. Go to AnnualCreditReport.com to get a free credit score report from TransUnion, Experian, and Equifax.

When you’ve your credit score studies in hand, discover the charge-off entry and have a look at each element to make sure the whole lot is totally correct. The important thing right here is to be very particular. If something is inaccurate you’ve the precise to dispute your entire entry.

Listed below are just a few particulars that you have to be verifying are correct:

- Account Quantity

- Creditor Title

- Open Date

- Cost-off Date

- Fee Historical past

- Borrower Names

- Stability

If you happen to discover any info that isn’t appropriate, write a letter to every of the three credit score bureaus itemizing the wrong info and stating you’ve discovered incorrect info that must be corrected or eliminated. If the credit score reporting companies can’t confirm the entry, they’ll should appropriate or take away the charge-off in compliance with the Truthful Credit score Reporting Act. Generally the data merely can’t be verified and the entry will likely be eliminated. Do word, nevertheless, that if the charge-off is reported precisely, disputing it won’t assist.

3. Have A Skilled Take away The Cost-Off

Corporations like Lexington Regulation, Credit score Saint, and Sky Blue have years of expertise getting inaccurate and unfavorable gadgets eliminated, and will assist pace up the method of repairing your credit score.

In case you have a number of gadgets to take away, aren’t capable of commit devoted time to do it your self, or need an knowledgeable to assist information you thru the method, we suggest getting help from these consultants. Right here’s our full listing of really useful credit score restore firms. Every firm presents a free session to assist decide how they will help you restore your credit score.

Even should you pay a number of hundred {dollars} to a credit score restore firm like Lexington Regulation, Credit score Saint, or Sky Blue, it can save you much more by getting decrease rates of interest and constructing a extra steady private finance life.

Understanding Cost-Offs

What Is A Cost-Off?

Once you haven’t paid on an account for six months to a 12 months, a bank card issuer or different debt collectors will usually mark your account as a “charge-off.” This implies the creditor has decided it’ll probably by no means accumulate your debt. It considers the debt a enterprise loss. The corporate can write off debt at tax time.

However writing off the debt doesn’t imply the creditor will cease its debt assortment efforts. Actually, the corporate would possibly even rent a third-party debt collector to deal with the gathering course of. That is necessary to grasp in case you’re contacted by a group company you don’t acknowledge. Both the gathering company purchased the debt out of your unique creditor and now needs to gather on it — or the company has been employed by your bank card issuer, lender, or creditor to gather the debt on behalf of the unique creditor.

This may occur with bank card debt, unpaid private loans, and even hospital payments. One or two late funds shouldn’t lead to a charge-off, however ongoing delinquency will ultimately flip right into a charge-off.

How Does a Cost-Off Have an effect on Your Credit score Rating?

As soon as an account has been charged off, two issues will probably occur:

- First, you’re going to start out receiving calls and letters from assortment companies making an attempt to gather the debt.

- Second, the account will likely be marked as a “charge-off” in your credit score report.

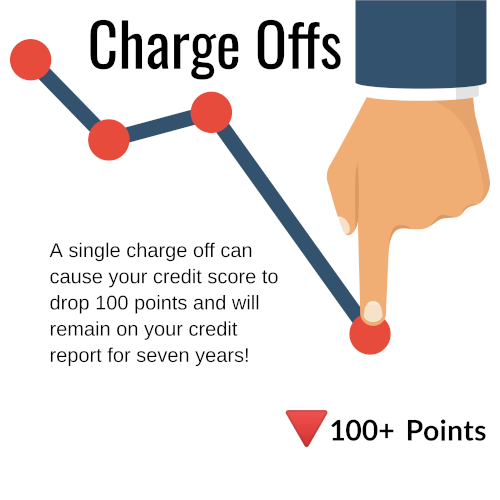

A charged-off account in your credit score report will devastate your FICO rating. A single charge-off may cause your credit score rating to drop 100 factors or extra. It’s a giant deal.

Along with your credit score rating dropping, you’re additionally going to have a very troublesome time getting permitted for any new bank cards, mortgages, or auto loans. Lenders hardly ever lengthen credit score to folks with even one charge-off on their credit score report.

Paid vs. Unpaid Cost-Offs

There are two sorts of charge-offs that would seem in your credit score report. In case you have paid the charged-off account in full, the credit score bureaus will mark the account as paid; should you haven’t it’ll stay marked as unpaid.

Will My Credit score Rating Enhance if I Pay the Cost-Off in Full?

Some assortment companies could attempt to persuade you that paying off the complete quantity of your charge-off will restore your FICO rating. This isn’t true. A paid charge-off will certainly look higher to lenders who take the time to do guide underwriting, however it’ll have a minimal impact in your credit score rating. Additionally, paying off the complete charge-off gained’t robotically delete the entry out of your credit score report. Paying it off won’t take away the charge-off out of your account, both.

How Lengthy Do Cost-Offs Keep on Your Credit score Report?

A charge-off will stay in your credit score report for seven years, after which it’s robotically deleted. For instance, should you stopped making funds on one in every of your bank cards for six months, and it was marked as a charge-off on January 1, 2020, it might stay in your credit score report till January 1, 2027.

Even when the statute of limitations on the debt expires after three or 5 years in your state, your credit score report will nonetheless present the charge-off, and your credit score rating will undergo. Statutes of limitations shield you from authorized motion however not from below-average credit or from cellphone calls from debt collectors.

Pattern Letter To Take away a Cost-Off From Credit score Report

Notice: Use this in making an attempt to barter an entire removing or PAID AS AGREED on a debt that states CHARGE-OFF or SERIOUSLY PAST DUE in your credit score report.

[today’s date]

[original creditor or name of collection agency if the account was sold]

[creditor address]

RE: [account ex: Citibank Mastercard] account # [full account number] (if contacting

a group company embrace the unique acc. quantity, i.e., the Mastercard quantity in

this case, and in addition embrace any acc. quantity assigned by the gathering company –this

quantity can be on one in every of your assortment letters)

Expensive Sir or Madam,

After not too long ago reviewing my credit score report, I took discover that the above-mentioned

account is presently in [status of account, ex: Charge-Off] standing. I sincerely would

prefer to maintain this account as quickly as attainable.

Resulting from [whatever caused you to be late on your payments, ex: illness], I

sadly acquired behind on my funds and was unable to satisfy my obligations.

Nevertheless, since then my state of affairs has significantly improved and I’m within the place to

recompense this debt.

I’m keen to pay [creditor’s name] [x payments a month] equalling the quantity of

[total they are requesting] supplied that the above account is up to date on all credit score

reporting companies to state: PAID AS AGREED, or fully faraway from all credit score

reporting companies upon my remaining fee.

I’m not agreeing to an up to date credit score report that states this account as: “PAID

CHARGE-OFF” or the like, as this won’t considerably enhance my credit score rating, nor

will it replicate my honest willingness to revive my good identify and hopefully,

sometime, once more do enterprise along with your firm.

Your written response will function an settlement to my proposal and I’ll start

funds. Thanks very a lot on your valued time.

Greatest regards,

[first & last name] [street address] [city, state, zip code]