Getting a small private mortgage could be a improbable approach to begin repairing below-average credit or to assist enhance the variety of your credit score. Nevertheless, determining how one can get one among these loans within the first place in case you have below-average credit might sound intimidating. In any case, in case you have troubled credit score, getting any sort of mortgage might show to be harder.

Fortunately, there are particular forms of loans which might be particularly designed that will help you construct your credit score. You’ll be able to usually qualify for them even when you would not have a credit score historical past and in case your credit score is poor. These loans are known as (you guessed it!) credit score builder loans.

Credit score Builder Loans for Dangerous Credit score or No Credit score

Apply for a Credit score Builder Account at this time!

Self Credit score Builder Account

Credit score builder loans are a novel manner for many who have below-average credit to rebuild their credit score. One credit score builder mortgage that might be just right for you is the Credit score Builder Account from Self.

Credit score builder loans are a novel manner for many who have below-average credit to rebuild their credit score. One credit score builder mortgage that might be just right for you is the Credit score Builder Account from Self.

There are three issues to know in regards to the Self Credit score Builder Account. First, all of it begins with an easy approval and plan choice course of with no credit score examine required. For those who choose to undergo Self, you will want to have a checking account, debit card, or pay as you go card, and ChexSystems report.

Second, when you’re accepted, you construct your credit score and financial savings on the similar time by making on-time funds every month. Self reviews these funds to the credit score bureaus, constructing your cost historical past — which makes up 35% of your credit score rating.

Lastly, on the finish of your plan, you get the cash you have got saved again — minus curiosity and costs.

Selecting A Plan That Matches Your Finances

If you join a Credit score Builder Account, you’ll want to find out which of Self’s 4 plans is greatest for you. place to start out is to contemplate how a lot cash you possibly can comfortably afford to place away every month.

Small Builder |

Medium Builder |

Giant Builder |

X-Giant Builder |

$25/mo |

$35/mo |

$48/mo |

$150/mo |

| for twenty-four months | for twenty-four months | for 12 months | for 12 months |

| Complete funds: $600 | Complete funds: $840 | Complete funds: $576 | Complete funds: $1800 |

| Get again: $520 | Get again: $724 | Get again: $539 | Get again: $1663 |

| APR: 15.92% | APR: 15.97% | APR: 15.67% | APR: 15.91% |

| Get began | Get began | Get began | Get began |

Curiosity and Charges

Curiosity is constructed into the funds you make every month towards your Credit score Builder Account. That manner, you possibly can concentrate on crucial factor: staying on time every month, so you possibly can keep away from any potential late charges and maintain constructing credit score.

As for charges, we like the truth that the Self Credit score Builder Account comes with only a few (and extremely clear) charges. There’s one charge that’s unavoidable and that’s a one-time, non-refundable $9 administrative charge you pay while you open your account.

One other charge you may come throughout is an expedited cost charge, if you choose to pay with a debit card. This charge varies relying on which Credit score Builder Account you join. For those who pay straight from a checking account there is no such thing as a cost processing charge. Clearly, that’s the best way to go.

Self additionally doesn’t routinely cost late cost charges. If you’re late on a cost, you get a 15-day grace interval. Afterward, you do need to pay a charge equal to about 5% of your month-to-month cost.

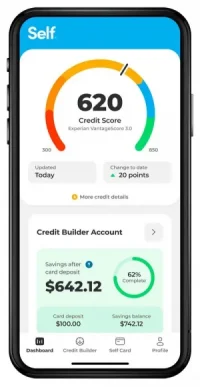

Handy App

To remain on prime of your credit score, you possibly can obtain the Self app, which comes at no further value and is obtainable for iOS and Android. You’ll be able to monitor your rating, make funds, examine in in your financial savings progress, and extra, all out of your cellphone.

Construct Credit score With 3 Main Credit score Bureaus

Self sends info to all three credit score bureaus each month while you make an on-time cost, which lets you construct credit score over a interval of 12 or 24 months. That is roughly on par for many credit score constructing loans, but it surely’s good to have assurances from Self that each one three of the foremost credit score bureaus will find out about your monetary habits.

Unlock the Self Visa® Credit score Card

As if that wasn’t sufficient, Self additionally provides qualifying prospects the power to unlock a secured bank card. To qualify, you must make three on-time month-to-month funds, have no less than $100 in financial savings in your Credit score Builder Accountand maintain your account in good standing. When you do, you turn out to be eligible for a secured Visa bank card that ties straight into your credit-building efforts.

Over 1,000,000 folks have signed as much as construct their credit score and financial savings concurrently with Self. Possibly you must, too.

Apply for a Self Credit score Builder Account Immediately!

What Are Credit score Builder Loans?

Credit score builder loans are a kind of mortgage the place the financial institution holds onto the cash borrowed whilst you make funds on it, thus, constructing your credit score within the course of. Usually, these loans are possibility for many who are in want of credit score restore or those that are simply beginning to construct their credit score.

Your credit score rating is essential in at this time’s world. And not using a good rating, it will likely be troublesome to get bank cards, loans for automobiles, houses, and extra. These kind of loans may help to make sure you are on the best path. The quantity of the mortgage will range however is usually between $500 and $1,500.

There are two normal forms of credit score builder loans—secured and unsecured.

Loans Secured by Funds

For those who get one among most of these loans, you’ll not obtain the cash instantly. As a substitute, the cash is put into an account that you’re not capable of entry.

This may be a financial savings account or a certificates of deposit. You’ll then make month-to-month funds on the mortgage. After you have got paid the mortgage in full, the cash will then be launched so you need to use it.

Loans Secured by Collateral

One other sort of secured mortgage is one which’s secured with collateral. The collateral may very well be cash or a automobile, for instance. You might then obtain cash and be required to repay the mortgage, together with the curiosity by the tip of the mortgage time period.

If you don’t pay, you’ll then need to give up the collateral to the lending establishment. This has a bit extra threat with it since you could possibly lose your property.

Unsecured Loans

There are alternatives for unsecured credit score builder loans, as properly. Nevertheless, these are more durable to qualify for as a result of they’re riskier to the lender. Getting accepted will usually depend on your credit score historical past.

When you’ve got a considerably tarnished historical past you are attempting to enhance, you may get accepted. When you’ve got horrible credit score, although, possibilities of approval are slim. Remember that the rates of interest on these loans will usually be greater than utilizing a secured credit score builder mortgage, as properly.

The place to Discover Credit score Builder Loans

Now that you’ve got a greater thought of what credit score builder loans are and the way they work, you’re most likely questioning the place yow will discover them. You aren’t usually going to seek out these by the large banks.

Nevertheless, you possibly can usually discover them by group banks, nonprofits, and credit score unions. They aren’t closely marketed, although, so that you may not notice that your credit score union even has this feature. Oftentimes they are going to be known as one thing else similar to “Beginning Over Loans” or “Contemporary Begin Loans.”

If you’re already a member of a credit score union or a group financial institution, get in contact with them and ask if they provide credit score builder loans. In the event that they don’t, it would be best to open an account with one which does have this feature.

Remember that many occasions, you will want to have an account in good standing with them for a number of months earlier than you possibly can apply for a credit score builder mortgage. Ask them about their necessities.

Take a while to discover the entire completely different out there choices, and take into account Self, which is a web based supplier of credit score builder loans. There are alternatives on the market, however they aren’t all the time simple to seek out. Put in some research and discover a answer that may work in your wants.

Tips on how to Qualify for Credit score Builder Loans

It isn’t normally too troublesome to qualify for credit score builder loans. Nevertheless, the necessities for qualification will differ from one lender to the subsequent. For those who discover which you could’t qualify by one lender, seek for one other. There are alternatives out there for nearly everybody.

When going by a financial institution or a credit score union, you will want to indicate that you’ve got proof of secure residence, regular employment, and no current overdrafts to your account. As talked about, you’ll doubtless must have had an account with them for a number of months. For those who choose to undergo Self, you will want to have a checking account, debit card, or pay as you go card, and ChexSystems report.

As you possibly can see, you don’t need to have an ideal credit score rating for most of these loans. In any case, the aim is that will help you construct and strengthen your credit score. It wouldn’t be honest or make sense when you had been required to have good credit score earlier than getting one among these loans.

What Do Credit score Builder Loans Value?

One of many essential issues to recollect is that there are prices related to most of these loans. Naturally, the price varies from lender to lender.

Usually, in case you are getting a secured mortgage, the rates of interest will probably be underneath 10%. For those who get an unsecured mortgage, the rates of interest may very well be as excessive as 30%. There are additionally administration charges to contemplate.

Though you’re paying curiosity, whether or not you get one of many credit score builder loans by Self, a financial institution, or a credit score union, it’s nonetheless serving to your credit score to enhance.

Which means that when you take out a conventional private mortgage later, the upper credit score rating you obtain from the credit score builder mortgage will, in flip, scale back your rates of interest going ahead. Paying curiosity to start out constructing credit score rating is price it.

After all, if you find yourself getting a credit score builder mortgage, you don’t need to need to pay a ridiculous quantity of curiosity. Spend time evaluating the assorted lenders you’re contemplating to see which of them have essentially the most favorable charges.

How Credit score Builder Loans Assist Enhance Your Credit score

You may be questioning simply how most of these loans will enable you to construct your credit score. It’s comparatively easy. If you take out one among these loans, the lender will report your cost historical past to the three credit score bureaus every month. This can present that you’ve got a mortgage and that you’re making the funds on time.

For those who don’t have a lot in the best way of credit score, reporting will enable you to get on the credit score map. These with no credit score will begin with a FICO Rating XD. This rating is supplied by FICO and principally makes use of various sources to generate a credit score rating for many who don’t have any credit score historical past.

After six months of getting the mortgage, you’ll obtain a conventional FICO Rating. A VantageScore ought to present a rating after 30 days.

Those that are attempting to enhance their credit score will discover that making the funds will assist them to see a lift of their rating. After all, there’s no approach to know the precise variety of factors that the rating will enhance.

Remember that for credit score builder loans to be just right for you, you want to be paying on time. Don’t be late on these funds. Having below-average credit is worse than not having any credit score in any respect. For those who get behind on one among these loans, even a secured mortgage, it should find yourself dropping your rating additional.

At all times Ask

At all times be sure to double-check and ask to see whether or not they report back to the bureaus every month. In the event that they don’t, then it’s not a credit score builder mortgage and it’ll not do your credit score rating any good. It merely means you’re paying on a mortgage and it isn’t doing something for you.

Professionals and Cons of Credit score Builder Loans

Let’s look at the nice and the unhealthy related to secured and unsecured credit score builder loans.

Secured Credit score Builder Loans

Professionals

- You do not want to have good credit score, or any credit score, to qualify for the mortgage

- Rates of interest are decrease on these than they’re with unsecured credit score builder loans

- Making funds on time will enable you to enhance your credit score

- Since that is an installment mortgage, it may possibly assist along with your credit score combine

Cons

- You would not have entry to the funds as a result of they’re frozen in a financial savings account or certificates of deposit—you possibly can’t entry them till the entire funds have been made.

- The rates of interest are decrease, however you’re nonetheless basically paying cash to enhance your credit score rating.

Unsecured Credit score Builder Loans

Professionals

- You get the mortgage funds instantly

- On-time funds assist enhance your credit score

- You’ll enhance your credit score combine since that is an installment mortgage

Cons

- When you’ve got no credit score or below-average credit, it may be troublesome to get

- The rates of interest are greater than with secured credit score builder loans

5 Ideas for Making Credit score Builder Loans Work for You

There are some nice advantages to utilizing credit score builder loans, however they aren’t with out their drawbacks, as you have got seen above. Listed below are some suggestions that may assist to make sure you are getting essentially the most out of your mortgage.

Tip #1: Select a Secured Credit score Builder Mortgage

Except there’s a necessity for money instantly, it’s higher to go for a secured credit score builder mortgage than an unsecured one. Though it’s good to have the funds launched to you instantly, the rates of interest of an unsecured mortgage could also be too excessive.

Whether or not you safe the mortgage with your personal cash or use a fund-secured mortgage, you’ll save on curiosity and nonetheless construct your credit score with out the chance.

You need to be sure to’re getting an precise credit score builder mortgage. Title loans and payday loans usually are not credit score builder loans. They don’t report back to the credit score bureaus except you don’t pay and default on the mortgage. These are dangerous and so they don’t do something for you, so keep away from them.

Tip #2: Know What You Are Signing

At all times take the time to just remember to learn by the contract and that you understand what you’re signing. It’s worthwhile to know:

- Rate of interest

- Month-to-month cost quantity and date

- Size of the mortgage

- What the general value will probably be

- Late cost charges

- When late funds are reported to the credit score bureaus

- What occurs when you default on the mortgage

Tip #3: At all times Pay on Time

That is important. It’s worthwhile to pay on time every month. Even in case you have only a single late cost, there’s the potential that it may possibly drop your credit score rating by as a lot as 100 factors. Whereas this may not appear honest, it’s the system that’s in place. At all times pay on time or it should come again to hang-out you.

For those who fear that you simply may not be capable to pay the mortgage on time, it’s higher to carry off on getting one among these loans till you’re extra financially secure.

Tip #4: Don’t Pay It Off Early

You may be in monetary place and be tempted to repay your credit score builder mortgage early. It is a unhealthy thought. Despite the fact that you may save on curiosity, you’ll scale back the variety of funds you make, which signifies that your credit score rating is not going to enhance as a lot because it may.

This recommendation is just for these credit score builder loans. With conventional loans or bank cards, it’s all the time a good suggestion to repay your debt as quickly as you possibly can.

Tip #5: Get a Secured Credit score Card

Credit score builder loans are nice, however you possibly can enhance your credit score rating additional while you additionally get a secured bank card.

This supplies you with extra alternatives for on-time funds, and it’ll enhance your credit score combine. The playing cards require a deposit, but it surely’s normally only a couple hundred {dollars}. They’re simple to make use of and could be a main profit.

Takeaway

It’d take you a while to construct your credit score, however you are able to do it, even in case you have no credit score or horrible credit score proper now. Use the ideas on this article that will help you get on the trail to raised credit score. It’ll make an enormous distinction in your future.