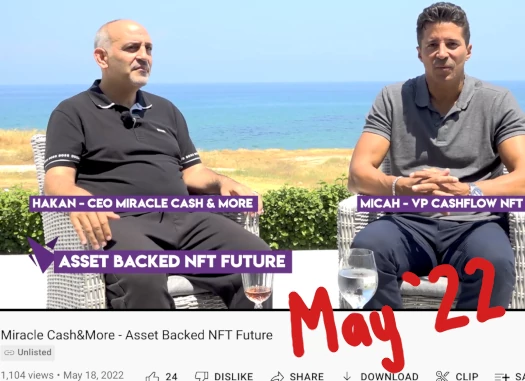

Following a webinar final month that detailed securities fraud by NFTs, CashFlow NFT co-founder Micah Theard needed to “get extra element on sure issues and fewer element on others”.

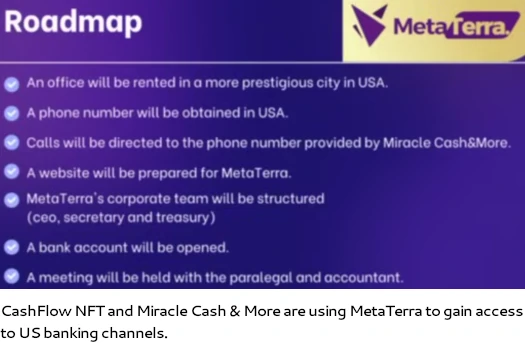

Micah held one other webinar on November eighth, this time overlaying MetaTerra.

Theard claims MetaTerra is owned by Miracle Applied sciences Holding SGPS, LDA, a Portuguese shell firm.

MetaTerra Corp is a repurposed Nevada shell firm that was registered with the SEC in March 2022. MetaTerra’s SEC filings present a company handle within the Dominican Republic.

That is from MetaTerra’s Type S-1 submitting from March twenty third, 2022;

Metaterra Corp. is a growth stage firm and has lately began its operation. To this point now we have been concerned primarily in organizational actions. We would not have ample capital for operations.

We’re a growth stage firm that plans to interact within the enterprise of promoting auto components that we buy in the US to prospects within the Dominican Republic.

MetaTerra’s Type S-1 detailed plans to promote two million MetaTerra shares for five cents every.

There are 2,000,000 shares of widespread inventory issued and excellent as of the date of this prospectus, held by our sole officer and director, Anyoline De Jesus De Perez.

In March 2023, MetaTerra filed its Annual 10K Report. Evidently the “auto components” enterprise had flopped. After a yr, MetaTerra didn’t actually have a web site to promote on.

We plan to develop an internet site that may show a wide range of auto components and their costs, and can promote our providers and charges.

A Quarterly 10-Q Report filed in July 2023 offered perception into MetaTerra’s financials;

The Firm has collected loss from inception (January 20, 2021) to June 30, 2023, of $48,044.

These components amongst others increase substantial doubt concerning the capacity of the corporate to proceed as a going concern for an inexpensive time frame.

An 8K Present Report filed on October sixteenth, particulars CashFlow NFT’s Portuguese shell firm buying MetaTerra.

On October 13, 2023, Anyoline De Jesus De Perez, the earlier majority shareholder of the Firm, entered right into a inventory buy settlement for the sale of two,000,000 shares of Frequent Inventory of the Firm, to Miracle Applied sciences Holding SGPS, LDA.

Additionally on October 13, 2023, the earlier sole officer and director of the corporate, Anyoline De Jesus De Perez, resigned her positions with the Firm.

Upon such resignations, Ebru Törehan was appointed as Chief Govt Officer, Chairman of the Board, Treasurer and Secretary, and Director of the Firm.

Ebru Torehan is President of Miracle Money & Extra.

She’s additionally the spouse of Hakan Torehan. And what’s attention-grabbing right here is the try to maintain Micah Theard and Hakan Torehan, the precise homeowners and first beneficiaries, off MetaTerra’s SEC reviews.

Torehan has ties to organized crime:

And Micah Theard is a former promoter of the infamous OneCoin Ponzi scheme.

A month after the acquisition, MetaTerra filed a 10-Q Quarterly Report on November 14th. And so they’re nonetheless going with the failed auto components enterprise ruse;

The Firm sells auto components within the Dominican Republic.

As of September 30, 2023, the Firm whole stock was $35,495. The stock comprised of two cars.

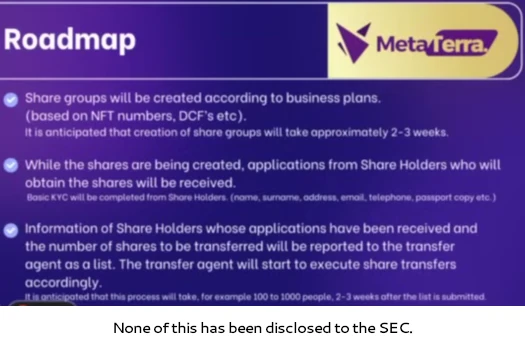

The report spans the quarter ending September thirtieth, so there’s no point out of

- CashFlow NFT or Miracle Money & Extra;

- Micah Theard or Hakan Torehan;

- the unique real-estate passive returns funding scheme; or

- digital shares offered by Boogie Gopher NFTs

With respect to securities legislation within the US, the first downside is that CashFlow NFT has already been soliciting funding since mid 2022. And digital shares have already been offered by Boogie Gopher NFTs.

CashFlow NFT or Miracle Money & Extra disclosed their crypto funding scheme securities providing to the SEC. And shopping for a failed auto components shell firm with present shares doesn’t undo securities fraud.

From what I can inform the plan is to distribute MetaTerra’s present shares (or digital representations) to CashFlow NFT affiliate traders.

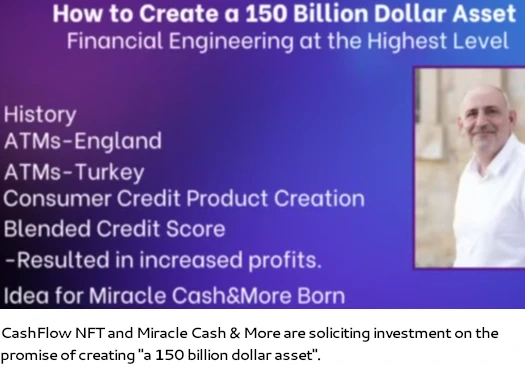

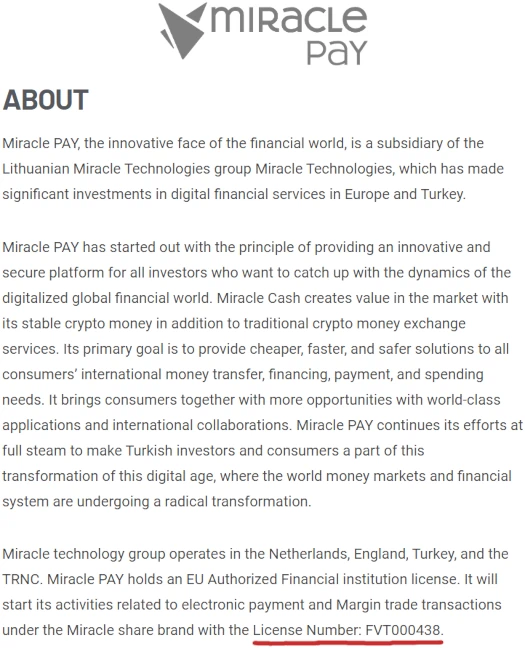

One closing factor to notice is Miracle Money & Extra’s Lithuanian shell corporations, below Miracle Applied sciences, referencing an already revoked monetary license.

Miracle Pay, a part of Miracle Applied sciences, gives this on the “about” part of their web site;

Miracle PAY, the revolutionary face of the monetary world, is a subsidiary of the Lithuanian Miracle Applied sciences group Miracle Applied sciences, which has made important investments in digital monetary providers in Europe and Turkey.

Miracle expertise group operates within the Netherlands, England, Turkey, and the TRNC. Miracle PAY holds an EU Approved Monetary establishment license.

It’ll begin its actions associated to digital fee and Margin commerce transactions below the Miracle share model with the License Quantity: FVT000438.

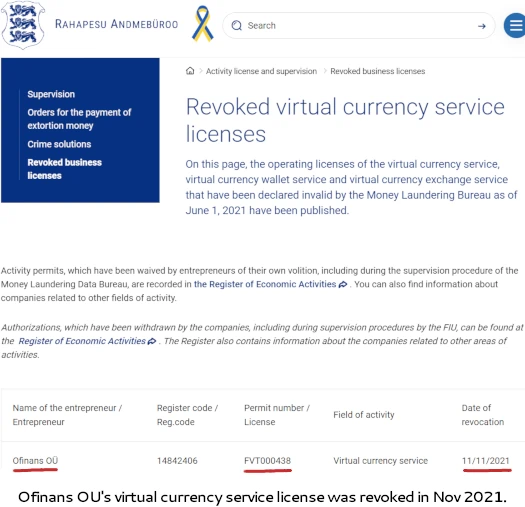

FVT000438 corresponds to the Estonian shell firm Ofinans OU, who had their digital forex service license revoked in November 2021:

Why Miracle Pay is referencing an already revoked digital forex service license is unclear. It might definitely be of concern is banks or different monetary establishments have been deceived with the revoked “FVT000438” license.

Miracle Money & Extra’s revoked EU crypto license was first noticed by the web site “Miracle Money Details“. The positioning additionally claims Miracle Money & Extra’s app was lately faraway from the Apple Retailer.

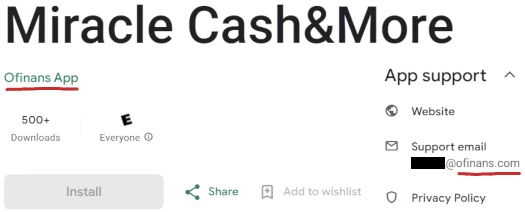

The app remains to be out there on Google’s Play Retailer, with “Ofinans App” listed because the developer.

Pending any additional updates, we’ll maintain you posted.