[ad_1]

Monetary Schooling Providers’ court-appointed Monitor (previously Receiver), has filed his first report.

Monetary Schooling Providers’ court-appointed Monitor (previously Receiver), has filed his first report.

Total FES has taken steps to handle compliance, however high earners seem to nonetheless be flouting guidelines.

The FES Receivership was transformed right into a Monitorship following denial of a preliminary injunction again in July.

The FTC maintains FES is a $467 million greenback pyramid scheme, with the case scheduled for an October 2023 trial.

Until then FES has been given permission to function underneath supervision of the Monitor.

The Monitor’s filed November tenth report focuses closely on FES’ compliance efforts.

On the July 26, 2022 assembly with the Monitor and members of the Monitor Staff, Mr. Naik reported the event of a “new compliance plan” for the Firm that may be prepared “this week.”

“Mr. Naik” refers to Parimal Naik, one in all FES’ co-founders.

“Mr. Naik” refers to Parimal Naik, one in all FES’ co-founders.

Documented compliance modifications within the Monitor’s report embody:

- new prospects going by way of an “preliminary session” earlier than any charges are paid

- FES’ Safety Plan capped at six months, ongoing subscription requires prospects to opt-in

- full disclosure of “anticipated charges” in the course of the preliminary six-month Safety Plan subscription interval

- informing and emphasizing to prospects that they can “cancel at any time”

Most of FES’ prospects cancel their subscription “inside two to 3 months of enrolling”.

FES refers to its distributors as “Brokers”. To raised monitor Agent compliance, FES has bought FieldWatch.

FieldWatch mechanically searches social media platforms, blogs, web sites, information websites, and personal on-line teams – utilizing search phrases offered by the Firm – for non-compliant postings by the Monitored Entities’ brokers.

The software program then returns outcomes based mostly on the relevant search phrases, which ends are reviewed by the Firm for incidents of non-compliance.

Whereas FieldWatch can monitor stay streams and posted movies, as of November tenth, 2022, FES hasn’t opted for that subscription tier.

This deficiency creates a doubtlessly materials hole in monitoring of agent exercise.

Whereas the price of buying the upgraded search function shouldn’t be insignificant, the Firm apparently deferred hiring extra personnel to bolster its on-line compliance monitoring largely due to the efficiencies ensuing from the FieldWatch know-how.

Again in July Naik additionally represented to the court docket that he would “create a brand new five-person Compliance Division”.

The Monitor inquired as to the standing of the Compliance Division in August, whereby solely two employees names have been offered.

FES does have a seven-person assist crew, nonetheless they’re unable to behave on compliance points.

Helping the Compliance Division is Javier Canales;

Mr. Canales apparently was referred to the Firm by Kevin Thompson, an legal professional who advises the Firm on multi-level advertising and marketing authorized compliance.

A member of the Monitor Staff interviewed Mr. Canales. Mr. Canales is predicated in Las Vegas, Nevada. Mr. Canales states he has been concerned within the multi-level advertising and marketing trade since roughly 2009, and has served in a authorized compliance position within the multi-level advertising and marketing trade for roughly 10 to12 years.

Nonetheless, Mr. Canales evidently has no formal coaching in authorized compliance issues regarding the direct promoting trade, however slightly, has realized the position “on the job.”

The Monitor expresses concern over Canales’ lack of formal coaching. He goes on to state he’s “not assured” in FES’ Compliance Division having the ability to deal with Credit score Restore Organizations Act necessities (CROA).

The Monitor recommends FES put their Compliance Division, together with Javier Canales

complete and thorough compliance coaching offered by a educated legal professional specializing in the necessities of CROA and relevant state legal guidelines and/or (b) formally incorporate outdoors authorized counsel extra incessantly and frequently to evaluation particular CROA-related compliance issues.

FES has engaged two regulation corporations, Greenspoon and Thompson Burton, however the Monitor believes “extra may be accomplished”.

The Monitored Entities’ failure to constantly make the most of competent exterior compliance authorized counsel previously possible led to lots of the points the Firm at the moment faces in reference to the litigation initiated by the FTC.

The Firm ought to develop new and improved advertising and marketing supplies, probably with agent enter, and in shut collaboration with exterior compliance authorized counsel, to make sure that all supplies (together with PowerPoint displays) are reviewed and authorised by exterior authorized counsel with experience in such issues.

Shifting on to Agent compliance, the Monitor was suggested by the Compliance Division that “displays” have been to be held ” in an effort to strengthen compliance as a part of the Firm’s tradition.”

The Monitor is unable to substantiate as of October 15, 2022 whether or not any such presentation has occurred.

Cited “Compliance Studies”, put collectively on a weekly foundation, revealed a relative “low variety of violations”.

At the moment, FES Brokers are allowed 4 offenses earlier than they’re terminated.

Certainly, whereas the Firm has expressly prohibited brokers from utilizing advertising and marketing supplies that haven’t been ready by the Firm, brokers however incessantly use their very own self-developed advertising and marketing supplies in violation of firm coverage.

In some cases the Compliance Studies point out that the violations have been corrected. In lots of cases, nonetheless, it’s unclear whether or not the offending motion was finally corrected.

One compliance blindspot is “in-person occasions” (PBRs) that Brokers maintain to promote FES and its merchandise.

The Monitor Staff requested a schedule of all PBRs at the moment being carried out by the Firm or that the Firm is conscious of.

As of October 15, 2022, the Firm has not reported any in-person occasions hosted by brokers (i.e., PBR) to the Monitor Staff.

Apparently brokers don’t report scheduled PBRs to the Firm.

One other blind spot is following up on Discipline Agent stories.

In a single instance offered, a FES Agent was picked up by FieldWatch for a non-compliant social media submit.

The Monitor Staff verified that the offending submit had been taken down, however discovered a number of different cases of non-compliance.

The above report reveals (Agent) had a violation of “revenue claims,” which the Monitor Staff was unable to search out proof of on-line.

However, based mostly on Monitor Staff’s evaluation of social media, (Agent) did submit images with the next statements: “In case your credit score rating begins with a 3, 4, 5, or 6 DM me,” “Your credit score rating has improved! +201,” with the remark, “This may be you the following in our program to do what you’ve been desirous to do, restore your credit score.”

Such a posting presumably violates Firm coverage, however was not famous within the Firm’s report.

Due to this fact, though the Firm trains brokers to not submit shopper credit score rating will increase and carried out a evaluation of (Agent’s) account, noting an “revenue claims” advertising and marketing violation, the agent additionally had different posts that violated Firm coverage that don’t seem like addressed or faraway from such agent’s profile.

FES’ official firm coverage is to close down an affiliate’s advertising and marketing web site on a primary offense (until the offense is remedied.

A equipped FieldWatch report for October third reveals that, of the twelve violations cited, no Brokers had their advertising and marketing web site shut down.

A subsequent October seventh report reveals that web sites weren’t disabled till Brokers had obtained three or 4 offense warnings.

Once more, Brokers are alleged to be terminated upon receiving 4 compliance warnings.

The Monitor notes FES’ inaction “doesn’t align with the motion notes taken in response to advertising and marketing violations.”

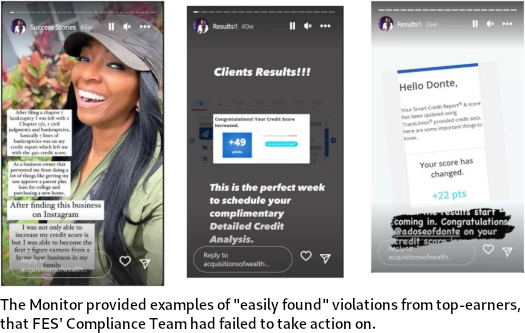

A big a part of the issue seems to be inaction with respect to FES’ high earners.

Social media posts from Alisa Barnes and Daniella Crevecoeur are offered as examples.

The next examples present non-compliant social media posts made by high-earning brokers Alisa Barnes and Daniella Crevecoeur that the Monitor Staff discovered.

Agent Alisa Barnes, posted on Instagram

“Shopper Outcomes!!! Congratulations! Your Credit score Rating Elevated. +49 factors. That is the right week to schedule your complimentary Detailed Credit score Evaluation” and “When the outcomes begin coming in. Congratulations @adoseofdonte in your credit score rating enhance”

Alisa Barnes is among the Firm’s most extremely compensated brokers, having earned roughly [redacted] in commissions per the 2021-2022 Fee Report.

Agent Daniella Crevecoeur posted objects on Instagram displaying credit score rating will increase, with footage stating “Your credit score rating has improved! +344”, “Your credit score rating has improved! +197”, “Your credit score rating has improved! +267”, “My rating went up 178 factors”, and “Your credit score rating has improved! +46”.

Given the absence on the Firm’s violation report, such posts apparently weren’t flagged by FieldWatch or the Firm’s compliance personnel.

Ms. Crevecoeur can also be a excessive incomes agent with about [redacted] in commissions per the 2021-2022 Fee Report.

Alfred Nickson, Morgan Hardman (Nickson’s spouse) and Michal Bien-Aime Burgos, are additionally recognized as FES top-earning Brokers.

Primarily based on simply discovered compliance violations from FES’ high earners, the Monitor recommends;

The Firm ought to take particular observe of its greater incomes brokers to confirm compliant practices. On this regard, the Firm ought to think about focusing on its FieldWatch searches to the Firm’s high promoting brokers in an effort to see and proper potential compliance violations.

Regardless of the elevated variety of social media violations reported and the Firm’s efforts to teach brokers on compliance insurance policies, the Monitor Staff simply discovered non-compliant posts by sure excessive incomes brokers.

Lastly, the Monitor raised issues that FES’ Greenspoon legal professional could be interfering with the Monitor’s duties.

Legal professional Richard Epstein of Greenspoon addressed the August 6, 2022 Tremendous Saturday Occasion from a authorized standpoint, with an replace on the FTC litigation, reassuring the viewers that “nobody ought to be alarmed, as that is typical and regular within the trade,” and that he and his agency had been concerned in lots of such lawsuits with the FTC.

Mr. Epstein defined the Firm had quite a few optimistic enhancements and modifications coming to raised observe the principles, rules, and legal guidelines of the trade.

Mr. Epstein famous the Firm is underneath a monitorship and mentioned the next to the viewers of brokers:

“One factor I, you already know, I’ll really feel obliged to let you know is that a few of chances are you’ll get a name from Mr. Miles or his crew.

The Firm is underneath an obligation, willingly, to cooperate with Mr. Miles’ position because the Monitor.

We are able to ask you to do the identical. However as you already know, every of you’re unbiased enterprise individuals, and you may — you need to consider your personal roles on this, however the Firm is actually cooperating and is as clear as it will probably humanly be with Mr. Miles and his crew, and we solely ask you to be aware, you already know, that what it’s you say and do displays on the Firm in addition to you.”

Whereas Epstein didn’t say something incorrect, it does come throughout as a bit *winkwink, nudge nudge*.

The Monitor was involved about these feedback as a result of, within the Monitor’s view, the one obvious purpose to notice that brokers are “unbiased enterprise individuals” in such context is to suggest that brokers needn’t cooperate with the Monitor since they’re legally separate from the Monitored Entities.

Additional, asking the brokers “to be aware” in reference to cooperating with the Monitor as to what they are saying to the Monitor seemed to be an effort to stifle full and candid disclosures by brokers to the Monitor.

The Monitor shared such issues with Mr. Epstein privately in individual shortly after his remarks.

All up there was an effort by FES to handle compliance. Whether or not that justifies the court docket turning the enterprise again over to its house owners to doubtlessly proceed defrauding shoppers, stays inconclusive.

Personally I feel that is going to come back all the way down to FES not reining in its top-earners, and the Monitor having to proceed pointing this out.

I think the explanation top-earners are ignoring compliance, is as a result of FES as an MLM enterprise isn’t in any other case possible.

This ties in with the Monitor’s earlier report (as Receiver), expressing viability issues with respect to FES working legally.

It additionally in fact brings dwelling the FTC’s lawsuit, which let’s not neglect accuses FES’ founders of working a close to half-billion greenback pyramid scheme.

Keep tuned for additional updates from the FES Monitor and case on the whole.

[ad_2]

Supply hyperlink