You want credit score for absolutely anything as of late, together with opening a checking account. For anybody that’s dwelling with broken credit score, getting one thing so simple as a checking account to pay payments could be a problem.

Fortunately, there are banks that need your online business no matter what your credit score appears to be like like. Listed here are the highest on-line financial institution accounts for spotty credit that may offer you important financial institution performance, in addition to some added advantages.

Open an account immediately!

Winners: Finest Banks For These With Unhealthy Credit score

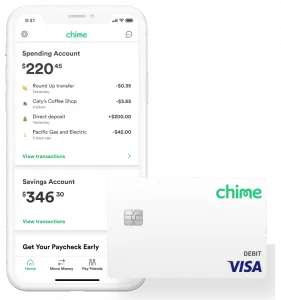

Chime | Our Prime Decide

Chime® is a fast-growing internet-only monetary firm and our best choice for a second likelihood checking account.

Chime® is a fast-growing internet-only monetary firm and our best choice for a second likelihood checking account.

And, better of all, Chime accepts nearly all clients who apply. Even you probably have dangerous or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Options embrace cellular deposits, direct deposit, on-line invoice fee, NO month-to-month or annual charges, NO overdrafts charges1, NO credit score examine, and NO CheckSystems. Opening an account is tremendous straightforward. It takes about 2 minutes and also you don’t should make an preliminary deposit. Right here’s what we like:

No Month-to-month Charges

For the previous couple of years, Chime’s big development has come on the expense of the large banks and their outrageous charges. And it’s top-of-the-line options of a Chime account. There aren’t any month-to-month or annual service prices, no minimal steadiness requirement, no overseas transaction charges, no charges at over 60,000 ATMs2, and no charges for cellular and on-line invoice pay.

Deposit Money for FREE at Over 8,500 Walgreens

Accessing a bodily location for money deposits is vital to Chime members. And now it’s straightforward. All it’s important to do is go right into a Walgreens retailer, hand the cashier the money you wish to deposit alongside along with your Chime card, and the deposit will present up in your account instantly. This gives Chime members extra walk-in areas than another financial institution within the U.S. With over 78% of the nation inside 5 miles of a Walgreens, it is a important profit for hundreds of thousands.3

Good Know-how

Not like large banks, Chime was created through the smartphone period and, due to this fact, options an app that’s greater than only a means for patrons to overview their financial institution accounts.

You’ll be able to switch funds to family and friends, Chime members or not… they usually can declare their cash immediately4 with none further apps. The Chime app additionally has a collection of notifications you could activate or flip off so that you keep in full management. Misplaced or misplaced your card? You’ll be able to instantaneously flip off your card utilizing the app. No marvel over 300,000 clients have given the app a 5-star overview.

Clients First

Chime was one of many first to supply a “spherical up” choice. When you use your Chime card on a purchase order of $10.65, Chime offers you the choice of routinely rounding as much as $11.00 and placing the remaining $.35 in your free Chime financial savings account. And that provides up over time! Plus, Chime pays 0.50% Annual Share Yield (APY)5 in curiosity on that financial savings account.

When you use direct deposit along with your Chime account, you may get your paycheck as much as 2 days early6. And Chime is simply saying no to large financial institution NSF prices with a fee-free overdraft program as much as $200. Lastly, Chime only in the near past launched their Credit score Builder bank card with no curiosity and no annual price. We don’t suppose there’s one other firm innovating for his or her clients like Chime.

Get a Chime Account Immediately!

Present | Earn Excessive Curiosity

Present is one other web-only nationwide financial institution that has some actually nice options… and has develop into one of many fastest-growing checking accounts for customers who need all of it with out all the prices and hassles.

Present is one other web-only nationwide financial institution that has some actually nice options… and has develop into one of many fastest-growing checking accounts for customers who need all of it with out all the prices and hassles.

Why are we that includes Present on our web site? It’s easy: they don’t use ChexSystems or your credit score report back to open a brand new account. Signal-up takes about 2 minutes and Present has extraordinarily excessive acceptance charges. However what’s actually cool are the unbelievable options supplied with this account:

- NO minimal steadiness

- NO deposit required to open an account

- NO overdraft charges while you overdraw by as much as $100 with Overdrive™

- NO charges at over 40,000 ATMS within the U.S.

- Get your paycheck as much as 2 days early with direct deposit

- Earn 4.0% curiosity in your steadiness as much as $6,000

- Earn factors for limitless cashback at taking part retailers

- Ship cash immediately without cost

- A chic however easy smartphone app

- 24/7 member assist

Present gives a very distinctive service it calls Gasoline Maintain Removals. What’s a fuel maintain? Some fuel stations might apply a maintain from $50 to $100 while you use a debit card to pump fuel. When you solely pumped $10 of fuel, however the fuel station locations a $100 maintain in your funds, you received’t have entry to the $90 distinction for as much as 3 enterprise days!

The Present debit card will instantly refund the maintain so you will have entry to all of your funds. We haven’t discovered that profit anyplace within the market.

Right here’s what’s actually vital, although. Deposits are FDIC-insured as much as the best doable quantity allowed: $250,000. We love the options, we love the smartphone app, and we love Present. That makes us suppose you’ll love them too.

Get a Present Account Now!

NorthOne | No ChexSystems Small Enterprise Banking

- FREE enterprise Mastercard debit card

- FREE entry at over 1,000,000 ATMs nationwide

- FREE on-line and cellular app

- FREE reside chat (not a chatbot), phone, or e-mail assist

- FREE in-app bill creator

- NO minimal month-to-month steadiness requirement

- NO NSF charges

- NO ACH switch charges

- NO credit score examine or ChexSystems

Banking Providers

NorthOne doesn’t require a minimal account steadiness and prices a $10 month-to-month price that features limitless transactions in your account. These embrace ACH funds, invoice pay, debit card utilization, cellular deposits, and transfers. The one different price is $15 for wire transfers.

You may also grant read-only entry to workers or your accountant or bookkeeper. This retains your account protected whereas additionally giving entry to those that want it.

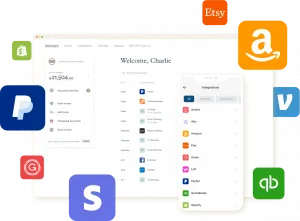

Integrations

With NorthOne enterprise banking, you’ll be able to join your account to an nearly limitless variety of third-party apps. NorthOne integrates with enterprise instruments together with Paypal, Stripe, Sq., Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and lots of extra. Via these integrations, you’ll be able to sync transaction particulars, gather funds, see and pay invoices, ship payroll, pay contractors, and extra.

If creating and sending invoices, quotes, and estimates is crucial to your online business, NorthOne gives a free stand-alone bill creator that integrates seamlessly with the banking app. We’ve tried it and suppose it’s a chic resolution.

Envelopes

NorthOne has created a function that helps you propose for and handle vital expense classes. They name these sub-accounts “Envelopes” and you’ll arrange as many as you need. This lets you put aside funds you’ll want sooner or later corresponding to taxes or payroll. You’ll be able to set customized guidelines to your envelopes and simply transfer cash backwards and forwards as wanted.

Utility Course of

NorthOne targets account approvals inside one to 2 enterprise days. Info required to open an account consists of identify, tackle, and social safety quantity or tax identification quantity. If relevant, NorthOne might ask for a replica of your online business license and enterprise formation paperwork. After you’re permitted, you’ll have to make a $50 minimal opening deposit.

NorthOne is likely one of the best enterprise financial institution accounts for entrepreneurs and small enterprise house owners. Their mixture of providers and choices, the quick utility course of, and buyer assist create an outsized aggressive benefit for each the financial institution and its clients. Each small enterprise proprietor understands how crucial that’s for achievement.

Open an account immediately!

Chase Safe BankingSM | $100 New Account Bonus

For many individuals, accessing a neighborhood financial institution department is paramount when establishing a checking account. With over 16,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account could be the proper match.

For many individuals, accessing a neighborhood financial institution department is paramount when establishing a checking account. With over 16,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account could be the proper match.

Listed here are a few of our favourite options with this account:

- NO credit score examine

- NO ChexSystems

- NO minimal deposit to open

- NO overdraft charges

- FREE entry to over 16,000 Chase ATMs

- FREE Chase On-line Invoice Pay

- FREE cash orders and cashier’s checks

Extremely Rated Cell App

Accessible for iOS and Android, the Chase Cell app gives 24/7 entry to your account. The app is very rated, incomes 4.8 stars out of 5 on the App Retailer and 4.4 stars out of 5 on Google Play.

You’ll be able to switch funds, deposit checks, ship cash with Zelle, arrange account alerts and notifications, and lock your card if it’s been misplaced or stolen.

The app additionally has extremely useful budgeting instruments, personalised insights, and the flexibility to examine your credit score rating without cost.

How The Account Works

Opening the Chase Safe Banking account is straightforward. They confirm your identify, tackle, and social safety by Experian, however don’t pull a credit score report or credit score rating. Chase doesn’t use ChexSystems for this account, both. Account approval is instant, there’s no opening deposit requirement, and also you’ll obtain your Chase Safe card inside a matter of days.

Chase doesn’t provide overdraft providers with this account as you’ll be able to solely spend the cash you will have accessible and the account doesn’t embrace paper checks. You must also know that utilizing non-Chase ATMs can value from $3.00 to $5.00 per transaction.

Chase Safe Banking carries a $4.95 month-to-month service price that can’t be waived. However mixed with all of the free providers and the $100 money bonus while you use the cardboard for 10 purchases inside 60 days, the month-to-month price doesn’t pose an issue for many clients. And, you’ll have peace of thoughts with Chase’s Zero Legal responsibility Safety if you happen to detect and report unauthorized transactions.

Banking With A Chief

Chase claims to be concerned with 40% of People in a roundabout way or one other. There could be consolation in dimension, attain, and stability. Chase has all of that and the reassurance they are going to be there for an extended, very long time.

When you’ve wished to financial institution with Chase and questioned if you happen to’d qualify, we expect you’re going to be actually proud of the Chase Safe Banking account.

Get a Chase Safe Banking account immediately!

SoFi Cash | Earn a $275 Welcome Bonus

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking and financial savings account on steroids and we love that. Plus, they don’t use ChexSystems to approve accounts.

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking and financial savings account on steroids and we love that. Plus, they don’t use ChexSystems to approve accounts.

You get a debit MasterCard and a really slick smartphone app. You can also make deposits, write checks, make the most of digital invoice pay, and switch cash. There aren’t any month-to-month charges or overdraft charges. Plus, you earn curiosity on all the cash within the account! The sign-up course of can take lower than 60 seconds. With over 2.5 million members, SoFi is a financial institution you’ll be able to depend on!

The $275 bonus is available in two elements. While you deposit no less than $10, SoFi will credit score your account $25. While you arrange direct deposit from an employer, SoFi will credit score your account as much as $250 (relying on the quantity of your direct deposit) and bump the rate of interest you earn to 2.50% APY. The bonus and rate of interest are a few of the highest we’ve seen.

- No account charges

- No minimal steadiness

- No overdraft charges

- No charges at over 55,000 ATMs

- Entry to SoFi member advantages like profession teaching and monetary advising

- Automated invoice pay

- Freeze debit card on-the-go

SoFi Cash has been nice! The account was straightforward to open and I received my debit card a couple of days later. The smartphone app is straightforward to make use of and I can examine the whole lot from my pc, too. I’ve had some points with ChexSystems previously and SoFi Checking & Financial savings appears to be the proper account.

Kevin M., SoFi Buyer

Get a SoFi Account Now!

Acorns | $75 New Account Bonus

Acorns is making a reputation as a spot to take a position cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. Better of all, Acorns doesn’t use ChexSystems or a credit score report back to approve accounts! That makes Acorns Spend one other of our favourite second likelihood checking accounts. As an organization constructed to compete with the biggest banks, Acorns gives some extraordinary advantages.

Acorns is making a reputation as a spot to take a position cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. Better of all, Acorns doesn’t use ChexSystems or a credit score report back to approve accounts! That makes Acorns Spend one other of our favourite second likelihood checking accounts. As an organization constructed to compete with the biggest banks, Acorns gives some extraordinary advantages.

We love the heavy metallic tungsten Visa debit card and the world-class smartphone app that permits you to handle each side of your new checking account corresponding to budgeting, spending, and safety.

One other good choice is the flexibility to spherical up on each buy and Acorns will take that cash and routinely put it in a financial savings account. This actually helps construct a nest egg.

It takes about 2-3 minutes to enroll and never solely do you get a checking and financial savings account, however you even have entry to an funding account when you’re prepared to contemplate that. And, it’s free. Right here’s extra:

- FREE Visa® debit card

- FREE bank-to-bank transfers

- FREE bodily examine sending on-line or by the cellular app

- FREE cellular examine deposits

- FREE or reimbursed ATM withdrawals nationwide

- NO minimal steadiness or overdraft charges

- NO credit score examine; ChexSystems OK

- FDIC insured

There’s a $3 month-to-month price that’s simply lined by the ATM price reimbursement and different goodies included with the account. To get the $75 bonus, all it’s important to do is ready up Acorns Spend as your direct deposit technique along with your employer and obtain 2 direct deposits of no less than $250 every ($500 complete).

When you’ve struggled with poor credit score or ChexSystems, Acorns could be the proper account.

Get An Acorns Account!

What Is a Financial institution Account For Unhealthy Credit score and How Does It Work?

A checking account for spotty credit is usually known as a second likelihood checking account, and it’s a checking or financial savings account for a person with spotty credit. Most main banks will pull a credit score report for brand spanking new clients opening an account, and if their credit score isn’t as much as par, they’re denied an account. That is typically executed to mitigate the danger of bounced checks, however it may be irritating.

A no credit score checks checking account operates similar to conventional banks, however they’ve extra lenient necessities for getting an account opened. You’ll have to adjust to federal laws concerning proof of id and different disclosures, however ultimately, your credit score won’t be a think about whether or not or not you’re allowed to open an account.

9 Issues to Look For in a Checking Account

For these in search of financial institution accounts with spotty credit, there are going to be a couple of completely different choices so that you can think about. Listed here are the highest issues you must search for in your subsequent no credit score checks checking account. You could be stunned at what one financial institution gives over one other.

1. Charges

That is arguably one of many greatest issues to take note of when procuring round. Although you’re in search of a no credit score checks checking account, you shouldn’t be paying any form of charges to your banking service.

If you would like a financial institution with the bottom charges, search for the financial institution that doesn’t cost charges for the next:

- Low balances

- Overdrafts

- Exceeding the “most” variety of card transactions in a month

2. Deposit Simplicity

In case your financial institution goes to be largely on-line, that you must be completely positive they’ve a stable and dependable cellular deposit performance. All of us have to cope with paper checks sometimes, and if you happen to can simply snap an image of either side along with your digicam and add it for a deposit, it makes life a complete lot simpler.

3. Funds Availability

The funds’ availability is one thing that’s beginning to develop into comparatively customary throughout on-line financial institution accounts for spotty credit. Some banks will clear ACH paycheck deposits as much as 48 hours prior to different banks.

This implies if you happen to normally receives a commission on Fridays at 12:01 am, you could possibly get up Wednesday to that deposit. For those who reside on tight budgets, these early-access insurance policies could be vital standards for somebody taking a look at new banks.

4. ATM Community

Most on-line banks function sturdy ATM networks. ATMs which might be “in-network” are normally those that you need to use for no charges, which may prevent a ton if you happen to use ATMs with any frequency.

Your financial institution can also provide an ATM price refund as a promotion for some time or gives you a sure allowance of refunded transactions every month. See what perks are going to be greatest in the long term, while you is probably not in-network or close to any fee-free location.

5. Curiosity Charges

Let’s face it, no one places their cash in a financial savings account to develop their wealth. Nevertheless, in case your new financial institution gives considerably increased financial savings or checking account rates of interest, it will possibly assist the cash you entry repeatedly battle inflationary decay. It received’t be sufficient to retire on, but it surely would possibly assist offset a couple of months of the rising value of dwelling.

6. Cell & On-line Choices

That is the age of the whole lot digital, and that goes to your new financial institution accounts, and most of your invoice funds as nicely. Make sure your subsequent potential financial institution has a plethora of on-line, cellular, and general digital choices for accessing your account.

You must have the ability to safely and securely entry your account info from a smartphone, in addition to have the ability to accomplish extra complicated duties on a desktop model of their web site or app.

7. Minimal Deposit & Steadiness Necessities

It’s fairly customary for a no credit score checks checking account to require that you simply pay a gap deposit. With that being stated, you shouldn’t should preserve a sure minimal steadiness in your account.

The web financial institution accounts for spotty credit that we suggest might require a gap deposit which could be discovered within the description, however they won’t cost you charges so long as your steadiness stays optimistic.

8. Buyer Service Ease & Outcomes

Many on-line financial institution accounts for spotty credit use extremely smart AI for his or her frontline customer support interactions. Whereas this may occasionally already sound prefer it’s going to be irritating, it may be a extremely efficient interface that will get you the knowledge you want in milliseconds.

When you will have issues at 3 am, you must have the ability to get assist from somebody, someplace, regardless of if they’re human or digital. Your subsequent financial institution ought to have some form of 24-hour customer support choice.

9. Brick-And-Mortar Places

It received’t occur typically, and a few can go a long time with out setting foot in a department, however others want a bodily department or perhaps a accomplice financial institution that they will go to.

Within the case that your potential financial institution doesn’t have bodily areas or accomplice banks that permit you to go to personally, see what options your potential financial institution does provide. When you wished to talk to somebody about investments, for instance, do they provide digital consultations, or just not provide the service? For extra routine wants of cashier’s checks and comparable providers, have they got a digital choice? These are vital issues to contemplate.

Are Second Likelihood Banks Higher Than Typical Banks?

Whereas they aren’t “higher” per se, they’re much simpler to get an account with you probably have spotty credit. Generally what that you must get again in your ft is an precise checking account, and even if you happen to’ll solely have a paycheck in there till payments are paid, having the account is a safety blanket itself.

Second likelihood financial institution accounts do include some limitations, however generally, the advantages far outweigh these limitations. One such disadvantage is that within the case of most on-line second likelihood banks, they solely provide checking, financial savings, and typically bank card providers.

If you wish to apply for a private mortgage, dwelling fairness line of credit score, or comparable monetary merchandise, you’ll have to work with a much bigger financial institution. This is similar for issues like CDs or brokerage accounts, that are typically not among the many monetary merchandise supplied by on-line banks.

Incessantly Requested Questions About Financial institution Accounts With Unhealthy Credit score

Listed here are a few of the most frequently requested questions and solutions in the case of getting a no credit score checks checking account.

Can I open a checking account with spotty credit?

Sure, you’ll be able to open a checking account with spotty credit. Nevertheless, you might have restricted choices as some banks might deny your utility. You might also should pay increased charges or deposit a sure sum of money to open the account.

How can I discover a financial institution that may approve my checking account utility with spotty credit?

Fortunately, the exhausting work of looking out has already been executed and we’ve supplied you with a few of the high contenders for one of the best no credit score checks financial institution accounts above. These are all supplied nationwide.

Can I nonetheless use checks if I’ve spotty credit?

Sure, you’ll be able to nonetheless use checks with a checking account, no matter your credit score rating. Nevertheless, you might have to pay a better price for examine utilization or overdrafts.

How can I keep away from overdraft charges with spotty credit?

You’ll be able to keep away from overdraft charges by fastidiously monitoring your account steadiness and establishing alerts for low balances. You may also choose out of overdraft safety, which may prevent cash if you happen to unintentionally overdraw your account.

Can spotty credit have an effect on my capacity to get a debit card?

Some banks might require a credit score examine earlier than issuing a debit card, but it surely’s not a typical observe. So long as you will have a checking account, you must have the ability to get a debit card.

How can I enhance my credit score rating with a checking account?

Whereas a checking account received’t instantly influence your credit score rating, it will possibly not directly assist by displaying you could handle your funds responsibly. By avoiding overdrafts and sustaining a optimistic steadiness, you could possibly construct a optimistic banking historical past, which could be useful when making use of for credit score sooner or later.

Conclusion

When you’ve had issues getting a conventional checking account on account of spotty credit, there are nonetheless choices on the market for you. Peruse and share our record of one of the best checking accounts for these with spotty credit to anybody you suppose may gain advantage from it.

Chime is a monetary expertise firm, not a financial institution. Banking providers and debit card issued by The Bancorp Financial institution, N.A. or Stride Financial institution, N.A.; Members FDIC. Credit score Builder card issued by Stride Financial institution, N.A.

1Eligibility necessities apply. Overdraft solely applies to debit card purchases and money withdrawals. Limits begin at $20 and could also be elevated as much as $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal charges might apply besides at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Money deposit or different third-party charges might apply.

3Clients are restricted to a few $1,000 money deposits at Walgreens every day and $10,000 every month.

4Generally immediate transfers could be delayed. The recipient should use a legitimate debit card to say funds. See your issuing financial institution’s Deposit Account Settlement for full Pay Associates Transfers particulars.

5The Annual Share Yield (“APY”) for the Chime Financial savings Account is variable and will change at any time. The disclosed APY is efficient as of November 17, 2022. No minimal steadiness required. Should have $0.01 in financial savings to earn curiosity.

6Early entry to direct deposit funds is determined by the timing of the submission of the fee file from the payer. We typically make these funds accessible on the day the fee file is acquired, which can be as much as 2 days sooner than the scheduled fee date.