In immediately’s world, you want a credit score report back to get a mortgage, take out a mortgage and, generally, even to safe a job. This implies it’s by no means been extra essential to test whether or not the main points held about your monetary historical past are right.

Fortunately, each US citizen is entitled to at least one free credit score report a yr (and in the course of the pandemic, it’s one per week) from every of the three main credit-reporting companies. You may submit a request in your credit score report on-line or by dialing a toll-free telephone quantity. If you happen to select the web methodology, you’ll get entry to your report instantly. By telephone, it normally takes as much as 15 days.

However what if you happen to benefit from this service and your report incorporates errors? Your finest guess is to lift the problem with the corporate that created it as quickly as doable.

On this article, we’ll lay out file a dispute with Experian, one of many three huge credit score bureaus.

A Information to Errors in Credit score Stories

Errors in credit score stories are extra frequent than you would possibly assume. A research by the Federal Commerce Fee confirmed that 20% of individuals discovered errors on their stories from no less than one of many three main credit score bureaus. And round 5% of those have been inaccuracies that might severely have an effect on an individual’s remaining credit score rating.

As Howard Shelanksi, director of the FTC Bureau of Economics, explains, “The outcomes of this first-of-its-kind research make it clear that customers ought to test their credit score stories repeatedly. In the event that they don’t, they’re doubtlessly placing their pocketbooks in danger.”

Why Your Credit score Report May Include Errors

Compiling a credit score report entails an organization like Experian contacting all of the lenders you’ve borrowed from within the final seven years. It should test how promptly you have been capable of repay your money owed and, if you happen to’ve defaulted on any funds, it will present up in your report.

Nevertheless, collectors may need incorrect details about your monetary historical past as a result of:

- Your information was combined up with another person’s (this may occur if an organization has a number of shoppers with the identical identify).

A thief has stolen your id and run-up credit score in your identify. - In the event that they aren’t investigated and resolved, these kinds of conditions can simply injury your monetary popularity. And that’s why it’s so essential to test your credit score stories repeatedly and problem something that doesn’t look proper.

- You may file disputes with Experian totally free. However remember that if the data is confirmed correct after opening a dispute, it may’t be eliminated out of your credit score report.

Varieties of Errors to Watch Out For

If you obtain your credit score report, test the next fastidiously:

- All private info—be careful for misspelled names, improper account numbers, or incorrect IDs

- Balances and cost dates—evaluate these towards your personal data

- Any accounts you’ve had within the final seven years—test that none of those are lacking

- Accounts you’ve already closed—ensure none are proven as nonetheless open

- Names linked to accounts—you is perhaps listed as an account’s proprietor whenever you’re simply a licensed consumer

- Balances and credit score limits of accounts—these is perhaps incorrect

- The identical debt or account showing greater than as soon as within the checklist

- Variety of years recorded—the report ought to cowl solely the final seven years

What to Do if You Discover Inaccurate Data in Your Credit score Report

First, resolve the way you wish to proceed. You may both file a dispute on-line or by mail. Most authorized specialists say the latter is safer, because it means you possibly can preserve a paper path and show all of the actions you’ve taken.

How you can File a Dispute with Experian On-line

Utilizing Experian’s web site is the quickest and simplest way of disputing your credit score report.

To do that:

- Go to the web dispute heart and click on “Begin a brand new dispute on-line.”

- Learn via the report and select which entry you wish to dispute. You’ll probably discover these within the part marked “Doubtlessly Destructive.”

- Utilizing the dropdown field, decide the rationale for the dispute. It’d ask you to enter further info or add supporting paperwork. Assessment the dispute and click on “Submit.” You’ll then see a affirmation web page and a hyperlink to add your paperwork.

- Look ahead to Experian to contact you. The corporate will ship an electronic mail to let you already know the standing of the dispute, in addition to notify you about its growth. (If Experian doesn’t handle to resolve the dispute inside 30 days, the entry you’ve disputed will likely be deleted.)

- Verify the “Accomplished” part of the dispute heart to see the outcomes.

Professionals and Cons of Submitting a Dispute with Experian On-line

- That is the quickest strategy to start the dispute course of.

- You may simply add scanned copies of paperwork.

- You may test the progress of the dispute out of your pc or machine in only a few clicks.

- You do not get receipts for sending paperwork, which could be essential at a later stage to show you’ve got opened a dispute and adopted all crucial steps on time.

- Firms like Experian are sometimes overwhelmed with on-line disputes and should not prioritize yours.

- This methodology can find yourself being slower than mailing if the corporate dismisses your dispute and you find yourself having to ship a letter anyway.

How you can File a Dispute with Experian Credit score Reporting by Mail

You would possibly really feel that opening a dispute through snail mail is the most secure possibility. Whereas that is usually a slower course of than submitting a report on-line, it may find yourself being simpler as a result of it entails sending paper copies of your paperwork. The corporate can’t ignore a letter if in case you have a receipt to show that you just despatched it; the corporate is legally obliged to comply with up with you on the contents of the letter.

To open a credit score report dispute with Experian by mail it is best to:

- Obtain this printable type, which is able to take you thru the data you must present.

- Fill in your private particulars, together with:

- Your contact info (full identify, deal with, and phone quantity)

- Your date of beginning

- Your Social Safety quantity (if you happen to don’t have one, write that on the shape)

- All addresses you’ve lived at in the course of the previous two years

- A replica of a government-issued ID, akin to a driver’s license

- A replica of a monetary assertion from a service supplier or an insurance coverage assertion

- Fill out a separate field for every dispute. Use the primary field to point if any of your private info is inaccurate.

- Embrace copies (not originals—they will’t be returned) of any paperwork that may help your dispute.

- Mail the shape and documentation to Experian, P.O. Field 4500, Allen, TX 75013. Ensure to ship it by licensed mail and preserve your receipt—chances are you’ll want to offer proof later that you just despatched the paperwork and of the date on which you probably did.

- Ask for a return receipt so you possibly can show that the corporate obtained the paperwork.

- For extra help and recommendation, try this information from the Shopper Monetary Safety Bureau, which features a useful template for disputes.

Professionals and Cons of Submitting a Dispute with Experian Credit score Reporting through Mail

- You may preserve a paper path with dated receipts for all of the paperwork you ship.

- The corporate is legally obliged to contact the collectors associated to the dispute. If the dispute is verified, you will by no means must see this info once more on future credit score stories.

- It is advisable to be ready to reply promptly and have the required paperwork copied and able to ship as quickly as you open the dispute.

- This methodology is extra time-consuming and laborious as you will have to scan, print, and bodily ship all the required paperwork.

Data to Present When Submitting a Dispute

In addition to all the private info listed above, you’ll want to produce:

- Your report affirmation quantity

- All account numbers for any disputed entries

- A replica of the unique credit score report that features the data you imagine is inaccurate

- Copies of any paperwork that may help your declare

- The date on which you opened the dispute (on the primary letter or type you ship)

How Lengthy Credit score Reporting Bureaus Should Resolve Your Dispute

Experian has 30 days from the date you open the dispute to attempt to confirm the data you’ve challenged in your report. They need to both show that it’s right or take away it whether it is inaccurate. If the corporate hasn’t made a correction or verification after 30 days, the Honest Credit score Reporting Act (FCRA) offers you the precise to sue.

What to Do if Your Closing Credit score Report Is Unhealthy

Credit score Restore

If in spite of everything that, you’ve a low credit score rating, all is just not misplaced. It’s doable to restore your score with the next strategies:

Begin making funds on any excellent money owed. Create a timeline and finances to assist with this.

Hold paid-off accounts open. Although you would possibly wish to take away temptation by chopping up your bank cards when you’re out of debt, having no less than one account that’s not within the minus figures can increase your credit standing.

Resist taking out any new loans. This may make you appear extra unreliable to lenders.

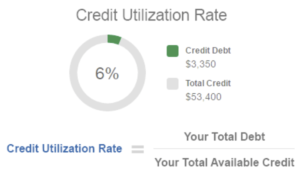

Get to know your credit score utilization ratio. That is the quantity you owe in comparison with how a lot credit score is accessible to you. To make this calculation, merely divide your general debt by the entire of all of your credit score limits and multiply it by 100 to get a proportion. A charge under 30% is taken into account acceptable.

Picture from: https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/credit-repair/

How you can Enhance Your Credit score Report

Owe a manageable amount of cash? You could possibly think about taking out a debt consolidation mortgage. If you happen to go down this route, your new lender will group all of your current money owed collectively and anticipate a single cost, normally month-to-month.

To get a debt consolidation mortgage, you’ll want credit standing. If yours is any decrease than 670, you’ll probably get lumbered with an especially high-interest charge. That is one more reason why it’s so essential to research your personal credit score stories and repair any errors earlier than permitting another person to run a credit score test on you.

Concentrate on the dangers of taking out a debt consolidation mortgage. You’ll merely be changing your outdated loans with a brand new bigger one and might want to follow a strict finances to maintain up with the cost plan. It gained’t prevent from your personal ingrained spending habits, so ensure you’re prepared to vary your way of life considerably.

FAQs

Is it unhealthy to dispute a credit score report?

Disputing a credit score report is a smart possibility to verify incorrect information does not keep in your file and injury your rating. Simply remember that if unfavourable info is verified, it will stay on all of your subsequent stories and your rating might lower consequently.

Will my credit score rating return up after a dispute?

A dispute will not have an effect on your rating, however the final result of the dispute would possibly. If incorrect info is faraway from the report, your rating will almost definitely rise.

What is the quickest strategy to dispute a credit score report?

Submitting a dispute with Experian on-line is the quickest strategy to inform them about incorrect info. Nevertheless, contacting the corporate through mail is taken into account safer as you will then have a paper path that proves your actions and the dates of your responses.

How lengthy does it take to get a dispute off your credit score report?

If the dispute is confirmed correct after investigation, the inaccurate info needs to be eliminated inside 30 days.

What occurs when a credit score dispute takes longer than 30 days?

If the corporate hasn’t resolved or completed investigating a dispute inside 30 days, they’re legally obliged to take away the disputed file.