[ad_1]

Mindset 24 International’s John Brian McLane Jr. has pled responsible to tax fraud.

Mindset 24 International’s John Brian McLane Jr. has pled responsible to tax fraud.

Following an IRS investigation, the DOJ filed expenses towards McLane in June 2022.

As per a June twenty first “data” submitting, McLane made simply over one million {dollars} in 2019, which he did not pay $417,481 in taxes on.

Along with earnings from Mindset 24 International, McLane did not declare earnings from Protected ID Belief and Testculin (dba Stiff Advertising and marketing).

Each defunct, Protected ID Belief was an id safety themed MLM firm. Testculin offered male enhancement merchandise.

On prime of selling firm earnings, McLane additionally generated earnings via playing.

That earnings, likewise, ought to have been reported as taxable earnings on the Defendant’s particular person earnings tax returns, however was not.

The IRS’ investigation revealed that, as a substitute of paying his taxes, McLane used the cash

to pay a wide range of private bills, together with journey, housing, his youngsters’s school tuition, autos, retail purchases, and different dwelling bills.

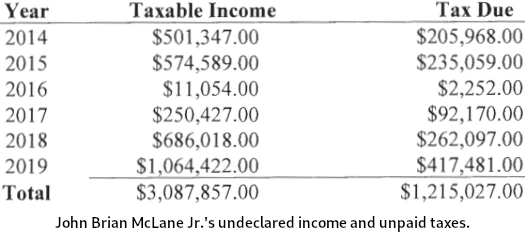

On July twenty second, McLane pled responsible to tax evasion. McLane’s plea settlement detailed further unreported earnings, spanning 2014 to 2019:

On November thirtieth, McLane was sentenced to:

- 5 years probation;

- dwelling detention for twelve months with digital monitoring;

- $1.2 million in restitution; and

- 100 hours group service

Along with tax fraud, McLane settled Mindset 24 International securities fraud expenses with the SEC final month.

McLane pays $135,200 in disgorgement, $17,770 in prejudgment curiosity and a $60,000 civil financial penalty ($212,970 complete).

The SEC filed swimsuit towards Mindset 24 International and McLane in 2021. The regulator alleged McLane ran a Ponzi scheme topping one million {dollars}.

[ad_2]

Supply hyperlink