[ad_1]

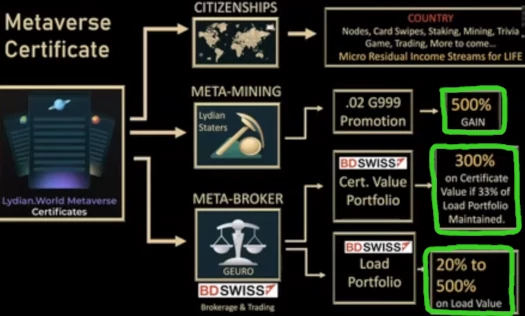

When GSPartners unveiled its “metaverse certificates” Ponzi scheme final Might, BDSwiss was offered as a buying and selling associate.

When GSPartners unveiled its “metaverse certificates” Ponzi scheme final Might, BDSwiss was offered as a buying and selling associate.

So the ruse went, BDSwiss was buying and selling invested funds in order that GSPartners may pay out as much as 480% yearly.

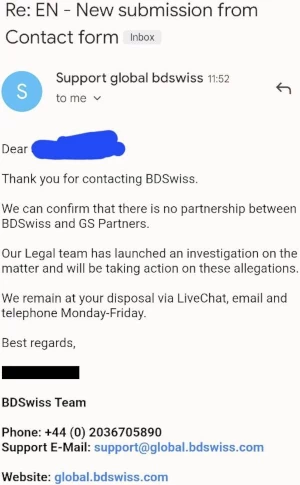

Now, roughly eight months into the purported association, BDSwiss deny any partnership existed.

A BehindMLM reader reached out to BDSwiss to question why the dealer, which claims to do $84 billion in common month-to-month buying and selling quantity, had partnered up with a Ponzi scheme.

Right here’s the response from BDSwiss World Assist;

Right here’s the response from BDSwiss World Assist;

We will verify that there isn’t any partnership between BDSwiss and GS Companions.

Our authorized group has launched an investigation on the matter and will likely be taking motion on these allegations.

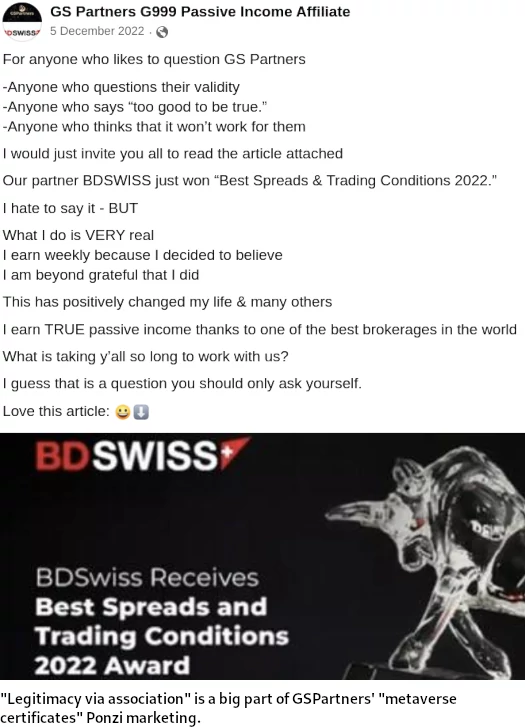

BDSwiss has featured closely in GSPartners’ metaverse certificates Ponzi promotion.

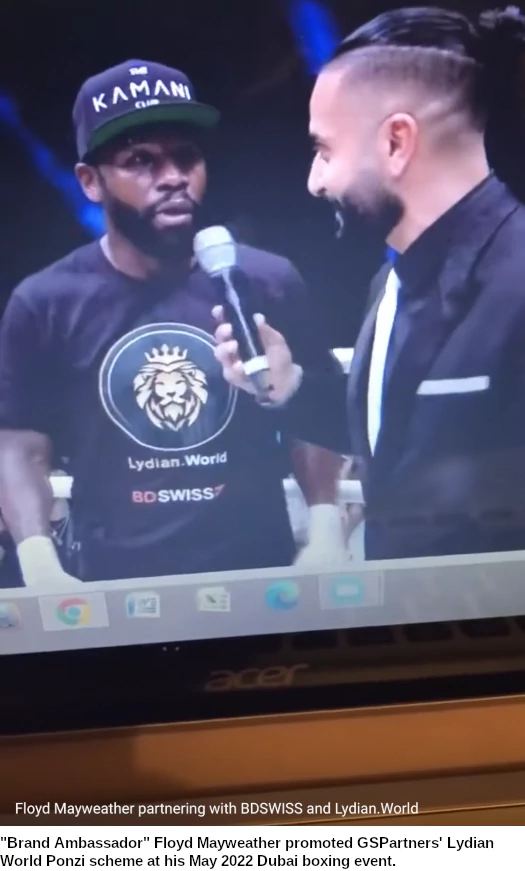

In Might 2022, a purported BDSwiss government appeared on stage at a GSPartners occasion to verify and market the partnership.

Placing apart it has no bearing on GSPartners committing securities fraud, BDSwiss being registered with monetary regulators was a serious promoting level.

And that promoting level has been parroted by GSPartners associates seeking to recruit new victims:

It’ll be attention-grabbing to see if something comes of BDSwiss’ authorized investigation.

This isn’t the primary time GSPartners has landed in scorching water for fabricating company partnerships.

Certainly one of GSPartners’ prior Ponzi schemes, JONE tokens, was pitched on a supposed partnership between GSPartners and Accor Group.

Accor Group owned Movenpick Resorts and Flats, which GSPartners represented it had purchased a collection of residences from in Dubai. The ruse was that GSPartners would break up the floorspace into tokens, promote these to affiliate buyers, and generate exterior income through leases.

Upon studying of the supposed partnership, Accor Group confirmed GSPartners was not approved to promote their property.

GSPartners’ Dubai-based property developer was additionally despatched a stop and desist. In spite of everything this performed out, GSPartners’ JONE Ponzi fizzled out and was by no means talked about once more.

Getting again to BDSwiss, with the dealer out of the image GSPartners’ metaverse certificates exterior income ruse falls aside.

We all know new funding is what funds metaverse certificates withdrawals (that’s at all times been the enterprise mannequin), however i’ll be attention-grabbing to see whether or not a brand new ruse surfaces now that BDSwiss are out.

Previous to metaverse certificates GSPartners was flogging LYS tokens and G999. LYS has collapsed to beneath $10 and G999 to $0.0019.

The metaverse certificates Ponzi is run by yet one more token, GEUR. GSPartners represents GEUR is pegged to the euro.

The issue is GEUR doesn’t exist exterior of GSPartners, so In actuality nonetheless it’s pegged to new funding.

Pending any additional updates, we’ll preserve you posted.

[ad_2]

Supply hyperlink