[ad_1]

![]() US authorities have lastly taken motion in opposition to The Merchants Area Ponzi scammers.

US authorities have lastly taken motion in opposition to The Merchants Area Ponzi scammers.

On September thirtieth the CFTC filed go well with in opposition to Merchants Area FX LTD and a number of other further company and particular person defendants.

Whereas The Merchants Area itself wasn’t an MLM alternative, the rip-off is of curiosity to BehindMLM because of a number of MLM Ponzis feeding into it. The Merchants Area was additionally promoted by a number of well-known MLM figures.

All up there are sixteen named defendants within the CFTC’s The Merchants Area lawsuit;

- Merchants Area FX LTD., dba The Merchants Area, St. Vincent and the Grenadines shell firm

Fredirick Teddy Joseph Safranko, aka Ted Safrank (proper), co-founder of The Merchants Area

Fredirick Teddy Joseph Safranko, aka Ted Safrank (proper), co-founder of The Merchants Area- David William Negus-Romvari, co-founder of The Merchants Area

- Ares World LTD., dba TruBlueFX, Saint Lucia shell firm

- Algo Capital LLC, Miami shell firm

- Algo FX Capital Advisor LLC, nka Quant5 Advisor LLC, Delaware shell firm

- Robert Collazo Jr., co-owner of Algo FX Capital Advisor LLC

- Juan Herman, aka JJ Herman, co-owner of Algo FX Capital Advisor LLC

- John Fortini, Vice President of Algo FX Capital Advisor LLC

- Steven Likos, Algo FX Capital Advisor LLC gross sales rep

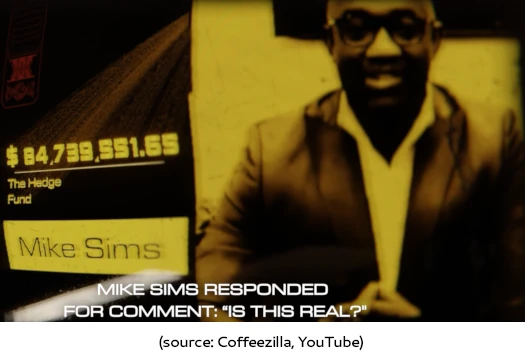

- Michael Shannon Sims, aka Mike Sims, The Merchants Area promoter and insider

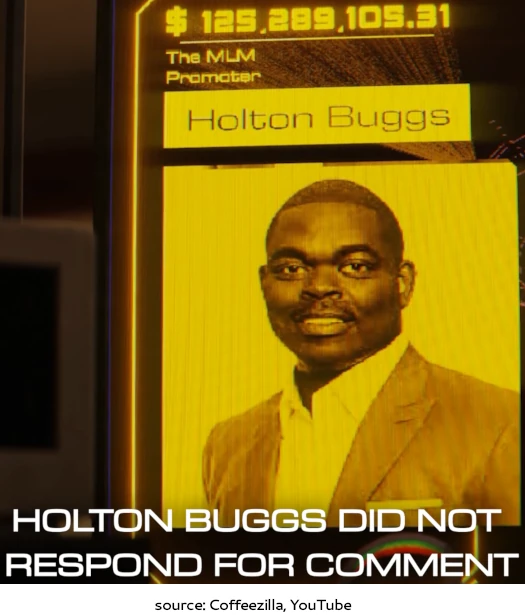

- Holton Buggs Jr., The Merchants Area promoter

- Centurion Capital Group INC, Florida shell firm

- Alejandro Santiestaban, aka Alex Santi, co-owner Centurion Capital Group INC

- Gabriel Beltran co-owner of Centurion Capital Group INC, and

- Archie Rice, Centurion Capital Group INC gross sales rep

As alleged by the CFTC;

From a minimum of November 2019 by means of current, Merchants Area FX LTD. d/b/a/ The Merchants Area, by and thru its officers, staff, and brokers, (“TD”) and its co-owners Frederick Teddy Joseph Safranko a/ok/a/ Ted Safranko (“Safranko”) and David Negus-Romvari (“Negus-Romvari”), individually and as controlling individuals of TD (collectively, the “TD Defendants”) orchestrated a multi-layered scheme to solicit funds for the aim of buying and selling leveraged or margined retail commodity transactions … in addition to assorted different commodities, by means of pooled and particular person accounts.

What made The Merchants Area a Ponzi scheme is the represented buying and selling, and related income, was all a sham.

TD misappropriated buyer funds by accepting buyer cash through third occasion financial institution accounts, cost processors, and crypto wallets, however failing to make use of a minimum of a few of these funds to commerce XAU/USD and by charging commissions on purported buying and selling income that didn’t exist.

And after The Merchants Area, the fraud continued by means of Ares World and TruBlueFX.

As well as, TD, and later it’s successor in curiosity Ares World d/b/a/ Trubluefx (“Trubluefx”), misappropriated buyer funds by failing to return buyer funds regardless of repeated makes an attempt by hundreds of consumers to entry and/or liquidate their accounts.

TD and Safranko additionally falsified buying and selling data, and the TD Defendants didn’t register as required below the Act.

As beforehand said, The Merchants Area wasn’t MLM however did incentivized recruitment by means of direct referral commissions.

Not solely did the TD Defendants immediately solicit prospects, the overwhelming majority of whom lived within the U.S., however additionally they engaged different people and entities (“sponsors”) to solicit U.S. prospects on TD’s behalf-with every sponsor performing like a spoke extending from the TD hub.

That is the place well-known MLM figures, who positively ought to have recognized higher, enter the image.

Along with the numerous sponsors unfold everywhere in the United States and internationally, the TD Defendants recruited the “Sponsor Defendants” ( collectively with the TD Defendants and Trubluefx, “Defendants”), 4 distinct teams named on this grievance which drove the most important variety of prospects and funds to the TD Pool:

(i) Algo Capital LLC (“Algo Capital”) and Algo FX Capital Advisor, LLC (“Algo FX”), now referred to as Quant5 Advisor, LLC, by and thru their officers, staff, and brokers ( collectively, “Algo”), Robert Collazo, Jr. (“Collazo”), Juan Herman (“Herman”), John Fortini (“Fortini”), and Stephen Likos (Likos) (collectively, the “Algo Defendants”);

(ii) Michael Shannon Sims (“Sims”);

(iii) Holton Buggs (“Buggs”); and

(iv) Centurion Capital Group, Inc., by and thru its officers, staff, and brokers (“Centurion”), Alejandro Santiestaban a/ok/a Alex Santi (“Santi”), Gabriel Beltran (“Beltran”), and Archie Rice (“Rice”) (collectively, the “Centurion Defendants”).

Mike Sims and Holton Buggs are of curiosity right here. The opposite people and firms I’m not conversant in.

Mike Sims, a central determine within the associated OmegaPro MLM crypto Ponzi, is believed to have stolen $84 million by means of The Merchants Area.

Holton Buggs is an MLM veteran courting again to Organo Gold. Circa 2018 Buggs started transitioning to MLM crypto fraud.

This culminated in Buggs launching the Meta Bounty Hunters collection of Ponzi schemes. Buggs is believed to have stolen $125 million by means of The Merchants Area.

Alongside his MLM crypto fraud scamming, Buggs owns and operates iBuumerang. Buggs cannibalized iBuumerang and fed distributors into his fraudulent crypto dealings.

The CFTC teams Sims and Buggs as “Sponsor Defendants”.

Though the Sponsor Defendants every supposed the funds they solicited from prospects to be traded within the TD Pool, a minimum of some Sponsor Defendants presupposed to be inquiring for their very own swimming pools or “hedge funds.”

The Sponsor Defendants solicited funds for the TD Pool although every knew or ought to have recognized that TD was not buying and selling the funds as represented.

Every of the Sponsor Defendants turned conscious ofred flags that put them on discover that TD was not a authentic buying and selling operation.

The Sponsor Defendants confronted a selection: stop selling TD in gentle of the alarming info they knew or comply with the sturdy monetary motivations they needed to ignore the crimson flags and proceed to gather beneficiant commissions on the purported buying and selling.

Every of the Sponsor Defendants selected the latter. The Sponsor Defendants actively downplayed the crimson flags and continued to solicit prospects, serving to to create the misunderstanding that prospects had been taking part in authentic buying and selling even because the scheme was getting ready to collapse.

Every of Sponsor Defendants knowingly made oral and written fraudulent and materials misrepresentations and omissions on social media, through textual content messages, by phone, and in individual to potential and current prospects that they knew or ought to have recognized had been false.

The Sponsor Defendants misappropriated buyer funds, together with by accepting funds supposed for buying and selling into financial institution accounts they managed and/or gathering commissions on buyer income regardless of that the Sponsor Defendants knew or ought to have recognized that TD was not buying and selling the funds as purported.

Among the Sponsor Defendants additionally commingled buyer funds and most weren’t registered as required below the Act.

Safranko … established relationships with different sponsors, together with Sims and Buggs. Safranko communicated with Sims and Buggs through phone and/or messaging purposes.

Moreover, on quite a lot of events, Safranko participated in phone and video conferences with potential or current prospects that Buggs was soliciting.

On a minimum of one event, Safranko traveled with Buggs to Dubai in reference to TD.

Like the opposite Sponsor Defendants, the TD Defendants paid Buggs and Sims commissions primarily based on the shoppers that they recruited for the TD Pool.

Particular to Mike Sims;

Starting in a minimum of September 2021 by means of current (the “Related Sims Interval”), Michael Sims fraudulently solicited prospects to deposit cash for the aim of taking part in pooled buying and selling of leveraged or margined XAU/USD by his “hedge fund” by making materials misrepresentations and omissions to potential and precise prospects.

In truth, Sims was utilizing buyer funds to take part within the TD Pool although Sims knew or ought to have recognized TD was not buying and selling buyer funds because it purported.

As well as, Sims misappropriated buyer funds and didn’t register as required below the Act.

Pursuant to this scheme, a minimum of 42 Sims prospects deposited a minimum of $22 million for the needs of buying and selling leveraged or margined XAU/USD.

After working with different sponsors to solicit buyer for TD, starting in a minimum of September 2021, Sims started soliciting prospects for his personal “hedge fund,” by means of phone calls, textual content messages, messaging apps, and in-person conferences.

Sims made quite a few fraudulent misrepresentations and omissions about:

(i) the possession and operation of the buying and selling enterprise,

(ii) the revenue and threat related to the purported buying and selling, and

(iii) capacity and timeliness of buyer withdrawal requests.

From the outset, Sims informed potential prospects that he was soliciting funds for his hedge fund.

Sims claimed his hedge fund had been in operation for greater than 10 years and employed a crew of skilled merchants to commerce leveraged or margined XAU/USD on behalf of its prospects.

These statements had been false.

Sims was not soliciting funds on behalf of a hedge fund. Sims didn’t personal any “hedge fund” not to mention one which had been in operation for greater than 10 years and employed a crew of merchants.

Neither Sims, personally, nor any hedge fund or different entity owned by him traded any funds on behalf of consumers.

Quite, as Sims later admitted to a buyer, he was a sponsor that recruited prospects for the TD Pool.

Lastly, along with misrepresenting the id and site of the buying and selling operation, Sims additionally omitted to inform a minimum of one potential buyer that he can be charging commissions, and sizeable ones at that.

Solely after this buyer acquired his first account assertion did he discover a sizeable withdrawal from his account.

When the shopper questioned Sims in regards to the withdrawals, Sims knowledgeable him that there can be “each day and month-to-month commissions” which might vary from 40-50%.

Sims didn’t clarify who can be receiving these commissions, nor what share Sims himself would take.

Sims additionally made misrepresentations to potential and present prospects in regards to the timeframe and skill to withdraw their funds permitting the scheme to proceed for months after it initially started to unravel.

When prospects requested Sims in regards to the standing of those withdrawal requests, Sims repeatedly made excuses for delays and supplied false statements in regards to the timing of the withdrawals.

Sims additionally tried to dissuade prospects from taking withdrawals from their accounts.

Later, Sims stopped responding to the shoppers communications in search of details about the pending withdrawal.

Along with the opposite indications of fraudulent TD exercise about which Sims knew or ought to have recognized, Sims demonstrated his information that TD was engaged in probably unlawful and problematic actions by directing potential prospects to disguise their funding funds.

Although Sims knew or ought to have recognized that TD was not buying and selling buyer funds as purported, Sims directed tens of millions of {dollars} in buyer funds to the TD Pool, and misappropriated buyer funds by taking sizable commissions. Sims’ fee ranged from 40-50% of the purported buying and selling revenue.

Particular to Holton Buggs;

Starting in a minimum of February 2021 persevering with by means of current (the “Related Buggs Interval”), Buggs fraudulently solicited prospects to deposit cash for the aim of taking part within the TD Pool by making materials misrepresentations and omission to precise and potential prospects.

Buggs solicited prospects for the TD Pool although Buggs knew or ought to have recognized TD was not buying and selling buyer funds because it purported

As well as, Buggs misappropriated buyer funds and didn’t register as required below the Act.

Pursuant to this scheme, a minimum of 517 Buggs prospects deposited a minimum of $54 million for the aim of buying and selling leveraged or margined XAU/USD.

Round February 2021 , Buggs bought a buying and selling schooling firm, and regardless of not being a licensed dealer, started increasing the corporate past coaching and schooling.

Buggs constructed upon his already giant community of MLM companies and trade acquaintances to start soliciting prospects for the TD Pool.

A number of months after the acquisition of his buying and selling firm, Buggs started working as a “sponsor” to solicit prospects for the aim of buying and selling XAU/USD after which directed their funds to the TD Pool.

Utilizing his current MLM companies and the associates affiliated with them, Buggs held out the chance to take part in his “personal buying and selling hedge fund” by means of his “personal dealer” as a reward for hitting sure gross sales tiers in his different MLM companies.

As soon as associates hit the “emerald” stage they got the chance to take part within the buying and selling through Buggs’ “personal dealer,” creating an aura of exclusivity.

Buggs hid the id of TD till associates reached the upper “diamond” stage and executed a non-disclosure settlement.

Buggs additionally solicited potential prospects past his pre-existing MLM community by means of in-person occasions. For instance, in early 2022, Buggs invited roughly fifteen potential prospects to a dinner assembly in San Diego, California.

Equally, in 2022 Buggs attended a convention in Miami, Florida, throughout which he solicited a minimum of two prospects for the commodity pool.

In the course of the Related Buggs Interval, Buggs fraudulently solicited prospects by means of, phone, messaging apps, and in-person occasions akin to conferences and dinners- to deposit cash for the needs of buying and selling leveraged and margined XAU/USD although he knew or ought to have recognized that TD was not buying and selling the funds as purported.

Utilizing his MLM companies and community of trade connections, Buggs touted the unimaginable returns that the commodity pool generated by means of leveraged or margined buying and selling ofXAU/USD.

He informed potential prospects that the commodity pool had an “unimaginable successful streak” and claimed that it “by no means had a shedding month”.

Buggs boasted to a enterprise affiliate by textual content that “I HA VE A MONEY PRINTING MACHINE.”

In some situations, Buggs used the Buying and selling App to indicate potential prospects the purported XAU/USD buying and selling historical past and accounts that he managed with “balances” of roughly $80 million and $650 million.

These assertions about unimaginable beneficial properties had been on their face, unrealistic and unattainable.

Buggs knew or ought to have recognized that these purported buying and selling returns had been false.

In 2021 , a minimum of one potential buyer informed Buggs that he had performed a background verify on Safranko and was involved in regards to the unfavorable info and evaluations he had seen on-line.

When assuring this potential buyer in regards to the TD and Safranko warnings that he raised, Buggs made further fraudulent statements.

Buggs reassured this buyer that he traded “proper beside [Safranko]”; that Buggs was “accountable for [his customers’] funds. ”

These statements had been false and deceptive. In truth, Buggs didn’t commerce his personal prospects’ funds, nor was he in management over the funds purportedly despatched to TD.

And, regardless of figuring out in regards to the numerous warnings about and unfavorable evaluations of TD and Safranko, Buggs continued to solicit new prospects for the TD Pool and failed to inform present prospects about these warnings and unfavorable evaluations.

Buggs continued to make false assurances in regards to the capacity of consumers to withdraw funds even after prospects started to expertise vital withdrawal difficulties and delays within the Fall of 2022.

In February 2023, when one buyer contacted Buggs to inquire in regards to the delay in acquiring his withdrawal, Buggs falsely assured him that “withdrawals have steadily gone out” from TD.

Buggs knew or ought to have recognized that this assertion was false: Withdrawals had not steadily gone out since August 2022.

In an effort to insulate himself from claims that he was complicit in a fraudulent scheme, Buggs additionally claimed to a complaining buyer that he additionally “had not withdrawn my buying and selling income as they sit in TD.”

Buggs knew that this assertion was false : Whereas common prospects withdrawals had been stalled for months, Buggs, and his household, had taken a minimum of one million {dollars} in purported buying and selling income from TD accounts throughout this time interval.

Buggs knew or ought to have recognized that TD was engaged in unlawful and fraudulent conduct as a result of, as an agent of TD, Buggs was directing potential and present prospects to disguise the aim of their funding funds and international locations of origin.

Buggs, himself and thru his assistant, instructed potential and present prospects to hide the aim of those deposits by directing that they use sure opaque language within the wire switch memorandum.

For instance, he instructed one buyer that the deposit ought to say “providers (ONLY!)” and if the wire “reference embrace[ d] anything, the wire will probably be returned & the associated account closed. No exceptions!”

Different prospects had been equally instructed that to be able to take part within the pool by means of Buggs, that they need to wire funds with the memo line for “Providers.”

Buggs additionally instructed TD prospects to take misleading steps when funding their TD account by means of cryptocurrency. When prospects opted to fund TD accounts with cryptocurrency, they had been requested their nation ofresidence within the TD account set-up directions.

Buggs and/or his assistant instructed US prospects that they need to select “crypto” of their nation of origin, somewhat than the USA.

As an alternative of heeding or investigating the quite a few crimson flags signaling that TD was a fraud and never engaged in authentic buying and selling, Buggs downplayed the warnings and continued to solicit prospects for the TD Pool, gathering tens of millions of {dollars} in commissions on purported buying and selling income.

Buggs misappropriated some TD buyer funds by accepting TD a portion of buyer funds into financial institution accounts he managed and utilizing these funds for private use.

For instance, though he began with a checking account steadiness of roughly $45,000, between April 11-Thirteenth, Buggs accepted 4 wires from TD prospects every together with memo strains incorporating the phrase “Providers,” totaling $370,000.

Buggs didn’t wire or in any other case switch these funds to any recognized brokerage or buying and selling entity. Buggs additionally took in an extra $110,000 from one other supply into the account.

On April 14, 2022, Buggs used all or among the $370,000 to wire $465,000 to a 3rd occasion with a memo “Steadiness for Lambo.”

In one other instance, on the finish of April 18, 2022, Buggs had a steadiness of roughly $70,000 in his checking account.

Buggs accepted wires, every of which with memo strains together with the outline “Providers,” from three prospects totaling $545,000 into this account.

Buggs didn’t switch the funds to any recognized brokerage or buying and selling entity. Two days after the shoppers wired the funds to Buggs’ account, Buggs wired $350,000 for the acquisition of a condominium.

Buggs additionally misappropriated TD buyer funds by taking sizable commissions on purported buying and selling income when he knew or ought to have recognized that income mirrored within the TD Pool account had been false.

The Merchants Area collapsed in late 2022, producing tens of millions in client losses.

Within the fall of 2022, the scheme started to unravel, and prospects started to expertise excessive withdrawal delays and/or had been unable to withdraw their funds.

To influence prospects that the withdrawal points weren’t a sign of fraud, the TD Defendants supplied quite a few, conflicting excuses for the delays-including, in June 2023, saying that TD had been acquired by Trubluefx.

The TD Defendants falsely assured prospects that their funds had been secure and withdrawals can be processed. However the numerous withdrawal delays, the Sponsor Defendants ignored or downplayed the withdrawal points and continued to solicit funds from new and current prospects to be traded within the TD Pool.

These misstatements allowed Defendants to proceed their fraudulent scheme for greater than six months and bilk prospects out of tens of millions of further {dollars}.

Not less than a few of Defendants’ conduct is ongoing-upon info and perception, the vast majority of buyer funds haven’t been returned.

Except restrained and enjoined by this Court docket, Defendants will seemingly proceed to have interaction in acts and practices alleged on this Criticism and comparable acts and practices.

The CFTC cites “a minimum of $283 million” in The Merchants Area losses throughout “a minimum of 2046 prospects”. Primarily based on leaked investor knowledge, The Merchants Area is estimated to have taken in round $3.3 billion.

In the course of the Related Interval, TD immediately and … by means of the Sponsor Defendants, precipitated a minimum of $180 million in buyer funds to be deposited into financial institution accounts held within the title of assorted third-party entities that TD managed by means of a TD agent who was the signatory on these accounts.

None of those third occasion entities had been corporations that engaged in buying and selling. Not one of the funds deposited in these third occasion financial institution accounts had been ever despatched to TD or some other agency that engaged in buying and selling.

As an alternative, TD directed its agent to make use of buyer funds deposited into the third-party financial institution accounts to make funds unrelated to buying and selling and to make Ponzi-style funds to different prospects.

In its filed lawsuit the CFTC alleges fraud throughout a number of violations of the Commodity Trade Act.

The CFTC is in search of an injunction in opposition to The Merchants Area defendants, prohibiting additional violations of the Commodities Trade Act.

If granted, the injunction can even bar The Merchants Area defendants from having something to do with commodities buying and selling within the US.

Moreover, disgorgement of ill-gotten beneficial properties, full restitution of investor losses, pre-judgment and post-judgment curiosity and a civil financial penalty are additionally sought.

As beforehand famous, the CFTC’s The Merchants Area Criticism was filed below seal on September thirtieth.

The CFTC requested the Criticism be stored below seal in order to

permit the Fee to

(1) acquire a Statutory Restraining Order freezing Defendants’ property, prohibiting destruction of data, and authorizing the Fee’s speedy inspection of uch data and

(2) serve related monetary establishments with the Court docket’s Statutory Restraining Order to effectuate the asset freeze, with out discover ot the Defendants.

The courtroom granted the CFTC’s seal movement on October 1st.

On October third, the courtroom granted the CFTC’s request for an ex-parte statutory restraining order in opposition to The Merchants Area defendants (freezing of property and so forth.). A Momentary Receiver was additionally appointed.

There may be additionally good trigger for the appointment of a Momentary Receiver to take management of all property owned, managed, managed or held by Defendants, or wherein they’ve any helpful curiosity (“Defendants’ Belongings”), in order that the Momentary Receiver could protect property, examine and decide buyer claims, decide illegal proceeds retained by Defendants and quantities because of prospects as a outcomes of Defendants’ alleged violations, and distribute remaining funds below the Court docket’s supervision.

On October eleventh, the CFTC filed a movement with the courtroom requesting the case be unsealed. The courtroom unsealed the case later the identical day.

Whereas it’s far too early to get into specifics, it’s assumed clawback litigation will probably be filed in opposition to The Merchants Area’s prime net-winners in some unspecified time in the future.

Lots of The Merchants Area’s prime net-winners are MLM firm house owners or prime firm distributors/associates.

It needs to be famous that the CFTC beforehand filed a lawsuit focusing on Tin Quoc Tran’s SAEG Ponzi scheme. Ted Safranko and Mike Sims are named defendants within the go well with.

Safranko, who’s believed to have gone on the run for the reason that CFTC’s SAEG lawsuit was filed in February 2023, copped a $3.8 million default judgment in September 2023.

Mike Sims settled the CFTC’s alleged SAEG Ponzi fraud costs for $250,000 final month.

Lastly, the most important MLM Ponzi I’m conscious of that fed into The Merchants Area was OmegaPro (estimated $4 billion in client losses).

Mike Sims and Eric Worre had been immediately tied to OmegaPro. Sims as a co-founder and Worre as OmegaPro’s Official Strategic Coach.

OmegaPro collapsed in late 2022, shortly after The Merchants Area collapsed.

OmegaPro co-founder Andreas Szakacs was arrested in Turkey in July 2024. Dilawar Singh, final recognized to be dwelling in Spain, has gone underground.

Whether or not there are pending felony costs in relation to The Merchants Area is unknown.

A Present Trigger listening to on the CFTC’s filed TRO movement is scheduled for October twenty ninth. Keep tuned for updates as BehindMLM continues to trace the case.

[ad_2]

Supply hyperlink