Bank cards can oftentimes be helpful monetary instruments if used accurately. They can be utilized to finance giant purchases you don’t have the money for or pay for emergency bills when you have just a few days to go till payday. With that being stated, it may be very tough to get a bank card when you have a subpar or nonexistent credit score rating.

Most bank card firms solely lengthen new bank card affords to these with truthful to glorious credit score. If in case you have weak credit or no credit score in any respect, it’s possible you’ll solely discover bank card affords with costly charges, excessive rates of interest, and different unfavourable qualities.

Fortunately, there are some exceptions. It’s attainable to get a good bank card with weak credit or no credit score – you simply must know the place to look. Right here’s a breakdown of the very best bank cards for weak credit or no credit score. There’s certain to be an choice that may fit your wants!

Get a bank card at this time!

The Finest Credit score Playing cards for Unhealthy Credit score or No Credit score

Sable ONE Secured Credit score Card | Our Prime Decide

When you concentrate on secured bank cards, you normally take into consideration excessive charges and low spending limits. However the Sable ONE Secured Credit score Card does a terrific job at eliminating each of these negatives whereas additionally touting some superb positives.

When you concentrate on secured bank cards, you normally take into consideration excessive charges and low spending limits. However the Sable ONE Secured Credit score Card does a terrific job at eliminating each of these negatives whereas additionally touting some superb positives.

First, Sable ONE makes it straightforward to use and their 98% acceptance fee is extraordinary. It’s an awesome card for rebuilding broken credit score as a result of there’s no credit score verify and Sable ONE studies your exercise and balances to every of the credit score bureaus each month.

There aren’t any month-to-month or annual charges and the Sable ONE offers rewards of 1 – 2% money again on all of your purchases.

- NO credit score verify or US credit score historical past required

- NO SSN required for non-US residents

- NO month-to-month or annual charges

- FREE smartphone app rated 4.8 out of 5.0 by over 400,000 customers

- Takes solely 3 minutes to use

- As much as $10,000 credit score restrict

- Earn 2% money again on on a regular basis purchases at Amazon, Uber, Uber Eats, Complete Meals, Netflix, Spotify, and extra! Plus, earn 1% money again on all different purchases.

- Get a dollar-for-dollar match on all money again on the finish of your first yr with Sable Double Money Bonus.

- Graduate to an unsecured bank card in as little as 4 months (3X quicker than wherever else)

How The Secured Card Works

If you arrange your account, you’ll must deposit cash from a checking account to your Sable ONE account. Should you switch $500, your Sable ONE credit score restrict might be $500. When it comes time to pay your bank card invoice, you’ll pay it out of your checking account, not the deposit quantity.

If you arrange your account, you’ll must deposit cash from a checking account to your Sable ONE account. Should you switch $500, your Sable ONE credit score restrict might be $500. When it comes time to pay your bank card invoice, you’ll pay it out of your checking account, not the deposit quantity.

If you wish to make a fee lower than the total quantity due, you can also make a minimal fee of a minimum of $25. Sable will cost you curiosity on the unpaid portion of prime curiosity + 6.99% (at present 11.74%). That’s one of many lowest bank card rates of interest we’ve ever seen.

If you wish to improve your restrict, you possibly can deposit more cash out of your checking account. Your deposit quantity might be returned for those who want to shut your account or scale back your credit score restrict sooner or later.

Sable’s Commencement Promise

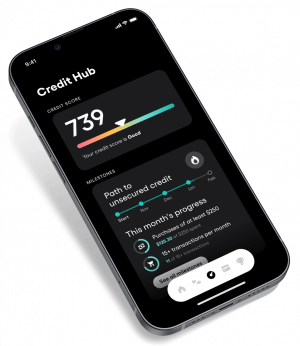

Numerous secured bank cards promise the power to maneuver to an unsecured bank card sooner or later, however they do a horrible job at explaining how to do that. One in all Sable’s best options is its guided path to commencement.

You get clear steerage by means of tangible milestones to unlock unsecured credit score. Sable makes this journey straightforward to know and fully clear. That is why graduating to unsecured standing can occur in as little at 4 months.

Money Again and Premium Advantages

There are solely a handful of secured bank cards that provide a cashback program and we actually just like the one supplied by Sable. You’ll be able to earn 2% again on purchases at Amazon, Uber, Uber Eats, Complete Meals, Netflix, Spotify, and a number of different retailers. On all different purchases, you obtain 1% money again.

You additionally get premium advantages like cellphone safety (together with cracked screens), automotive rental insurance coverage protection, double the unique producer or retailer guarantee, assured value safety, and a 90-day new buy insurance coverage.

The Utility Course of

Getting a Sable ONE card is simple. Most candidates have a social safety quantity and proof of deal with by means of a driver’s license or ID card. Should you don’t have these types of identification, you’ll want your passport, your US deal with, and your US Visa or Non-Vacationer I-94 Visa waiver.

The Sable ONE Secured Credit score Card is a best-of-breed credit score constructing card. It studies your exercise to all three credit score bureaus, supplies very robust money again and premium advantages, and permits you complete management over your account from the comfort of your smartphone. It comes with our highest suggestion.

Get a Sable ONE Account Right this moment!

Credit score Scores Defined

A credit score rating is an estimation of your creditworthiness. Consider it as a math-based abstract of your earlier monetary behaviors, calculated in order that lenders (like banks and credit score unions) know the way possible it’s that you simply’ll pay again a future mortgage.

What Elements Go Into Your Credit score Rating?

Credit score scores are affected by a number of elements, together with:

- Cost Historical past: Your entire funds made on traces of credit score similar to a bank card, mortgage, or debt.

- Credit score Utilization: The quantity of revolving credit score you’ve gotten used compared to the whole quantity you’ve gotten accessible.

- Credit score Combine: The various kinds of credit score accounts you’ve gotten (bank cards, auto loans, and so on).

- Size of Credit score Historical past: The period of time through which you’ve had a credit score account in good standing.

- New Credit score: Inquiries for brand spanking new traces of credit score that present up in your report.

By analyzing this data, the three massive credit score bureaus – Experian, Equifax, and TransUnion – create credit score scores. Then banks, lenders, credit score unions, and different organizations can estimate what sort of borrower you’ll be once you apply for a mortgage or bank card.

When Do You Get a Credit score Rating?

You obtain an preliminary credit score rating after you make your first bank card fee. Your rating goes up for those who pay your payments on time, don’t take out too many loans or get too many bank cards without delay, and follow different constructive monetary habits. On the flip aspect, your credit score rating can lower for those who miss funds, open a number of new bank cards, and so forth.

What Counts as a “Good” or “Unhealthy” Credit score Rating?

Credit score scores are damaged down into a number of classes. Every class can differ barely from credit score bureau to credit score bureau, however they’re all roughly the identical.

- 300-579 – Poor

- 580-669 – Truthful

- 670-739 – Good

- 740-799 – Excellent

- 800-850 – Glorious

The upper your credit score rating is, the higher bank cards and mortgage affords you’ll obtain. These affords normally include low rates of interest, little to no charges, and a myriad of different advantages. The alternative is true in case your credit score rating is low. Low credit score scores solely qualify you for the worst bank cards, loans, and different traces of credit score.

3 Issues to Look For in a Credit score Card

As you possibly can see from the record above, there are many stable bank cards on the market even when you have weak credit or no credit score in any respect. Nonetheless, you’ll must know the way to decide on between these playing cards so you choose the absolute best choice. Listed here are three issues to search for and evaluate.

1. Curiosity Fee

The rate of interest, additionally generally represented because the Annual Proportion Fee (APR), is how a lot cash the financial institution, lender, or bank card issuer costs every billing cycle. The rate of interest is predicated on the remaining steadiness of your bank card.

For instance, say that you’ve got a bank card with a steadiness of $150. The rate of interest on the cardboard is 10%. That implies that when the following billing cycle begins, the bank card issuer will add $15 to the steadiness, making your complete steadiness $165 as a substitute of $150.

The rate of interest is how bank card issuers and different lenders earn money from lending to debtors. Typically, it’s a good suggestion to select the very best bank card with the bottom rate of interest attainable. That manner, you pay much less for utilizing the bank card in the long term.

2. Charges

Some bank cards include charges. Annual charges are the most typical. These might be wherever from $20 to upwards of $100 and are due annually you retain a bank card account open. After all, the very best bank cards for weak credit may have no or low annual charges.

Some playing cards even have late charges. These solely kick in for those who miss a fee. Though you must attempt to not miss a fee in any respect, it is perhaps a good suggestion to use for a bank card with no late charges simply in case.

3. Rewards

Some bank cards for unhealthy or no credit score might include rewards, similar to 1% money again on choose purchases in sure classes. Rewards gained’t make or break a card when the aim is to construct credit score, however they may also help you select between two very related playing cards.

Credit score Playing cards for Unhealthy Credit score or No Credit score Q&A

When you’ve gotten weak credit or no credit score in any respect, making the choice to use for a bank card is necessary. Listed here are a few generally requested questions that can assist you make the very best determination attainable.

What Are the Advantages of Credit score Playing cards for Unhealthy Credit score?

Bank cards for weak credit have a number of benefits that make them extra accessible for folk with low or no credit score, together with:

- Simpler approval necessities, similar to decrease credit score rating thresholds and (doubtlessly) no obligatory credit score verify.

- Can be utilized to enhance credit score scores over time.

- Many supply credit-building instruments, like free entry to your credit score rating, autopay instruments, and extra.

What Are the Downsides to Credit score Playing cards for Unhealthy Credit score?

Some bank cards for weak credit have notable downsides that make them less-than-ideal choices. These embrace:

- Fewer rewards or much less spectacular rewards in comparison with different playing cards.

- Larger than common rates of interest. Thus, those that use bank cards for weak credit will normally find yourself paying extra in the long term than those that use playing cards with excessive credit score rating necessities.

- Doubtlessly increased charges, like annual charges and late charges.

- Safety deposit necessities. This sometimes solely applies to secured bank cards. However it may be a tough monetary hurdle to beat for folk with low or no credit score.

Who Ought to Apply for Credit score Playing cards for Unhealthy Credit score?

Bank cards for weak credit are perfect for two completely different shoppers:

- Individuals who wish to rebuild their credit score. For instance, for those who have been just lately affected by chapter, you’ll must rebuild your credit score to take out loans sooner or later. Bank cards for weak credit are good instruments for this function, particularly “credit score builder playing cards” or secured playing cards.

- Individuals with out credit score scores. These are most frequently younger adults or youngsters simply moving into the world of credit score. It’s powerful to qualify for good loans and playing cards with none credit score rating, and bank cards for weak credit or no credit score may also help you get began from the bottom up.

How Ought to You Use a Credit score Card for Unhealthy Credit score?

After getting a bank card for weak credit, you must use it rigorously and properly. Having a bank card open is a chance to spice up your credit score rating by means of cautious purchases and funds.

For instance, you should utilize a bank card for weak credit by making an inexpensive buy, like $50 on the grocery retailer. After utilizing the cardboard, pay that $50 off in the identical week or any time earlier than your invoice is due. In doing this, you’ll present the credit score bureaus you can be trusted to borrow cash and repay it again promptly. Don’t misuse your bank card or miss funds. This can solely lower your credit score rating and make it even tougher so that you can get good bank cards sooner or later.

It’s additionally a good suggestion to regulate your credit score rating. Your bank card issuer might supply credit score checking capabilities, through which case it is possible for you to to observe your credit score rating usually without spending a dime. Most bank card issuers additionally embrace instruments like autopay. Autopay is phenomenal for rebuilding your credit score since they routinely take cash out of your checking account and put it towards your bank card with out you having to carry a finger. It’s one of the best ways to make sure you by no means miss a bank card fee!

Conclusion

As you possibly can see, you continue to have choices for good bank cards even when you have weak credit or no credit score in any respect. Make sure to examine every card’s options, rate of interest, and different components earlier than making use of. Then keep in mind to make use of the bank card properly so you possibly can enhance your credit score rating and get even higher playing cards sooner or later!