Your credit score rating is a quantity assigned to you between 300 and 850 that bank card suppliers and lenders use to find out how financially reliable you might be. Many elements have an effect on your credit score rating, however unpaid money owed, particularly people who seem as assortment accounts in your credit score report, are essentially the most influential. The typical credit score rating for a US citizen in 2021 was 714, as reported by FICO, one of many main credit score analytics firms. A rating above 700 is mostly considered “good.”

Checking your FICO rating in addition to studying your credit score experiences from the three main credit score reporting companies (CRAs)—Equifax, Experian, and TransUnion—helps you determine what to do to enhance your credit score rating. All US residents and everlasting residents can request a free copy of their report every year from every of the credit-reporting bureaus. By spacing your requests 4 months aside, you’ll get common updates. In case your rating dips, look to see if any collections have appeared in your report. These are unpaid money owed that the lending firm has handed on to a debt assortment company. Collections can have a devastating affect in your credit score rating, limiting your potential to mortgage a home, finance a automotive, and even discover a job.

What are Collections on Your Credit score?

When a compensation you owe is 180 days or extra late, the corporate you owe the cash to will shut the account (that is referred to as a “charge-off”). A charge-off signifies that the creditor or lender doesn’t consider you’ll pay and gained’t waste any extra time or sources chasing your debt. Nevertheless, this doesn’t allow you to off the hook. The corporate will go the debt on, both to its in-house collections division or to an outdoor company specializing in debt assortment.

From that second on, all of your credit score experiences will embody a line about how a lot cash you have got in collections accounts. And, if the corporate you owed cash to initially has bought the debt to a set company, there’ll be not only one however two unfavourable objects in your report: one for the charge-off and one for the collections account. This might trigger your credit score rating to drop by 100 factors or extra.

You Have Adverse Assortment Gadgets on Your Report—What Now?

You’re unlikely to get an account in collections eliminated out of your credit score report except the lender has reported the unpaid debt inaccurately (an error like this may very well be the results of identification theft—when somebody steals your account particulars and makes use of them to spend in your credit score as in the event that they had been you). This is only one (essential!) purpose why it is best to examine your credit score experiences usually. You’ll be able to spot and contest any errors in your credit score as quickly as they seem. In case you discover errors, learn up on learn how to take away unfavourable objects from credit score after which take motion.

With round 29% of firms checking the credit score experiences of potential workers, having unfavourable objects on yours may elevate crimson flags and cease you from touchdown your dream job—particularly if the position entails dealing with cash. Even unpaid medical payments may rely in opposition to you. There’s a widespread false impression that medical money owed don’t matter as a lot as a result of they’re handled in a different way; nevertheless, they’ll nonetheless present up as unfavourable objects in your report and can have an effect on your FICO rating if left unpaid.

Eradicating or Disputing a Assortment

In case you consider {that a} lender or credit score supplier has made a mistake in reporting you for non-payment, you possibly can dispute the account in collections and attempt to have the unfavourable merchandise eliminated out of your report.

We’ve damaged this course of down into 4 steps: The primary is crucial. The three that observe are numerous approaches you possibly can take.

-

Confirm that the unfavourable merchandise is inaccurate

Examine your monetary data and credit score experiences fastidiously. Have a look at the dates of all of your previous funds on the related account and determine the place the error occurred, as exactly as you possibly can. You also needs to request a debt validation letter from whichever firm owns the debt now, whether or not that’s nonetheless the unique lender or a debt assortment company. A debt validation letter is a written discover that collectors and assortment companies are required by legislation to provide you, stating how a lot you owe together with another particulars associated to the debt.

In case you nonetheless assume the unfavourable merchandise is an error, you possibly can file your dispute with the related CRA on-line (by way of its web site) however doing so makes your case tougher to trace. In case you ship your dispute by mail, alternatively, you’ll create a helpful paper path. Ensure you maintain dated copies of all of the letters you ship and use registered mail. You’ll discover a template for a dispute letter on the Federal Commerce Fee’s web site. Our pattern negotiation letters for goodwill deletions, debt validation, and extra, may also be useful.

If it seems that the gathering account in your report is correct, it’s nonetheless price having a go at having it eliminated, although your probabilities of success are restricted. You possibly can, for instance, ask for a “goodwill deletion.” That is when the corporate that owns the debt (not the CRA) removes the merchandise. Typically, a lender or creditor will do that provided that you’ve settled the debt and don’t have a historical past of spotty credit administration. You can even attempt negotiating with debt collectors, saying that you simply’ll repay the quantity if they comply with delete the merchandise (that is referred to as a “pay-to-delete” association).

However keep in mind that almost all assortment companies have contracts with the CRAs obliging them to report credit score information precisely. If the credit score bureaus see too many deletions from sure collectors, they could cease doing enterprise with them. As a result of all assortment companies wish to keep away from this state of affairs, they’re prone to say no in the event you request a pay-to-delete deal.

Though we don’t advocate not paying your money owed as a technique, it’s a indisputable fact that late repayments, also called delinquencies, fall off your credit score report after seven years. You probably have a couple of late cost, the seven years begin from the date of the primary late cost. Moreover, even when the unique lender has bought the debt to a set company, the seven-year interval begins on the date of the primary late cost, not from the date on which the company took the debt. So, say you haven’t made a compensation that was due in April 2015 and one other that was due in October 2015—the delinquency will not present up in your report after April 2022.

However the truth that the delinquency gained’t present up after seven years doesn’t absolve you of the debt. You’ll at all times owe it till it’s settled. It’s simply that almost all assortment companies will surrender chasing you for cost after seven years, as they will not report the debt.

How Assortment Accounts Harm Your Credit score Rating

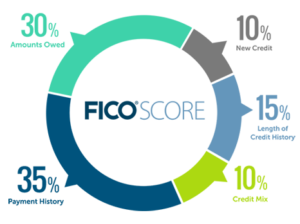

FICO scores are detailed assessments of your monetary reliability. They encompass an amalgamation of a number of items of information. FICO categorizes this information into 5 sorts: quantities owed (30%), new credit score (10%), size of credit score historical past (15%), credit score combine (10%), and cost historical past (35%).

Quantities Owed

It’s not essentially a foul factor to be in debt in the event you’re maintaining with repayments. A very powerful factor is to not be overextended so as to reliably meet your compensation obligations.

You have to be conscious of your credit score utilization charge: the decrease that is, the higher. Your charge is the overall sum of money you owe divided by your whole credit score restrict. So, in the event you owe $10,000 and the credit score restrict of all of your playing cards mixed is $20,000, then your credit score utilization charge will likely be 50%. Typically, it’s a good suggestion to maintain your credit score utilization charge beneath 30%.

New Credit score

The extra accounts you open in a brief time frame, the riskier you’ll appear to lenders. New accounts will decrease your common account age, which might injury your rating. Additionally, once you apply for a brand new mortgage or credit score account, lenders run laborious inquiries in your credit score report—this negatively impacts your FICO rating, too.

Size of Credit score Historical past

Generally, the longer you’ve been utilizing credit score, the higher—so long as your credit score historical past reveals immediate funds relatively than delinquencies.

Credit score Combine

It is a calculation primarily based on the several types of credit score you employ: bank card accounts, mortgages, retail retailer playing cards, auto loans, scholar loans, and so forth. Typically, having a wide range of strains of credit score and maintaining repayments on all of them offers impression to lenders and raises your credit score rating.

Fee Historical past

Your monitor report of repayments makes up 35% of your credit score rating—it’s an important issue. Having accounts in collections will negatively have an effect on this a part of your rating. The quantity by which a collections account will drag your rating down is dependent upon how excessive your rating was to start with.

A rating within the 700s will likely be rather more negatively affected by a collections account than one within the 500s. The injury to your rating additionally is dependent upon which scoring mannequin you seek the advice of—some newer scoring fashions don’t embody collections accounts that had been ultimately paid off within the rating calculation.

Methods to Bounce Again After a Assortment Incident

In case you’ve acquired a collections account, don’t despair! Credit score restoration remains to be attainable.

Pay Up

In case you’ve checked all of the related data and discover that you could’t dispute the account, one of the best factor to do is pay the debt. Though this gained’t make it easier to within the brief time period, ultimately it’ll enhance your credit standing. In any case, a paid account appears a lot better in your report than an unpaid one.

Settle the Account

In case you’re struggling financially, you possibly can contact the creditor to ask in the event you can settle the account. Which means that the creditor accepts a smaller proportion of the cost since you pay it immediately. A debt settlement also can damage your credit score rating, nevertheless it’s higher than having a collections account in your report.

Keep on Prime of Bills

You probably have different strains of credit score, be sure you don’t accrue any extra missed funds. Having some optimistic data in your credit score report will assist to stabilize your rating. It’s possible you’ll want to draw up a strict funds or arrange computerized funds. You can even look into debt consolidation as an choice for simplifying your accounts.

Get a Secured Credit score Card

You possibly can additionally open a secured bank card account—that’s a bank card that requires a deposit matching your credit score restrict. So, for a restrict of $300, you’ll have to put down the identical quantity to get the cardboard within the first place. In case you don’t sustain with repayments, the credit score supplier will maintain the $300 as collateral to cowl what you owe.

Making common bank card funds on this sort of account will reveal your potential to vary your compensation habits. Follow utilizing your secured card just for small purchases which can be straightforward to repay every month. The aim of this card is to not accrue extra unpayable debt however to construct a optimistic credit score historical past.

One factor to look out for—some secured bank cards include excessive charges that eat into your deposit. Ask the supplier about this earlier than you apply.

Monitor Your Credit score Repeatedly

One of the best ways to make sure your credit score rating climbs and stays excessive is to concentrate on what it’s and of what lenders have been reporting about your credit score exercise. Examine your rating usually with FICO and the opposite credit score analytics firms. Request a full credit score report each 4 months from one of many main CRAs to view all the main points.

Rent a Credit score Restore Company

Credit score restore will be tough and time-consuming to do by yourself, so that you may discover it useful to have an skilled skilled by your aspect. If that is you, do your analysis fastidiously to seek out the finest credit score restore firms.

Unhealthy Credit score Loans

You’ll be able to nonetheless get loans even you probably have spotty credit, though they’re prone to include larger rates of interest. A number of firms supply secured loans (for which you need to put down collateral similar to a home or automotive to be authorized). You can even try our picks for the finest debt consolidation loans, the place you amalgamate all of your money owed into one to make it simpler to pay them off.

Remaining Ideas on Assortment Accounts on Your Credit score

Restoring your credit score rating to good well being after you’ve had accounts in collections requires loads of effort and time. However with dedication and accountable administration of your funds, it’s attainable to rebuild credit score. Our prime suggestions for when you end up in a spotty credit state of affairs are:

- Pay or settle any excellent money owed which have moved to collections

- Examine your credit score rating and skim your credit score experiences usually

- Carry on prime of your bills going ahead

- Take into consideration hiring the companies of a good credit score restore company.