Should you’re seeking to purchase a house and resolve to finance it by means of a mortgage, it’s necessary to grasp that your credit score rating will affect your capability to get one in addition to what charges you’ll qualify for. Ought to your credit score be broken, you could be considering there’s no means so that you can obtain house possession.

Fortunately, there are easy methods to enhance your credit score when you’re devoted to creating it occur and keen to be affected person.

What’s the Mortgage Course of?

The very first thing you should perceive is what the mortgage course of entails and the way to get accredited. If you begin looking for a house, it’s necessary to know what worth vary you’ll be capable to look in. Many people discover it useful to get prequalified or to get a house mortgage pre-approval earlier than they start looking for a home.

Whereas a prequalification or preapproval isn’t an official supply, it can provide you an concept of what quantity you’ll be accredited for, the forms of packages you should utilize, and what your charges could also be. Similar to they do throughout the precise approval course of, throughout pre-approval a lender will have a look at varied elements like your earnings, credit score rating, and debt-to-income ratio.

If you wish to get one of the best deal attainable in your mortgage and know your credit score rating is in want of assist, it’s sensible to start out the method of repairing it earlier than you attain the pre-approval stage of your own home shopping for journey.

How Are Credit score Scores Calculated?

Should you’re making an attempt to enhance your credit score rating, it’s a must to begin by understanding how credit score scores are calculated and what areas to concentrate on, in addition to the truth that you may have multiple credit score rating and that totally different lenders will have a look at totally different scores.

Components which might be usually utilized in rating calculation embody the size of your credit score historical past, what number of credit score accounts you may have open versus the age of these accounts, and the way a lot credit score you may have used versus what you may have accessible (also called your credit score utilization). Your credit score scores can be impacted by late or missed funds and what number of inquiries into your credit score rating have been made by lenders.

Components which might be usually utilized in rating calculation embody the size of your credit score historical past, what number of credit score accounts you may have open versus the age of these accounts, and the way a lot credit score you may have used versus what you may have accessible (also called your credit score utilization). Your credit score scores can be impacted by late or missed funds and what number of inquiries into your credit score rating have been made by lenders.

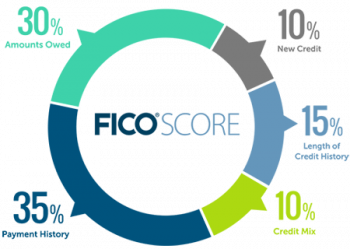

In line with Experian, a very powerful issue of your FICO credit score rating is your cost historical past, adopted by the quantities you owe to collectors. After that, the size of credit score, the combination of credit score sorts, and any new credit score have an effect on how your credit score is scored, although their impacts are a lot much less important.

As soon as calculated, credit score rating ranges are used to point out whether or not a credit score rating is poor, truthful, good, superb, or distinctive. Whereas this rating is much less helpful than understanding your precise credit score rating, it may be helpful data for monitoring how your credit score constructing or restore efforts are going.

5 Credit score Restore Tricks to Know Earlier than Shopping for a House

With an understanding of credit score scores and the way they’re used within the house shopping for course of, you’ll be able to start to think about one of the best choices for enhancing your credit score. Listed below are 5 issues to know.

Tip #1: Know and Monitor Your Credit score Scores

There isn’t any means to enhance your credit score when you don’t know what your rating is or in case your efforts are rising it. Fortunately, there are various locations the place you will get your credit score rating. For instance, when you at present have a bank card, at the least one among your credit score scores will usually be included in your month-to-month assertion.

There are additionally free credit score monitoring providers you should utilize, comparable to CreditWise and Credit score Karma. It’s additionally necessary to needless to say these scores might not be completely correct with reference to what lenders see, however the scores proven on these providers are a good way to maintain up with adjustments in your scores and see the place your efforts are getting you.

It’s additionally necessary to request your full credit score studies. Yearly you’ll be able to request your credit score studies totally free on AnnualCreditReport.com. The Shopper Monetary Safety Bureau recommends you order from the three credit score bureaus (Experian, Equifax, and TransUnion) separately so you’ll be able to proceed to watch your credit score report all year long.

Should you’ve used your whole free studies and need to examine once more throughout the 12-month interval, you should purchase extra studies; federal legislation caps expenses from the credit score bureaus to $13.50 per report.

Tip #2: Pay Off Your Current Money owed

Excellent debt is without doubt one of the most necessary issues to handle if you wish to elevate your credit score rating. Should you monitor your credit score studies, you’ll have a stable concept of what you owe and to whom. It is best to make word of what money owed are nonetheless owned by the unique creditor and which have been bought to a set company.

Collections can have a bigger affect in your credit score as a result of it permits debt to remain in your credit score report for longer. If in case you have money owed in collections and may’t afford to pay them off in full, it may be a wise concept to barter with debt collectors. This may embody arranging for a cost plan or settling with the lender to take a partial cost.

In a settlement, the quantity is normally solely barely decrease than the unique debt. The draw back to settling is that the account received’t be eliminated out of your credit score report, nevertheless it’ll have much less of an affect. Additionally, when you do select to barter with debt collectors, at all times be certain that to get your settlement in writing.

Snowball Technique vs. Avalanche Technique

For money owed nonetheless with the unique lender, you’ll have to resolve on a debt reimbursement technique. The most typical methods are generally known as the debt snowball and the debt avalanche methodology.

First, the debt snowball methodology requires that you just have a look at the quantities of your money owed and manage them from smallest to largest quantity. Then, you begin paying off your whole money owed. Whereas sustaining the minimal month-to-month funds on your whole different money owed, you’ll concentrate on paying off the smallest debt by paying as a lot as you’ll be able to each month. As soon as that debt is paid off, you begin over with the following smallest quantity and proceed till they’re all paid.

Subsequent, the debt avalanche methodology is comparable, however you’ll manage your money owed by rates of interest from highest to lowest. Then, you’ll repay your money owed beginning with a concentrate on the one with the very best rate of interest whereas sustaining your whole minimal month-to-month funds. When that’s paid off, you progress to the following highest rate of interest and proceed on till you’re completed with funds.

Each strategies have their benefits. Utilizing the debt avalanche methodology is a great transfer as a result of you find yourself saving cash on curiosity. Nonetheless, when you’re an individual who feels motivated by accomplishments, the debt snowball methodology might be an excellent match for you as you’ll be able to examine gadgets off your record earlier than with the debt avalanche methodology.

Tip #3: Maintain Future Funds On-Time

Late funds have the biggest destructive affect in your credit score rating. If in case you have bad credit report, then ensuring future funds aren’t late is without doubt one of the most necessary issues you are able to do. Many payments have an autopay choice and opting into it’s one of the best ways to keep away from late funds. Payments that don’t have autopay would require planning.

Begin by what quantity you’ll have to pay every month and account for this in your month-to-month funds. You also needs to discover a methodology of reminders that works finest for you. This may increasingly contain writing them on a bodily calendar or setting an alert in your telephone. Should you can afford it, hiring an account supervisor or cash supervisor will help to make sure you don’t miss funds, as they’ll be dealing with them for you.

Typically you’ll be able to’t keep away from late funds. If you’ll be unable to pay on time, you’ll be able to attain out to the supplier to make a particular association or apply for emergency help. Or, when you’re already late on a cost you must attempt to keep away from lacking a whole cycle. Delinquency received’t be reported till you’re greater than 29 days late. So, talk together with your lenders, attempt to make the cost earlier than the lender studies to credit score bureaus, and resume on-time funds as shortly as you’ll be able to.

Tip #4: Take into account if Debt Consolidation Is Proper for You

Debt consolidation is the method of getting a brand new line of credit score to repay your present money owed. This sometimes entails getting a mortgage however is typically completed utilizing a stability switch bank card. Many private loans can be used for this objective.

It is best to solely think about debt consolidation if it’ll take you greater than a yr to repay your present money owed. That is additionally an choice to think about in case your credit score is healthier now than while you bought the opposite strains of credit score that you just’re now seeking to consolidate.

Relying in your credit score rating, you’ll be able to presumably get a decrease rate of interest than you bought out of your earlier lenders, which can prevent cash over time. It might additionally enable you a decrease month-to-month cost and show you how to get out of debt by permitting you to repay the brand new mortgage quicker.

Consolidation may scale back your credit score utilization and assist you to have on-time funds reported to credit score bureaus, thus elevating your credit score rating. The flip aspect is that some loans could include extra charges (comparable to mortgage origination charges). You would additionally threat the next rate of interest in case your credit score is worse than it was while you took out the outdated loans or injury your credit score rating additional when you miss funds on the brand new mortgage.

Tip #5: Construct on a Skinny Credit score File

The explanation why the age of your credit score accounts impacts your rating is that lenders favor to supply loans to debtors with a confirmed historical past of paying their money owed again on time. If in case you have restricted or no credit score historical past, or have a report that exhibits main delinquency, a secured bank card is usually a good choice for you. When individuals consider bank cards, they sometimes image what is called an unsecured card. A secured card is the place a lender offers you a line of credit score primarily based in your perceived creditworthiness.

An unsecured card works equally in that it permits you to purchase issues now and pay for them later over time. Nonetheless, secured playing cards require you to make an preliminary deposit from a checking account. Sometimes your credit score restrict for these playing cards is the same as the quantity of the deposit that you just make. The lender will maintain this accretion in an account, comparable to a certificates of deposit, as collateral.

Should you fall behind on funds, the lender will take the deposit and shut the account. This reduces the danger for the lender, and due to that, the approval necessities for these playing cards are a lot much less strict. When the account the deposit is in matures, you’ll get your deposit again. Oftentimes, at this level, the lender will assist you to improve to an unsecured card primarily based in your cost historical past, credit score rating, and earnings at the moment.

Takeaway

Your credit score rating is a vital think about giant purchases that require loans, particularly while you’re making an attempt to purchase a home. In case your credit score is broken, it could actually really feel like getting a mortgage is ceaselessly out of attain. Fortunately, with some work and a while, you’ll be able to restore your credit score and get accredited for a mortgage that may assist you to purchase your dream house.