[ad_1]

![]() Again in 2020 Daisy AI surfaced as a Ponzi scheme pushed out by EndoTech.

Again in 2020 Daisy AI surfaced as a Ponzi scheme pushed out by EndoTech.

EndoTech pitched itself as a Israeli crypto buying and selling bot agency headed up by Anna Becker and Dmitry Gushchin.

BehindMLM reviewed Daisy AI on December third, 2020. We discovered a typical MLM crypto Ponzi dressed up as “fairness crowdfunding”.

Since publishing our evaluation, EndoTech has positioned itself as a agency that permits different corporations to commit securities fraud.

Daisy AI is a kind of corporations, with Jeremy Roma rising because the face of the operation.

In hindsight Roma was seemingly all the time behind Daisy AI, however this was masked when Daisy AI launched.

Having scammed a bunch of individuals and stashed a little bit of ill-gotten good points away, Roma has gotten extra snug associating himself with Daisy AI.

Roma is a US nationwide who relocated to Dubai as a part of his transition to crypto fraud. In keeping with his confidence in getting away with fraud rising, Roma now spends his time between Dubai and the US.

Roma’s MLM origins date again to promoting espresso at Organo Gold. In 2019, a 12 months earlier than Daisy AI launched, BehindMLM got here throughout Roma in Apex.

Apex was a $13,750 five-year funding crypto mining Ponzi. Apex in its unique incarnation lasted just a few months.

Roma tried to maintain the Ponzi going with former OneCoin scammers however that didn’t final lengthy.

Roma transitioned into crypto fraud in or round 2018 by Holton Buggs, a disgraced Organo Gold founder turned crypto Ponzi scammer in his personal proper.

Since its 2020 launch Daisy AI has collapsed quite a few occasions. BehindMLM hasn’t actually been monitoring Daisy AI’s collapses, however we did doc the “daisy token” exit-scam in 2021.

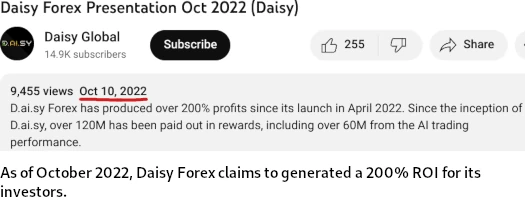

The newest incarnation is Daisy Foreign exchange, launched in or round April 2022.

This present Daisy Foreign exchange iteration is what we’re reviewing immediately.

Daisy Foreign exchange’s Merchandise

Daisy Foreign exchange has no retailable services or products.

Associates are solely capable of market Daisy Foreign exchange affiliate membership itself.

Daisy Foreign exchange’s Compensation Plan

Daisy Foreign exchange associates make investments tether (USDT) on the expectation of a passive ROI, purportedly derived through bot buying and selling.

- Tier 1 – make investments 100 USDT and obtain a 50% break up in buying and selling income

- Tier 2 – make investments 200 USDT and obtain a 50% break up in buying and selling income

- Tier 3 – make investments 400 USDT and obtain a 70% break up in buying and selling income

- Tier 4 – make investments 800 USDT and obtain a 70% break up in buying and selling income

- Tier 5 – make investments 1600 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $1600 USDT is invested)

- Tier 6 – make investments 3200 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $3200 USDT is invested)

- Tier 7 – make investments 6400 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $6400 USDT is invested)

- Tier 8 – make investments 12,800 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $12,800 USDT is invested)

- Tier 9 – make investments 25,600 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $25,600 USDT is invested)

- Tier 10 – make investments 51,200 USDT and obtain a 70% break up in buying and selling income (will be elevated to 90% if one other $51,200 USDT is invested)

Daisy Foreign exchange’s funding tiers are cumulative, that means tiers have to be invested into in sequential order.

Notice that at Tier 10, Daisy Foreign exchange associates are capable of proceed investing in $51,200 quantities.

Fairness Shares

Daisy Foreign exchange takes 5% of company-wide invested USDT and locations it into an fairness share pool.

This pool is paid out to investing associates, based mostly on what number of shares they’ve within the pool.

- $200 USDT funding tier associates obtain 1 share

- $400 USDT funding tier associates obtain 2 shares

- $800 USDT funding tier associates obtain 4 shares

- $1600 USDT funding tier associates obtain 8 shares

- $3200 USDT funding tier associates obtain 16 shares

- $6400 USDT funding tier associates obtain 32 shares

- $12,800 USDT funding tier associates obtain 64 shares

- $25,600 USDT funding tier associates obtain 128 shares

- $51,200 USDT funding tier associates obtain 256 shares

As with Daisy Foreign exchange’s funding scheme, fairness shares are cumulative as greater tiers are invested into.

Notice that if double investments are constituted of Tier 5 and better, double the shares are allotted at these tiers.

Referral Commissions

Daisy Foreign exchange associates earn a 5% fee on all USDT invested by personally recruited associates.

Residual Commissions

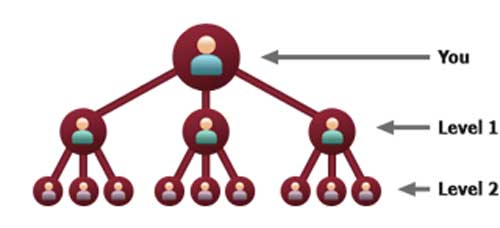

Daisy Foreign exchange pays residual commissions through a 3×10 matrix.

A 3×10 matrix locations a Daisy Foreign exchange affiliate on the prime of a matrix, with three positions immediately below them:

These three positions kind the primary degree of the matrix. The second degree of the matrix is generated by splitting every of those first three positions into one other three positions every (9 positions).

Ranges three to 10 of the matrix are generated in the identical method, with every new degree housing thrice as many positions because the earlier degree.

Every Daisy Foreign exchange funding tier corresponds to a separate 3×10 matrix. I.e. if a Daisy Foreign exchange affiliate has invested in every of the ten accessible tiers, they’ll be collaborating in ten 3×10 matrices.

Associates positioned right into a matrix will be immediately or not directly recruited.

Residual commissions are paid as a share of USDT invested by downline associates recruited into the matrix at every tier.

Residual fee charges are the identical throughout all ten tiers however are elevated as further matrix ranges are certified for.

For Daisy Foreign exchange funding tier 1, associates earn on all ten ranges of the matrix:

- a 4% residual fee price is paid on matrix ranges 1 and a couple of

- a 2% residual commision price is paid on matrix ranges 3 to 10

From funding tiers 2 to 10, ranges 3 to 10 of the matrix have to be unlocked by further qualification standards.

Notice that as greater matrix ranges are certified for, total residual fee charges are adjusted throughout all tiers.

- degree 3 of the matrix is certified for by recruiting three 3 buyers and producing $1000 in downline funding quantity, commissions lowered to three% on ranges 1 and a couple of and 1.5% on ranges 3 to 10

- degree 4 of the matrix is certified for by recruiting 6 affiliate buyers and producing $2000 in downline funding quantity

- degree 5 of the matrix is certified for by recruiting 9 affiliate buyers and producing $4000 in downline funding quantity

- degree 6 of the matrix is certified for by recruiting 12 affiliate buyers and producing $8000 in downline funding quantity

- degree 7 of the matrix is certified for by recruiting 15 affiliate buyers and producing $16,000 in downline funding quantity

- degree 8 of the matrix is certified for by recruiting 18 affiliate buyers and producing $32,000 in downline funding quantity

- degree 9 of the matrix is certified for by recruiting 21 affiliate buyers and producing $64,000 in downline funding quantity, commissions restored to 4% on ranges 1 and a couple of and a couple of% on ranges 3 to 10

- degree 10 of the matrix is certified for by recruiting 24 affiliate buyers and producing $128,000 in downline funding quantity

If the above qualification standards isn’t glad, associates solely earn on ranges 1 and a couple of of their matrix tiers.

Residual Fee Matching Bonus

Daisy Foreign exchange associates earn a ten% match on residual commissions earned by personally recruited associates.

ROI Matching Bonus

Daisy Foreign exchange pays the ROI Matching Bonus through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel crew, with each personally recruited affiliate positioned immediately below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel crew.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Daisy Foreign exchange caps payable unilevel crew ranges at 10:

- degree 1 (personally recruited associates) = 3.5% ROI match

- ranges 2 to 10 – 1% ROI match

Pacesetter Gold Bonus Pool

Daisy Foreign exchange’s Pacesetter Gold Bonus Pool is funded with 1.8% of company-wide funding and 1.25% of company-wide returns paid out.

To qualify for a share within the Pacesetter Gold Bonus Pool, a Daisy Foreign exchange affiliate should recruit 24 or extra associates and persuade them to speculate at the least $128,000 USDT.

Pacesetter Gold bonus pool qualification standards have to be achieved inside a Daisy Foreign exchange affiliate’s first 30 days.

Pacesetter Chief Bonus Pool

Daisy Foreign exchange’s Pacesetter Chief Bonus Pool is funded with 1.8% of company-wide funding and 1.25% of company-wide returns paid out.

To qualify for a share within the Pacesetter Chief Bonus Pool, a Daisy Foreign exchange affiliate should personally recruit three associates who’ve certified for the Pacesetter Gold bonus pool (see above).

There isn’t any restrict to the quantity of Pacesetter Chief Bonus Pool shares a Daisy Foreign exchange affiliate can qualify for.

Foreign exchange Builder Bonus Pool

The Foreign exchange Builder Bonus Pool is funded by:

- a $500,000 Daisy Foreign exchange funding account

- 5% of all double-tier investments throughout tiers 5 and 10

- 4% of Daisy Foreign exchange funding throughout tiers 1 and a couple of

- 2.7% of Daisy Foreign exchange funding throughout tiers 3 to 10

- any unpayable residual commissions attributable to associates not being certified for all ten ranges (presumably break up with the Foreign exchange Achievers Bonus Pool)

The Foreign exchange Builder Bonus Pool is paid out month-to-month.

Daisy Foreign exchange associates qualify for a share within the pool every month by convincing personally recruited associates to speculate $5000 USDT the month prior (as much as 70% will be counted from anybody recruited affiliate).

For each $5000 USDT counted, a Foreign exchange Builder Bonus Pool is awarded.

- if a Daisy Foreign exchange affiliate earns 4 or extra shares within the Foreign exchange Builder Bonus pool, their share quantity is doubled for that month

- if a Daisy Foreign exchange affiliate earns 4 shares or extra for 3 consecutive months, these shares are made everlasting going ahead

Foreign exchange Achievers Bonus Pool

The Foreign exchange Achievers Bonus Pool is funded by

- a $500,000 Daisy Foreign exchange funding account

- 5% of all double-tier investments throughout tiers 5 and 10

- 4% of Daisy Foreign exchange funding throughout tiers 1 and a couple of

- 2.7% of Daisy Foreign exchange funding throughout tiers 3 to 10

- any unpayable residual commissions attributable to associates not being certified for all ten ranges (presumably break up with the Foreign exchange Builder Bonus Pool)

The Foreign exchange Achievers Pool is paid out month-to-month.

To qualify for shares within the Foreign exchange Achievers Bonus Pool, a Daisy Foreign exchange affiliate should have recruited 24 associates who collectively have invested at the least $128,000 USDT

As soon as that standards is met, Daisy Foreign exchange associates qualify for a share within the pool when a personally recruited affiliate qualifies for the Pacesetter Gold Bonus Pool.

Pacesetter Gold Bonus Pool shares don’t expire.

Becoming a member of Daisy Foreign exchange

Daisy Foreign exchange affiliate membership is free.

Full participation within the connected revenue alternative requires a $102,300 funding.

Daisy Foreign exchange solicits funding in tether (USDT).

Daisy Foreign exchange Conclusion

The center of Daisy Foreign exchange’s MLM alternative isn’t all that totally different to what Daisy AI began with two years in the past.

The ruse behind Daisy Foreign exchange’s funding scheme remains to be buying and selling by EndoTech. Right here’s the pitch from 2020;

(Anna Becker’s) groups of AI scientists have greater than 20 proprietary AI programs in operation and function the AI investing spine of buying and selling at greater than 150 funding corporations throughout the US, Europe and Asia.

The unique buying and selling ruse was cryptocurrency. Final 12 months that was swapped out for foreign exchange.

At present Daisy Foreign exchange’s web site has been stripped of every part besides a YouTube advertising video, app obtain hyperlink and hyperlink to Daisy Foreign exchange’s Telegram group.

DaisyForex is tied to the US by Jeremy Roma. Exterior of the US, SimilarWeb presently tracks prime sources of site visitors to Daisy Foreign exchange’s web site as Hungary (20%), Spain (18%), Egypt (8%) and Russia (6%).

Regardless of representing it generates exterior income through foreign currency trading since 2020, Daisy Foreign exchange will not be registered to supply securities or commerce commodities in any jurisdiction. Neither are EndoTech.

One other securities fraud violation is Daisy Foreign exchange providing digital shares in EndoTech.

To cite Jeremy Roma from a Daisy Foreign exchange advertising presentation;

(At) Tier 10 you’d have over 71,000 USDT that will likely be positioned into the reside buying and selling.

And you’ll have an accumulation of shares that will exceed effectively over 400 shares, that you’d have in EndoTech previous to the compny going public.

This nonsense has been happening for 2 years and EndoTech nonetheless isn’t publicly listed anyplace.

The explanation Daisy Foreign exchange and EndoTech decide to commit securities and commodities fraud is as a result of there isn’t any buying and selling. Or at the least not sufficient to maintain Daisy Foreign exchange’s marketed returns.

All Daisy Foreign exchange are doing is recycling newly invested funds to repay present buyers. As this Ponzi mannequin has collapsed over the previous two years, all Jeremy Roma has performed is reboot with new smart-contracts.

As with each iteration of Daisy Foreign exchange that got here earlier than it, when affiliate recruitment dries up so too will new funding.

This may see Daisy Foreign exchange starved of ROI income, ultimately prompting a collapse.

As I perceive it earlier iterations of Daisy Foreign exchange have collapsed by the use of returns lowering to nothing. Then a brand new alternative is launched and former losses are glossed over.

Regardless of what number of occasions Daisy Foreign exchange reboots, math is math – and math ensures the vast majority of individuals in Ponzi schemes ultimately lose cash.

[ad_2]

Supply hyperlink