[ad_1]

Again in 2020 scammers launched the Seedchange Ponzi scheme.

Again in 2020 scammers launched the Seedchange Ponzi scheme.

Seedchange the MLM Ponzi impersonated Seedchange Execution Companies, which caught the eye of California’s Division of Monetary Safety.

This prompted a site title change, however in any other case Seedchange continued till it collapsed in late 2021.

Seedchange’s collapse coincided with the SEC including the fraudulent funding scheme to its PAUSE record.

On or round December 2021, Seedchange rebooted as Yosemite EP. From what I can inform Yosemite EP collapsed in early to mid 2022.

Now the identical scammers seem like again with Yosemite AP.

Yosemite AP operates from the area “yosemite-ap.com”, privately registered on June twenty eighth, 2022.

No verifiable details about who owns or operates Yosemite AP is offered on their web site. The identical fictional government group from Seedchange and Yosemite EP is recycled.

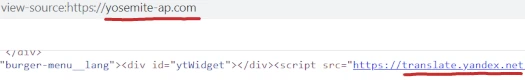

Yosemite AP’s web site source-code suggests Russian audio system is likely to be behind the corporate:

This sadly isn’t definitive however usually no person exterior of Russia makes use of Yandex.

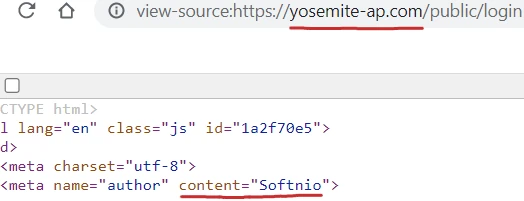

One other breadcrumb is Yosemite AP’s web site being put collectively by Softnio.

Softnio is an internet growth firm based mostly out of Bangladesh. This probably weakens the Russian connection to Yandex, as it would simply have been used for comfort.

Within the “about us” part of Yosemite AP’s web site, we get a load of baloney about regulatory compliance.

Yosemite AP is an funding platform that was established in 2012 in San Francisco.

Securities are provided by way of Yosemite Execution Companions, Inc., a broker-dealer registered with the SEC USA and FINRA | SIPC.

The SEC has already investigated Seedchange’s and Yosemite EP’s purported ties to Yosemite Trade Companions (an precise firm).

Not surprisingly, neither Seedchange or Yosemite EP have something to do with Yosemite Trade Companions. Neither does Yosemite AP.

As at all times, if an MLM firm just isn’t overtly upfront about who’s operating or owns it, suppose lengthy and onerous about becoming a member of and/or handing over any cash.

Yosemite AP’s Merchandise

Yosemite AP has no retailable services or products.

Associates are solely in a position to market Yosemite AP affiliate membership itself.

Yosemite AP’s Compensation Plan

Yosemite AP associates make investments funds on the promise of marketed returns:

- JMW Farms – make investments $200 or extra and obtain 0.55% a day for 290 days

- Henry Streeter Sand & Ballast – make investments $100 or extra and obtain 0.55% a day for 280 days

- Moxon Farms – make investments $1800 or extra and obtain 0.6% a day for 254 days

- St. Nicholas Courtroom Farms – make investments $18,000 or extra and obtain 1.4% a day for 147 days

- BrightRock Gold Company – make investments $50,000 or extra and obtain 1.85% a day for 155 days

- Xanodyne Prescription drugs – make investments $12,000 or extra and obtain 1.2% a day for 175 days

- XT-Power Group – make investments $5000 or extra and obtain 0.85% a day for 230 days

- Ashmarden Restricted – make investments $3000 or extra and obtain 0.75% a day for 215 days

- Legacy Measurement Options – make investments $10,000 or extra and obtain 1.05% a day for 165 days

- Serene Fishing Firm – make investments $2000 or extra and obtain 0.55% a day for 255 days

- Energotek – make investments $8000 or extra and obtain 1.05% a day for 170 days

- Tempus Utilized Options – make investments $30,000 or extra and obtain 1.4% a day for 147 days

- Lakes Oil NL – make investments $2000 to $1,000,000 and obtain 3% a day for 7 days

Notice that I’ve introduced Yosemite AP’s funding plans as they seem on its web site. All however the final plan seem like filler fluff.

On the MLM aspect of issues, Yosemite AP pays referral commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel group, with each personally recruited affiliate positioned straight below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel group.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Yosemite AP caps payable unilevel group ranges at 4.

Associates are paid a share of funds invested throughout these 4 ranges as follows:

- degree 1 (personally recruited associates – 10%

- degree 2 – 6%

- degree 3 – 4%

- degree 4 – 2%

Becoming a member of Yosemite AP

Yosemite AP affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal $100 funding.

Yosemite AP Conclusion

Yosemite AP is a clone of Yosemite EP, which was a detailed of Yosemite EP.

The Ponzi ruse is funding in fictional copies of precise corporations. Not shocking seeing as each Seedchange and Yosemite EP and AP are additionally fictional adapations of precise corporations.

Evidently all Yosemite AP are doing is recycling newly invested funds to repay current traders.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Yosemite AP of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that once they collapse, nearly all of traders lose cash.

For proof of this, look no additional than Seedchange and Yosemite EP. Yosemite AP will finish in precisely the identical method.

[ad_2]

Supply hyperlink