[ad_1]

The SEC has filed securities fraud expenses in opposition to two Apex promoters.

The SEC has filed securities fraud expenses in opposition to two Apex promoters.

Anthony Lotito and Joseph Hagan stand accused of defrauding shoppers by Apex, a collapsed passive returns funding scheme.

Along with Lotito and Hagan, each New Jersey residents, the SEC additionally names their respective corporations; Revolution Leasing and Scryptmob II LLC.

As alleged by the SEC;

Hagan and Lotito, by their respective companies, ScryptMob and Revolution Leasing, fraudulently provided and bought unregistered securities as distributors for a purported sale leaseback program involving cryptocurrency associated know-how (“the Apex Program”).

Apex, working as Apex Tek was a fraudulent funding scheme launched by publicly traded firm Investview in 2019.

A since-deleted official advertising and marketing video on YouTube cites Jeremy Roma (proper) as Apex’s founder. Roma was additionally a Director at Investview till 2020.

A since-deleted official advertising and marketing video on YouTube cites Jeremy Roma (proper) as Apex’s founder. Roma was additionally a Director at Investview till 2020.

Apex’s funding scheme noticed shoppers pitched on returns of as much as $500 a month for 5 years. Recruited Apex traders had been informed they had been investing in “machines that mined bitcoin”.

The purported mining machines had been purchased from Apex after which leased again to Safetek, one other Investview owned firm Roma was President of.

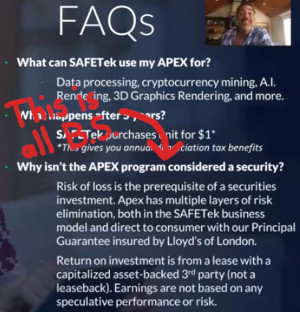

In his then capability as an Investview Director and founding father of Apex, Roma hosted Apex advertising and marketing webinars.

Within the webinars, Roma incorrectly asserted Apex’s passive returns funding scheme wasn’t a securities providing.

Within the webinars, Roma incorrectly asserted Apex’s passive returns funding scheme wasn’t a securities providing.

The SEC allege Hagan and Lotito primarily promoted Apex’s unregistered securities providing to aged victims.

Many who invested within the Apex Program by Hagan and Lotito

had been aged, and a few invested utilizing funds of their Particular person Retirement

Accounts (“IRAs”).

By way of Investview’s Apex providing, Lotito defrauded his principally aged victims of over $2 million. Hagan defrauded his victims out of over $3.1 million.

In reference to a few of these investments, Lotito and Hagan every

misappropriated a portion of traders’ cash and used it to pay for their very own

private bills.In some cases, through the Related Lotito Interval, Lotito paid

earlier Apex Program traders with the cash invested by later Apex Program

traders.

Lower than a 12 months after it launched, Apex started collapsing in early 2020.

Hagan and Lotito every knew, or they recklessly disregarded, from not less than April 27, 2020, that there have been issues with the Apex Program, together with that there have been important supply delays with the Apex Packs, which had been essential to generate this passive revenue for traders, and that month-to-month lease cost quantities to traders had been drastically lowered by as a lot as 80%.

Apex collapsing by no means made it into Lotito’s and Hagan’s pitch. The pair continued to market Apex to unsuspecting traders as if nothing was happening.

Ultimately, Apex collapsed in June 2020. To clean over investor losses, Apex rolled out a “COVID-19 delivery points” exit-scam.

However even Apex’s collapse didn’t deter Lotito and Hagan (proper) from persevering with to defraud shoppers.

However even Apex’s collapse didn’t deter Lotito and Hagan (proper) from persevering with to defraud shoppers.

Nonetheless, Lotito and Hagan continued to supply and promote investments within the Apex Program, misrepresenting to traders that their investments can be used within the Apex Program regardless that the Apex Program Father or mother Firm was now not accepting new investments.

With no rip-off to direct investor funds into, Lotito and Hagan simply stored the cash for themselves.

In reference to these post-June 30, 2020 gross sales, Hagan and Lotito retained all of the traders’ cash and didn’t transmit investor cash to Subsidiary #1.

Subsidiary #1 refers to Apex Tek.

Additionally, post-June 30, 2020, Lotito and Hagan continued to vow potential traders that 100% of their investments had been insured by the Apex Program Father or mother Firm’s third-party insurer.

The “Apex Program Father or mother Firm” refers to Investview.

Actually, nonetheless, as Lotito and Hagan knew, or recklessly disregarded, Lotito and Hagan wouldn’t transmit the traders’ cash to Subsidiary #1 and thus the traders’ purchases wouldn’t be insured.

The Apex Program ceased to function utterly on or about September 10, 2020.

Lotito continued to supply and promote purported investments within the Apex Program from October 2020 till July 2021, regardless of his information that the Apex Program had ceased to function completely.

The SEC alleges Lotito and Hagan, in selling Investview’s Apex funding alternative, of a number of violations of the Securities and Change Act.

In a lawsuit filed in New Jersey on September twentieth, 2024, the SEC is looking for

- an injunction prohibiting additional acts of securities fraud;

- an injunction prohibiting Lotito and Hagan from having something to do with securities choices;

- disgorgement of ill-gotten positive aspects;

- civil financial penalties; and

- an injunction prohibiting Lotito and Hagan from serving as an officer or director for a corporation that has securities registered with the SEC

I’ve added the SEC’s Apex promoter case to BehindMLM’s calendar. Keep tuned for updates as we proceed to trace the case.

Within the meantime, the SEC’s Apex promoter lawsuit raises additional questions on Investview and Jeremy Roma.

Whereas Investview referenced Apex Tek and Safetek in its SEC filings, it didn’t register the Apex funding scheme as a securities providing.

Having now gone after two Apex promoters for “fraudulently provide[ing] and [selling] unregistered securities as distributors” of Apex, the larger query is when will the SEC go after Investview?

And probably, pending settlement or trial, what function Lotito and Hagan may play as cooperating witnesses?

Jeremy Roma ditched Apex Tek, SafeTek and Investview shortly after Apex collapsed (August 2020).

After stealing who is aware of how a lot from shoppers by Apex, Roma scurried off to Dubai to launch Daisy AI just a few months later.

In partnership with EndoTech, a purported Israeli securities fraud manufacturing unit fronted by Anna Becker and Dmitry Gushchin (aka Gooshchin), Roma continued to defraud shoppers over a number of Daisy collapses.

It ought to be famous that after Apex, Investview additionally continued its securities fraud with CryptoElite.

CryptoElite introduced Investview’s firm iGenius and EndoTech collectively. Though by no means publicly confirmed, it’s believed the iGenius/EndoTech deal was brokered by Jeremy Roma.

Investview disclosed it had been subpoenaed by the SEC in relation to potential iGenius associated securities fraud in November 2021.

As of Could 2024, the SEC’s investigation into Investview and iGenius is confirmed to be ongoing.

The final iteration of Daisy AI’s EndoTech sequence of unregistered securities choices collapsed in late 2023. A “Blockchain Sports activities” reboot was launched however didn’t go wherever.

In opposition to the backdrop of widespread Daisy AI sufferer losses, Roma’s newest grift is BioLimitless.

BioLimitless presents itself as a cookie-cutter MLM complement firm promoting a $300 a month probiotic complement.

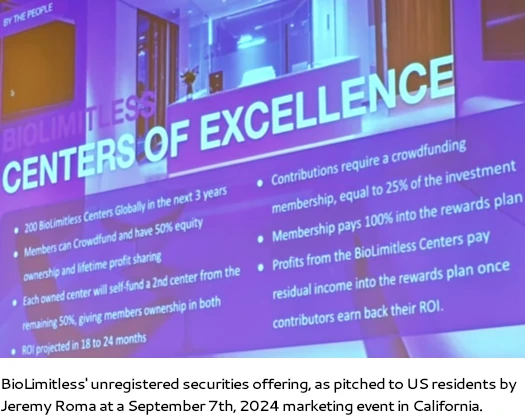

On the backend nonetheless, Roma and BioLimitless are pitching US resident shoppers on unregistered securities tied to “BioLimitless Facilities of Excellence”.

Neither BioLimitless or Jeremy Roma are registered with the SEC. As a substitute, on September sixteenth, 2024, BioLimitless Facilities of Excellence, Inc., a Delaware shell firm, filed a Type D Discover of Exempt Providing of Securities.

BioLimitless Facilities of Excellence, Inc.’s submitting cites:

- Eric Nepute as a Director;

- Jeremy Roma as a Promoter; and

- CJ Mertz as an government officer

The submitting particulars BioLimitless hoping to lift $20 million for “revenue share”. $1 million of funds invested by shoppers will likely be put aside to pay Nepute $50,000 a month and Mertz $30,000 a month.

Contemplating Roma’s current BioLimitless in California noticed him pitch US resident shoppers on “50% fairness” shares for $500, and a “ROI projected in 18 to 24 months”, BioLimitless trying to skirt US securities legislation by a Type D is regarding.

Following Roma falsely representing Apex wasn’t a securities providing in 2019, BioLimitless’ doing the identical with its “50% fairness” passive returns funding scheme isn’t stunning.

Whether or not the SEC is investigating Roma as a part of its Investview investigation or in any other case stays unclear.

[ad_2]

Supply hyperlink