[ad_1]

![]() KIWIsmart offers no details about who owns or runs the corporate on its web site.

KIWIsmart offers no details about who owns or runs the corporate on its web site.

KIWIsmart’s web site area (“kiwismart.org”), was privately registered on August twentieth, 2021.

At time of publication KIWIsmart’s web site advises a “zoom launch occasion” going down on January twenty ninth.

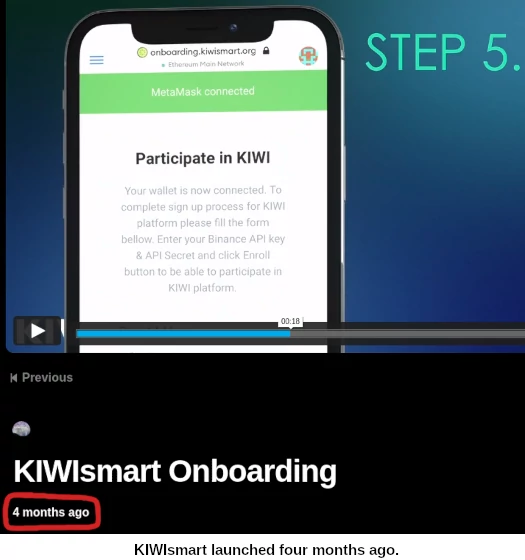

This appears odd, seeing as KIWIsmart promotion movies began going up 4 months in the past:

If I didn’t know any higher, KIWIsmart already launched and it flopped. They’re now rebooting with a second launch.

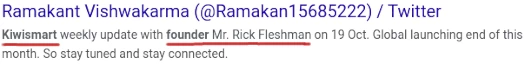

In any occasion, names hooked up to KIWIsmart’s launch webinar are Rick Fleshman, Alex Ruiz, Syed Jawad Haider, “Tatjana”, Jonas Todorovic, Mike Soh, Malik Atif, Christi Chitic and Gian Luca Gallo.

Of the group, Rick Fleshman seems to be working KIWIsmart as its founder:

Rick Fleshman relies out of California within the US.

Fleshman (proper) first popped up on BehindMLM’s radar in 2017, as certainly one of Ormeus World’s founders.

Fleshman (proper) first popped up on BehindMLM’s radar in 2017, as certainly one of Ormeus World’s founders.

Ormeus World was a Ponzi scheme that went by means of three incarnations, Ormeus World, IQ Chain and IQ Legacy.

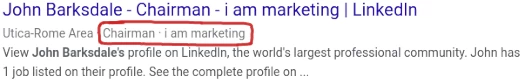

The Ponzi scheme collapsed in 2019, following John Barksdale’s arrest in Thailand that very same 12 months.

Following his launch, Barksdale has continued to take care of the scheme as “Ormeus Ecosystem”

Curiosity is nearly non-existent.

Rick Fleshman is tied to John Barksdale by means of iAM Advertising and marketing.

Fleshman is iAM Advertising and marketing’s CEO:

Barksdale is iAM Advertising and marketing’s founder and Chairman:

If Barksdale is concerned in KIWIsmart he’s holding a low profile.

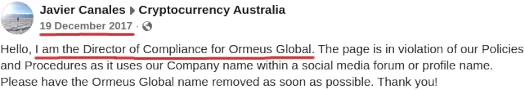

Replace thirtieth January 2022 – One other former Ormeus World government concerned in KIWIsmart is Javier Canales.

Canales headed up Ormeus World’s compliance division:

What we additionally study from the primary screenshot above is that KIWIsmart went into tender launch in August 2021. /finish replace

Learn on for a full assessment of KIWIsmart’s MLM alternative.

KIWIsmart’s Merchandise

KIWIsmart markets an automatic buying and selling bot and entry to third-party passive funding schemes.

KIWIsmart has named their buying and selling bot Ki100.

Ki100 is

a simplified buying and selling assistant for cryptocurrency, linked to your crypto pockets by means of a trade-only API connection. Management or modify your danger stage and withdraw your funds at any time by means of a user-friendly interface.

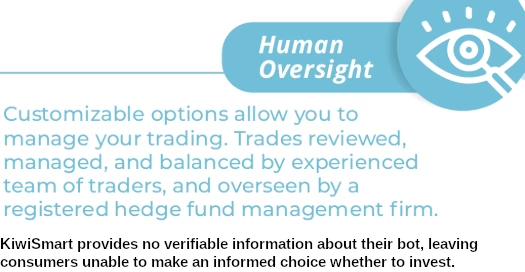

No technical or possession particulars of Ki100 are offered.

Ki1000 feeds KIWIsmart associates and clients into “alternatives in liquidity swimming pools and yield farming.”

“Liquidity swimming pools” and “yield farming” are crypto bro phrases for passive funding alternatives. These are usually run as Ponzi schemes.

No additional particulars on Ki1000 are offered.

Entry to Ki100 and Ki1000 is paid for by means of “buying and selling credit”. Buying and selling credit are bought from KIWIsmart associates.

Buying and selling credit are offered in packages starting from $70 to $10,000:

- spend $70 and obtain 90 buying and selling credit

- spend $250 and obtain 280 buying and selling credit

- spend $500 and obtain 540 buying and selling credit

- spend $1000 and obtain 1100 buying and selling credit

- spend $5000 and obtain 5750 buying and selling credit

- spend $10,000 and obtain 12,000 buying and selling credit

New credit can’t be bought till 70% of already bought credit are used.

“Estimated” month-to-month buying and selling credit score necessities for Ki100 are:

- 70 buying and selling credit to commerce $1000

- 500 buying and selling credit to commerce $9000

- 1000 buying and selling credit to commerce $20,000

- 5000 buying and selling credit to commerce $100,000

- 10,000 buying and selling credit to commerce $200,000

What number of buying and selling credit are required to entry Ki1000 isn’t disclosed.

KIWIsmart’s Compensation Plan

KIWIsmart associates earn commissions promoting buying and selling credit to retail clients and recruited associates.

KIWIsmart Affiliate Ranks

There are twenty-one affiliate ranks inside KIWIsmart’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- K1 – refer/recruit and preserve one retail buyer or recruited affiliate

- K2 – refer/recruit and preserve two retail clients and/or recruited associates

- K3 – refer/recruit and preserve three retail clients and/or recruited associates

- K4 – refer/recruit and preserve 4 retail clients and/or recruited associates

- K5 – refer/recruit and preserve 5 retail clients and/or recruited associates

- K6 – refer/recruit and preserve six retail clients and/or recruited associates

- K7 – refer/recruit and preserve seven retail clients and/or recruited associates

- K8 – refer/recruit and preserve eight retail clients and/or recruited associates

- K9 – refer/recruit and preserve 9 retail clients and/or recruited associates

- K10 – refer/recruit and preserve ten retail clients and/or recruited associates

- K11 – refer/recruit and preserve eleven retail clients and/or recruited associates

- K12 – refer/recruit and preserve twelve retail clients and/or recruited associates

- K13 – refer/recruit and preserve 13 retail clients and/or recruited associates

- K14 – refer/recruit and preserve fourteen retail clients and/or recruited associates

- K15 – refer/recruit and preserve fifteen retail clients and/or recruited associates

- K16 – refer/recruit and preserve sixteen retail clients and/or recruited associates

- K17 – refer/recruit and preserve seventeen retail clients and/or recruited associates

- K18 – refer/recruit and preserve eighteen retail clients and/or recruited associates

- K19 – refer/recruit and preserve nineteen retail clients and/or recruited associates

- K20 – refer/recruit and preserve twenty retail clients and/or recruited associates

- K21 – refer/recruit and preserve twenty-one retail clients and/or recruited associates

Referred retail clients and recruited associates should be “energetic” to depend in direction of rank qualification.

An energetic retail buyer or recruited affiliate is one which has bought 50 buying and selling credit or extra prior to now 4 weeks.

The opposite factor to notice is KIWIsmart rank qualification counts for six months.

While you qualify for a rank, you maintain it for six months no matter your exercise. On the finish of the six months you might be re-ranked based mostly in your qualification standards for that month.

This then applies for an additional six months.

Be aware if you happen to qualify for the next rank at any time, that rank is utilized and the six month timer is reset.

Residual Commissions

KIWIsmart pays residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel crew, with each personally recruited affiliate positioned immediately underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel crew.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

KIWIsmart caps payable unilevel crew ranges at twenty-one, topic to the next standards:

- ranges 1 to three of the unilevel crew are unlocked by referring and sustaining one retail buyer

- ranges 4 to six of the unilevel crew are unlocked by referring and sustaining two retail clients

- ranges 7 to 10 of the unilevel crew are unlocked by referring and sustaining three retail clients

- ranges 11 to 21 of the unilevel crew are unlocked by referring and sustaining 5 retail clients

Referred retail clients should be energetic to depend in direction of residual fee qualification.

Topic to the above standards, residual commissions are paid as a proportion of 70% of funds spent on buying and selling credit throughout these twenty-one ranges as follows:

- stage 1 (personally recruited associates) – 30%

- ranges 2 to five – 10%

- ranges 6 to twenty – 2%

- stage 21 – 5%

Fast Begin Pool

The Fast Begin Pool is a month-to-month bonus pool, funded by an unspecified proportion of “commissions that weren’t certified for within the final 30-day interval”.

If a KIWIsmart affiliate refers ten retail clients inside thirty days of signing up, they obtain a share in that month’s Fast Begin Pool.

NFT Bonus Pool

The NFT Bonus Pool is funded by an unspecified proportion of “commissions that that weren’t certified for within the final 30-day interval”.

There are “Aldermen NFTs” and “Ambassador NFTs”.

Aldermen NFTs are awarded when a KIWIsmart affiliate

- qualifies within the prime 300 based mostly on unilevel crew quantity (throughout 21 ranges, min 300,000 GV every month); and

- maintains a prime 300 place for 3 consecutive months.

Ambassador NFTs are awarded when a KIWIsmart affiliate

- qualifies within the prime 13 based mostly on unilevel crew quantity (throughout 21 ranges, min 3,000,000 GV every month); and

- maintains a prime 13 place for 3 consecutive months

So far as I can inform KIWIsmart’s NFT Bonus Pool is the equal of a standard share-based pool, paid month-to-month.

Becoming a member of KIWIsmart

KIWIsmart affiliate membership is $49 yearly.

KIWIsmart Conclusion

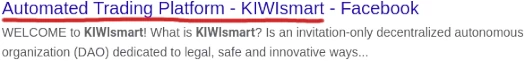

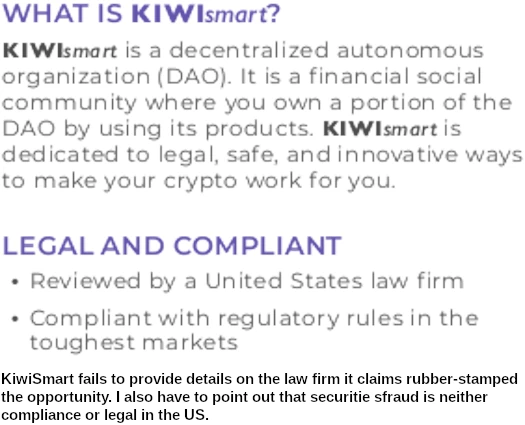

KIWIsmart describes itself as

an invitation-only decentralized autonomous group.

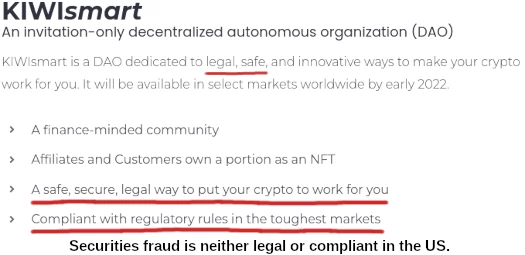

As an MLM alternative, KIWIsmart is your typical buying and selling bot securities fraud scheme.

That is a kind of bots created by who is aware of who with no verifiable buying and selling historical past.

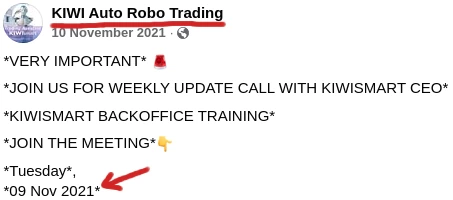

KIWIsmart launched their buying and selling bot on or round November 2021.

It’s suspicious then that there’s no buying and selling historical past talked about wherever.

KIWIsmart failing to reveal possession, growth and previous buying and selling particulars of their bot is a possible violation of the FTC Act (misleading advertising and marketing).

Securities fraud takes place by means of passive returns generated by way of KIWIsmart’s Ki100 buying and selling bot.

To ascertain the existence of an funding contract, regulators within the US depend on the Howey Check.

Below the Howey Check, an funding contract exists if there’s an “funding of cash in a standard enterprise with an affordable expectation of income to be derived from the efforts of others.”

In KIWIsmart we’ve got associates putting funds underneath management of a bot.

The bot is a “widespread enterprise”. And funds are clearly invested with the bot “with an affordable expectation of income”.

The bot is run by Kiwismart, satisfying the income are “derived from the efforts of others” standards.

At time of publication KIWIsmart will not be registered with the SEC, or a monetary regulator in some other jurisdiction.

Which means at a minimal KIWIsmart is committing securities fraud.

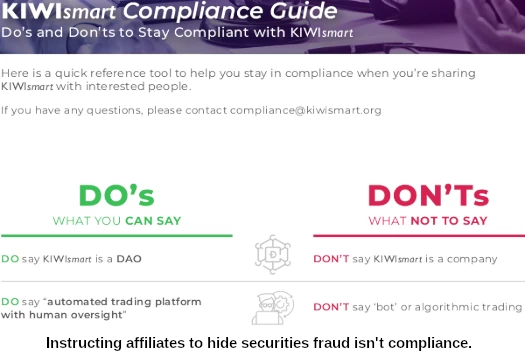

For his or her half KIWIsmart seems to concentrate on what it’s doing.

Instead of acknowledging their monetary regulatory obligations, we’ve got nonsense like this in KIWIsmart’s Insurance policies and Procedures;

Governing Legislation, Jurisdiction and Venue

Jurisdiction and venue of any matter not topic to arbitration shall be decided by vote, dealt with by the DAO.

“The DAO”is neither a governing legislation, jurisdiction or authorized venue.

KIWIsmart additionally don’t need their associates brazenly selling the scheme for what it’s:

Instead of registering with the SEC and disclosing essential due-diligence data, KIWIsmart as an alternative focuses compliance on not working as a pyramid scheme.

However even that is wonky.

KIWIsmart’s compensation plan first suggests retail clients are required to earn residual commissions:

A web page or two later nonetheless it turns into evident that recruited associates could be swapped in:

If for some purpose your not fazed by securities fraud, KIWIsmart do make it straightforward to confirm your upline isn’t working their enterprise as a pyramid scheme.

5.9 Retail Gross sales Information

All Associates are required to maintain information of all gross sales for a interval of three years.

KIWIsmart will randomly monitor compliance with gross sales necessities sometimes.

Every product bought by a buyer is routinely counted on a month-to-month foundation in direction of qualification necessities.

Personally I’m inclined to imagine retail throughout KIWIsmart will probably be nearly non-existent exterior of ties to associates.

8.2 No Refunds

Because of the nature of the Buying and selling Credit product, there shall be no refunds on any merchandise.

An absence of disclosures and anti-consumer practices like “no refunds”, places an enormous query mark on KIWIsmart’s retail viability.

To summarize, KIWIsmart is a “lulz can’t contact our cash!” MLM buying and selling scheme.

Whereas it’s true traded funds are sourced from an affiliate’s/buyer’s personal account, the affiliate/buyer doesn’t personal the bot – leaving their account extensive open for abuse.

There are 3 ways a “lulz can’t contact our cash!” buying and selling scheme finish:

- regulators shut it down;

- the bot cleans out accounts; or

- the admins carry out a rigged trades exit-scam.

Both method members are finally left with losses, if not fully cleaned out.

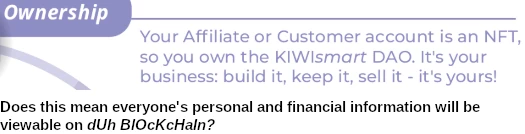

One last item I’ll contact on is KIWIsmart’s use of NFTs. So far as I can inform this can be a gimmick.

NFTs are used as bonus pool positions, providing no profit over a standard share-based system.

Effectively, at the least not any sensible profit. The usage of NFTs does permit KIWIsmart to make use of crypto buzzwords in its advertising and marketing and seem stylish.

KIWIsmart can be utilizing NFTs to additional help those that get in early with ripping off those that be a part of after them:

That’s on prime of the individuals who joined KIWIsmart final 12 months, who’re hoping you’ll be a part of the reboot to allow them to recoup any losses.

[ad_2]

Supply hyperlink