[ad_1]

Investview has confirmed the SEC’s investigation into iGenius is ongoing as of Could 2024.

Investview has confirmed the SEC’s investigation into iGenius is ongoing as of Could 2024.

The standing replace was confirmed by Investview in a 10-Q quarterly report, filed with the SEC on August thirteenth.

By means of the tip of our second quarter in 2024, except for a follow-up request to supply supplemental documentation throughout Could 2024, we’ve acquired no follow-up communications from the SEC following our authentic manufacturing of paperwork in 2022.

Investview first disclosed the SEC’s investigation into iGenius again in November 2021. Past acknowledging the subpoenas pertaining to iGenius, particular info the SEC requested hasn’t been disclosed.

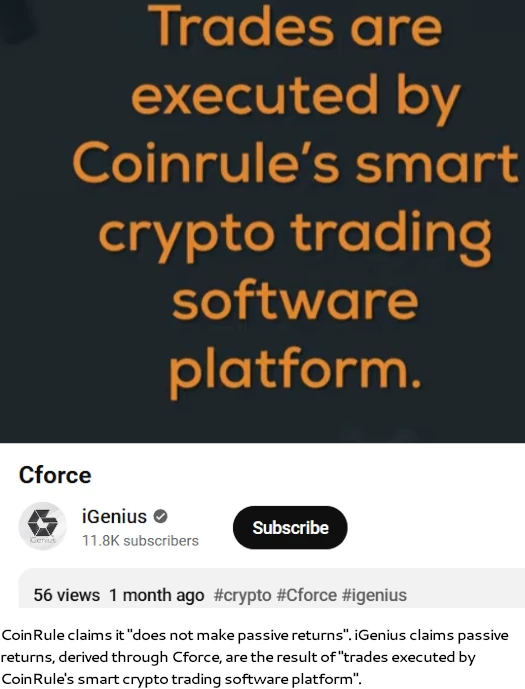

Latest affirmation of the SEC’s investigation into iGenius is important following the launch of a brand new passive returns funding scheme by CoinRule.

On July 2024 BehindMLM reported on “Cforce”, the identify iGenius had provide you with for his or her new alternative.

To cite iGenius President Chad Garner (proper);

To cite iGenius President Chad Garner (proper);

CoinRule, these guys they primarily create software program that connects to your crypto trade account.

And the software program may execute trades. You give it mainly authorization to execute trades in your behalf, and so you’ll be able to have automated buying and selling happen in your trade account.

Upon software of the Howey Check, as per US legislation Cforce is clearly a securities providing. But there isn’t any point out of both Cforce or CoinRule in any of Investview’s SEC filings (together with the August thirteenth 10-Q).

Shortly after BehindMLM’s video went reside, iGenius’ Cforce and CoinRule advertising movies, together with the 2 cited by us, disappeared.

Maybe cautious of their very own SEC investigation, CoinRule has since tried to suppress client consciousness by requested search engine delisting.

In a meritless defamation criticism despatched to Google Search on or round August fifteenth, Collyer Bristow LLP, representing CoinRule to be a shopper of theirs, raised seven factors.

Level 1

Quoted BehindMLM textual content;

Beneath the “lulz can’t contact our cash!” mannequin, an MLM firm’s prospects place their funds beneath management of a central entity. On this case its “Cforce”, a purported “unique” buying and selling bot CoinRule offers to iGenius.

CoinRule’s response:

That is incorrect:

(i) Coinrule doesn’t maintain person funds, funds are held on the exchanges; and

(ii) the technique isn’t supplied by Coinrule, Coinrule is a software program platform that analyses market knowledge and permits its customers to undertake varied buying and selling methods of their selecting and converts indicators into buying and selling directions which might be despatched to exchanges.

The technique is operated by iGenius and never by Coinrule. This assertion provides the deceptive impression that our shopper units technique which is certainly not the case.

BehindMLM’s response:

On level (i), BehindMLM by no means claimed CoinRule holds person funds. We did state traders place funds beneath the management of CoinRule, which is sufficient to fulfill the Howey Check.

The relevant Howey Check prong is “funding of cash in a typical enterprise”. On this case the “frequent enterprise” is Cforce, which is operated by CoinRule.

The place precisely funds are held whereas invested into and beneath management of Cforce and Coin Rule is irrelevant.

On level (ii), that is from CoinRule’s web site;

Create a bot technique from scratch, or use a prebuilt rule that has traditionally been traded on the exchanges trade.

So by “prebuilt guidelines”, CoinRule gives traders automated buying and selling methods. Once more, whether or not CoinRule themselves got here up with these methods or not is neither right here nor there.

With respect to securities fraud, all that issues is CoinRule and iGenius are those promoting entry to passive returns, purportedly derived by way of automated buying and selling.

Level 2

Quoted BehindMLM textual content:

Lulz can’t contact our cash!” buying and selling schemes usually implode by dangerous or rigged trades. I can’t communicate particularly to CoinRule however bot house owners usually steal shopper funds by rigged trades and blame it on hackers, or disappear and many others.

CoinRule’s response:

This assertion is grossly defamatory and implies that our shopper will steal shopper funds by rigging trades. It’s also wholly inaccurate in addition to being baseless remark.

Coinrule is a good firm with a public profile and presence which has been working for six years and as talked about above, Coinrule is just a instrument utilized by customers to execute a technique. Coinrule doesn’t set the technique.

BehindMLM’s response:

To begin with we by no means implied something – actually, as quoted by CoinRule, BehindMLM categorically said, “I can’t communicate particularly to CoinRule …”

As for the way “lulz can’t contact our cash!” scams finish, from our finish this can be a assertion of reality. It’s backed by sixteen years of revealed analysis.

With respect to securities fraud, CoinRule’s second paragraph is irrelevant advertising waffle.

Level 3

Quoted BehindMLM textual content:

CoinRule launched its passive returns automated buying and selling scheme in 2021. CoinRule seems to be UK based mostly and is headed up by CEO Gabriele Musella.

CoinRule’s response:

Coinrule isn’t a passive returns automated buying and selling scheme. Coinrule is a ‘DIY’ technique builder.

Coinrule is a platform that permits customers to construct their very own buying and selling methods. Coinrule facilitates the technique constructing course of by others and doesn’t make ‘passive returns’ as alleged.

BehindMLM’s response:

Securities legislation violators come up all types of psychological gymnastics to justify fraud.

Right here’s a handy-dandy YouTube video from the SEC immediately addressing the observe.

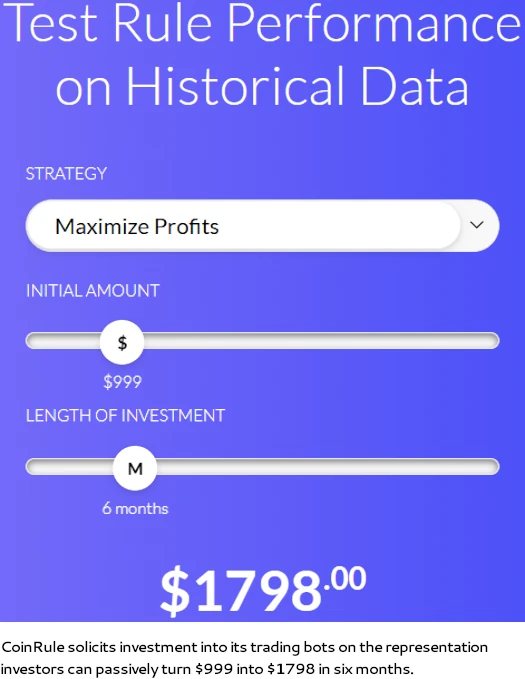

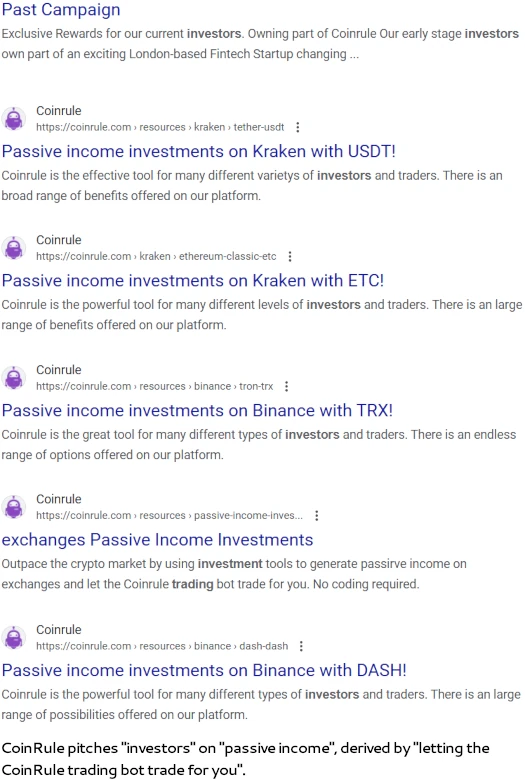

Past that, that is from CoinRule’s web site (accessed August seventeenth, 2024):

Immediately beneath that CoinRule offers a handy-dandy passive returns calculator:

Terminology is vital right here, as a result of passive returns is a prong of the Howey Check (“an inexpensive expectation of income to be derived from the efforts of others”).

Right here’s CoinRule advertising precisely that to traders:

Be aware that whereas the above is search outcomes of CoinRule’s web site, every web page was energetic “as is” on August seventeenth, 2024.

Circling again to the SEC’s goldfish video, calling a passive return “passive earnings” doesn’t change what’s. Even much less so when CoinRule is clearly aiming its “passive earnings” at traders.

Level 4

Quoted BehindMLM textual content:

On its web site, CoinRule additionally advertises a $200 referral program. Presumably this implies iGenius will get an undisclosed kickback per Elite member they enroll.

CoinRule’s response:

Coinrule has a referral program, which isn’t out there within the UK as a result of monetary promotions regime. Coinrule splits proceeds for CForce subscriptions with iGenius.

Nonetheless, Coinrule don’t refer any members to iGenius nor are they in any approach concerned in any membership program of iGenius. It’s unfaithful that there’s an ‘undisclosed kickback scheme’ and to make this allegation is defamatory.

BehindMLM’s response:

Right here CoinRule confirms BehindMLM’s suspicion that “iGenius will get an undisclosed kickback per Elite member they enroll.”

This wasn’t disclosed on iGenius’ web site, CoinRule’s web site or in any Cforce advertising materials that BehindMLM cited. Thus, by definition, CoinRule’s suspected kickback scheme with iGenius is undisclosed.

Level 5

Quoted BehindMLM textual content:

That stated CoinRule’s passive returns funding alternative by automated buying and selling ought to be registered with the FCA …. By failing to register its passive returns funding alternative with the FCA, CoinRule is committing verifiable securities fraud in its house jurisdiction.

CoinRule’s Response:

That is incorrect. Coinrule doesn’t present passive return funding alternatives.

As a software program platform, Coinrule doesn’t require the Monetary Conduct Authority (“FCA”) authorisation to conduct its actions.

This has been confirmed by the FCA. The article is wholly incorrect in its assertion that Coinrule is in breach of FCA necessities by not registering.

Additional the allegation that our shopper is committing ‘securities fraud’ is grossly defamatory. The remark is unfaithful and is a critical allegation made with none basis.

BehindMLM’s response:

As to “CoinRule doesn’t present passive return funding alternatives”, discuss with Level 3 above.

The FCA is to securities regulation within the UK because the SEC is to securities regulation within the US.

Whereas I can’t say for certain, I’d wager the subject of CoinRule’s marketed “passive earnings” funding schemes didn’t provide you with any purported dialog with the FCA.

Moreover whereas we stand by our factual assertion that CoinRule is committing securities fraud within the UK, extra to the purpose is iGenius’ and CoinRule’s US securities fraud.

As of July 2024, SimilarWeb tracked the highest supply of site visitors to CoinRule’s web site because the US (39%). Regardless of providing a “passive earnings” alternative to US residents, CoinRule isn’t registered with the SEC.

For what ought to be apparent causes, iGenius’ securities fraud is presently directed exterior of the US – particularly in Poland and Germany.

Polish authorities launched an iGenius pyramid fraud investigation in late 2023.

Level 6

Quoted BehindMLM textual content:

Beneath US legislation (the Howey Check), the passive returns iGenius markets by CoinRule’s automated buying and selling bot represent a securities providing.

iGenius shopper traders place their cash beneath management of Cforce, which is owned and operated by a typical enterprise (CoinRule).

That is executed on the “affordable expectation of income to be derived from the efforts of others” (returns generated by way of automated buying and selling by CoinRule’s bot).

CoinRule’s response:

Coinrule is a software program platform. iGenius is utilizing our shopper’s software program to supply Cforce however they don’t have any perception or management over the ‘contents’ of Cforce or whether or not iGenius has the precise to supply this technique to its members.

BehindMLM’s response:

Once more, discuss with SEC’s goldfish video on CoinRule referring to its unregistered passive returns funding scheme as a “software program platform”.

Whether or not one other third-party shopper is concerned or not is irrelevant with respect to CoinRule’s alleged defamation claims.

The place it may be related is disclosure failures with respect to violation of US federal securities legislation. A 3rd celebration shopper performing in live performance with iGenius and CoinRule to commit securities fraud was not disclosed in any of iGenius’ cited Cforce advertising materials.

Level 7

Quoted BehindMLM textual content:

iGenius associates join and take part with CoinRule’s unregistered funding scheme by their iGenius backoffice.

CoinRule’s response:

Coinrule doesn’t function an funding scheme. It’s a software program platform. It’s unfaithful and dangerously defamatory to state that our shopper is an unregistered funding scheme.

These false allegations once more wrongly recommend our shopper is working with out the suitable regulatory authorisation.

BehindMLM’s response:

With respect to CoinRule working a passive returns funding scheme, discuss with documented proof in Level 3.

By nature of CoinRule advertising and working a passive returns funding scheme being verifiable reality, BehindMLM’s quoted assertion can’t be defamatory – dangerously or in any other case.

As it’s within the US, securities fraud is illegitimate within the UK. Regardless of pitching shoppers on “passive earnings” purportedly derived from “automated buying and selling”, CoinRule isn’t registered it’s passive returns funding scheme with the the FCA.

This constitutes bonafide securities fraud, in violation of UK monetary legislation.

Regulated actions relate to investments specified by the Treasury or to property, and embrace …

- coping with investments (shopping for, promoting and many others) or providing or agreeing to take action

- funding administration and advising on investments

- pc or web-based funding transactions

- dealing in securities – eg shares and shares (or certificates representing them), or choices and futures

Closing ideas

Of their criticism, ConRule goes on to waffle on some extra about alleged defamation and copyright infringement;

The statements are in breach of the Defamation Act 2013. The which means of those statements learn collectively is obvious, the creator of the blogs is alleging that our shopper is working in breach of FCA necessities, is concerned in fraudulent exercise, it’s working with out the suitable authority and is subsequently committing legal acts.

They name into query the legitimacy and integrity of our shopper’s enterprise. We’re instructed that the allegations are false and fabricated.

These allegations are unfaithful, grossly defamatory and trigger critical injury to our shopper’s popularity and can trigger critical monetary hurt. We request that Google delists these URLs from its search consequence.

Article 1 can also be in breach of copyright utilizing {a photograph} and extract from the LinkedIn web page of Gabriel Musella CEO of our shopper. Mr Musella has not consented to this use.

In view of the above we require Google delist any hyperlinks to the above recognized pages from Google search outcomes.

Within the meantime, our shopper reserves their rights on this matter.

Yours faithfully

Collyer Bristow LLP

Reality is the last word protection to defamation claims and I’m assured I’ve greater than addressed the factual nature of BehindMLM’s reporting with respect to iGenius and CoinRule’s joint Cforce securities providing.

As for copyright infringement, BehindMLM’s use of any copyrighted work is protected beneath Truthful Use.

Tellingly, it ought to be famous that at no level did CoinRule attain out to BehindMLM immediately.

I’ll shut up by advising CoinRule and Collyer Bristow LLP, as a substitute of going the slimy route and attempting to suppress client consciousness by tried search consequence delistings, to get in contact with iGenius concerning their ongoing SEC investigation.

It’s additionally most likely price asking iGenius why, inside days of BehindMLM reporting on Cforce, iGenius advertising movies mentioning Cforce was pulled. Additionally why there’s by no means been any point out of Cforce or CoinRule in any of Investview’s SEC filings.

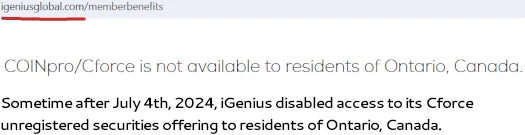

And you should definitely ask why Cforce is now not out there to residents of Ontario, Canada:

We’re assured it’s not as a result of BehindMLM’s reporting is “inaccurate and defamatory”.

Oh and naturally be at liberty to succeed in out to the SEC yourselves, both immediately or by Collyer Bristow LLP. For our half BehindMLM might be forwarding CoinRule’s frivolous defamation criticism to the SEC.

Suppression of BehindMLM’s analysis and reporting has been a focus in not less than two SEC securities fraud associated lawsuits (ref: OnPassive, NovaTech FX).

[ad_2]

Supply hyperlink