[ad_1]

Apex Monetary operates within the cryptocurrency area of interest.

Apex Monetary operates within the cryptocurrency area of interest.

The corporate’s web site area is “theapex.app”, which was privately registered on January twelfth, 2021.

Apex Monetary present various executives on their web site. The one one that truly appears to exist is James Ward.

Fairly than disclose possession of Apex Monetary, Ward has set himself up as Head of Advertising.

James Ward is the face of Apex Monetary and hosts the corporate’s advertising and marketing movies:

James Ward (proper) first popped up on BehindMLM’s radar in 2010, because the CEO of LGN Prosperity.

LGN Prosperity marketed journey vouchers, with every voucher producing a place in a matrix 2×2 cycler.

Following months of associates not getting paid, in mid 2011 LGN Prosperity morphed into LGN Worldwide.

This name-change introduced on the addition of commissions paid on journey companies booked by LGN.

LGN Worldwide finally collapsed in mid to late 2013, with Ward heading up iBizWave as CEO and co-founder in early 2014.

In 2015 Ward launched 2SL Begin Dwelling, which noticed him return to the journey MLM area of interest.

2SL Begin Dwelling was short-lived, prompting Ward to launch Pangea in 2016.

Pangea’s authentic enterprise mannequin was a matrix cycler hiding behind journey.

By early 2017 Pangea had collapsed. Ward rebooted Pangea with a brand new compensation plan.

The one materials distinction was the cycler expanded to 3 tiers, so it’s not shocking that Pangea 2.0 additionally didn’t final lengthy.

In late 2019 Ward resurfaced with Sports activities Buying and selling BTC, a crypto Ponzi scheme.

Sports activities Buying and selling BTC collapsed by December 2019, prompting Ward to reboot the scheme as World Credit Community.

As per web site site visitors charts supplied by Alexa, World Credit Community collapsed in or round April 2020.

In late June 2020 Ward launched his first smart-contract Ponzi scheme, Lion’s Share.

One can safely assume that the launch of Apex Monetary means Lion’s Share has or is on the breaking point.

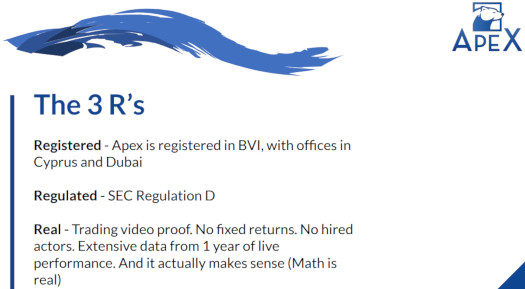

In an try to seem official, Apex Monetary bangs on about incorporation and having registered with the SEC.

For the aim of MLM due-diligence, fundamental incorporation wherever is meaningless.

Incorporation in jurisdictions chosen particularly for his or her lack of MLM securities fraud regulation is much more meaningless.

The BVI, Cyprus and Dubai are all scam-friendly jurisdictions.

To judge Apex Monetary’s SEC regulation declare, I hit up the SEC’s Edgar database.

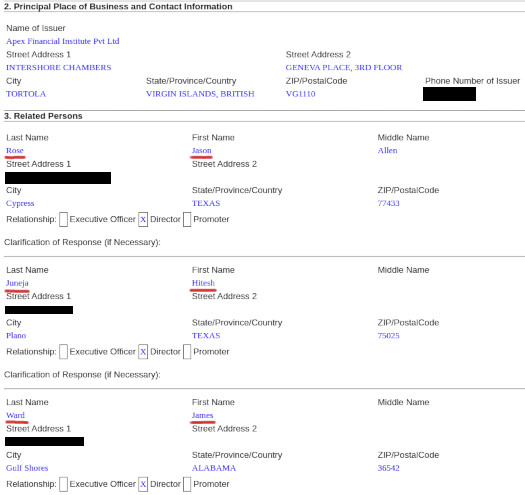

Apex Monetary Institute filed a FORM D Discover of Exempt Providing of Securities on March sixteenth, 2021.

There may be nothing about Apex Monetary’s passive funding alternative on this submitting.

What the submitting does affirm is James Ward is a co-owner of the corporate. Apex Monetary’s different two homeowners are Jason Rose and Hitesh Juneja.

The final time we got here throughout them Rose and Juneja have been launching Rise Community. This was again in November 2019.

Rise Community’s web site continues to be lively, nevertheless Alexa site visitors estimates reveal a collapse starting mid 2020.

Why James Ward is the one Apex Monetary proprietor talked about on the corporate’s web site (and even then Ward isn’t credited as an proprietor), is unclear.

Learn on for a full evaluation of Apex Monetary’s MLM alternative.

Apex Monetary’s Merchandise

Apex Monetary has no retailable services or products.

Apex Monetary associates are solely in a position to market Apex Monetary affiliate membership itself.

Apex Monetary’s Compensation Plan

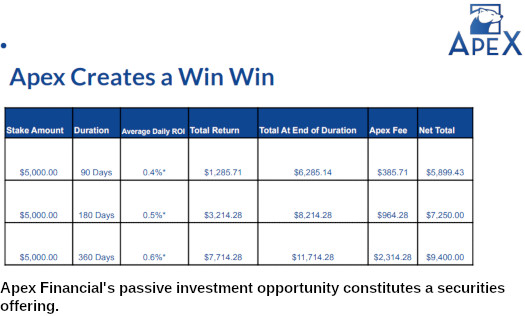

Apex Monetary associates buy AFT tokens from Apex Monetary.

Apex Monetary sells AFT tokens to associates at a 1:$1 alternate charge.

As soon as acquired, AFT tokens are parked with Apex Monetary on the promise of marketed returns:

- Apex Rise – make investments 500 AFT or extra and obtain 0.3% to 0.6% a day, paid over 90 weekdays

- Apex Scale – make investments 2000 AFT or extra and obtain 0.4% to 0.7% a day, paid over 180 weekdays

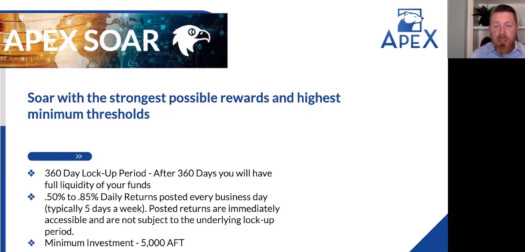

- Apex Soar – make investments 5000 AFT or extra and obtain 0.5% to 0.85% a day, paid over 360 weekdays

Observe that in the course of every Apex Monetary funding contract, tokens are locked till maturity.

Apex Monetary takes a 30% minimize of returns paid out.

Apex Monetary associates are in a position to withdraw AFT tokens to ethereum, bitcoin or litecoin by an inner alternate.

Referral Commissions

Apex Monetary pays referral commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel crew, with each personally recruited affiliate positioned immediately underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel crew.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Apex Monetary caps payable unilevel crew ranges at twenty.

Referral commissions are paid out as a proportion of funds invested into AFT tokens throughout these twenty ranges as follows:

- stage 1 (personally recruited associates) – 2.5%

- ranges 2 to five – 1%

- ranges 6 and seven – 0.5%

- ranges 8 to 14 – 0.25%

- ranges 15 to twenty – 0.125%

Efficiency Bonus

Of the 30% AFT tokens paid out as every day returns that Apex Monetary withholds, 90% are used to pay the Efficiency Bonus.

The Efficiency Bonus is paid utilizing the identical unilevel crew construction as referral commissions (see above).

- stage 1 – 25%

- ranges 2 to five – 10%

- ranges 6 and seven – 5%

- ranges 8 to 14 – 2.5%

- ranges 15 to twenty – 1.25%

Becoming a member of Apex Monetary

Apex Monetary affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal $500 funding in AFT tokens.

Apex Monetary solicits funding in bitcoin, ethereum and litecoin.

Conclusion

AFT token is an everyday ERC-20 Ponzi shit token. These take a couple of minutes to create at little to no value.

AFT token is an everyday ERC-20 Ponzi shit token. These take a couple of minutes to create at little to no value.

Apex Monetary associates hand over bitcoin, ethereum or litecoin and obtain nugatory AFT tokens.

They park them with Apex Monetary on the promise of marketed returns, additionally paid in AFT tokens.

Supposedly there’s buying and selling happening behind the scenes to fund withdrawals, nevertheless in true Ponzi vogue no proof is supplied. A minimum of nothing credible that may be verified (monetary studies filed with regulators).

As such Apex Monetary is ready to pay withdrawals by its inner alternate, so long as there’s nonetheless new funding to steal.

Earlier funds invested into Apex Monetary are known as “liquidity”.

What occurs if AFT loses worth?

AFT shouldn’t be a speculative token. It’s staked at a steady worth mounted at 1 USD per token. This worth doesn’t fluctuate and is underwritten by Apex’s liquidity.

No liquidity (invested funds to steal), no withdrawals.

Being a passive funding alternative, Apex Monetary constitutes a securities providing.

Neither Apex Monetary, James Ward, Jason Rose or Hitesh Juneja are registered to supply securities within the US.

That is critically vital, as a result of Alexa at present estimates that 92% of site visitors to Apex Monetary’s web site originates out of the US.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can see Apex Monetary unable to pay withdrawal requests, finally prompting a collapse.

The maths behind MLM Ponzi schemes ensures that once they collapse, nearly all of contributors lose cash.

Apex Monetary’s exit-scam of selection seems to be the general public alternate route:

The place can I buy Apex tokens?

At present, Apex tokens could solely be bought from the official Apex web site.

Upon reaching 100m tokens in lively circulation, we’ll pursue token itemizing with main defi and non-defi exchanges.

This can see APT tokens overestimated and pumped, previous to itemizing on some dodgy alternate.

The preliminary pump will enable James Ward, Jason Rose and Hitesh Juneja to steal much more cash by cashing out pre-generated APT tokens.

High recruiters and early traders can even money out as this stage.

What follows is the inevitable dump to $0, leaving nearly all of Apex Monetary associates bagholding yet one more nugatory Ponzi shit token.

[ad_2]

Supply hyperlink