[ad_1]

Following suspension of withdrawals after which withdrawal restrictions, HomesCNL has introduced its CNL token exit-scam.

Following suspension of withdrawals after which withdrawal restrictions, HomesCNL has introduced its CNL token exit-scam.

HomesCNL disabled withdrawals in early July. Some baloney about “API software program” was the excuse offered.

On July twenty first, the corporate introduced it was resuming withdrawals, with newly carried out restrictions:

On July twenty first, the corporate introduced it was resuming withdrawals, with newly carried out restrictions:

- the minimal withdrawal quantity was now $50; and

- HomesCNL buyers might solely withdraw as much as $1000 a day.

Whereas HomesCNL clamped down on the outflow of cash into the Ponzi, the incoming earlier $5000 funding restrict was raised to $50,000.

The minimal funding quantity can even be raised from $50 to $500 on August 1st.

HomesCNL is a reboot of the collapsed CryptoCNL Ponzi scheme. The first distinction between the 2 scams is a brand new advertising and marketing ruse and introduction of CNL token.

As famous in BehindMLM’s June 2022 protection of the HomesCNL reboot;

This time round when the Ponzi inevitably collapses, Properties CNL will exit-scam by paying their token out.

This enables them to take advantage of gullible buyers for a short while longer as a substitute of simply doing a runner.

HomesCNL’s July twenty first announcement additionally revealed the inevitable CNL token exit rip-off.

Withdrawals will quickly be with CNL TOKEN.

You’ll be able to nonetheless purchase the CNL Token at $0.50 within the again workplace.

Paying out in CNL token, which HomesCNL generates on demand out of skinny air for gratis, permits the Ponzi scheme to cease straight paying out in bitcoin.

Owing to CNL token being nugatory outdoors of HomesCNL, they’ll nonetheless need to not directly cowl withdrawals (associates changing CNL into bitcoin or one thing else).

Paying in CNL token nonetheless permits HomesCNL to maximise investor losses. An inhouse token is simpler to control internally over a third-party token/coin.

To that finish HomesCNL will transition to a staking Ponzi, permitting customers to park CNL token with the corporate in trade for returns. Returns are after all additionally paid in CNL token.

This successfully permits HomesCNL to kick it’s exit-scam collapse additional down the street.

HomesCNL has additionally introduced a deliberate NFT grift. Particular particulars nonetheless have but to emerge.

Fronted by Boris CEO “Jack Wilson”, HomesCNL is believed to be run by serial scammers Andrew Arrambide and Juan Carlos Guinea.

Arrambide is believed to be a resident of Utah or California within the US. Guinea operates out of Mexico.

Following a advertising and marketing marketing campaign focusing on South America, final month HomesCNL recruitment in Peru shot up 5000%.

SimilarWeb at the moment studies high sources of visitors to HomesCNL’s web site as Mexico (40%), Peru 31%, Venezuela (16%) and El Salvador (7%).

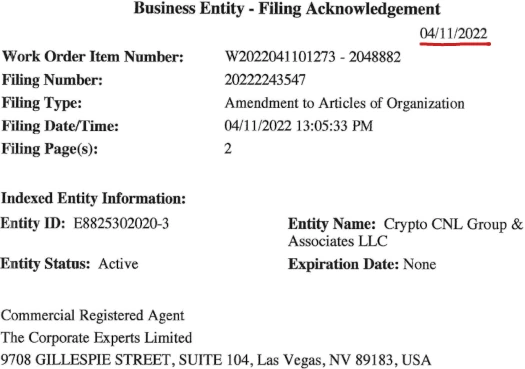

HomesCNL is integrated within the US as “Crypto CNL Group & Associates LLC”, a Nevada shell firm.

Neither Crypto CNL, Properties CNL, Crypto CNL Group & Associates LLC, Andrew Arrambide or Juan Carlos Guinea are registered with the SEC.

On July thirtieth HomesCNL is holding a advertising and marketing occasion in Dubai:

Arrambide left the US for Dubai on July third:

Leaving a month upfront of HomesCNL’s deliberate occasion is odd. Whether or not Arrambide’s go to is everlasting or not is unclear.

Juan Carlos Guinea’s present standing is unknown.

Dubai is the MLM crime capital of the world. Via restricted extradition treaties, non-cooperation with international regulation enforcement and turning a blind-eye to MLM associated securities fraud, the UAE gives a safe-haven for scammers.

[ad_2]

Supply hyperlink