[ad_1]

Auratus Gold has launched its third unregistered securities providing, “Storage Bins” constructed round its TGP token.

Auratus Gold has launched its third unregistered securities providing, “Storage Bins” constructed round its TGP token.

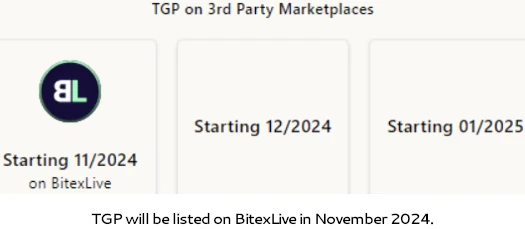

TGP, or Tas Gold Factors, is scheduled to be dumped on the BitexLive alternate in November. BitexLive is owned by Josip Heit’s longtime enterprise associate Leon Filipovic.

Auratus Gold’s Storage Bins unregistered securities providing coincides with a bungled promotional occasion in Australia final week.

Initially billed as an Auratus advertising and marketing extravaganza hosted by “company”, the occasions transitioned right into a three-day circlejerk for Martene Wallace’s Auratus downline.

Josip Heit, suspected proprietor of Auratus, revealed he was in Brisbane on Sunday, October thirteenth.

Someday between Sunday and Wednesday Heit then represented he was again in Dubai.

What induced Heit (proper), a convicted fraudster, to abruptly depart Australia simply earlier than the Auratus advertising and marketing occasion stays unclear.

What induced Heit (proper), a convicted fraudster, to abruptly depart Australia simply earlier than the Auratus advertising and marketing occasion stays unclear.

In any occasion, this left sidekicks Dirc Zahlmann (GSPartners CEO) and Bruce Hughes (GSPartners Company Coach) to entrance the occasions alone.

Properly, form of. Whereas Zahlmann and Hughes did briefly communicate at Yot Membership’s hosted Auratus occasion on Thursday, they seem to have in any other case spent most of their time avoiding cameras.

Dirc Zahlmann and Bruce Hughes are Respondents in standing GSPartners securities fraud enforcement orders from Texas, New Hampshire and California.

The pair are moreover cited as individuals of curiosity in GSPartners fraud enforcement actions from Kentucky, Arkansas and Alabama.

Both simply earlier than, throughout or simply after the advertising and marketing occasions final weekend, “storage containers” popped up within the Auratus Gold backoffice (click on to enlarge):

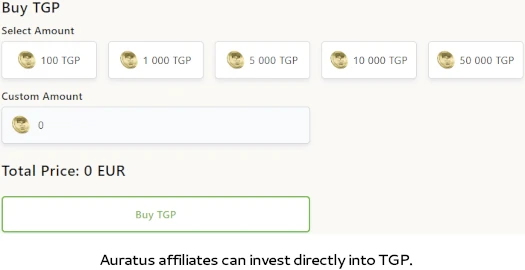

As above, Auratus Gold’s “storage containers” scheme sees associates put money into TGP (observe “g” refers to grams of gold however traders pay USD equivalents in cryptocurrency).

TGP can be immediately invested into by Auratus:

Presently TGP has an inside 0.82 EUR worth inside Auratus.

Presently TGP has an inside 0.82 EUR worth inside Auratus.

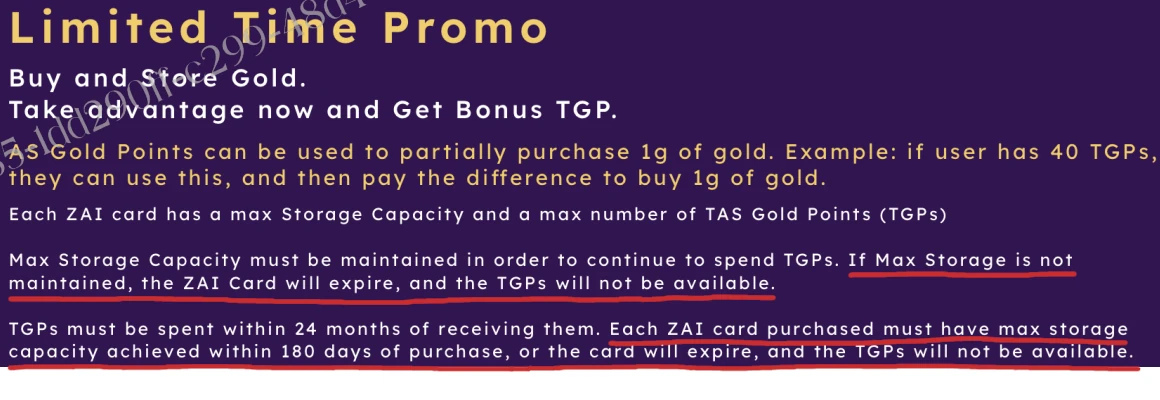

“Spending” TGP requires Auratus traders to max out Zai Card.

This seems to be an try to each lure invested funds within the system and resuscitate Auratus’ second unregistered securities providing launch (click on to enlarge):

No matter how their acquired, Auratus solicits funding into TGP on the promise of a passive return over “24 to 36 months” (click on to enlarge):

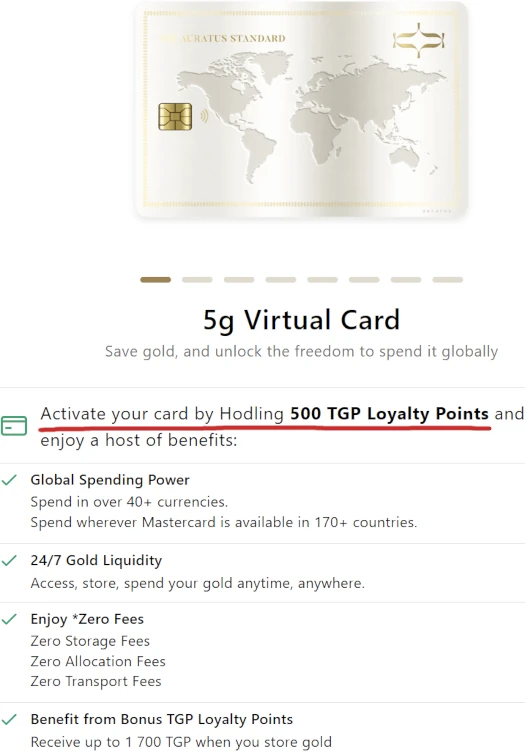

A minimal 500 TGP funding unlocks a “digital card”, connected to MasterCard’s community by an undisclosed shell firm:

Trying ahead, Auratus plans to permit associates to money TGP out by BitexLive subsequent month:

Auratus presents BitexLive as a “third social gathering market” however it’s something however.

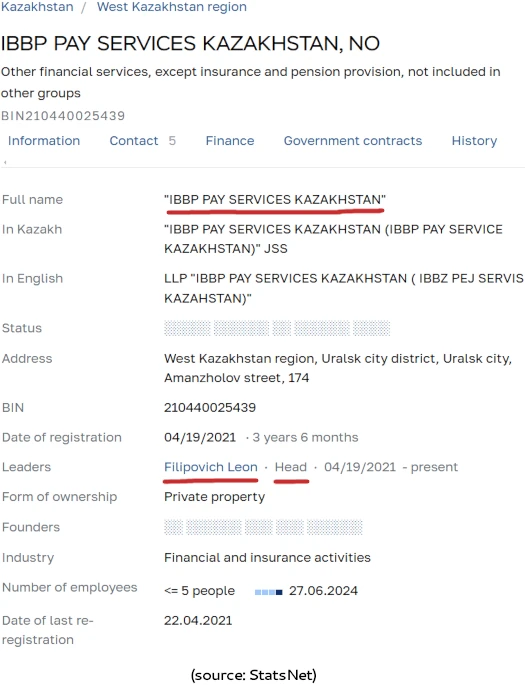

As per the footer of its web site, BitexLive is tied to IBBP Pay Companies Kazakhstan Ltd.

![]()

IBBP Pay Companies Kazakhstan Ltd. is a Kazakhstan registered shell firm tied to Leon Filipovich:

Filipovic (proper) is believed to be tied to the cash facet of GSPartners. He’s been registering shell firms for Josip Heit’s varied funding schemes for years.

Filipovic (proper) is believed to be tied to the cash facet of GSPartners. He’s been registering shell firms for Josip Heit’s varied funding schemes for years.

Extra not too long ago, Filipovic surfaced the the only real director of Orbit Conceptum AG, a shell firm connected to Billionico – one other GSPartners spinoff adjoining to Auratus Gold.

The Texas State Securities Board cited Filipovic as a associated non-respondent of their April 2024 Billionico securities fraud stop and desist.

TSSB cited Auratus in its Billionico stop and desist. In the meantime the Australian Securities and Investments Fee issued a blanket Auratus fraud warning in August 2024.

A second fraud warning pertaining to Auratus’ authentic “digital gold vaults” funding scheme was issued in September 2024.

[ad_2]

Supply hyperlink