[ad_1]

Across the similar time US authorities started wanting into OneCoin, Dubai’s Normal Division of Prison Investigations raised cash laundering considerations.

Across the similar time US authorities started wanting into OneCoin, Dubai’s Normal Division of Prison Investigations raised cash laundering considerations.

How the parallel investigations concluded nonetheless, couldn’t be any extra totally different.

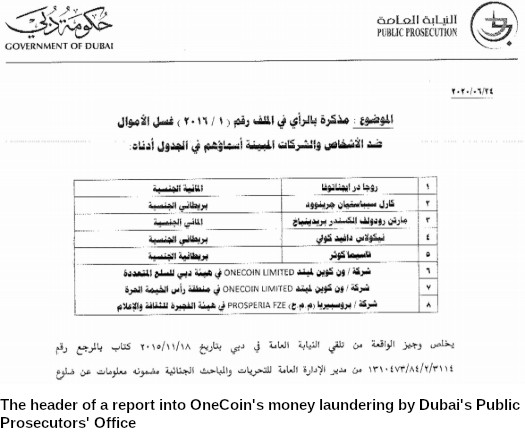

In November 2015 Public Prosecutors in Dubai obtained a report from the Director of the Normal Division of Prison Investigations.

The report detailed

the involvement of Ruja Ignatova in cash laundering operations in favor of suspicious worldwide our bodies.

These allegations had been based mostly on “stories of suspicious transactions” from a number of UAE banks.

Funds in query had been frozen, pending the end result of a regulatory investigation.

As noticed by Mashreq Financial institution, Ignatova was laundering OneCoin funds from HSBC accounts in Hong Kong.

The GDCI’s investigation prolonged past Mashreq Financial institution. As a part of the investigation they sought clarification from HSBC as to the character of Ignatova’s transactions.

In a spectacular show of regulatory non-compliance, HSBC ignored them.

Business Financial institution of Dubai has contracted the transferring financial institution in Hong Kong, inquiring in regards to the particulars of the monetary and business relationship between the transferor and the beneficiary within the UAE, and whether or not the financial institution in Hong Kong is reassured of the character and sources of the sums transferred, in addition to scanning copies of the portfolio of economic paperwork and business contracts.

The financial institution in Hong Kong didn’t reply to the inquiries despatched by Business Financial institution of Dubai and solely said the explanation for the 2 monetary transfers, i.e. the fee of loans.

The transferring financial institution refused to provide extra detailed data on the inquiries and requests made by the Business Financial institution of Dubai regardless of repeated requests.

The explanation HSBC pushed again on the requests is clear; they didn’t do any due-diligence on Ignatova or the supply of funds she was laundering into the UAE.

Further stories had been obtained from United Arab Financial institution and Noor Financial institution, citing considerations with accounts and transactions facilitated by Sebastian Greenwood.

The Central Financial institution’s Anti-Cash Laundering and Monetary Intelligence Unit obtained a suspicious banking transaction report from United Arab Financial institution concerning Karl Sebastian Greenwood and a woman known as Tasmiya Kauser (she was working in Mashreq Financial institution as an administrative officer) and she or he was supervisor of financial institution accounts for which suspicious banking transaction stories referred to within the report had been filed by Mashreq Financial institution.

Mashreq Financial institution’s filed SAR talked about “particular emphasis on employees collusion”.

This seems to be confirmed through a separate SAR filed by HSBC’s Dubai department.

HSBC Financial institution (Dubai department) submitted a suspicious banking transaction report on the private account of the woman Tasmiya Kauser.

The financial institution said within the report that in her work with Mashreq Financial institution, which ran for a interval not exceeding (5) months, she deposited sums of cash amounting to AED 4.2 million paid from SS FZC and from Karl Sebastian Greenwood.

Upon the financial institution’s inquiries in regards to the nature of the sums, she reported that Sheikh Saud Faisal bin Sultan Qasimi gave her a mortgage of AED 3.7 million to purchase a property and an quantity of AED 500,000 is a wedding reward introduced by her pal Karl Sebastian Greenwood.

Sheikh Saud Faisal bin Sultan Qasimi is expounded to Sheikh Saoud, who’s straight implicated in OneCoin’s cash laundering exercise.

Each Sheikh Saud and Sheikh Saoud belong to the Al Qasimi royal household, headed up by Sheikh Faisal bin Sultan bin Salem Al Qasimi.

Sheikh Faisal is founder and Chairman of United Arab Financial institution.

Outdoors of the UAE the GDCI obtained a letter from Germany’s Normal Directorate of the Federal Prison Police, citing documentation from Interpol’s Manchester workplace.

The letter cited a “critical crimes investigation into fraud and cash laundering”, by the Division of Harmful Crimes in Metropolitan Police in London.

Topics of the investigation had been Ruja Ignatova, Haja Barheila and Sebastian Greenwood.

Haja Barheila is a reputation I haven’t seen earlier than. They don’t seem to exist wherever on the web and I do not know who this particular person is.

The Division of Harmful Crimes expressed concern over the “seizure of investor’s cash” by the suspects, in relation to operation of OneCoin.

The report went on to quote Frank Ricketts and Manon Hubenthal as co-conspirators.

Dubai’s Public Prosecutors sat on the report till February 2016, whereby “a joint committee was appointed”.

The committee consisted of the Central Financial institution of the United Arab Emirate’s Monetary Intelligence Unit and Dubai Police Normal HQs, represented by the Division of Combating Organized Crime – Division of Cash Laundering and Monetary Crimes.

The aim of the committee was

to organize a joint detailed technical report on all transactions and transfers made within the accounts belonging to individuals and firms talked about in (the GDCI’s) report.

The committee filed an preliminary report on December fifteenth, 2016.

The report said the committee had been unable to get in touch with any of the people related to the suspicious exercise.

The request was handed via every of Tasmiya Kauser (as a result of) of her shut relationship with them and the involved banks.

Nonetheless, Karl Sebastian Greenwood and Ruja Ignatova didn’t pay any consideration and abstained from attending, they usually despatched mediators (regulation companies) to the assembly.

The committee famous each Greenwood and Ignatova had moved freely out and in of Dubai since being first approached by the committee, however “didn’t provoke contact or attend”.

Because of this, the committee famous that except it might sit down with Martin Breidenbach (proprietor of Prosperia FZE, one of many shell corporations used to launder funds between Hong Kong and the UAE), Ignatova, Greenwood and Nicholas David Cully (arrange Prosperia FZE via his firm The Sovereign Group), the committee can not file a closing technical report with the results of the sources and nature of funds.

Dubai authorities took motion on the report, issuing arrest warrants for Ignatova, Greenwood, Breidenbach and Cully.

The warrants had been by no means executed.

In June 2020 the committee filed its closing report.

As there have been no complaints or authorized claims towards the talked about corporations and Ruja Ignatova within the nation, in addition to the absence of any authorized requests from exterior the nation to freeze the financial institution accounts of corporations and Ruja Ignatova, apart from what was circulating on the web, subsequently the committee proposes to unfreeze the funds.

Upon reviewing the report, the Central Financial institution of the UAE’s Anti-Cash Laundering and Monetary Intelligence Unit, and Dubai Police’s Division for Combating Organized Crime, adopted the stories suggestions.

Consequently, the financial institution accounts beforehand frozen in 2015 had been unfrozen.

In issuing their report, the committee had been stringent in barring Sheikh Saud from claiming the funds.

This was on the idea “the freeze occurred earlier than he acquired (OneCoin) based on the Energy of Lawyer granted to him”.

The Central Financial institution of the UAE and Dubai Police Division disagreed, granting Sheikh Saud permission to assert the frozen funds.

As it’s a matter associated to a dispute exterior the legal offense, the matter is left to the injured social gathering, i.e. Ruja Ignatova, to provoke civil proceedings on this regard.

That’s the place the Public Prosecutors report ends.

Presumably the hundreds of thousands that had been frozen had been handed over to Sheikh Saud or whoever rocked as much as acquire.

No one within the UAE has been held accountable for OneCoin’s cash laundering actions.

Conversely, the US’ parallel investigation into OneCoin’s cash laundering actions has seen at least six people indicted. That features Ruja Ignatova and Sebastian Greenwood.

Ignatova stays a fugitive needed by US authorities. Primarily based on her connections to the Al Qasimi household, the main principle is the royal household is sheltering Ignatova someplace within the UAE.

[ad_2]

Supply hyperlink