[ad_1]

Yesterday longtime BehindMLM reader GlimDropper shared a Nui replace with us.

Yesterday longtime BehindMLM reader GlimDropper shared a Nui replace with us.

Via Nui Worldwide, Darren Olayan was providing 12 month crypto funding contracts.

Following a $595,000 securities fraud effective from Utah in late 2020, Olayan had been laying low.

Having deserted his social media in December 2017 as a number of regulators launched investigations into Nui, Olayan had returned in mid January…

…to push NFTs. Hmm.

I ran a fast search on a connection between Nui and NFTs and turned up nothing. Whereas I wasn’t in a position to verify Nui Worldwide was nonetheless working as an MLM firm, I felt the brand new funding plans GlimDropper had shared warranted, on the very least, a evaluate replace.

And so I queued Nui for an replace and proceeded to maneuver onto placing collectively a evaluate.

…nevertheless it bugged me. Why had Olayan returned to social media after two years to bang on about NFTs, when Nui wasn’t providing any?

It was right here I fell down the rabbit gap of Olayan shifting his Nui Ponzi scheme to Brazil.

Whereas Nui itself isn’t providing NFTs (at the least circuitously and never but), in June 2021 Darren Olayan registered the area (“bitmobb.biz”).

There, amongst different issues, Olayan is advertising himself as a “crypto coach” and “Blockchain Entrepreneur and Enterprise Guide”.

Naturally, leaping on the NFT hype bandwagon is a part of the pitch.

So far as I’m conscious, NFTs are only a advertising instrument to Olayan.

What NFTs offered me was a springboard into Olayan’s present enterprise operations. There’s quite a bit to unpack right here so I’ll first present a listing of each firm and entity I got here throughout.

Under the checklist we’ll undergo them one after the other, adopted by a conclusion on why any of this issues.

The Darren Olayan crypto rabbit gap as of Might 2022

- BitMOBB

- DoMoreLLC

- Symatri

- Illuminex

- Bitcoin Automotive Cash

- Kala Cup

- Nui and Nui Worldwide

- KLA Make investments

- Naka Video games

- Sure Financial institution

BitMOBB

BitMOBB operates from “bitmobb.biz”. The MOBB a part of the title is an acronym for “My Personal Borderless Banking”.

It is a reference to crypto ATMs, which is a throwback to the previous KALA ATM advertising schtick from 2020:

Apart from that BitMOBB capabilities as a weblog for Olayan to market himself and his numerous schemes on.

Do Extra Consulting

Do Extra Consulting is linked off Olayan’s BitMOBB web site as “DoMoreLLC”.

Do Extra Consulting was launched in 2019 and operated from “domorell.com”. That web site area has since been deserted.

Do Extra Consulting itself was short-lived. The corporate’s official FaceBook web page was created in February 2019, solely to be deserted a couple of months later in Might.

In late 2021 Olayan made two video posts to the web page, sharing movies he’d uploaded to the just lately renamed “BitMobb – Blockchain, Crypto & NFT group” YouTube channel.

As of December 2021, Do Extra Consulting has been deserted once more.

Symatri

Symatri is the shell firm Darren Olayan launches his crypto schemes by. This started with Kala Coin (KALA) again in 2017.

Symatri is the shell firm Darren Olayan launches his crypto schemes by. This started with Kala Coin (KALA) again in 2017.

At present Symatri refers to Olayan’s numerous hooked up spinoff schemes as “shoppers”.

These may be recognized as corporations utilizing KALA, as a result of no one exterior of Nui is utilizing KALA.

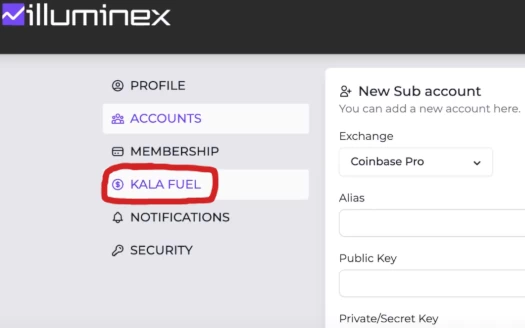

Illuminex

Illuminex is pitched as an “automated buying and selling bot” scheme:

Illuminex is represented to be a Symatri shopper, that means Darren Olayan runs it.

We will additional verify this by trying on the Illuminex backoffice, and seeing it makes use of “Kala Gas”:

Kala Gas is a “transactional token” utilized by corporations launched underneath Symatri.

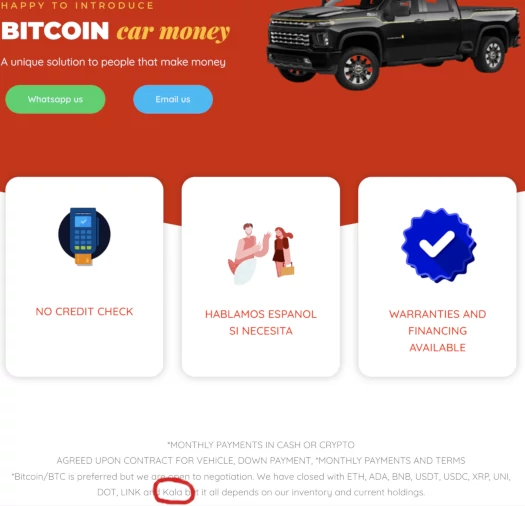

Bitcoin Automotive Cash

Bitcoin Automotive Cash is marketed on BitMOBB.

It’s some dodgy trying crypto automotive mortgage firm that was arrange in late 2021:

BitMOBB is predicated out of Utah and accepts numerous cryptocurrencies together with, you guessed it, KALA.

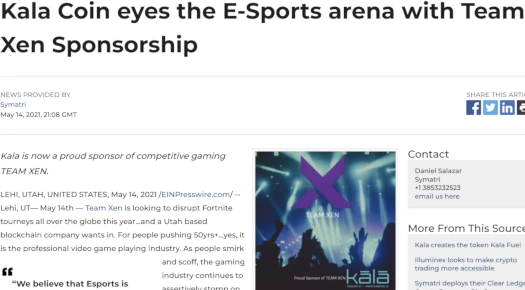

Kala Cup

Kala Cup was a lame try to get into gaming by Fortnite.

Final 12 months Symatri hosted “Kala Cup”, a Fortnite match they arrange by Rematch.

This seems to be a comply with on from now defunct sponsorship of Staff Xen, a Fortnite esports crew:

Nui and Nui Worldwide

Nui Worldwide options within the “become profitable” part of BitMOBB.

At this level Nui and Nui Worldwide are one and the identical. To maintain issues easy I’ll simply Nui.

As reported by GlimDropper, Nui Worldwide continues to supply unregistered securities by its crypto funding Ponzi scheme.

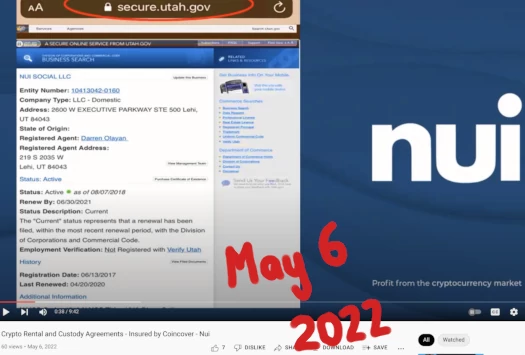

As a part of their advertising pitch, Nui promoters reference Nui Social LLC, a Utah company belonging to Olayan:

Olayan additionally owns Nui Worldwide LLC, one other Utah company. Each firms have been energetic at time of publication.

Nui solicits funding from shoppers by two cryptocurrency contracts; Nui Rental Contracts and Nui Custody Contracts.

Nui Rental Contracts sees associates make investments $5000 or extra on the promise of 5% a month. Observe that every Nui Rental Contract components in MLM commissions earned by Nui, capped at 200% of the invested quantity.

Particulars of Nui’s MLM alternative will not be offered.

Nui Rental Contracts expire in 12 months, no matter whether or not 200% is paid out.

Nui Custody Contracts sees Nui solicit $100 to $20,000 in bitcoin, on the promise of “variable every day returns”.

Nui Custody Contracts pay Monday by Friday for 12 months. Withdrawals of returns entice a 5% payment.

Neither Darren Olayan, Nui or Nui Worldwide are registered with the SEC.

KLA Make investments

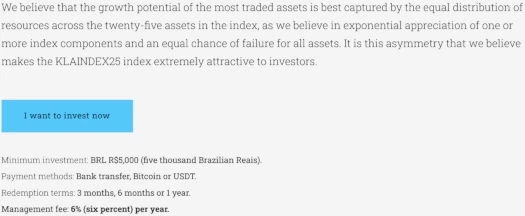

KLA Make investments solicits funding in bitcoin in KLAINDEX25;

an index that encompasses the primary 25 largest Cryptocurrencies that make up the cryptocurrency market cap.

Any particular person, bodily or authorized, can put money into KLAINDEX25.

Minimal Funding: BRL 5,000.00 (5 thousand reais).

If there’s a return of as much as 100% (100%) on the capital invested, KLA might be entitled to a efficiency payment of 20% (twenty %) on the end result.

If there’s a return above 100% (100%) and as much as 200% (2 hundred %) on the invested capital, KLA might be entitled to a efficiency payment of 35% (thirty-five %) on the end result.

If there’s a return above 200% (2 hundred %) on the capital invested, KLA might be entitled to a efficiency payment of fifty% (fifty %) on the end result.

If there’s a request for liquidation of the funding earlier than its maturity, the shopper pays a effective of 20% (twenty) %.

KLA Make investments is featured within the “become profitable” part of BitMOBB. Proper off the bat, it’s fairly apparent who’s behind it:

Olayan claims KLA Make investments (additionally goes by KLA Capital and KLA Crypto Index), is the “first crypto hedge fund licensed in all of Latin America”.

What they did is that they took two years to get a license from the CVM.

The CVM in Brazil is the equal to the SEC in the US.

Olayan has gone to nice lengths to signify KLA Make investments is predicated out of Brazil and has nothing to do with him.

To that finish you’ve gotten KLA Capital Group Gestora de Recursos Ltda, and a Brazilian company deal with.

Naturally no government info is offered on KLA Make investments’s web site. The corporate’s web site area (“klainvest.com”), was privately registered in July 2021.

On February 14th Olayan uploaded one other of his NFT advertising spam articles to World NFT information. Within the footer of the article Olayan provides away he’s behind KLA Capital Group and KLA Make investments;

Darren Olayan featured in Brazil after acquiring Crypto Hedgefund license from the CVM.

Whoops.

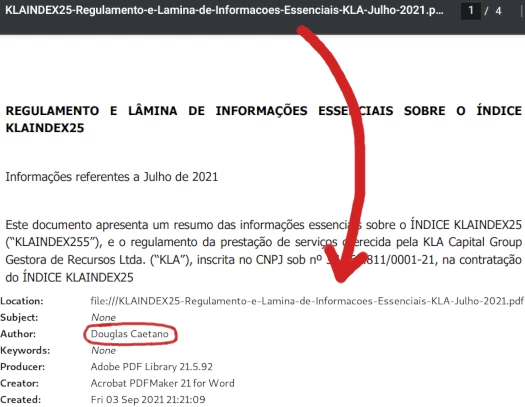

One other concrete hyperlink between KLA Make investments and Nui is the corporate’s company paperwork (handily offered on KL Make investments’s web site):

As above, they have been put collectively by Douglas Caetano.

Right here’s Caetano representing Nui Social’s company authorized crew in October 2020:

Right here’s Caetano, a couple of months in the past, selling KLA Spend money on his function as authorized for Nui Social:

The implication right here is Olayan’s Brazilian transition has been arrange with Caetano’s help and shell corporations.

Naka Video games

On January 14th, 2022, a KLA Make investments advertising video was hooked up to a World NFT Information spam article:

That video is unlisted on a YouTube channel bearing the title “Naka Video games”:

Not figuring out what Naka Video games is, I checked out the opposite movies on the channel.

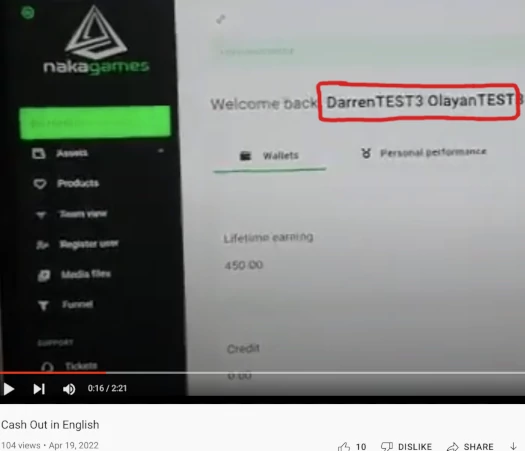

The primary video uploaded to Naka Video games’ YouTube channel is “Money Out in English“.

It was uploaded on April nineteenth, 2022, and options Darren Olayan narrating “the money out course of”.

So Naka Video games is one thing run by Darren Olayan that folks can money out from.

However what’s it?

When you have been scammed by some crypto/mining MLM, we’ve got an answer.

We have now actual good contract expertise that really protects you this time. We use NFT expertise to offer you management of your community, your commissions and your small business.

Placing apart the irony with mounting investor losses courting again to Divvee, Naka Video games sounds an terrible lot like Olayan’s failed CompChain grift from 2019.

Compchain is the world’s first blockchain created particularly for networking.

It places the ability of your private community again in YOUR palms.

Compchain supplies a secure, safe service that shops and protects your community, endlessly.

Constructed on immutable blockchain expertise, Compchain lets you lock in your community for all times, and faucet into new merchandise and alternatives as they’re added to the platform.

However y’know, with added NFT and smart-contract buzzwords.

Why name it Naka Video games although?

As a result of along with being a rehashed Compchain, Naka Video games sees Olayan leap on the NFT gaming bandwagon.

A Rewards Platform is a Blockchain-based answer for retaining observe of buyer reward factors, making a shared transaction ledger between all concerned manufacturers.

I’ll go away Naka Video games itself there as a result of, let’s face it, we’re properly into “no one is ever going to make use of this besides Nui KALA bagholders” territory.

However I’ll dig just a little deeper into Naka Video games’ affiliation with Upstream.

NAKA is affiliated with Upstream, a Horizon-powered regulated inventory trade for digital securities, eligible fan-driven belongings courses will be capable of commerce in real-time from a user-friendly buying and selling app.

Over on their web site Upstream claims to be a securities trade.

Upstream is a revolutionary trade and buying and selling app for digital securities.

Commerce US & Worldwide equities all on Upstream.

Spend money on US and worldwide equities which might be dual-listed on Upstream and different international marketplaces.

So uh, Upstream is registered with the SEC then I take it?

No in fact it isn’t.

Who’s behind Upstream

MERJ Alternate Restricted (“MERJ”) started in 2011 because the operator of the nationwide securities marketplace for the Republic of the Seychelles.

The trade was born as a part of the IMF backed Financial Reform Programme to diversify the nation’s financial system within the wake of the worldwide monetary disaster of 2009.

Horizon is a fintech firm that builds and powers international securities exchanges, unlocking liquidity for historically illiquid asset courses.

Seychelles… critically?

For the aim of investor due-diligence, Seychelles supplies no safety or energetic regulation by any means. It’s a purposefully chosen jurisidciton due to this.

Oh and until you reside in Seychelles, Upstream and its related corporations being included and registered there’s additionally utterly meaningless.

However I digress, what does any of this must do with Darren Olayan and Naka Video games?

The “money out” video Olayan narrates reveals him cashing out “commissions” from a check account.

That is what Naka Video games is promoting;

We goal to unlock liquidity for traders of all ranges on our investor-driven, app-based market. On the floor, NAKA presents international traders a real-time, safe, and intuitive buying and selling app.

Underneath the hood, NAKA introduces what we consider to be the way forward for securities and NFT buying and selling that includes a few of the highest ranges of transparency, accessibility, and investor protections enforced utilizing blockchain expertise.

It’s one other MLM grift with much more securities fraud.

One remaining be aware, Naka Video games’ web site contains a hyperlink to Climark in its footer. This seems to be a Brazilian digital advertising firm firm.

How far they’re built-in into Olayan’s securities fraud empire past Naka Video games is unclear.

Sure Financial institution

Darren Olayan’s Sure Financial institution, to not be confused with the foremost Indian financial institution of the identical title, is a deliberate fee processor.

Sure Financial institution operates from the area “yesbankbrazil.com.br”. That area was registered in April 2021. The registration up to date in March 2022 and the present holder web site is pretty new.

Jackson Amaral Erohin is listed because the area proprietor. Erohin runs J&F Capital, a Brazilian administration and consulting firm.

Past that I don’t know what his tie to Olayan and Nui is.

What I do know is YesBank, regardless of not having launched but, is promoting KALA integration:

This reveals Olayan’s hand within the firm, both wholly or partially.

Right here’s Sure Financial institution described in Olayan’s personal phrases;

[2:40] The financial institution is named Sure Financial institution. And guess what? Kala is without doubt one of the cryptocurrencies that they’re carrying, together with bitcoin and ethereum …

… You’re speaking a couple of financial institution that has a checking account, and financial savings account, and checking account. The power to do all the things that banks do.

Nonetheless we’re offering numerous the blockchain expertise, the pockets expertise, the insurance coverage expertise. And naturally kala is in there.

[4:11] I advised you guys. I mentioned what occurs if we actually had a financial institution utilizing our pockets expertise, our insurance coverage, and carrying our crypto?

Do you perceive what you are able to do when you’ve gotten these capabilities?

Oh yeah, I’m gonna deposit my kala after which I’m gonna switch it to bitcoin. Or Brazilian reals or {dollars} or no matter.

Are you able to see that? Are you able to think about what’s going to occur? Particularly after they have already got the entire card, Visa, MasterCard system in place.

It’s a financial institution guys. I’m not simply making this up. It’s a financial institution.

So uh, any takers who owns Sure Financial institution Brazil? For sure Olayan and Nui don’t maintain any banking licenses that I’m conscious of, in Brazil or elsewhere.

Why does any of this matter?

I’ve been documenting Nui’s origins as Divvee since 2016. I first caught wind of Darren Olayan’s securities fraud in 2017.

Olayan confirmed he knew he was violating US securities legislation in 2018.

Six years after Divvee’s launch and regardless of a number of regulatory investigations…

…Olayan continues to be at it and the crypto bro bullshit is as thick as ever.

If something after laying low for some time after the Utah effective, Olayan is again at it and increasing.

Brazil is an enormous a part of Olayan’s renewed crypto crime wave. I determine the gamble is reside within the US however rip-off Latin Individuals and fly underneath the regulatory radar.

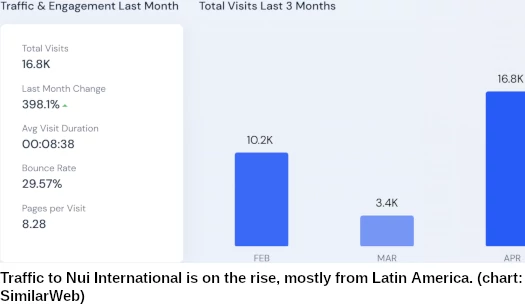

As I write this SimilarWeb ranks site visitors to Nui Worldwide as coming from Brazil (27%), Colombia (25%), (Italy (17%) and Portugal (14%).

And it’s on the rise…

Visitors to the opposite parts of Olayan’s Ponzi scheme is, at this stage, negligible.

The place does it finish? And maybe extra importantly, who’s nonetheless falling for this rubbish?

[ad_2]

Supply hyperlink