[ad_1]

One of many items in GSPartners’ new Meta Certificates Ponzi puzzle is GS Chain.

One of many items in GSPartners’ new Meta Certificates Ponzi puzzle is GS Chain.

Evidently for a while now, GSPartners has been awarding LSC shares based mostly how a lot associates invested. They’re now being doshed out as a recruitment incentive.

GS Chain is a UK incorporation, which in and of itself is nothing outstanding. Corporations Home indicators off on fraud on a regular basis.

GS Chain can also be nonetheless listed on the London Inventory Change.

In no way itself an indication of legitimacy, how Josip Heit fooled the LSE into itemizing his shell firm is nonetheless value documenting.

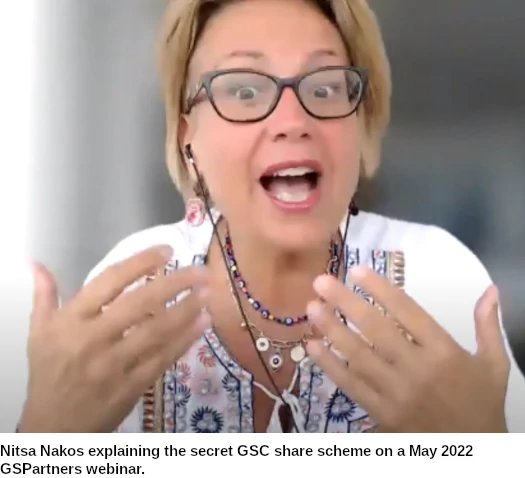

In response to Canadian GSPartners promoter Nitsa Nakos, GSPartners associates have been beforehand awarded LSC shares based mostly on how a lot they invested.

That not too long ago modified to associates being awarded GSC shares based mostly on investor recruitment.

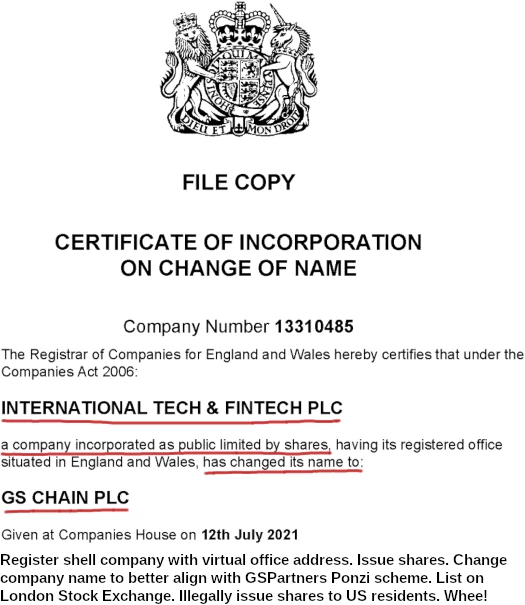

To fly below the regulatory radar, GS Chain was initially included as Worldwide Tech & Fintech PLC. Josip Heit fronted £1,049,900 to get the ball rolling. On paper although this was paid by his employed shareholders.

Worldwide Tech & Fintech PLC was included by way of a UK digital workplace handle.

Leon Filipovic (proper), by way of the identical digital handle, was listed as the corporate’s sole Director.

Leon Filipovic (proper), by way of the identical digital handle, was listed as the corporate’s sole Director.

Filipovic isn’t some random Heit plucked out of skinny air.

From 2016 to 2018 he was the top of compliance and CFO for IFLS Company Providers Ltd and from 2018 and 2019 Mr. Filipovic was answerable for training in blockchain know-how and improvement of buying and selling software program for the Pameroy Group. Extra not too long ago, from 2019 to 2021 he was head of software program improvement for BL Enceladus Ltd.

IFLS Company Providers and Pameroy Group focus on aiding acquisition of monetary licenses in jurisdictions the place regulation is lax to non-existent.

IFLS Company Providers Ltd is the world’s market chief for the acquisition of monetary licenses. Asset Administration, Foreign exchange, Brokerage, Fee Providers, Crypto ICO launches or Hedge Funds are typical actions IFLS’ clientele is conducting.

Greater than 700 efficiently established monetary entities over the past 15 years within the Seychelles, Vanuatu, Georgia, Czech Republic, Belize, Panama or New Zealand ought to replicate our professionalism not like no different supplier available on the market.

PAMEROY MANAGEMENT LTD is the world’s main acquirer for monetary licenses and operates within the Comoros, Vanuatu, the Marshall Islands, The Republic of Georgia, the Cook dinner Islands, Seychelles, Belize, St. Vincent and the Grenadines, Bahamas, Singapore, Hong Kong, Malaysia and Gibraltar.

There seems to be a hyperlink between the 2 firms, with the textual content “IFLS Company Providers Ltd: Register 99123” showing on Pameroy Group’s web site.

Pameroy claims its “focus is on the European Market, particularly the German talking nations”. Though he’s from Croatia, Josip Heit lived in Germany for many years earlier than relocating to Dubai final yr.

Pameroy establishing shell firms within the Comoros of is specific curiosity. In mid 2021 BehindMLM documented GSB Gold Customary Financial institution’s bogus Mwali banking license.

Mwali is a part of the Union of the Comoros. GSB Gold Customary Financial institution is a German shell firm throughout the GSPartners Ponzi scheme.

Pameroy additionally units up shell firms “in Kazakhstan for entrepreneurs who want to supply Foreign exchange, Crypto and Fee Processing.”

Tying all of this collectively is an October 2020 press-release, titled “G999: Josip Heit and the GSB Gold Customary within the cosmos of the blockchain monetary trade“;

GSB Gold Customary Banking Company AG (GSB), one among Germany’s main software program, IT and block chain teams, has launched an unprecedented know-how that makes transactions of crypto currencies a lot simpler and above all a lot sooner.

GSB Gold Customary Banking Company AG is an unbiased firm, the group consists of GSB Gold Customary Pay KB (Sweden), GSB Gold Customary Financial institution Ltd. (Comoros Union), GSB Gold Customary Pay Ltd. (Kazakhstan).

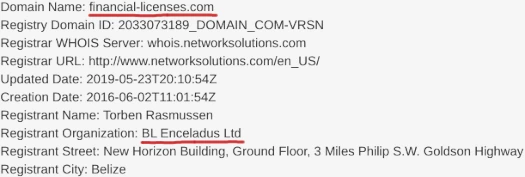

Filipovic’s final cited gig was at BL Enceladus Ltd. They seem to have renamed themselves “BL Group” and “BL Company Providers” in mid 2021.

BL Group and BL Company companies run “financial-licenses.com”, by way of which they supply “offshore monetary licenses of any type”.

Kazakhstan once more pops up on the BL Group’s Monetary Licenses web site:

Maybe you’re recognizing the sample in Filipovic’s employment historical past. Why Heit acquired Filipovic to entrance the Worldwide Tech & Fintech PLC shell incorporation must be apparent.

Filipovic represents he was from Croatia. Heit can also be from Croatia, so there is perhaps an extra private connection there.

Worldwide Tech & Fintech PLC was included on April third, 2021. Worldwide Tech & Fintech PLC rapidly acquired itself an organization registration quantity and Authorized Entity Identifier.

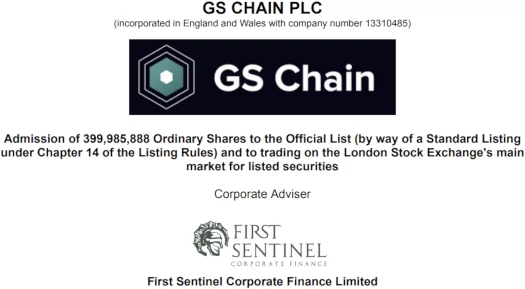

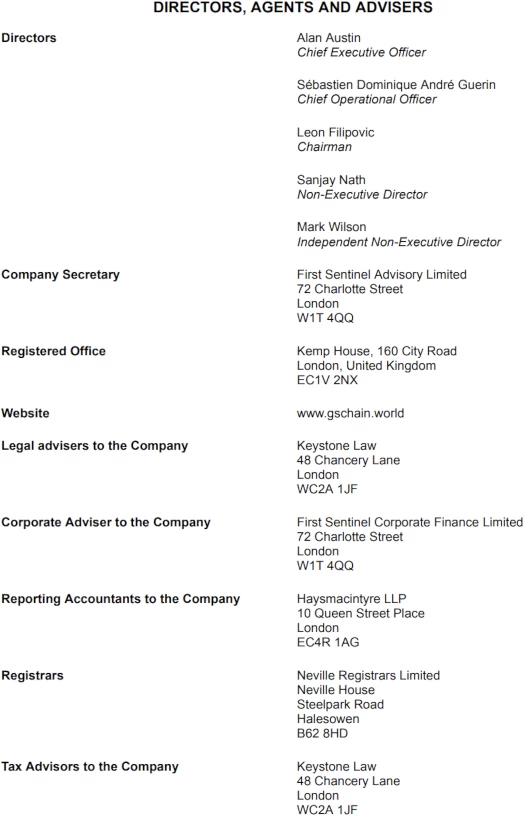

To maintain his title off the books, Heit (possible not directly) employed the UK agency First Sentinel to help.

As per their web site, First Sentinel

specialises in company and business regulation, in addition to company finance regulation, for SMEs, pre-IPO and listed firms.

That final half match into Josip Heit’s plans for Worldwide Tech & Fintech PLC.

First order of enterprise was altering Worldwide Tech & Fintech PLC’s title to GS Chain PLC. That passed off through a ninth July decision.

First Sentinel Advisory Restricted was appointed as a Secretary of PLC on July 14th.

A GS Chain PLC buying and selling certificates was obtained on July twenty eighth.

His job carried out establishing Heit’s shell firm, Leon Filipovic and his UK shell firm GS&IB Fintech LTD have been terminated as Director and Secretary, on thirtieth September and twenty ninth September respectively.

That to not say Filipovic cashed out and parted methods. He stayed on as GS Chain PLC’s Chairman and, at the very least on paper, owns 28.3% of GS Chain PLC shares.

Sébastien Dominique André Guerin, GS Chain’s COO, owns one other 28.3%. Guerin is a Director/Associate in Josip Heit’s GSB Gold Customary Company AG German shell firm.

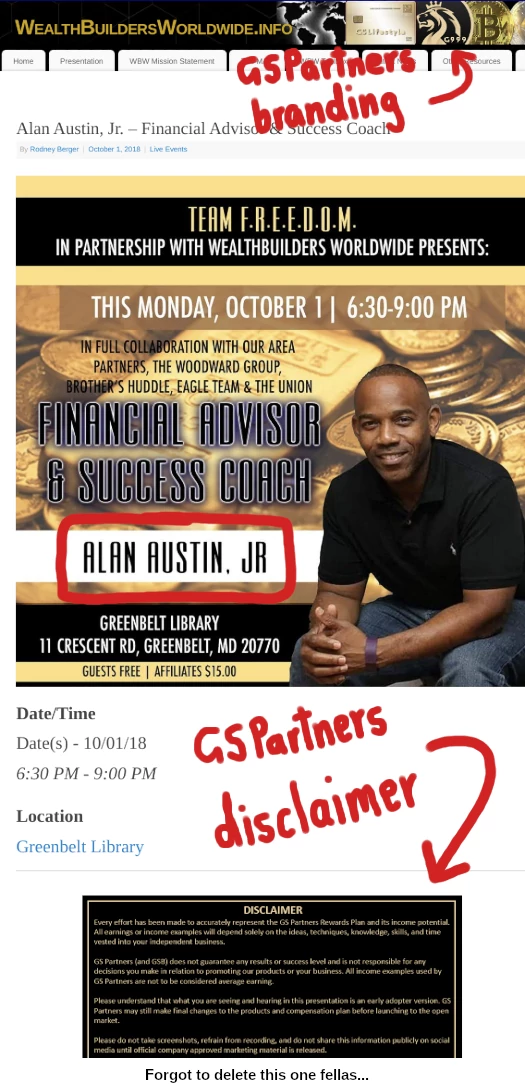

Right here I’ll briefly point out GS Chain’s appointed CEO, US citizen and resident Alan Austin.

Not surprisingly, Austin is a GSPartners investor:

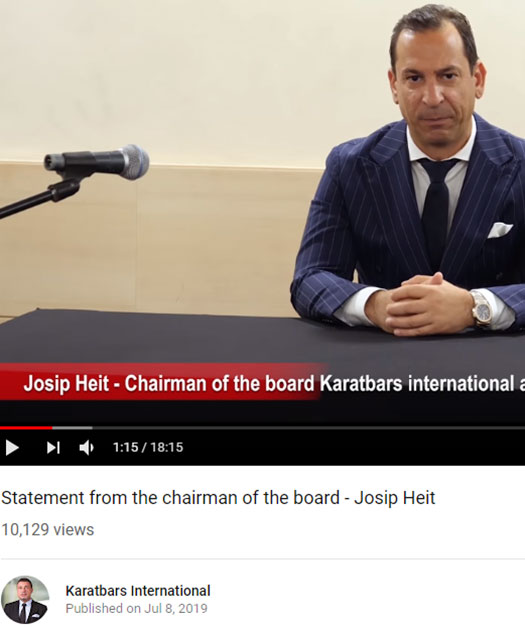

Austin is an OG Harald Seiz period Ponzi promoter, courting again to Karatbars:

Karatbars Worldwide in fact being the place Josip Heit’s MLM crypto Ponzi scamming started.

Austin is joined on GS Chain’s government board by Sanjay Nath, a Director/Associate in yet one more of Josip Heit’s shell firms GSB Gold Customary PLC:

Nath (proper) holds 2.25% of GS Chain’s shares. Nath’s son and daughter maintain 0.25% every respectively.

Nath (proper) holds 2.25% of GS Chain’s shares. Nath’s son and daughter maintain 0.25% every respectively.

Regardless of GSPartners associates purportedly being points GS Chain shares connected to their investments, none of them are recorded in GS Chain’s monetary filings.

The mob that signed off on all this nonsense was UK accounting agency Haysmacintyre LLP.

GS Chain PLC’s shell firm filings stopped on December nineteenth, 2021. For extra data we flip to GS Chain’s prospectus.

Right here we discover GS Chain’s shell firm cowl;

The Firm intends to establish alternatives throughout the know-how sector, to conduct the required due diligence and subsequently full an Acquisition.

Whereas the Administrators will think about a broad vary of know-how sectors, these which the Administrators imagine will present the best alternative and which the Administrators will initially concentrate on embody the usage of applied sciences in actual property, banking, finance, fintech,

telecommunications, automotive and blockchain industries.

However in fact, being a shell firm created for the only objective of furthering GSParner’s Ponzi scheme by way of securities fraud;

The Firm has not but commenced operations, apart from in respect of its proposed itemizing.

The Firm has no working enterprise and has not but recognized any potential goal firm or enterprise for an Acquisition.

The Firm has no working enterprise and at the moment, there are not any plans, preparations or understandings with any potential goal firm or enterprise concerning an acquisition.

The Firm is not going to generate any revenues from operations until it completes an Acquisition.

And until Heit has GS Chain “purchase” one among his different shell firms, or vice-versa, that’s unlikely to vary. All of the funding fraud motion goes down at GSPartners and Lydian World.

With the ruse in place and the London Inventory Change none the wiser, GS Chain submitted its software for a public itemizing.

It’s anticipated that Admission will turn into efficient and that dealings in Extraordinary Shares will begin at 8.00 a.m. on 13 Might 2022.

The London Inventory Change web site permits to substantiate GS Chain shares have been certainly issued on Might thirteenth.

Funnily sufficient, with none enterprise operations or income, the shares have gone from 3.63 GBP to five.45 GBP as of Might thirtieth.

Additionally funnily sufficient, the entire listed GS Chain shares have been traded “off-book”.

In gentle of nearly all of GSPartners traders being US residents and the corporate doshing out GS Chain shares to prime traders and now prime recruiters, the next disclosures in GS Chain’s potential are of serious significance.

The Extraordinary Shares haven’t been and won’t be registered below the US Securities Act of 1933, as amended (the “Securities Act”), or the securities legal guidelines of any state or different jurisdiction of america or below relevant securities legal guidelines of Australia, Canada, Japan or the Republic of South Africa.

Topic to sure exceptions, the Extraordinary Shares will not be, provided, bought, resold, transferred or distributed, straight or not directly, inside, into or in america or to or for the account or advantage of individuals in america, Australia, Canada, Japan, the Republic of South Africa or every other jurisdiction the place such supply or sale would violate the related securities legal guidelines of such jurisdiction.

What’s the purpose of stating that if, by way of digital shares or in any other case, you’re going to go forward and do the other?

Right here SimilarWeb’s present web site statistics for GSPartners’ and Lydian World’s respective web sites:

It’s inconceivable that no person from the US or South Africa doesn’t personal GS Chain shares. You’re not going to seek out any direct paper proof of that for the LSE to uncover, however we’ll once more depend on statements made by GS Companions promoter Nitsa Nakos a number of weeks in the past;

Due to the particular relationships that Gold Customary Chain firm has with GS Companions (Editor: in that they’re each owned by Josip Heit), it signifies that the members of GSPartners have a possibility to obtain gifted shares.

Now within the first wave we acquired gifted shares for product acquisition (Editor: investing) and for gross sales efforts (Editor: recruiting traders).

Now within the second wave and with us already now being listed, we will likely be receiving shares for gross sales efforts (Editor: recruiting traders).

There’ll not be shares issued for product acquisition.

And if you happen to’re questioning why Heit goes to a lot effort to masks doshing out GS Chain shares to US residents, once more of whom make up nearly all of GSPartners affiliate traders, look no additional than GS Chain’s prospectus;

The Extraordinary Shares haven’t been authorized or disapproved by the US Securities Change Fee, any State securities fee in america or every other US regulatory authority, nor have any of the foregoing authorities handed remark upon or endorsed the of this Doc.

Any illustration on the contrary is a legal offence in america.

As they usually do with securities fraud, the UK authority answerable for reviewing GS Chain’s itemizing software absolves itself of any duty.

IT SHOULD BE NOTED THAT THE UK LISTING AUTHORITY WILL NOT HAVE THE AUTHORITY TO (AND WILL NOT) MONITOR THE COMPANY’S COMPLIANCE WITH ANY OF THE LISTING RULES WHICH THE COMPANY HAS INDICATED IN THIS DOCUMENT THAT IT INTENDS TO COMPLY WITH ON A VOLUNTARY BASIS, NOR TO IMPOSE SANCTIONS IN RESPECT OF ANY FAILURE BY THE COMPANY TO SO COMPLY.

The FCA have jurisdiction…

HOWEVER THE FCA WOULD BE ABLE TO IMPOSE SANCTIONS FOR NON-COMPLIANCE WHERE THE STATEMENTS REGARDING COMPLIANCE IN THIS DOCUMENT ARE THEMSELVES MISLEADING, FALSE OR DECEPTIVE.

However… effectively, for probably the most half they’re hopeless. Heit selected the UK to fraudulently situation shares from for a cause.

Because it stands each individual and firm on this checklist is not directly complicit to the fraud being perpetrated by way of GSPartners, Lydian World and GS Chain:

How complicit is as much as an investigating authority to find out, be it within the UK or US. Heit runs GSPartners from and spends most of his time in Dubai.

Dubai is the MLM crime capital of the world. There’s diddly-squat probability of authorities there doing something.

[ad_2]

Supply hyperlink