[ad_1]

Undertaking Lantern has no web site or public presence. The corporate is promoted in secret.

Undertaking Lantern has no web site or public presence. The corporate is promoted in secret.

The three executives behind Undertaking Lantern are Michael Faust, Chris Thomson and Azli Noor.

Michael Faust (proper) is a serial promoter of Ponzi schemes.

Michael Faust (proper) is a serial promoter of Ponzi schemes.

In his Undertaking Lantern company bio, that is diminished to

36 years in enterprise, 20 years of that working on-line.

Has developed referral networks compromising of tens of hundreds of individuals in 100+ international locations a number of instances; based, co-owned, and managed firms, and consulted internationally.

By way of his Digital Tycoons staff, Ponzi schemes Faust has promoted embody USI-Tech, Ormeus International and Wenyard.

Faust additionally promoted SilverStar Reside, a buying and selling rip-off that collapsed in 2019.

Homeowners Hassan Mahmoud, Candace Ross-Mahmoud and David Mayer, have every been sued by the CFTC for SilverStar Reside associated fraud.

Previous to the CFTC crackdown, Faust threatened BusinessForHome for suggesting SilverStar Reside was committing securities fraud within the US.

In line with his Fb profile Faust, initially from Australia, is hiding out in Chonburi, Thailand.

There’s just a few Chris Thomsons within the MLM trade. I wasn’t capable of pin down Undertaking Lantern’s Thomson particularly.

There’s just a few Chris Thomsons within the MLM trade. I wasn’t capable of pin down Undertaking Lantern’s Thomson particularly.

Azli Noor relies out of Malaysia. He doesn’t seem to have any MLM expertise, at the least nothing he’s prepared to share publicly.

Learn on for a full evaluate of Undertaking Lantern’s MLM alternative.

Undertaking Lantern’s Merchandise

Undertaking Lantern has no retailable services or products, with associates solely capable of market Undertaking Lantern affiliate membership itself.

Undertaking Lantern’s Compensation Plan

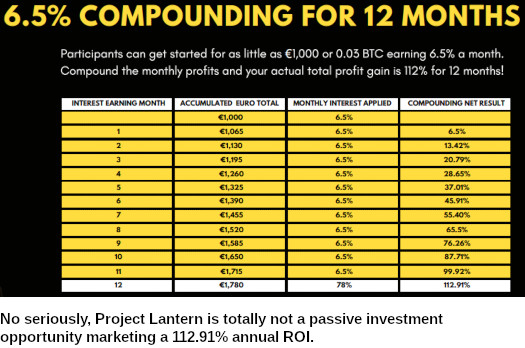

Undertaking Lantern associates spend money on 0.01 BTC models. That is achieved on the promise of a 6.5% “month-to-month curiosity” ROI.

Undertaking Lantern Affiliate Ranks

There are 5 affiliate ranks inside Undertaking Lantern’s compensation plan.

- 1 Star – join as a Undertaking Lantern affiliate, make investments and recruit one affiliate

- 2 Star – recruit two associates

- 3 Star – recruit three associates

- 4 Star – recruit 4 associates

- 5 Star – recruit 5 associates

Be aware to rely in the direction of rank qualification, recruited associates should have an energetic funding.

Referral Commissions

Undertaking Lantern pays referral commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel staff, with each personally recruited affiliate positioned straight below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel staff.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Undertaking Lantern caps payable unilevel staff ranges at 5.

Referral commissions are paid out as a share of bitcoin invested throughout these 5 ranges based mostly on rank

- 1 Stars earn 5% on degree 1 (personally recruited associates)

- 2 Stars earn 5% on degree 1 and a pair of% on degree 2

- 3 Stars earn 5% on degree 1, 2% on degree 2 and 1% on degree 3

- 4 Stars earn 5% on degree 1, 2% on degree 2 and 1% on ranges 3 and 4

- 5 Stars earn 5% on degree 1, 2% on degree 2 and 1% on ranges 3 to five

ROI Match

Undertaking Lantern pays a 5%-25% match on returns paid to personally recruited associates.

- 1 Stars earn a 5% ROI match

- 2 Stars earn a ten% ROI match

- 3 Stars earn a 15% ROI match

- 4 Stars earn a 20% ROI match

- 5 Stars earn a 25% ROI match

There’s additionally a residual ROI Match, paid out by way of the identical five-level deep unilevel staff used to pay residual commissions (see above).

- 2 Stars earn a ROI match on degree 1 (see above) and 10% on degree 2

- 3 Stars earn a ROI match on degree 1 (see above), 10% on degree 2 and 5% on degree 3

- 4 Stars earn a ROI match on degree 1 (see above), 10% on degree 2 and 5% on ranges 3 and 4

- 5 Stars earn a ROI match on degree 1 (see above), 10% on degree 2 and 5% on ranges 3 to five

Becoming a member of Undertaking Lantern

Undertaking Lantern affiliate membership is tied to an preliminary minimal 0.03 BTC funding.

Conclusion

Undertaking Lantern markets itself as

a singular, profitable and sustainable manner … to place funds to work, resulting in a residual, passive month-to-month income stream, with the capability to additionally construct money reserves (wealth).

You join, make investments bitcoin and gather a passive 6.5% month-to-month ROI.

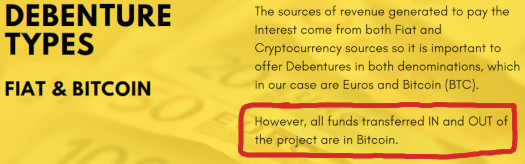

Moderately than simply be sincere and name Undertaking Lantern what it’s, a passive funding alternative, Michael Faust and the gang have provide you with “debentures”.

For these unfamiliar with a Debenture, it really works equally to a Bond (an unsecured mortgage certificates), the place you apply to mortgage the Undertaking funds for a delegated interval and, in return, are paid month-to-month curiosity.

The Debenture curiosity funds yield 6.5% monthly which is a really enticing end result.

Breaking down Undertaking Lantern’s pseudo-compliance bullshit;

- “the venture” = Undertaking Lantern

- debentures = funding contract

- mortgage = funding

- curiosity = returns

So what about these loans hey?

In easy phrases, you’re making use of to mortgage the Firm your Euro or Bitcoin (the Advance) and being paid month-to-month curiosity for the lifetime of that mortgage, after which, the Superior (mortgage) is returned to you.

For this Undertaking your advance is put to work for 12 months and on the finish of that 12 months the preliminary Advance loaned is returned to you, and the Debenture expires.

It’ s vital to notice {that a} Debenture is NOT an Funding or a Safety.

This is a crucial distinction by way of regulatory compliance.

The factor about pseudo-compliance is regulators don’t pay any consideration to it.

Undertaking Lantern is soliciting funding in bitcoin, on the promise of a passive 6.5% month-to-month ROI:

That’s not a mortgage, that’s an funding made on the expectation of an marketed return.

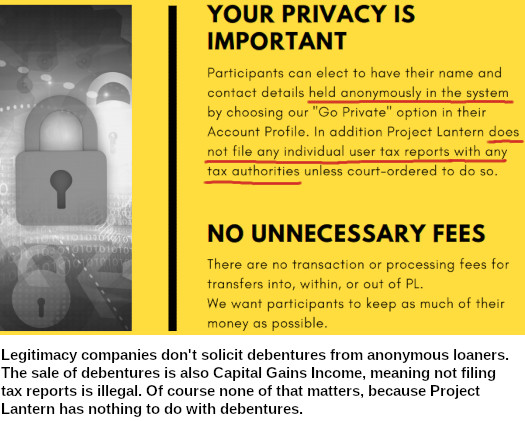

If Undertaking Lantern was to characterize itself as an organization legally soliciting loans from shoppers as debentures, they’d have to supply express particulars as to what they’re doing with the cash.

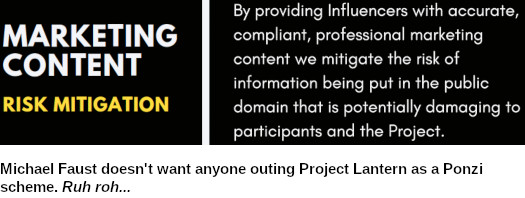

As an alternative all you get is identical “buying and selling” Ponzi bullshit Michael Faust has been scamming individuals with for years.

Whereas elevating the required seed capital to fund our R&D Tasks, all obtainable liquidity will likely be put to work in varied monetary sectors together with buying and selling foreign exchange, cryptocurrency and commodities, the place extremely expert merchants generate earnings which can allow us to pay the curiosity on Debentures initially in addition to develop the seed capital for this Undertaking.

Undertaking Lantern is a passive funding alternative, which constitutes a securities providing.

Neither Undertaking Lantern, Michael Faust, Chris Thomson or Azli Noor are registered to supply securities in any jurisdiction.

Thus at a minimal, Undertaking Lantern is committing securities fraud.

The one purpose MLM firms commit securities fraud is as a result of they aren’t doing what they declare to be.

With respect to Undertaking Lantern, that’d be producing returns via buying and selling actions.

To additional illustrate how ridiculous Undertaking Lanterns enterprise mannequin is, rates of interest are at document lows worldwide.

Why on Earth would you solicit funding from the general public at 6.5% a month?

Even in case you pretended Undertaking Lantern was producing exterior income (over 6.5% a month to cowl returns and commissions), it’d make way more sense to only apply for a ~1% annual mortgage and compound 6.5% a month to pay it off.

I imply that’s precisely what Undertaking Lantern recommends its buyers do:

Undertaking Lantern is yet one more Ponzi scheme run by at the least one serial scammer. You hand over your bitcoin, returns are paid till recruitment inevitably tanks, then Michael Faust and pals do a runner.

The secrecy alone is sufficient to elevate purple flags. Throw in Faust’s fraudulent previous, securities fraud and cute “debentures” pseudo-compliance, you understand how this ends.

[ad_2]

Supply hyperlink