Your credit score rating will be each a blessing and a curse. An excellent rating can provide you entry to significantly better monetary merchandise at decrease rates of interest, nevertheless it additionally takes a major quantity of effort to maintain your credit score in good condition. A nasty rating can tank your possibilities of approval for any traces of credit score and may take a very long time to restore.

Whether or not your credit score is in tip-top form or in want of some work, step one to managing your credit score is to know what your credit score rating is. Listed below are a few of the finest locations to get your credit score rating and credit score report.

What Is a Credit score Rating?

Your credit score rating is an important a part of your client monetary life. In most conditions the place somebody is speaking a couple of “credit score rating”, they’re referring to the more-or-less industry-standard FICO rating. There may be one other variation that’s changing into increasingly more fashionable, nonetheless, known as VantageScore.

The usual FICO rating ranges from 300 to 850 and is calculated on a fancy array of data in your credit score report. Credit score scores are designed to be a fast methodology of boiling down pertinent data in a credit score report back to a quantity, which may decide the general creditworthiness of a particular client.

Since your credit score rating is created out of your credit score report, it can provide a comparatively correct illustration of how seemingly it’s that you just’ll uphold your monetary obligations. It might appear unfair that our credit score lives will be lowered to a three-digit quantity, however it’s designed in such a means that it may be used to precisely and pretty consider a client’s probability to repay funds loaned to them.

The three Finest Locations to Get Your Credit score Rating

These are our high three locations to get your credit score rating. All of those choices are free and are backed by the three main credit score reporting businesses within the U.S.

1. Credit score Karma

Credit score Karma is among the hottest credit score monitoring providers on the market proper now. Their database is up to date each seven days and offers you prompt entry to your full Experian and TransUnion credit score experiences, in addition to a VantageScore 3.0 that’s primarily based in your Experian report. In addition they facilitate easy disputes proper from their app, which makes cleansing up your credit score a lot simpler.

is among the hottest credit score monitoring providers on the market proper now. Their database is up to date each seven days and offers you prompt entry to your full Experian and TransUnion credit score experiences, in addition to a VantageScore 3.0 that’s primarily based in your Experian report. In addition they facilitate easy disputes proper from their app, which makes cleansing up your credit score a lot simpler.

They’ve a free credit score simulator that reveals how new credit score report gadgets can influence your rating, equivalent to taking out a brand new mortgage or opening a brand new bank card. One closing profit is that they present you provides primarily based in your credit score rating, equivalent to loans and bank cards with excessive possibilities of approval, in addition to your auto insurance coverage rating.

2. Credit score Sesame

Credit score Sesame is a credit score monitoring service that’s much like, although barely completely different from, Credit score Karma. Whereas Credit score Karma provides an Experian-based VantageScore, Credit score Sesame supplies a free TransUnion VantageScore. Credit score Sesame is a superb possibility for getting personalised credit score provides and money-saving steering. In addition they present a major $50,000 in fraud decision help within the case of id theft.

is a credit score monitoring service that’s much like, although barely completely different from, Credit score Karma. Whereas Credit score Karma provides an Experian-based VantageScore, Credit score Sesame supplies a free TransUnion VantageScore. Credit score Sesame is a superb possibility for getting personalised credit score provides and money-saving steering. In addition they present a major $50,000 in fraud decision help within the case of id theft.

3. WalletHub

In case you’re on the lookout for a monitoring service that allows you to set alerts on credit score exercise, WalletHub is the platform you need. They’ll present each a TransUnion credit score report and TransUnion VantageScore. To register you’ll want to offer your social safety quantity and some identity-verification questions. The primary dashboard provides you ample data at a look, equivalent to having an excessive amount of debt, or in case your utilization charge is just too excessive, which may damage your rating.

5 Different Locations To Get Your Credit score Rating

Listed below are much more choices on the market to get your credit score rating. Some choices are at no cost, whereas others are for a payment.

1. Varied Credit score Playing cards

Loads of bank card issuers on the market present a FICO rating to their prospects periodically, for no cost. Uncover Card and First Nationwide Financial institution provide variations of the FICO rating, whereas Capital One provides the cardholder a VantageScore every month. There are lots of others, every with stipulations or circumstances that the cardholder might have to fulfill.

2. Experian

Experian provides a duplicate of their credit score report on you in addition to your present FICO 8 rating on their web site. This service is free, and for added charges, they provide further credit score providers.

3. Equifax

Equifax doesn’t have any method to get your rating at no cost. They do provide varied ranges of month-to-month paid subscriptions that supply elevated credit score visibility, and both an Equifax or FICO 5 rating, relying on the subscription package deal.

4. TransUnion

TransUnion provides a paid service to purchase limitless entry to the buyer’s TransUnion credit score report, and VantageScore 3.0 rating that’s primarily based on that report.

5. myFICO

MyFICO.com is a paid service that provides industry-specific scores. They provide paid packages that offer you your FICO 8 and FICO 9 scores, in addition to scores tailor-made to numerous industries like bank cards and mortgages.

What Is The Distinction Between A Credit score Rating & Credit score Report?

Your credit score rating is a quantity between 300 and 850 that provides an general ranking of your creditworthiness. It’s primarily based in your credit score report, and there are numerous completely different variations of it, although the most typical is just known as the FICO rating. It’s calculated by utilizing parts out of your credit score report which might be utilized with weighted significance.

Your credit score report is a literal historical past of your credit score life for the previous 7 years. It incorporates your month-by-month cost historical past for all installment loans, credit-reporting utility payments, and revolving credit score traces. It reveals how lengthy you’ve had a credit score report. It additionally particulars every of your mortgage or credit score accounts, giving particulars on cost historical past, stability, account age, and extra. Moreover, it incorporates a report of all of your delinquencies, late funds, closed accounts, and gadgets in collections.

How Is a Credit score Rating Calculated?

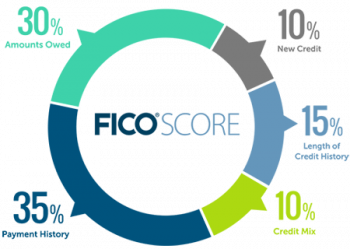

Your credit score rating is calculated utilizing a fancy system that mixes information from completely different areas right into a single quantity. With regard to your FICO rating, your cost historical past, credit score utilization ratio, credit score age, credit score combine, and credit score inquiries all issue into your closing rating.

The cost historical past will probably be crucial consider your rating and accounts for 35% of the outcome. The subsequent merchandise is your credit score utilization ratio, or how a lot credit score you might have versus how a lot credit score you’ve used, which can make up one other 30% of your credit score rating. Credit score age is how lengthy you’ve had credit score and the age of all of your accounts, this issue makes up 15% of your rating.

Credit score combine is just having a mixture of credit score sorts, equivalent to installment loans, revolving credit score, auto loans, or mortgages, and makes up 10% of the rating. The ultimate element is the variety of credit score inquiries you’ve generated, or what number of new traces of credit score you’ve utilized for, which accounts for the final 10%.

Takeaway

Your credit score rating itself is vital to anybody you contemplate a possible borrower. They are going to use your credit score rating as a means of quickly evaluating your general creditworthiness. In lots of automated or AI-based lender screening, your credit score rating determines who will lend to you and at what charges.

To you, the buyer, realizing your credit score rating and the way it’s calculated will help you make way more efficient monetary choices. Understanding how one other line of credit score will doubtlessly change your rating could affect your choice about opening the road of credit score in any respect.