Hundreds of thousands of Individuals are denied entry to a checking account as a consequence of banking errors they’ve made prior to now. This may be devastating to anybody who depends on banking providers to pay payments and get monetary savings.

Those that have gotten their checking account terminated are inclined to have a tough time getting accepted for a brand new one. It’s because 85% of banks and credit score unions use databases managed by ChexSystems, Early Warning Providers (EWS), or TeleCheck to share information about checking account holders.

Sadly, these financial institution monitoring corporations will retailer your information for as much as 5 years. This can be a very long time to attend for a brand new account. Fortunately there are alternatives obtainable for these in search of banking providers within the type of a second probability checking account.

The Prime Second Probability Financial institution Accounts

Open an account at present!

Chime | Our Prime Choose

Chime® is a fast-growing internet-only monetary firm and our best choice for a second probability checking account.

Chime® is a fast-growing internet-only monetary firm and our best choice for a second probability checking account.

And, better of all, Chime accepts nearly all clients who apply. Even when you have unhealthy or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Options embody cell deposits, direct deposit, on-line invoice fee, NO month-to-month or annual charges, NO overdrafts charges1, NO credit score test, and NO CheckSystems. Opening an account is tremendous straightforward. It takes about 2 minutes and also you don’t should make an preliminary deposit. Right here’s what we like:

No Month-to-month Charges

For the previous couple of years, Chime’s enormous progress has come on the expense of the massive banks and their outrageous charges. And it’s among the best options of a Chime account. There aren’t any month-to-month or annual service fees, no minimal steadiness requirement, no international transaction charges, no charges at over 60,000 ATMs2, and no charges for cell and on-line invoice pay.

Deposit Money for FREE at Over 8,500 Walgreens

Getting access to a bodily location for money deposits is vital to Chime members. And now it’s straightforward. All it’s important to do is go right into a Walgreens retailer, hand the cashier the money you need to deposit alongside along with your Chime card, and the deposit will present up in your account instantly. This presents Chime members extra walk-in areas than every other financial institution within the U.S. With over 78% of the nation inside 5 miles of a Walgreens, it is a vital profit for hundreds of thousands.3

Sensible Know-how

In contrast to large banks, Chime was created through the smartphone period and, subsequently, options an app that’s greater than only a manner for purchasers to evaluate their financial institution accounts.

You’ll be able to switch funds to family and friends, Chime members or not… they usually can declare their cash immediately4 with none extra apps. The Chime app additionally has a sequence of notifications which you could activate or flip off so that you keep in full management. Misplaced or misplaced your card? You’ll be able to instantaneously flip off your card utilizing the app. No surprise over 300,000 clients have given the app a 5-star evaluate.

Prospects First

Chime was one of many first to supply a “spherical up” possibility. In the event you use your Chime card on a purchase order of $10.65, Chime offers you the choice of routinely rounding as much as $11.00 and placing the remaining $.35 in your free Chime financial savings account. And that provides up over time! Plus, Chime pays 0.50% Annual Share Yield (APY)5 in curiosity on that financial savings account.

In the event you use direct deposit along with your Chime account, you will get your paycheck as much as 2 days early6. And Chime is simply saying no to large financial institution NSF fees with a fee-free overdraft program as much as $200. Lastly, Chime only recently launched their Credit score Builder bank card with no curiosity and no annual price. We don’t assume there may be one other firm innovating for his or her clients like Chime.

Get a Chime Account At present!

Present | Earn Excessive Curiosity

Present is one other web-only nationwide financial institution that has some actually nice options… and has grow to be one of many fastest-growing checking accounts for customers who need all of it with out all the prices and hassles.

Present is one other web-only nationwide financial institution that has some actually nice options… and has grow to be one of many fastest-growing checking accounts for customers who need all of it with out all the prices and hassles.

Why are we that includes Present on our web site? It’s easy: they don’t use ChexSystems or your credit score report back to open a brand new account. Signal-up takes about 2 minutes and Present has extraordinarily excessive acceptance charges. However what’s actually cool are the unimaginable options provided with this account:

- NO minimal steadiness

- NO deposit required to open an account

- NO overdraft charges once you overdraw by as much as $100 with Overdrive™

- NO charges at over 40,000 ATMS within the U.S.

- Get your paycheck as much as 2 days early with direct deposit

- Earn 4.0% curiosity in your steadiness as much as $6,000

- Earn factors for limitless cashback at taking part retailers

- Ship cash immediately without spending a dime

- A sublime however easy smartphone app

- 24/7 member assist

Present presents a extremely distinctive service it calls Fuel Maintain Removals. What’s a fuel maintain? Some fuel stations might apply a maintain from $50 to $100 once you use a debit card to pump fuel. In the event you solely pumped $10 of fuel, however the fuel station locations a $100 maintain in your funds, you received’t have entry to the $90 distinction for as much as 3 enterprise days!

The Present debit card will instantly refund the maintain so you’ve got entry to all of your funds. We haven’t discovered that profit anyplace within the market.

Right here’s what’s actually vital, although. Deposits are FDIC-insured as much as the very best potential quantity allowed: $250,000. We love the options, we love the smartphone app, and we love Present. That makes us assume you’ll love them too.

Get a Present Account Now!

NorthOne | No ChexSystems Small Enterprise Banking

- FREE enterprise Mastercard debit card

- FREE entry at over 1,000,000 ATMs nationwide

- FREE on-line and cell app

- FREE reside chat (not a chatbot), phone, or e mail assist

- FREE in-app bill creator

- NO minimal month-to-month steadiness requirement

- NO NSF charges

- NO ACH switch charges

- NO credit score test or ChexSystems

Banking Providers

NorthOne doesn’t require a minimal account steadiness and fees a $10 month-to-month price that features limitless transactions in your account. These embody ACH funds, invoice pay, debit card utilization, cell deposits, and transfers. The one different price is $15 for wire transfers.

You can too grant read-only entry to workers or your accountant or bookkeeper. This retains your account secure whereas additionally giving entry to those that want it.

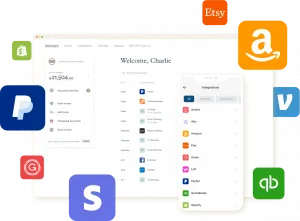

Integrations

With NorthOne enterprise banking, you possibly can join your account to an nearly limitless variety of third-party apps. NorthOne integrates with enterprise instruments together with Paypal, Stripe, Sq., Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and plenty of extra. By means of these integrations, you possibly can sync transaction particulars, accumulate funds, see and pay invoices, ship payroll, pay contractors, and extra.

If creating and sending invoices, quotes, and estimates is crucial to what you are promoting, NorthOne presents a free stand-alone bill creator that integrates seamlessly with the banking app. We’ve tried it and assume it’s a chic answer.

Envelopes

NorthOne has created a characteristic that helps you propose for and handle vital expense classes. They name these sub-accounts “Envelopes” and you may arrange as many as you need. This lets you put aside funds you recognize you’ll want sooner or later reminiscent of taxes or payroll. You’ll be able to set {custom} guidelines on your envelopes and simply transfer cash backwards and forwards as wanted.

Software Course of

NorthOne targets account approvals inside one to 2 enterprise days. Info required to open an account consists of title, tackle, and social safety quantity or tax identification quantity. If relevant, NorthOne might ask for a duplicate of what you are promoting license and enterprise formation paperwork. After you’re accepted, you’ll must make a $50 minimal opening deposit.

NorthOne is among the best enterprise financial institution accounts for entrepreneurs and small enterprise homeowners. Their mixture of providers and choices, the quick utility course of, and buyer assist create an outsized aggressive benefit for each the financial institution and its clients. Each small enterprise proprietor understands how crucial that’s for achievement.

Open an account at present!

Chase Safe BankingSM | $100 New Account Bonus

For many individuals, gaining access to an area financial institution department is paramount when establishing a checking account. With over 16,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is likely to be the proper match.

For many individuals, gaining access to an area financial institution department is paramount when establishing a checking account. With over 16,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account is likely to be the proper match.

Listed below are a few of our favourite options with this account:

- NO credit score test

- NO ChexSystems

- NO minimal deposit to open

- NO overdraft charges

- FREE entry to over 16,000 Chase ATMs

- FREE Chase On-line Invoice Pay

- FREE cash orders and cashier’s checks

Extremely Rated Cell App

Obtainable for iOS and Android, the Chase Cell app presents 24/7 entry to your account. The app is extremely rated, incomes 4.8 stars out of 5 on the App Retailer and 4.4 stars out of 5 on Google Play.

You’ll be able to switch funds, deposit checks, ship cash with Zelle, arrange account alerts and notifications, and lock your card if it’s been misplaced or stolen.

The app additionally has extremely useful budgeting instruments, customized insights, and the flexibility to test your credit score rating without spending a dime.

How The Account Works

Opening the Chase Safe Banking account is straightforward. They confirm your title, tackle, and social safety via Experian, however don’t pull a credit score report or credit score rating. Chase doesn’t use ChexSystems for this account, both. Account approval is instant, there’s no opening deposit requirement, and also you’ll obtain your Chase Safe card inside a matter of days.

Chase doesn’t supply overdraft providers with this account as you possibly can solely spend the cash you’ve got obtainable and the account doesn’t embody paper checks. You must also know that utilizing non-Chase ATMs can value from $3.00 to $5.00 per transaction.

Chase Safe Banking carries a $4.95 month-to-month service price that can’t be waived. However mixed with all of the free providers and the $100 money bonus once you use the cardboard for 10 purchases inside 60 days, the month-to-month price doesn’t pose an issue for many clients. And, you’ll have peace of thoughts with Chase’s Zero Legal responsibility Safety for those who detect and report unauthorized transactions.

Banking With A Chief

Chase claims to be concerned with 40% of Individuals ultimately or one other. There could be consolation in dimension, attain, and stability. Chase has all of that and the peace of mind they are going to be there for an extended, very long time.

In the event you’ve needed to financial institution with Chase and questioned for those who’d qualify, we predict you’re going to be actually proud of the Chase Safe Banking account.

Get a Chase Safe Banking account at present!

SoFi Cash | Earn a $275 Welcome Bonus

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking and financial savings account on steroids and we love that. Plus, they don’t use ChexSystems to approve accounts.

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking and financial savings account on steroids and we love that. Plus, they don’t use ChexSystems to approve accounts.

You get a debit MasterCard and a really slick smartphone app. You can also make deposits, write checks, make the most of digital invoice pay, and switch cash. There aren’t any month-to-month charges or overdraft charges. Plus, you earn curiosity on all the cash within the account! The sign-up course of can take lower than 60 seconds. With over 2.5 million members, SoFi is a financial institution you possibly can rely on!

The $275 bonus is available in two components. While you deposit at the least $10, SoFi will credit score your account $25. While you arrange direct deposit from an employer, SoFi will credit score your account as much as $250 (relying on the quantity of your direct deposit) and bump the rate of interest you earn to 2.50% APY. The bonus and rate of interest are a few of the highest we’ve seen.

- No account charges

- No minimal steadiness

- No overdraft charges

- No charges at over 55,000 ATMs

- Entry to SoFi member advantages like profession teaching and monetary advising

- Automated invoice pay

- Freeze debit card on-the-go

SoFi Cash has been nice! The account was straightforward to open and I bought my debit card a number of days later. The smartphone app is straightforward to make use of and I can test every thing from my laptop, too. I’ve had some points with ChexSystems prior to now and SoFi Checking & Financial savings appears to be the proper account.

Kevin M., SoFi Buyer

Get a SoFi Account Now!

Acorns | $75 New Account Bonus

Acorns is making a reputation as a spot to take a position cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. Better of all, Acorns doesn’t use ChexSystems or a credit score report back to approve accounts! That makes Acorns Spend one other of our favourite second probability checking accounts. As an organization constructed to compete with the biggest banks, Acorns presents some extraordinary advantages.

Acorns is making a reputation as a spot to take a position cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. Better of all, Acorns doesn’t use ChexSystems or a credit score report back to approve accounts! That makes Acorns Spend one other of our favourite second probability checking accounts. As an organization constructed to compete with the biggest banks, Acorns presents some extraordinary advantages.

We love the heavy steel tungsten Visa debit card and the world-class smartphone app that permits you to handle each facet of your new checking account reminiscent of budgeting, spending, and safety.

One other good possibility is the flexibility to spherical up on each buy and Acorns will take that cash and routinely put it in a financial savings account. This actually helps construct a nest egg.

It takes about 2-3 minutes to enroll and never solely do you get a checking and financial savings account, however you even have entry to an funding account when you’re prepared to contemplate that. And, it’s free. Right here’s extra:

- FREE Visa® debit card

- FREE bank-to-bank transfers

- FREE bodily test sending on-line or via the cell app

- FREE cell test deposits

- FREE or reimbursed ATM withdrawals nationwide

- NO minimal steadiness or overdraft charges

- NO credit score test; ChexSystems OK

- FDIC insured

There’s a $3 month-to-month price that’s simply coated by the ATM price reimbursement and different goodies included with the account. To get the $75 bonus, all it’s important to do is about up Acorns Spend as your direct deposit methodology along with your employer and obtain 2 direct deposits of at the least $250 every ($500 complete).

In the event you’ve struggled with poor credit score or ChexSystems, Acorns is likely to be the proper account.

Get An Acorns Account!

GO2bank

One vital downside to many online-only financial institution accounts is that they don’t have any option to settle for money deposits. However GO2bank accepts money deposits at over 90,000 Inexperienced Dot areas nationwide. Nevertheless, taking part retailers might cost you a price.

In the event you direct deposit over $500, your month-to-month upkeep price of $5.00 is waived. And, they provide a fairly candy overdraft safety program, however it has a gotcha cost of $15 for those who don’t substitute the funds inside 24 hours.

Account-holders will admire the flexibility to price range their cash with the assistance of a cell app, budgeting instruments, and a financial savings vault. In truth, they pay 1% on all cash within the saving vault as much as $5,000.

Get a GO2bank account

Lili | Fast Approval Small Enterprise Banking

Lili was custom-made for freelancers and unbiased contractors who’re working as sole proprietors and single-member LLCs and we actually like their providing. Lili goals to approve most accounts inside 2-3 days, however some accounts are accepted in 2-3 hours.

Lili was custom-made for freelancers and unbiased contractors who’re working as sole proprietors and single-member LLCs and we actually like their providing. Lili goals to approve most accounts inside 2-3 days, however some accounts are accepted in 2-3 hours.

Lili presents a checking account and Visa debit card with no preliminary deposit or minimal steadiness requirement, no hidden charges, no credit score test, and no ChexSystems. Lili makes getting your account straightforward! Right here’s extra of what we like:

- FREE enterprise VISA debit card

- FREE (and really user-friendly) cell app

- NO minimal steadiness

- NO NSF fees or charges

- NO credit score test or ChexSystems

- Obtain direct deposit funds 2 days sooner than many banks

- Cell test deposit

- Limitless fee-free transactions

- Takes 3 minutes to use

Built-in Instruments

The Lili smartphone app offers you entry to instruments to handle your bills and taxes. You assign a class for every expense by swiping left for “life” or private bills and proper for “work” or enterprise. You can too add receipts to transactions, obtain quarterly and annual expense stories, and monitor spending in real-time. Lili will routinely assign an expense class based mostly on the service provider, however permits you to edit the class as wanted.

Buckets

Lili has an non-obligatory characteristic referred to as “buckets” that permits you to put aside cash in a financial savings account. The primary of those is known as a “Tax Bucket”, the place you specify a share of your direct deposits you need to be saved for future tax funds. You’ll be able to simply make changes and adjustments alongside the best way and transfer the cash backwards and forwards out of your checking account and tax bucket financial savings account. That manner, you recognize the cash might be there when that you must make tax funds.

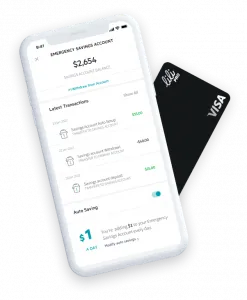

The second of those buckets is known as the Emergency Financial savings Bucket. You’ll be able to routinely switch at the least $1 a day to this financial savings account to make use of for any bigger buy or unexpected expense.

Sturdy for Most

Lili is greatest for small enterprise homeowners who desire a no-frills, no value, no minimal steadiness checking account. You’ll be able to run all what you are promoting and private bills via the account and may simply establish and separate them out for accounting and tax functions. After your account is about up, you possibly can add a enterprise title or DBA title to the account. And also you handle every thing from the contact of your smartphone.

However there are some limits, too. Lili doesn’t supply checks and you may’t arrange your account with an employer identification quantity. Depositing money at Inexperienced Dot areas can value as much as $4.95 and cell test deposits are restricted to $6,000 per thirty days.

Lili Professional

Lili just lately introduced a brand new set of options referred to as Lili Professional. The price is $9 per thirty days and features a no-fee overdraft as much as $200 on debit card purchases and a sturdy and limitless invoicing functionality constructed into the smartphone app. On prime of that, customers obtain 1.00% APY on financial savings account balances and a extra strong expense monitoring functionality. The Professional model additionally presents cashback once you make purchases at over 14,000 retailers. In the event you’re unsure you need to enroll in Lili Professional, get Lili Normal (no value) and you may improve later.

Software Course of

You’ll be able to arrange an account on-line. In the event you’re a freelancer, it’s best to obtain approval and account entry nearly immediately. All others (Sole Proprietor, Single-Member LLC, Multi-Member LLC, Basic Partnership, Restricted Legal responsibility Partnership, or S Corp) can take a few days to get accepted. You’ll be able to fund your account utilizing a cell test deposit, direct deposit, ACH switch, or by linking your Venmo, PayPal, or Money App account.

Lili is open for enterprise. Anybody who’s their very own boss: a sole proprietor, gigsters (ie. Uber and Lyft drivers), contractors, freelancers, or part-time entrepreneurs – you all qualify! Whether or not you go for the fee-free Lili Normal account or the upgraded Lili Professional account, we predict you’re going to love the best way Lili helps you handle your rising enterprise!

Open a Lili account now!

GTE Monetary

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. In the event you don’t qualify for a conventional account, the Go Additional account will assist you to get there in as little as 12 months. We think about this a low-cost second probability checking. So long as you make a complete deposit of $500 for the month, choose to obtain eStatements and make 15 month-to-month transactions, the $9.95 upkeep price is waived.

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. In the event you don’t qualify for a conventional account, the Go Additional account will assist you to get there in as little as 12 months. We think about this a low-cost second probability checking. So long as you make a complete deposit of $500 for the month, choose to obtain eStatements and make 15 month-to-month transactions, the $9.95 upkeep price is waived.

GTE Monetary is among the largest credit score unions within the US. Membership is open to anybody via straightforward necessities and an internet utility course of. The Go Additional account consists of:

- Free EMV-equipped debit card with built-in rewards

- On-line and cell banking instruments

- Free invoice pay service

- Simple cash transfers via the Popmoney service

GTE Monetary is predicated in Florida, however anybody within the 50 states can open an account on-line without spending a dime.

Get a GTE Monetary account

Varo Financial institution

Varo Financial institution is one other internet-only financial institution with providers based mostly on their cell apps for Apple and Android gadgets. Varo doesn’t cost charges at 55,000+ Allpoint ATMs and presents sturdy budgeting instruments and computerized financial savings packages.

Varo Financial institution is one other internet-only financial institution with providers based mostly on their cell apps for Apple and Android gadgets. Varo doesn’t cost charges at 55,000+ Allpoint ATMs and presents sturdy budgeting instruments and computerized financial savings packages.

Opening an account is straightforward and Varo doesn’t test your credit score or use ChexSystems. Varo doesn’t even require an preliminary deposit to open an account, both. There are by no means any month-to-month upkeep charges, account steadiness minimums, overdraft charges, international transaction charges, switch charges, or debit card alternative charges.

Varo’s current financial institution constitution has them innovating greater than ever. They’ve a really sturdy cashback program, a payroll advance possibility, and have began to supply their clients a secured bank card referred to as Varo Consider.

Lastly, if Varo receives a payroll notification earlier than your payday, it might probably deposit your cash extra shortly than many banks.

Get a Varo Account Now!

How ChexSystems, TeleCheck, and Early Warning Providers Function

In case you are in a scenario the place you’ve been banned out of your financial institution and your account has been terminated, you may assume which you could get round this by switching to a distinct financial institution. Nevertheless, this isn’t all the time straightforward due to corporations like ChexSystems, TeleCheck, and Early Warning Providers (EWS).

What Do These Corporations Do?

These organizations report and retailer your banking historical past for as much as 5 years, making it troublesome and irritating to open a brand new checking account. These financial institution companions monitor your information and may categorize you as “excessive threat” for those who’ve made sure errors.

Being thought-about a high-risk client will often occur when you have bounced checks (which is often unintentional), written unhealthy checks (a deliberate act), have a low credit score rating, or break a financial institution’s guidelines.

You can too be put within the high-risk class for those who exceed the every day ATM withdrawal restrict otherwise you’re regularly transferring cash between accounts.

Corporations like ChexSystems will primarily create a credit score report for banks that outlines any previous transgressions you may need made. These corporations work equally to the credit score reporting companies in that they collect all obtainable client information to create a banking report.

How will this have an effect on you?

Very like how a low credit rating can stop you from being accepted for a mortgage or a brand new bank card, having a foul banking report will make it troublesome to be accepted for one thing as important as a checking account. This will flip into a serious concern for purchasers who’ve good intentions however simply occur to make some unhealthy monetary choices.

Fortunately there are lots of second probability banking choices to contemplate if you end up in a scenario the place your present account has been terminated and you want to one other probability with the banking system.

These second probability accounts embody the newest banking options like cell and on-line instruments, nice customer support, and little to no month-to-month charges.

A few of these second probability banks even have very excessive approval charges making it potential for many who have made monetary errors prior to now to regain entry to the banking system.

5 Issues to Look For in a Second Probability Financial institution Account

When selecting a second probability checking account, you will need to store round for the best choice. You shouldn’t accept accounts with tight restrictions and excessive charges. Many determined clients will make this error as a result of they assume it’s the best choice they’ve after being banned from their earlier monetary establishment.

Listed below are 5 issues it’s best to evaluate when selecting a second probability account:

- No minimal steadiness necessities

- Low or zero month-to-month charges

- Examine-writing talents

- On-line and cell banking

- Debit card entry

What Is ChexSystems?

Many customers will go their entire lives with out ever even listening to about ChexSystems till they get denied a checking account or a service provider denies their test. For individuals who are usually not acquainted, ChexSystems is a client reporting company that tracks your checking and financial savings account exercise.

They work equally to credit score reporting companies like Equifax, Experian, and TransUnion. These companies accumulate information on customers’ mortgage and bank card historical past and take that info to calculate a credit score rating.

ChexSystems is barely completely different in that they accumulate banking information. Detrimental marks in your banking historical past won’t present up in your credit score rating. Nevertheless, they’ll severely damage your capacity to open a brand new checking account when you have too many unfavorable occasions reported.

This may be devastating to most individuals who depend on checking account providers to pay their payments and make on a regular basis purchases.

ChexSystems is finally not accountable for a financial institution denying you a checking account. Nevertheless, the knowledge they monitor and supply to the key banks does contribute to their choice to disclaim an account.

Right here is the knowledge that ChexSystems collects:

- Paid and unpaid inadequate fund objects (NSF)

- Any sort of fraud

- Overdrafts, ATM transactions, or computerized funds the financial institution paid

- Abuse of debit card, financial savings account, or ATM card

- Violations of any banking guidelines and laws

- Opening an account with false info

What Is Early Warning Providers (EWS)?

Early Warning Providers (EWS) was created by a gaggle of main banks, together with Wells Fargo, Capital One, BB&T, JP Morgan Chase, and Financial institution of America. They created this method to forestall fraud and scale back threat. In contrast to ChexSystems, which is primarily centered on monitoring people who mismanage financial institution accounts, EWS focuses solely on fraudulent exercise.

The EWS database primarily tracks customers’ unfavorable interactions with banks. These unfavorable interactions can embody actions like fraud, forgery, test alteration, and counterfeiting.

What Is TeleCheck?

Very like the credit score bureaus, ChexSystems, and EWS, TeleCheck is one other client reporting company whose main focus is client info associated to checks and financial institution accounts.

TeleCheck is mostly utilized by retailers as a option to decide how dangerous any given test is. TeleCheck’s system will flag any doubtlessly fraudulent checks on the time of the transaction. Checks accepted by the system assure the complete fee to the retailer. This method is crucial for retailers who want a manner of verifying the validity of a test.

What’s the Distinction Between a Second Probability Financial institution Account and a No-ChexSystems Financial institution Account?

Shoppers which were flagged by ChexSystems are going to need to search for a second probability financial institution that doesn’t use ChexSystems. Going with a financial institution that does will most definitely end in your account being denied.

When you’ve discovered an possibility that doesn’t use ChexSystems, it’s best to anticipate a fast credit score rating test or for the establishment to seek the advice of EWS to ensure you haven’t engaged in any fraudulent exercise. A lot of these banks are usually not straightforward to seek out, however there are alternatives obtainable.

Most second probability banks will use ChexSystems, EWS, and TeleCheck to display their account candidates. Nevertheless, they’re nonetheless more likely to approve your account so long as you don’t owe that establishment any cash.

With excessive approval charges for second probability financial institution accounts, you’ll get pleasure from many of the banking choices obtainable to different conventional checking accounts.

Is Second Probability Banking a Higher Choice Than a Pay as you go Card or Payday Mortgage?

Discovering a strong second probability banking account is a way more handy and reasonably priced possibility in comparison with check-cashing companies like payday loans and pay as you go debit playing cards.

Payday lenders will often trick their clients with hidden charges even for funds made on time. With excessive rates of interest and horrible reimbursement phrases, these kinds of monetary merchandise have been recognized as a few of the worst choices on the market for customers.

Steadily Requested Query About Second Probability Banking

Listed below are a number of generally requested questions on second probability financial institution accounts:

What info will I would like for the applying course of?

In the event you’re contemplating making use of for a second probability checking account, all you will want is your Social Safety quantity or particular person tax ID quantity. In some circumstances, you can be requested extra questions for verification.

What’s the probability that my utility might be accepted?

The most effective second probability banks have an acceptance price of roughly 95%. There’s an excellent probability it is possible for you to to open an account.

Will I obtain a pre-paid card or a checking debit card?

Out of all of the respected second probability banks we’ve researched, none will ship you a pre-paid card. As an alternative, you’ll get both a Visa or Mastercard debit card, which might be linked on to your checking account. These playing cards will include a PIN and may have the identical performance as every other card on the Visa or Mastercard community.

Will my second probability checking account be FDIC insured?

Most second probability financial institution accounts are insured as much as $250,000 by the federal authorities.

The Greatest Second Probability Banks by State

Most main banks fail to supply second probability checking accounts. Nevertheless, many group banks and credit score unions do however below completely different names like “Alternative Checking” or “Contemporary Begin Checking.”

Our sister web site, CheckingExpert.com, usually updates the checklist of banks providing second probability checking accounts in each state. Right here’s an outline of those accounts and the place you could find them in your space.

Conclusion

Getting your checking account terminated could make it difficult to get accepted for one more conventional checking account. The excellent news is that you’ve loads of choices!

You’ll be able to open a second probability checking account that may supply numerous the identical advantages as a conventional checking account and get your funds again so as very quickly.

Chime is a monetary expertise firm, not a financial institution. Banking providers and debit card issued by The Bancorp Financial institution, N.A. or Stride Financial institution, N.A.; Members FDIC. Credit score Builder card issued by Stride Financial institution, N.A.

1Eligibility necessities apply. Overdraft solely applies to debit card purchases and money withdrawals. Limits begin at $20 and could also be elevated as much as $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal charges might apply besides at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Money deposit or different third-party charges might apply.

3Prospects are restricted to 3 $1,000 money deposits at Walgreens every day and $10,000 every month.

4Typically instantaneous transfers could be delayed. The recipient should use a sound debit card to assert funds. See your issuing financial institution’s Deposit Account Settlement for full Pay Mates Transfers particulars.

5The Annual Share Yield (“APY”) for the Chime Financial savings Account is variable and should change at any time. The disclosed APY is efficient as of November 17, 2022. No minimal steadiness required. Will need to have $0.01 in financial savings to earn curiosity.

6Early entry to direct deposit funds is determined by the timing of the submission of the fee file from the payer. We usually make these funds obtainable on the day the fee file is obtained, which can be as much as 2 days sooner than the scheduled fee date.