[ad_1]

The QZ Asset Administration Ponzi scheme has collapsed.

The QZ Asset Administration Ponzi scheme has collapsed.

Withdrawals had been disabled on or round Might 1st, beneath the ruse of an “SEC audit” exit-scam.

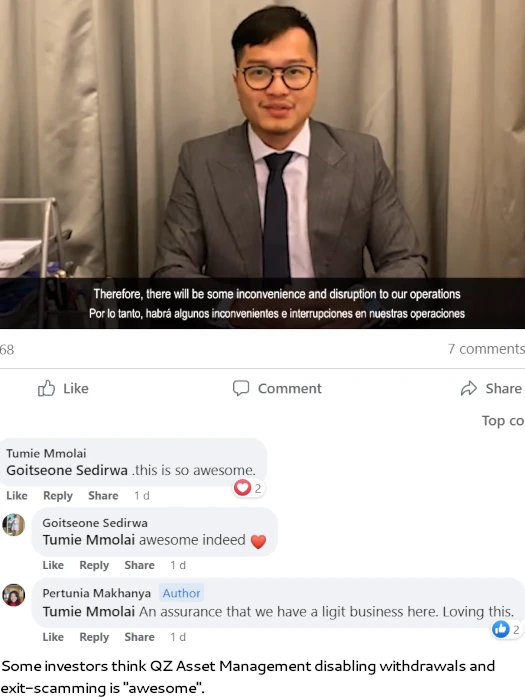

CEO Blake Yeung Pu Lei knowledgeable traders withdrawals had been delayed in a Might 1st “weekly replace“.

We at the moment are on the final part of economic auditing by SEC which is able to take between 6 to eight weeks to finish.

And naturally, QZ Asset Administration withdrawals are disabled throughout this time.

Subsequently, there will probably be some inconvenience and disruption to our operations.

As soon as this auditing is finished, we are able to then resume again to norm and enterprise as typical.

Yeung goes on to blabber about “adhering to strict SEC necessities”…

…which is amusing seeing as QZ Asset Administration has been committing securities fraud within the US and elsewhere on this planet since launch.

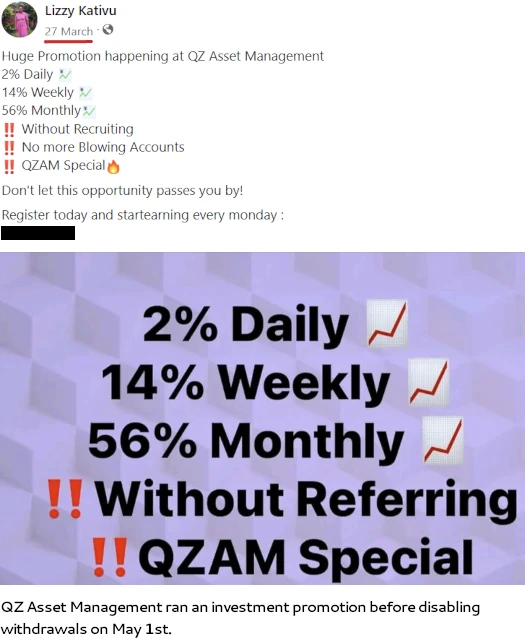

Launched in late 2022, QZ Asset Administration is a straightforward 400% ROI MLM crypto Ponzi scheme.

Preparations for QZ Asset Administration’s exit-scam started in February, by a misinformation riddled S-1 Registration Assertion filed with the SEC.

One instance is QZ Asset Administration claiming to have “roughly $8.4 billion in belongings”. By way of it’s MLM alternative, QZ Asset Administration pitches as much as 3.5% every week.

3.5% of $8.4 billion is $280 million. If that cash really existed QZ Asset Administration clearly doesn’t want your cash. There’s additionally no want for Blake Yeung to be stringing traders together with advertising replace movies from his basement.

That mentioned, submitting something with the SEC is a little bit of effort to go to for an exit-scam. A lot simpler to only disappear.

On the flip aspect, for those who simply disable withdrawals and do a runner, you don’t get “6 to eight weeks” to create distance between you and your victims.

Getting again to Yeung’s exit-scam video; In the beginning, the SEC doesn’t audit firms. Registered firms rent third-party auditors, who then put collectively periodic monetary statements which can be filed.

QZ Asset Administration have didn’t make any monetary filings. In reality, QZ Asset Administration hasn’t made any extra SEC filings past its first February submitting.

QZ Asset Administration doesn’t have a third-party monetary auditor as a result of apparent Ponzi is apparent.

Sometimes we don’t see Ponzi scammers tempt the SEC however if you’re working a rip-off focusing on Africa from Hong Kong, with a simple backdoor to mainland China, you’re most likely not too fearful about US authorities coming after you.

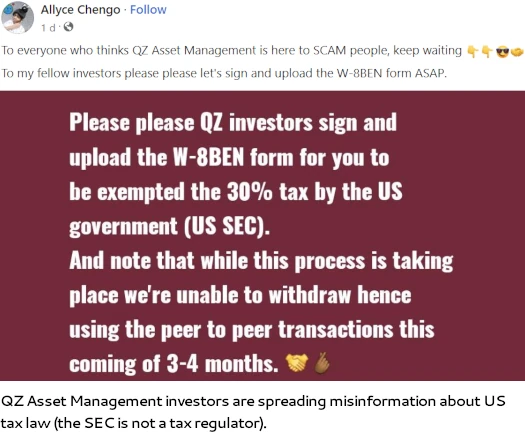

Within the wake of Yeung’s “withdrawals are disabled” announcement, promoters are circulating a request to finish a W-8BEN tax type.

I don’t know if that is an official communication by QZ Asset Administration or promoters making an attempt to reap knowledge.

Replace 4th Might 2023 – QZ Asset Administration is sending out W8-BEN kinds by its backoffice.

Traders are being advised in the event that they don’t return the finished kinds, QZ Asset Administration will deduct 30% from their backoffice funds. /finish replace

A W8-BEN tax type is an IRS submitting for non-US residents, used to declare non-US sources of earnings.

For the overwhelming majority of QZ Asset Administration traders, who haven’t any ties to the US and aren’t submitting US tax returns, that is smoke and mirrors.

What I think is going on is W8-BEN kinds are getting used to substantiate investor particulars, as soon as the kinds are returned to QZ Asset Administration (or promoters making the request).

As soon as confirmed, particulars of QZ Asset Administration’s most gullible traders will possible be bought on.

Presently SimilarWeb tracks prime sources of QZ Asset Administration web site site visitors as South Africa (72%), the Philippines (8%), Namibia (5%) and Botswana (3%).

South African authorities can’t get on prime of a $1.7 billion Ponzi scheme being run by South Africans, so don’t count on an excessive amount of from them.

Again in February Indonesian authorities confirmed QZ Asset Administration was working illegally, shortly killing off recruitment there.

Pending QZ Asset Administration finishing its exit-scam someday in June or July (“unhealthy new guys, the SEC mentioned we didn’t go the audit. Oh effectively… bye!”, complete QZ Asset Administration sufferer numbers and the way a lot they’ve misplaced stays unknown.

[ad_2]

Supply hyperlink