[ad_1]

iX International has collapsed.

iX International has collapsed.

On a “remaining international name” held on June twenty fourth, founder Joe Martinez confirmed an ongoing SEC investigation into the corporate.

[1:38] During the last 12 months or so … we bumped into some regulatory points right here within the US, the place we’re headquartered.

Sadly these challenges, doesn’t matter that we acquired the case dismissed towards us, these challenges have uh, given us … challenges which can be inconceivable.

[2:19] We simply acquired phrase this final week that the SEC is, as they mentioned they’d, reinvestigating the case towards Debt Field.

The SEC filed go well with towards Debt Field and iX International in August 2023. On the middle of the go well with was an alleged $49 million {dollars} in securities fraud.

Following fallout from admin errors by SEC attorneys, the case was voluntarily dismissed in Might 2023. Attorneys tied to the errors left the SEC and a brand new group of attorneys are dealing with the case.

This brings us to Martinez’s response to renewed investigation into iX International’s alleged securities fraud.

This brings us to Martinez’s response to renewed investigation into iX International’s alleged securities fraud.

[2:40] Due to how a lot regulation and regulatory points all through the world have been difficult us, we’ve determined … that iX International as of this week will stop operations.

ix International affiliate traders have been suggested they’ll be capable of withdraw any pockets balances of their backoffice.

All techniques will stay on-line for the subsequent 30 days, with model ambassadors capable of login to their accounts, request payouts, and proceed to function in accordance to the corporate agreements and procedures via July twenty fourth.

iX International’s preliminary enterprise mannequin hid purported automated foreign currency trading returns behind an training platform. To defraud customers out of tens of millions, Martinez teamed up with Debt Field within the US and TP International FX in India.

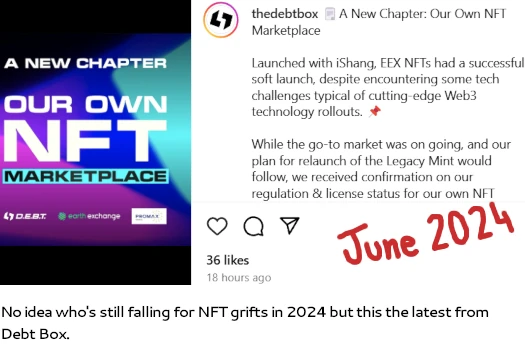

The Debt Field aspect of the rip-off got here to an finish after the SEC filed go well with. iX International and Debt Field doubled down on securities fraud with an IN8 NFT grift. That lasted just a few months earlier than collapsing.

IN8 Tech, an iX International related shell firm owned by Martinez, would resurface as a service supplier in CloudX.

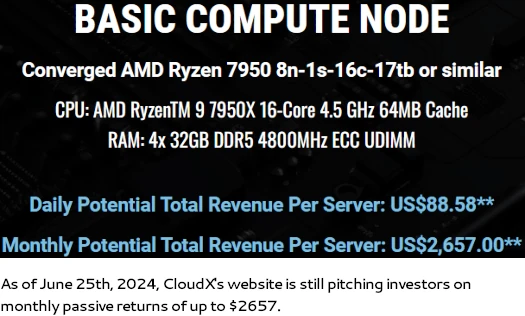

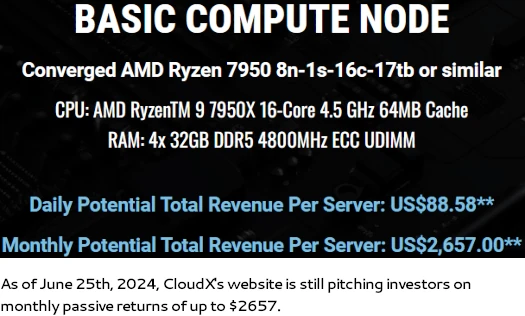

By CloudX, iX International pitched traders on annual passive returns of as much as $72,000 per $15,000 funding.

Evidently believing the SEC’s investigation gained’t develop to IN8 NFTs and CloudX, Martinez suggested;

[8:11] Anyone that’s persevering with to buy any of our know-how merchandise, like CloudX or Nova, these merchandise will keep on-line with the merchandise supplier of the know-how corporations.

So all of these issues are staying in place however they had been fully separate from iX International.

That is in fact baloney seeing as Martinez owns each iX International and IN8. That CloudX traders needed to be addressed on an iX International say all of it actually.

The TP International FX aspect of the rip-off collapsed following the arrest of Viraj Patil in India.

As a part of an ongoing legal investigation into TP International FX and iX International, Martinez himself is a fugitive wished by Indian authorities.

Addressing iX International’s Indian traders on the ultimate international name, Martinez confirmed they had been screwed. Martinez suggested funds stolen from Indian iX International traders could be put in the direction of his authorized charges.

Upon changing into conscious of regulatory investigations into Debt Field, its founders started transferring property to Dubai. With the SEC’s case nonetheless energetic, they too then additionally fled to Dubai.

From Dubai, Debt Field’s founders proceed to defraud customers via varied crypto schemes.

There haven’t been any public updates from Debt Field company following voluntary dismissal of the SEC’s case.

SimilarWeb tracked simply ~11,400 month-to-month visits to Debt Field’s web site for Might 2024. Most of that’s assumed to be traders questioning the place their cash went.

There is no such thing as a timeline for when the SEC’s renewed investigation will full and when the regulator will file new prices.

[ad_2]

Supply hyperlink