Opening a second likelihood checking account is usually a means so that you can entry banking companies and rebuild your banking historical past in the event you’ve been denied a checking account up to now resulting from banking points.

What Is A Second Probability Financial institution Account?

Second likelihood financial institution accounts are for individuals who have been denied a daily account resulting from previous monetary challenges. They provide primary companies like a debit card and on-line banking and are usually supplied by just a few banks and credit score unions.

Banks and credit score unions depend on a financial institution reporting company known as ChexSystems and plenty of use this info to find out whether or not somebody is eligible for an account. Folks might must depend on second likelihood financial institution accounts if they’ve a historical past of monetary difficulties which have led to damaging objects on their banking file, similar to unpaid overdraft charges or bounced checks.

You can too select a financial institution or credit score union that doesn’t depend on ChexSystems when evaluating new prospects. These monetary establishments are referred to as non-ChexSystems banks or credit score unions.

Whichever choice you select, we’ve acquired you coated. We’ve chosen the most effective second likelihood financial institution accounts primarily based on acceptance charges, checking account options and advantages, and the accounts with the bottom charges. Better of all, you possibly can open an account at the moment!

What are the Finest Second Probability Banks?

Open an account at the moment!

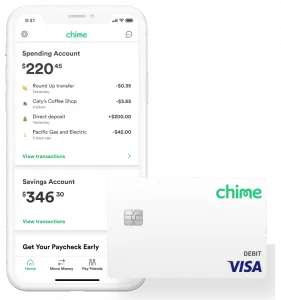

Chime | Our Prime Decide

Chime® is a fast-growing internet-only monetary firm and one among our high picks for a second likelihood checking account.

Chime® is a fast-growing internet-only monetary firm and one among our high picks for a second likelihood checking account.

And, better of all, Chime accepts nearly all prospects who apply. Even if in case you have unhealthy or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Options embody cellular deposits, direct deposit, on-line invoice fee, NO month-to-month or annual charges, NO overdrafts charges1, NO credit score examine, and NO CheckSystems. Opening an account is tremendous straightforward. It takes about 2 minutes and also you don’t must make an preliminary deposit. Right here’s what we like:

No Month-to-month Charges

For the previous couple of years, Chime’s enormous progress has come on the expense of the large banks and their outrageous charges. And it’s the most effective options of a Chime account. There are not any month-to-month or annual service expenses, no minimal stability requirement, no international transaction charges, no charges at over 60,000 ATMs2, and no charges for cellular and on-line invoice pay.

Deposit Money for FREE at Over 8,500 Walgreens

Gaining access to a bodily location for money deposits is vital to Chime members. And now it’s straightforward. All you must do is go right into a Walgreens retailer, hand the cashier the money you need to deposit alongside along with your Chime card, and the deposit will present up in your account instantly. This gives Chime members extra walk-in areas than every other financial institution within the U.S. With over 78% of the nation inside 5 miles of a Walgreens, this can be a important profit for hundreds of thousands.3

Sensible Expertise

In contrast to huge banks, Chime was created in the course of the smartphone period and, due to this fact, options an app that’s greater than only a means for purchasers to evaluate their financial institution accounts.

You’ll be able to switch funds to family and friends, Chime members or not… they usually can declare their cash immediately4 with none further apps. The Chime app additionally has a collection of notifications you could activate or flip off so that you keep in full management. Misplaced or misplaced your card? You’ll be able to instantaneously flip off your card utilizing the app. No marvel over 300,000 prospects have given the app a 5-star evaluate.

Clients First

Chime was one of many first to supply a “spherical up” choice. Should you use your Chime card on a purchase order of $10.65, Chime provides you the choice of mechanically rounding as much as $11.00 and placing the remaining $.35 in your free Chime financial savings account. And that provides up over time! Plus, Chime pays 0.50% Annual Share Yield (APY)5 in curiosity on that financial savings account.

Should you use direct deposit along with your Chime account, you may get your paycheck as much as 2 days early6. And Chime is simply saying no to huge financial institution NSF expenses with a fee-free overdraft program as much as $200. Lastly, Chime only recently launched their Credit score Builder bank card with no curiosity and no annual price. We don’t assume there may be one other firm innovating for his or her prospects like Chime.

Get a Chime Account As we speak!

Discovered Enterprise Banking | Our Favourite Enterprise Account

One of many largest challenges for small companies, entrepreneurs, and gig employees is discovering the precise checking account for his or her rising enterprise.

One of many largest challenges for small companies, entrepreneurs, and gig employees is discovering the precise checking account for his or her rising enterprise.

The Discovered Enterprise Banking Account solves that downside by simplifying your monetary journey. Obtainable solely to sole proprietors and single-owner companies, the sign-up course of takes just a few minutes. There’s no credit score examine or ChexSystems.

Discovered Enterprise Banking at a Look

- No opening deposit required

- No minimal stability

- No required month-to-month charges

- Free limitless ACH funds

- Free limitless invoicing

- Free cellular examine deposits

- Free built-in expense administration instruments

- Settle for financial institution transfers and card funds

- Simply connect with Quickbooks, Stripe, Venmo, PayPal, Etsy, and so forth.

- Receives a commission as much as 2 days early with direct deposit1

- Ship cash to anybody throughout the U.S. utilizing their telephone quantity or e-mail handle

- Deposit money at over 79,000 areas

- Entry your account on-line or on the free app

- Discovered’s core options are free. Additionally they provide a paid product, FoundPlus

Quick Approval Course of

Time is cash and Discovered respects each. Apply for your small business account on-line and the streamlined approval course of ensures you’re up and operating rapidly. No prolonged paperwork wanted to get swift entry to your monetary hub.

Simple Bookkeeping and Tax Administration Instruments

Managing your small business funds shouldn’t be a headache. You get intuitive instruments similar to automated expense monitoring, receipt seize, limitless customized invoices, and the flexibility to handle 1099 contractor funds. Plus, you get the flexibility to auto-save for tax funds and mechanically generate tax varieties.

No Hidden Charges, No Surprises

Say goodbye to surprising expenses. Discovered.com believes in transparency. They’ve stripped away pointless charges, leaving you with an easy banking expertise. No hidden prices—simply readability and peace of thoughts.

Discovered is a monetary know-how firm, not a financial institution. Enterprise banking companies are supplied by Piermont Financial institution, Member FDIC.2

Open a Discovered account now!

Fifth Third Financial institution | Get $200 Bonus

The Momentum® Checking account from Fifth Third Financial institution gives a really enticing new account bonus. And with no month-to-month upkeep price, no minimal deposit, and no minimal stability required, banking is easy.

The Momentum® Checking account from Fifth Third Financial institution gives a really enticing new account bonus. And with no month-to-month upkeep price, no minimal deposit, and no minimal stability required, banking is easy.

Fifth Third Momentum® Checking at a Look

- No preliminary deposit required

- No minimal stability required

- No month-to-month upkeep charges

- Ship and obtain cash with Zelle®

- Further Time overdraft avoidance

- Cell alerts for transactions

- Receives a commission as much as 2 days early once you enroll in Early Pay

- Entry to greater than 40,000 fee-free ATMs nationwide

- 1,200 department areas

- Get pleasure from limitless examine writing

- Cell and on-line invoice pay and examine deposit

Keep away from Overdraft Charges

Fifth Third has an “Further Time” overdraft characteristic the place they supply an additional day for purchasers to cowl any overdraft purchases which have hit their account. This characteristic offers you with some additional time to keep away from overdraft charges and handle your account successfully.

Financial institution a $200 Bonus

Fifth Third will add $200 to your account once you make direct deposits totaling $500 or extra inside 90 days of opening your new account. Qualifying direct deposits embody payroll, pension, or authorities funds similar to Social Safety. To obtain the money bonus, your checking account have to be open and in good standing. Provide ends June 30, 2024. Member FDIC.

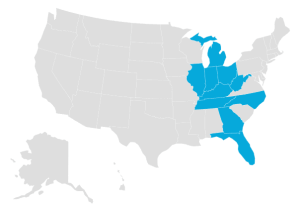

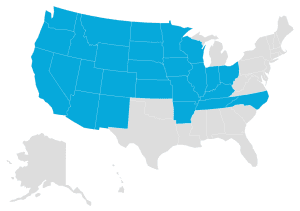

States The place Fifth Third Financial institution is Obtainable

You’ll be able to apply on-line in the event you dwell in one of many following 11 states: Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, South Carolina, Tennessee, or West Virginia.

Paycheck Advances By MyAdvance

MyAdvance is a money advance service supplied by Fifth Third Momentum that lets you borrow a sure sum of money towards your upcoming direct deposit. The charges for this service are primarily based in your account’s age, and the quantity you borrow might be deducted out of your subsequent direct deposit. This is usually a helpful choice for overlaying surprising bills rapidly and simply.

Opening a Fifth Third Momentum® Checking account is straightforward and takes just a few minutes. The mixture of on-line banking instruments, checking account options, and department areas makes this a powerful alternative.

Open an account at the moment!

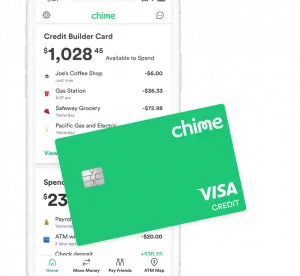

Present | Construct Credit score Whereas You Financial institution

Present gives an modern account to customers who need all of it with out the prices and hassles.

Present gives an modern account to customers who need all of it with out the prices and hassles.

The Present Construct account works similar to a checking account but in addition helps you construct credit score each time you utilize the cardboard. Signal-up takes about 2 minutes and Present has extraordinarily excessive acceptance charges.

Present at a Look

- NO credit score examine

- NO minimal stability

- NO deposit required to open an account

- NO charges at over 40,000 ATMs within the U.S.

- Get your paycheck as much as 2 days early with direct deposit

- Earn 4.0% APY in your stability as much as $6,000 with direct deposit; earn 0.25% APY with out

- Earn factors for limitless cashback at taking part retailers

- Ship cash immediately without cost

- A sublime however easy smartphone app

- 24/7 member assist

- FDIC insured account as much as $250,000

Swipe The Card and Construct Credit score

Utilizing your Present Construct account to BUILD your credit score is easy. Right here’s the way it works:

- You add cash to your account

- Swipe your card to make purchases, pay payments, or get cash from an ATM machine

- The funds in your account pay for these transactions

- Present studies your fee to construct your credit score historical past

Present Works Laborious for You

Present gives a very distinctive service it calls Gasoline Maintain Removals. What’s a fuel maintain? Some fuel stations might apply a maintain from $50 to $100 once you use your card to pump fuel. Should you solely pumped $10 of fuel, however the fuel station locations a $100 maintain in your funds, you gained’t have entry to the $90 distinction for as much as 3 enterprise days! The Present Construct card will instantly refund the maintain so you will have entry to all of your funds. We haven’t discovered that profit anyplace within the market.

We love the options, we love the smartphone app, and we love Present. That makes us assume you’ll love them too.

Get a Present Account Now!

Chase Safe Banking | $100 New Account Bonus

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is perhaps a superb match for a second likelihood checking account.

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is perhaps a superb match for a second likelihood checking account.

Chase Safe Banking at a Look

- NO credit score examine

- NO ChexSystems

- NO minimal deposit to open

- NO overdraft charges

- FREE entry to over 15,000 Chase ATMs

- FREE Chase On-lineSM Invoice Pay

- FREE cash orders and cashier’s checks

- Shortly ship and obtain cash with Zelle®

- Paper checks should not supplied with the account

Incomes the $100 Bonus

To earn the $100 bonus, you’ll want to finish 10 qualifying transactions inside 60 days of account enrollment. Qualifying transactions embody debit card purchases, on-line invoice funds, Chase QuickDepositSM, utilizing Zelle®, or receiving ACH credit.

What to Know Concerning the Approval Course of

Chase Safe Banking is the one account supplied by Chase that doesn’t use ChexSystems however does use Early Warning Providers (EWS). Moreover, in the event you’ve had an account closed by Chase up to now, your utility is not going to be authorised. Previous account closures can embody missteps similar to non-payment of charges, extreme overdrafts, or suspected fraud.

Charges

Chase doesn’t provide overdraft companies with this account as you possibly can solely spend the cash you will have accessible. You also needs to know that utilizing non-Chase ATMs can value from $3.00 to $5.00 per transaction. Surcharges from the ATM proprietor/community might apply.

Chase Safe Banking carries a $4.95 month-to-month service price, however it may be waived when you will have digital deposits made into the account totaling $250 or extra throughout every month-to-month assertion interval.

Different Account Options

Chase Safe Banking gives a number of different options we like. This consists of:

- Zero Legal responsibility Safety. Get reimbursed for unauthorized debit card transactions when reported promptly.

- Budgeting Instruments. Handle your spending and get each day spending insights with Snapshot within the Chase Cell® app.

- Credit score and Identification Monitoring. Observe your credit score rating, get a customized motion plan supplied by Experian™ to assist enhance your rating and obtain id monitoring without cost by way of Chase Credit score Journey®.

- Early Direct Deposit. Get that “simply paid” feeling as much as two enterprise days sooner with early direct deposit.

Should you’ve needed to financial institution with Chase and puzzled in the event you’d qualify, we expect you’ll be proud of the Chase Safe Banking account.

Get a Chase Account Now!

Improve Rewards Checking Plus

Improve is a digital banking platform offering a variety of monetary companies, together with checking accounts, private loans, and bank cards with out annual charges.

Improve is a digital banking platform offering a variety of monetary companies, together with checking accounts, private loans, and bank cards with out annual charges.

Improve Rewards Checking Plus at a Look

- As much as 2% money again on purchases

- NO opening deposit required

- NO month-to-month upkeep charges

- NO minimal stability requirement

- NO NSF or overdraft charges

- Receives a commission as much as 2 days early with direct deposit

- 10%-20% decrease rates of interest on loans & bank cards by way of Improve

- Earn as much as 5.21% APY with a free Efficiency Financial savings Account

- FDIC insured account as much as $250,000

Incomes 2% Money Again

The Improve Rewards Checking Plus permits you to earn 2% money again rewards with debit card purchases. Eligible bills embody:

- Comfort and drug shops

- Gasoline stations

- Month-to-month subscriptions, together with streaming companies

- Eating places

- Utilities and cellphone companies

All different purchases will earn 1% money again. To earn the reward your account have to be “energetic”. An energetic account is one which has a month-to-month direct deposit of $1,000 or extra.

However in the event you select to not or can not meet the month-to-month direct deposit requirement, the account cashback program is decreased from 2% to 1%. In our view, that’s nonetheless a really robust providing with only a few charges.

Shoppers Love Improve

Managing your transactions is easy, facilitated by way of both an intuitive on-line dashboard or the handy Improve cellular app, accessible for each iOS (4.8 out of 5 ranking) and Android (4.7 out of 5 ranking) customers. You’ll even have free entry to your credit score rating and might be notified of any adjustments.

Not solely is the Improve Rewards Checking Plus one among our favorites, however the account additionally has very excessive approval charges.

Get an Improve Account Now!

SoFi Checking & Financial savings | Earn a $325 Welcome Bonus

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

SoFi Checking & Financial savings at a Look

- FREE SoFi debit MasterCard

- FREE smartphone app. Handle your account on-line, too

- No opening deposit required

- No month-to-month minimal stability requirement

- No month-to-month upkeep charges

- No charges at 55,000+ ATMs

- Receives a commission as much as two days early with direct deposit

Find out how to Earn the $325 Bonus

As quickly as you get your SoFi Checking & Financial savings account and deposit $10 or extra, you’ll earn $25. Once you arrange direct deposit from an employer, SoFi will credit score your account as much as a further $300 (relying on the quantity of your direct deposit).

Utilizing the SoFi direct deposit choice unlocks further advantages, too. First, in the event you overspend a bit, SoFi will cowl as much as $50 with no overdraft charges. Second, you’ll obtain a a lot increased curiosity quantity of 4.60% APY on financial savings account balances and .50% APY on checking account balances. Should you determine to not make the most of direct deposit, you’ll obtain 1.20% APY on financial savings balances.

The sign-up course of can take lower than 60 seconds. With over 6 million members, SoFi is a financial institution you possibly can depend on!

SoFi has been nice! The account was straightforward to open and I acquired my debit card a number of days later. The smartphone app is straightforward to make use of and I can examine the whole lot from my laptop, too. SoFi appears to be the proper financial institution.

Claire M., SoFi Buyer

Get a SoFi Account Now!

mph.financial institution Contemporary Account

It’s a tall order to “Make Folks Glad” in the case of banking, however that’s the acknowledged mission behind mph.financial institution.

It’s a tall order to “Make Folks Glad” in the case of banking, however that’s the acknowledged mission behind mph.financial institution.

Powered by Liberty Financial savings Financial institution (established in 1889!), the mph.financial institution Contemporary account does use ChexSystems, however so long as you don’t have greater than 3 charge-offs totaling $1,000 or studies of fraud approval charges are very excessive. Charges for the account embody a $9 month-to-month service price and a $10 overdraft price.

mph.financial institution Contemporary Account at a Look

- $0 preliminary deposit to open account

- Ship and obtain cash with Zelle®

- Entry your account along with your telephone or laptop

- When coupled with a free financial savings account, earn as much as 5.00% APY

- Elective capability to spherical up expenses and stash the money into financial savings

- Receives a commission as much as 2 days early with direct deposit

- Entry to over 55,000 fee-free ATMs

Apply for a Contemporary Account As we speak!

Walmart MoneyCard

Need to earn money again on Walmart purchases – as much as $75 annually? Then you definitely would possibly love the Walmart MoneyCard.

Need to earn money again on Walmart purchases – as much as $75 annually? Then you definitely would possibly love the Walmart MoneyCard.

It’s a debit card that has some robust options similar to cashback on Walmart purchases, overdraft safety, curiosity in your financial savings, and a cellular app that permits you to observe your purchases and deposit funds into your account.

Our favourite options embody:

- Simple approval: no ChexSystems or credit score examine

- No preliminary deposit is required and there are not any month-to-month minimums

- Deposit money without cost at any Walmart retailer and it exhibits up 10 minutes later

- Deposit checks utilizing the Walmart MoneyCard smartphone app

- Simply request a number of playing cards for household use1

- Handle your account out of your laptop or the smartphone app

- 3% cashback on Walmart.com purchases, 2% cashback for Walmart gasoline stations, and 1% money again to be used in-store2

- Earn 2.00% APY on cash you put aside in a free financial savings account3

- With qualifying direct deposits4, you possibly can opt-in and revel in overdraft safety of as much as $200 on eligible purchases5

- No month-to-month price once you direct deposit $500+ within the earlier month-to-month interval. In any other case, there’s a $5.94 month-to-month price.6

The Walmart MoneyCard is out there in all 50 states, Washington D.C., and Puerto Rico.

Get a Walmart MoneyCard Account Now!

U.S. Financial institution | Earn Up To $700 Money Bonus

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches positioned in 26 states largely positioned within the west and midwest.

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches positioned in 26 states largely positioned within the west and midwest.

You’ll be able to earn as much as $700 once you open a brand new U.S. Financial institution Neatly® Checking account and a Normal Financial savings account and full qualifying actions. The provide is topic to sure phrases and limitations and is legitimate by way of June 27, 2024. Member FDIC. Provide is probably not accessible in the event you dwell exterior of the U.S. Financial institution footprint or should not an current consumer of U.S. Financial institution or State Farm.

U.S. Financial institution Neatly® Checking at a Look

- A U.S. Financial institution Visa debit card

- On-line banking and invoice pay

- Cell banking and cellular examine deposit

- Ship cash with Zelle®

- 24/7 buyer assist

- No NSF expenses for overdraft balances below $50

- Entry to U.S. Financial institution Sensible Rewards® to reap further advantages

- No charges at U.S. Financial institution ATMs

- No surcharge charges at 40,000 MoneyPass ATMs

States The place U.S. Financial institution is Obtainable

Should you dwell in one of many following 26 states the place this account is out there, you possibly can apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Should you dwell in one of many following 26 states the place this account is out there, you possibly can apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Account Particulars and Prices

To get an account, you’ll must make a gap deposit of $25. The month-to-month service price is $6.95 however may be waived in the event you preserve a minimal stability of $1,500 or by having a mixed month-to-month direct deposit totaling $1,000. You can too keep away from the month-to-month price in case you are 24 and below, 65 and over, or a member of the army (should self-disclose) or qualify for one of many 4 Sensible Rewards® tiers (Main, Plus, Premium, or Pinnacle).

Banking Made Simple

The U.S. Financial institution Neatly® Checking account comes with the most effective cellular apps in the marketplace. Over a million prospects have given the app an total ranking of 5 stars. You’ll be able to handle your total account from a pc or your smartphone.

And there’s extra to U.S. Financial institution than an impressive smartphone app: 24/7 customer support, Zelle® prompt transfers, free budgeting and automatic instruments, overdraft leniency, and Sensible Rewards®. Maybe that’s why U.S. Financial institution repeatedly makes the record of the most effective banks within the nation.

Open an account at the moment!

Second Probability Banks Close to Me

Should you choose to financial institution domestically, there may be some stable choices. Whereas most main banks aren’t second likelihood banks, many neighborhood banks and credit score unions provide checking accounts that may work for anybody with a ChexSystems or below-average credit historical past.

Nearly all of these banks and credit score unions provide second likelihood checking accounts that go by numerous names, similar to “Proper Begin Checking” and “Contemporary Begin Checking.” Different banks and credit score unions are native choices the place the establishment doesn’t use ChexSystems within the account approval course of.

Alabama

- Cadence Financial institution – My Method Checking

- BankPlus – CreditPlus Checking

- Commonwealth Nationwide Financial institution – Contemporary Begin Checking

- Jefferson Monetary Federal Credit score Union – Second Probability Checking

- West Alabama Financial institution – Contemporary Begin Checking

- See the total record >>

Alaska

- MAC Federal Credit score Union – eChecking

- Matanuska Valley Federal Credit score Union – Share Draft Account

- Northrim Financial institution – Easy Checking

- Spirit of Alaska Federal Credit score Union – E-Z Checking

- True North Federal Credit score Union – True Choices Checking

- See the total record >>

Arizona

- Banner Federal Credit score Union – Alternative Checking

- BOK Monetary – Alternative Banking

- Copper State Credit score Union – Strive Once more Checking

- MariSol Federal Credit score Union – Begin Once more Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- See the total record >>

Arkansas

- Financial institution OZK – Pathway Checking

- Centennial Financial institution – Alternative 100 Checking

- Focus Financial institution – Contemporary Begin Checking

- River Valley Neighborhood Federal Credit score Union – Contemporary Begin Checking

- US Financial institution – Secure Debit Account

- See the total record >>

California

- California Neighborhood Credit score Union – New Beginnings Checking

- Excite Credit score Union – Contemporary Begin Checking

- OneUnited Financial institution – U2 E-Checking

- Union Financial institution – Financial institution Freely Checking

- Upward Credit score Union – Renew Checking

- See the total record >>

Colorado

- 5Star Financial institution – E-Checking

- NuVista Federal Credit score Union – Final Probability Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- US Financial institution – Secure Debit Account

- White Crown Credit score Union – Free Checking

- See the total record >>

Connecticut

- Neighborhood Credit score Union of New Milford – Share Draft Checking

- Japanese Connecticut Financial savings Financial institution – Restart Checking

- FineX Credit score Union – Re-Begin Checking

- New Haven Financial institution – Second Probability Checking

- Webster Financial institution – Alternative Checking

- See the total record >>

Delaware

- Del-One Credit score Union – Rewards Checking

- FSNB (Fort Sill Nationwide Financial institution) – Fundamental Checking

- See the total record >>

District of Columbia

- Healthcare Programs Federal Credit score Union – Renew Checking

- Library of Congress Federal Credit score Union – Free Checking

- Transit Workers Federal Credit score Union – Contemporary Begin Account

- United Financial institution – United Free Checking

- See the total record >>

Florida

- Axiom Financial institution – Alternative Checking

- Centennial Financial institution – Alternative 100 Checking

- Coral Neighborhood Federal Credit score Union – Lifesaver Checking

- McCoy Federal Credit score Union – Contemporary Begin Checking

- San Antonio Residents Federal Credit score Union – Checking Rebuilder

- See the total record >>

Georgia

- Financial institution OZK – Pathway Checking

- Georgia’s Personal Credit score Union – Decision Checking

- Well being Middle Credit score Union – Contemporary Begin Checking

- MyGeorgia Credit score Union – Secured Checking

- Peach State Federal Credit score Union – Contemporary Begin Checking

- See the total record >>

Hawaii

- CU Hawaii Federal Credit score Union – Checking Account

- Collect Federal Credit score Union – Share Draft Checking

- Hawaii Neighborhood Federal Credit score Union – Verify Benefit

- Hawaii USA Federal Credit score Union – MyChance Checking

- HomeStreet Financial institution – Free Checking

- See the total record >>

Idaho

- Cottonwood Neighborhood Federal Credit score Union – Share Draft Checking

- Horizon Credit score Union – Replenish Checking

- Idaho Central Credit score Union – Free Checking

- Latah Federal Credit score Union – Second Probability Checking

- Mountain West Financial institution – Completely Free Checking

- See the total record >>

Illinois

- Banterra Financial institution – Banterra Restart Checking

- Fifth Third Financial institution – Momentum Checking

- First American Financial institution – Contemporary Begin Checking

- Marquette Financial institution – ReStart Checking

- Staley Credit score Union – Renew Checking

- See the total record >>

Indiana

- 3Rivers Federal Credit score Union – Onward Checking

- Centra Credit score Union – Alternative Checking

- First Monetary Financial institution – NoWorry Checking

- Horizon Financial institution – Contemporary Begin Checking

- United Constancy Financial institution – New Day Checking

- See the total record >>

Iowa

- Better Iowa Credit score Union – Contemporary Begin Checking

- Nice Southern Financial institution – Second Probability Checking

- Marine Credit score Union – Credit score Builder Checking

- North Iowa Neighborhood Credit score Union – Contemporary Begin Debit

- US Financial institution – Secure Debit Account

- See the total record >>

Kansas

- Central Nationwide Financial institution – New Alternative Checking

- Neighborhood Financial institution & Belief – Completely Free Checking

- Heartland Credit score Union – Renew Checking

- United Shoppers Credit score Union – Second Probability Checking

- Unity One Credit score Union – Clear Begin Checking

- See the total record >>

Kentucky

- Appalachian Neighborhood Federal Credit score Union – Contemporary Begin Checking

- Cecilian Financial institution – Selection Alternative Checking

- MidWest America Federal Credit score Union – Freedom Checking

- South Central Financial institution – Inexperienced Tree Renew Checking

- Woodforest Nationwide Financial institution – Second Probability Checking

- See the total record >>

Louisiana

- Alive Credit score Union – Contemporary Begin Checking

- Barksdale Federal Credit score Union – Contemporary Begin Checking

- Jefferson Monetary Federal Credit score Union – Second Probability Checking

- Louisiana Federal Credit score Union – Reboot Checking

- Woodforest Nationwide Financial institution – Second Probability Checking

- See the total record >>

Maine

- 5 County Credit score Union – Second Probability Checking

- Midcoast Federal Credit score Union – Compass Checking

- New Dimensions Federal Credit score Union – Fundamental Checking

- Saco Valley Credit score Union – Free Checking

- City & Nation Federal Credit score Union – Higher Checking

- See the total record >>

Maryland

- Central Credit score Union of Maryland – Renew Checking

- Clear Mountain Financial institution – StartFresh Banking

- Market USA Federal Credit score Union – Contemporary Begin Checking

- Safety Plus Federal Credit score Union – Revive Checking

- Woodforest Nationwide Financial institution – Second Probability Checking

- See the total record >>

Massachusetts

- Alden Credit score Union – No Boundaries Checking

- Bellwether Neighborhood Credit score Union – Reside Free Checking

- OneUnited Financial institution – U2 E-Checking

- US Alliance Monetary – MyLife Checking

- Webster Financial institution – Alternative Checking

- See the total record >>

Michigan

- Birmingham Bloomfield Credit score Union – New Beginnings Checking

- Fifth Third Financial institution – Momentum Checking

- Intandem Credit score Union – Contemporary Begin Checking

- Michigan State College Federal Credit score Union – Rebuild Checking

- United Monetary Credit score Union – Contemporary Begin Checking

- See the total record >>

Minnesota

- Marine Credit score Union – Credit score Builder Checking

- MBT Financial institution – GoEasy Checking

- Minnesota Valley Federal Credit score Union – Second Probability Checking

- Unity One Credit score Union – Clear Begin Checking

- WESTconsin Credit score Union – Foundations Checking

- See the total record >>

Mississippi

- Cadence Financial institution – My Method Checking

- Gulf Coast Neighborhood Federal Credit score Union – New Probability Checking

- Liberty Federal Credit score Union – Alternative Checking

- The First Financial institution – First AID Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- See the total record >>

Missouri

- Columbia Credit score Union – Contemporary-Begin Checking

- Concordia Financial institution – Second Probability Checking

- First State Neighborhood Financial institution – New Alternative Checking

- Nice Southern Financial institution – Second Probability Checking

- Wooden & Huston Financial institution – StartFresh Checking

- See the total record >>

Montana

- Clearwater Credit score Union – SmartSpend Checking

- First Safety Financial institution – Completely Free Checking

- Garfield County Financial institution – Pay Much less Checking

- Rocky Mountain Credit score Union – Contemporary Begin Checking

- US Financial institution – Secure Debit Account

- See the total record >>

Nebraska

- Clark County Credit score Union – CheckAgain

- Nevada State Financial institution – OnBudget Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- US Financial institution – Secure Debit Account

- WestStar Credit score Union – Contemporary Begin Checking

- See the total record >>

Nevada

- Clark County Credit score Union – CheckAgain

- Nevada State Financial institution – OnBudget Banking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- US Financial institution – Secure Debit Account

- WestStar Credit score Union – Contemporary Begin Checking

- See the total record >>

New Hampshire

- Bellwether Neighborhood Credit score Union – Reside Free Checking

- GFA Federal Credit score Union – Second Probability Checking

- Members First Credit score Union – On a regular basis Checking

- See the total record >>

New Jersey

- Atlantic Federal Credit score Union – Take 2 Checking

- Credit score Union of New Jersey – Proper Flip Checking

- Jersey Shore Federal Credit score Union – Contemporary Begin Checking

- M&T Financial institution – My Method Banking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- See the total record >>

New Mexico

- First American Neighborhood Credit score Union – Second Probability Checking

- Guadalupe Credit score Union – Second Probability Debit

- Lea County State Financial institution – Alternative Checking

- US Financial institution – Secure Debit Account

- US Eagle Federal Credit score Union – FlexChecking

- See the total record >>

New York

- Adirondack Regional Federal Credit score Union – New Beginnings Checking

- Financial institution OZK – Pathway Checking

- Fulton Financial savings Financial institution – New Alternative Checking

- Webster Financial institution – Alternative Checking

- Woodforest Nationwide Financial institution – Second Probability Checking

- See the total record >>

North Carolina

- Financial institution OZK – Pathway Checking

- Excite Credit score Union – Contemporary Begin Checking

- Fifth Third Financial institution – Momentum Checking

- North Carolina Neighborhood Federal Credit score Union – FreshStart Checking

- SouthState Financial institution – Direct Checking

- See the total record >>

North Dakota

- American Federal Financial institution – American Free Checking

- Gate Metropolis Financial institution – Completely FREE Checking

- Hometown Credit score Union – Share Draft Checking

- US Financial institution – Secure Debit Account

- Western State Financial institution – Free Checking

- See the total record >>

Ohio

- Buckeye State Credit score Union – Second-Probability Checking

- Cardinal Credit score Union – Second Probability Checking

- Eaton Household Credit score Union – Second Probability Checking

- First Federal Financial institution of Ohio – Thrifty Checking

- LCNB Nationwide Financial institution – Second Probability Checking

- See the total record >>

Oklahoma

- Allegiance Credit score Union – Second Probability Checking

- Residents Financial institution of Edmond – Contemporary Begin Checking

- Focus Federal Credit score Union – Contemporary Begin Checking

- TTCU Federal Credit score Union – Contemporary Begin Checking

- Weokie Federal Credit score Union – Contemporary Begin Checking

- See the total record >>

Oregon

- Consolidated Neighborhood Credit score Union – Easy Checking

- HomeStreet Financial institution – Free Checking

- Level West Credit score Union – Contemporary Begin Checking

- Union Financial institution – Financial institution Freely Checking

- US Financial institution – Secure Debit Account

- See the total record >>

Pennsylvania

- Juniata Valley Financial institution – Contemporary Begin Banking

- Market USA Federal Credit score Union – Contemporary Begin Checking

- Parkview Neighborhood Federal Credit score Union – Contemporary Begin Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- West Department Valley Federal Credit score Union – Again on Observe Checking

- See the total record >>

Rhode Island

- Rhode Island Credit score Union – Fundamental Checking

- Rockland Belief – Free Checking

- Webster Financial institution – Alternative Checking

- See the total record >>

South Carolina

- Caro Federal Credit score Union – Rebound Checking

- Carolina Foothills Federal Credit score Union – Refresh Checking

- Carver State Financial institution – Second Probability Checking

- HopeSouth Federal Credit score Union – Contemporary Begin Checking

- Skyla Credit score Union – Contemporary Begin Checking

- See the total record >>

South Dakota

- Dakota Plains Federal Credit score Union – Share Draft Checking

- Farmers and Retailers State Financial institution – Common Checking

- First Dakota Nationwide Financial institution – FREE Checking

- US Financial institution – Secure Debit Account

- See the total record >>

Tennessee

- Cadence Financial institution – My Method Checking

- First Nationwide Financial institution – On Us Account

- Better Japanese Credit score Union – Contemporary Begin Checking

- Market USA Federal Credit score Union – Contemporary Begin Checking

- The Tennessee Credit score Union – Restart Checking

- See the total record >>

Texas

- 4U Credit score Union – Contemporary Begin Checking

- Related Credit score Union of Texas – 180 Checking

- Beacon Federal Credit score Union – Second Probability Checking

- First Service Credit score Union – Contemporary Begin Checking

- Premier America Credit score Union – Contemporary Begin Checking

- See the total record >>

Utah

- American United Federal Credit score Union – Contemporary Begin Checking

- Cyprus Credit score Union – Contemporary Begin Checking

- Desert Rivers Credit score Union – Free Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- US Financial institution – Secure Debit Account

- See the total record >>

Vermont

Virginia

- Appalachian Neighborhood Federal Credit score Union – Contemporary Begin Checking

- Central Virginia Federal Credit score Union – Contemporary Begin Checking

- Credit score Union of Richmond – Second Probability Checking

- Choose Seven Credit score Union – Second Probability Checking

- Virginia Credit score Union – Encore Checking

- See the total record >>

Washington

- American Lake Credit score Union – Compass Checking

- MountainCrest Credit score Union – Contemporary Begin Checking

- Union Financial institution – Financial institution Freely Checking

- US Financial institution – Secure Debit Account

- Wheatland Financial institution – Free-Vary Checking

- See the total record >>

West Virginia

- Clear Mountain Financial institution – StartFresh Banking

- First Trade Financial institution – Take 2 Checking

- Market USA Federal Credit score Union – Contemporary Begin Checking

- UNIFY Monetary Credit score Union – Proper Begin Checking

- West Virginia Federal Credit score Union – Contemporary Begin Checking

- See the total record >>

Wisconsin

- Crossbridge Neighborhood Financial institution – Contemporary Begin Checking

- Dane County Credit score Union – Relationship Builder Checking

- First American Financial institution – Contemporary Begin Checking

- Tomahawk Neighborhood Financial institution – Contemporary Begin Checking

- UW Credit score Union – Encore Account

- See the total record >>

Wyoming

- Pelican State Credit score Union – Second-Probability Checking

- US Financial institution – Secure Debit Account

- Valley Credit score Union – Alternative Checking

- WyHy Federal Credit score Union – Second Probability Checking

- WYO Central Federal Credit score Union – 2nd Probability Checking

- See the total record >>

Who wants a second likelihood banking account?

Banks usually refuse to open checking accounts for customers who’re thought of a ‘unhealthy threat.’ You possibly can be thought of a foul threat for issues like bouncing checks (which may be unintentional), writing unhealthy checks (a deliberate act), having a low credit score rating, or just breaking a financial institution’s guidelines by exceeding the each day ATM withdrawal restrict or steadily transferring cash between accounts.

Many of those actions lead to charges being charged to your account, and if in case you have too many charges or should not paying the charges resulting from a low account stability, chances are you’ll be thought of a foul threat for a financial institution. This may result in the denial of a conventional checking account and make it tough to handle your funds.

Nonetheless, in the case of second likelihood financial institution accounts, the state of affairs is completely different. Banks don’t take into account your banking historical past once you apply for a second likelihood account, so in nearly all circumstances, you shouldn’t be denied an account. This offers a possibility for people who’ve confronted monetary challenges up to now to nonetheless have entry to banking companies and work in direction of bettering their monetary state of affairs.

It’s price mentioning that whereas opening a second likelihood account can present a recent begin, it’s important to be accountable and conscious of your banking actions. Constructing a optimistic banking historical past by managing your account responsibly can assist you regain belief with monetary establishments and probably qualify for extra conventional banking companies sooner or later.

It may be reassuring to know that many of the second likelihood financial institution accounts we’ve featured above are simply pretty much as good, if not higher than a conventional checking account you’ll have had up to now or which can be supplied by many banks and credit score unions at the moment.

What do I must open a second likelihood checking account?

To open a second likelihood account, you usually solely want to supply an official type of identification and primary private info. If the account has a minimal opening deposit requirement, additionally, you will must have money accessible.

It’s important to notice that some banks might have age restrictions on their accounts, so chances are you’ll want to satisfy a sure age requirement to qualify for a second-chance account. Moreover, it’s vital to know that minors can not open an account with out an grownup co-signer.

Are there any low-fee on-line banks that provide second likelihood checking accounts?

Sure, there are low-fee on-line banks that provide second likelihood checking accounts. One instance is Chime, which offers a second likelihood checking account with out charging month-to-month charges. Chime additionally gives instruments and options to assist automate financial savings, making it a helpful choice for these looking for a second likelihood checking account.

What components must be thought of when selecting a second likelihood checking account?

When selecting a second likelihood checking account, it’s vital to contemplate a number of components. One issue is the charges related to the account, together with month-to-month charges and different expenses that may add up rapidly.

One other issue to contemplate is the account necessities, such because the minimal opening deposit and ongoing stability necessities. It’s essential to find out how a lot cash you possibly can afford to deposit or preserve within the account.

Accessibility is one other issue to contemplate, so it’s helpful to discover a financial institution or credit score union that gives on-line and cellular banking choices, together with a debit card and close by ATM entry.

What are the cons or drawbacks of second likelihood checking accounts?

There are some drawbacks to second likelihood checking accounts. They normally include increased charges in comparison with conventional checking accounts. Moreover, there are extra restrictions, similar to no overdrafts, and restricted advantages and perks related to these accounts. Moreover, there are fewer banks to select from in the case of second likelihood checking accounts.

What are the particular advantages of second likelihood checking accounts?

Second likelihood checking accounts have a number of advantages, together with straightforward qualification even with a poor banking historical past. They usually include on-line and cellular banking choices, in addition to a free debit card and checkbook. Moreover, these accounts are federally insured by both the FDIC (banks) or NCUA (credit score unions).

What Is ChexSystems?

Most customers aren’t conversant in ChexSystems till they’re denied a brand new checking account or a service provider declines to just accept their examine. Briefly, ChexSystems is a client reporting company (CRA) that tracks your checking and financial savings account exercise.

It’s much like the three main credit score reporting companies (Equifax, Experian, and TransUnion) which gather information on customers’ mortgage and bank card historical past. A ChexSystems file doesn’t have an effect on your credit score rating and doesn’t issue into banks’ selections to increase credit score, however it might probably affect your capability to open a checking account or write checks. And in at the moment’s tech-forward world, getting access to a checking account for a bunch of companies is vital.

ChexSystems shouldn’t be answerable for the choice made by banks to disclaim you a checking account; nevertheless, the data reported by banks and credit score unions and saved by ChexSystems may end up in a denial of a checking account.

The next info could also be saved in your ChexSystems report:

- Paid and unpaid inadequate fund objects (“NSF”)

- Any form of fraud

- Uncollected overdrafts, ATM transactions, or computerized funds the financial institution paid

- Abuse of debit card, financial savings account or ATM card

- Violation of any banking guidelines and laws

- Opening an account with false info

There could also be further causes a financial institution studies their prospects to ChexSystems, however the above record represents the commonest causes customers find yourself in ChexSystems.

What Is Early Warning Providers (EWS)?

EWS was created by main banks together with Wells Fargo, Capital One, BB&T, JP Morgan Chase, and Financial institution of America to stop fraud and scale back threat. Whereas firms similar to ChexSystems and TeleCheck deal with retaining data of people that mismanage financial institution accounts with overdrafts or writing checks on closed accounts, EWS focuses on fraudulent exercise.

Its database tracks customers’ damaging interactions with banks, in addition to actions similar to financial institution fraud, forgery, examine kiting, examine alteration, and counterfeiting.

What’s Telecheck?

Just like the credit score bureaus, ChexSystems, and EWS, Telecheck is a client reporting company (CRA) that focuses particularly on client info associated to checks and financial institution accounts.

Retailers use Telecheck to find out how dangerous it’s to just accept somebody’s examine, making a choice on the spot whether or not or not they’ll settle for it as fee. If a examine is authorised by the Telecheck system, the service provider is assured that they’ll get the total quantity of the authorised examine.

Some banks and different monetary establishments use Telecheck when deciding whether or not or not they need to permit a client to open a checking account. That is executed in an effort by monetary establishments to cut back fraud and decrease threat as a lot as doable.

The Finest Second Probability Financial institution Accounts in Each State

Sadly, most main banks don’t provide second likelihood banking accounts, however many neighborhood banks and credit score unions have them below numerous names, similar to Alternative Checking and Contemporary Begin Checking.

Our employees commonly updates the record of banks providing second likelihood banking in each state. Right here’s an summary of those accounts and the place you could find them at branches in your space.

Conclusion

Whereas conventional banks might deny checking accounts to people thought of a foul threat, second likelihood banking gives a pathway to banking companies even if in case you have confronted monetary challenges up to now. By assembly primary necessities similar to offering identification and private info, you possibly can open a second likelihood account and work in direction of bettering your monetary state of affairs.

It’s vital to be accountable and conscious of your banking actions to construct a optimistic banking historical past, which may pave the way in which for extra conventional banking choices sooner or later.

Acorns is making a reputation as a spot to speculate cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. That makes Acorns one other of our favourite financial institution accounts. As an organization constructed to compete with the most important banks, Acorns gives some extraordinary advantages.

Acorns is making a reputation as a spot to speculate cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. That makes Acorns one other of our favourite financial institution accounts. As an organization constructed to compete with the most important banks, Acorns gives some extraordinary advantages.

The BMO Sensible Cash checking account is perhaps a fantastic match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.

The BMO Sensible Cash checking account is perhaps a fantastic match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.

Regardless of your banking previous, Navy Federal Credit score Union gives conventional checking for all members throughout the US. With no evaluate necessities of your banking historical past, NFCU is a superb alternative for energetic obligation or retired US army, relations and authorities contractors. There are two banking decisions to select from: Lively Responsibility Checking and Free eChecking.

Regardless of your banking previous, Navy Federal Credit score Union gives conventional checking for all members throughout the US. With no evaluate necessities of your banking historical past, NFCU is a superb alternative for energetic obligation or retired US army, relations and authorities contractors. There are two banking decisions to select from: Lively Responsibility Checking and Free eChecking.

The Citi® Entry Checking account is a stable choice in the event you’ve been blacklisted by ChexSystems or Early Warning Programs. So long as you haven’t been flagged for fraudulent habits and don’t owe Citibank an impressive quantity, approval charges for this account are good.

The Citi® Entry Checking account is a stable choice in the event you’ve been blacklisted by ChexSystems or Early Warning Programs. So long as you haven’t been flagged for fraudulent habits and don’t owe Citibank an impressive quantity, approval charges for this account are good.

Wells Fargo just lately modified the Alternative Checking account to Clear Entry Banking. And we like one change, specifically. Wells Fargo has executed away with overdraft and non-sufficient funds (NSF) charges.

Wells Fargo just lately modified the Alternative Checking account to Clear Entry Banking. And we like one change, specifically. Wells Fargo has executed away with overdraft and non-sufficient funds (NSF) charges.

The Capital One 360 Checking Account makes use of a proprietary approval course of that doesn’t embody ChexSystems and is perhaps a stable choice for many who have had previous monetary challenges.

The Capital One 360 Checking Account makes use of a proprietary approval course of that doesn’t embody ChexSystems and is perhaps a stable choice for many who have had previous monetary challenges.