[ad_1]

Household First Life operates within the life insurance coverage MLM area of interest.

Household First Life operates within the life insurance coverage MLM area of interest.

The corporate was based in 2013. A company deal with in Connecticut is supplied.

Heading up Household First Life is CEO and President Shawn Meaike.

Heading up Household First Life is CEO and President Shawn Meaike.

As per Meaike’s LinkedIn profile;

After I graduated with my Masters Diploma I obtained a job with the state of CT as a social employee and I additionally obtained an actual property license to complement my revenue.

For 15 years I labored two jobs to only maintain my head above water.

After I was launched to this chance, I used to be enthusiastic about one factor at first.

NAA had 1000’s of leads that we’re crammed out and signed by purchasers that WANTED insurance coverage and I obtained paid on common $550 for every particular person I helped.

In 2008 I labored half time with NAA and earned $296,000 in my first 12 months… I used to be FIRED up!!

I give up each my jobs and labored with NAA full time and the yr after I earned $602,000.

This previous yr I 1099’d 1.4 million {dollars}.

I by no means dreamed about being a millionaire, I simply wished to assist folks and I used to be afraid to be broke.

Andy Albright the president and CEO of NAA personally mentored me and taught me the right way to comply with the quite simple system NAA has in place.

“NAA” is Nationwide Brokers Alliance, one other life insurance coverage MLM.

Whereas Maike’s LinkedIn profile would possibly sound rosy, his cut up with NAA in 2013 was messy.

As alleged by NAA;

On December 12, 2013, Meaike notified NAA that he was terminating his employment.

NAA asserts that previous to Meaike ending his employment with NAA, Meaike fashioned FFL and actively recruited different brokers employed by NAA to hitch FFL.

Later in December 2013 NAA’s mother or father firm, Superior Performers, filed go well with in opposition to Maike and a number of other former NAA brokers.

Of their lawsuit, NAA alleged;

The solicitation of NAA’s brokers was a violation of the Agent Agreements by every Defendant.

Upon data and perception, Meaike, (Marc) Meade, and (Bryant) Stone have additionally every violated the non-competition provisions of their Administration Agreements.

Meade is a prime Household First Life affiliate. I couldn’t discover any present data on Bryant Stone.

NAA’s lawsuit in opposition to Meaike was prolonged, coming in at just below 400 filings.

The case was settled following mediation proceedings in January 2017.

In Might 2014 NAA filed an extra trademark infringement lawsuit in opposition to Household First Life.

That case was dismissed comparatively early on in February 2015.

Naturally it follows that Meaike’s time at NAA influenced the launch of Household First Life.

That mentioned Meaike seems adamant in advertising shows that he’s operating the corporate his personal approach.

Learn on for a full evaluate of Household First Life’s MLM alternative.

Household First Life’s Merchandise

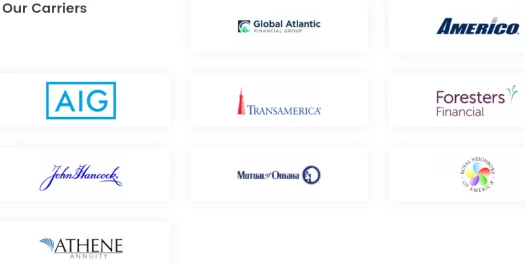

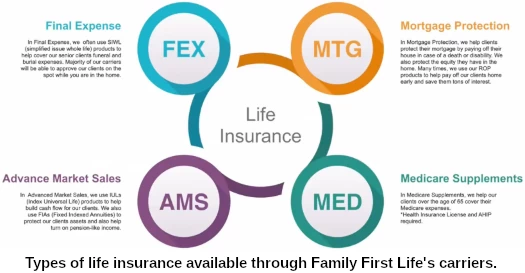

Household First Life market life insurance coverage insurance policies written by third-party carriers.

There’s completely no specifics about life insurance coverage insurance policies wherever on Household First Life’s web site.

As a substitute Household First Life’s web site is devoted to advertising the corporate’s revenue alternative.

Household First Life’s Compensation Plan

Household First Life don’t present a duplicate of their compensation plan on their web site.

I attempted to supply this data elsewhere however got here up clean.

What Household First Life do present is a imprecise breakdown of their compensation plan.

Cross-referencing this with official advertising movies, right here’s what I used to be in a position to confirm.

First 12 months Coverage Commissions

Household First Life associates earn a first-year fee on every coverage they promote.

The corporate’s web site particulars a 90% fee paid on first-year month-to-month premium charges.

Additional analysis reveals Household First Life’s first yr coverage fee price ranges from 80% to 140%.

Particular first yr coverage fee charges are decided by month-to-month private coverage quantity or complete downline month-to-month coverage quantity.

Word that in each situations a fee price is certified for by satisfying required coverage quantity for 2 consecutive months.

Private quantity first yr coverage fee charges vary from 80% to 110%.

- beginning first yr coverage fee price – 80%

- generate $5000 a month in insurance policies for 2 consecutive months and earn 85%

- generate $10,000 a month in insurance policies for 2 consecutive months and earn 90%

- generate $15,000 a month in insurance policies for 2 consecutive months and earn 95%

- generate $20,000 a month in insurance policies for 2 consecutive months and earn 100%

- generate $30,000 a month in insurance policies for 2 consecutive months and earn 105%

- generate $40,000 a month in insurance policies for 2 consecutive months and earn 110%

Downline quantity first yr coverage fee charges are tracked by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned straight below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel staff.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Downline quantity (GV) is capped at as much as 50% of required quantity per unilevel staff leg. It additionally contains an affiliate’s personal coverage quantity.

- generate $15,000 GV for 2 consecutive months and obtain a 90% first yr coverage fee price

- generate $20,000 GV for 2 consecutive months and earn 95%

- generate $25,000 GV for 2 consecutive months and earn 100%

- generate $75,000 GV for 2 consecutive months and earn 105%

- generate $100,000 GV for 2 consecutive months and earn 110%

- generate $125,000 GV for 2 consecutive months and earn 115%

- generate $150,000 GV for 2 consecutive months and earn 120%

- generate $200,000 GV for 2 consecutive months and earn 125%

- generate $250,000 GV for 2 consecutive months and earn 130%

- generate $300,000 GV for 2 consecutive months and earn 135%

- generate $350,000 GV for 2 consecutive months and earn 140%

Word that when a primary yr coverage fee price is certified for, it’s stored no matter future month-to-month coverage quantity manufacturing.

Household First Life calculates direct commissions primarily based on the projected complete annual charge fee.

75% of the calculated annual coverage fee is paid upfront.

The remaining 25% is paid throughout month-to-month ten to 12 of the coverage.

For the 100%+ fee charges, presumably there’s some “borrowing” of coverage charge funds past the primary yr.

Second 12 months Onwards Coverage Commissions

Household First Life are imprecise on the subject of commissions paid on insurance policies after the primary yr.

Renewal Commissions are paid Yearly on sure varieties of insurance policies when the contract renews on the finish of the yr.

The common renewal fee is 5% of the Annual Premium.

Commissions are solely paid on “sure” insurance policies and no particular percentages are supplied.

Residual Commissions

Household First Life are equally opaque concerning the MLM aspect of their enterprise.

We all know residual commissions are paid as overrides, in that greater ranked associates acquire proportion variations in opposition to decrease ranked associates of their downline, however specifics once more aren’t supplied.

The override fee is the same as the distinction of fee ranges between you and your brokers.

The common override fee is 15% of the Annual Premium.

This may counsel that the 90% instance cited for First 12 months Coverage Commissions will not be mounted.

Usually override type commissions are tied to rank. Such that there are ranks inside Household First Life, particulars aren’t supplied on the corporate’s web site.

Bonuses

In a single Household First Life advertising video I cited Shawn Meaike referencing bonuses, awarded to associates when these below them hit 140% fee charges.

No particular data past that was supplied.

Becoming a member of Household First Life

Household First Life affiliate membership is free.

The corporate emphasizes that it doesn’t have its associates signal any contracts.

Conclusion

I get the sense from the Household First Life advertising movies I watched, that Shawn Meaike is a fairly straight-forward man.

I don’t know him from a bar of cleaning soap however he got here throughout as fairly candid concerning the enterprise. Which begs the query why is there no detailed compensation materials supplied?

I discovered this unusual seeing as Meaike was in any other case upfront about numerous figures pertaining to the enterprise.

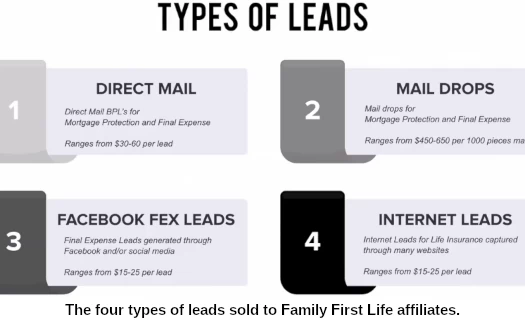

Household First Life’s primary enterprise mannequin is join, buy leads and promote life insurance coverage insurance policies.

The leads are purportedly supplied by third-parties, with Meaike claiming Household First Life doesn’t become involved.

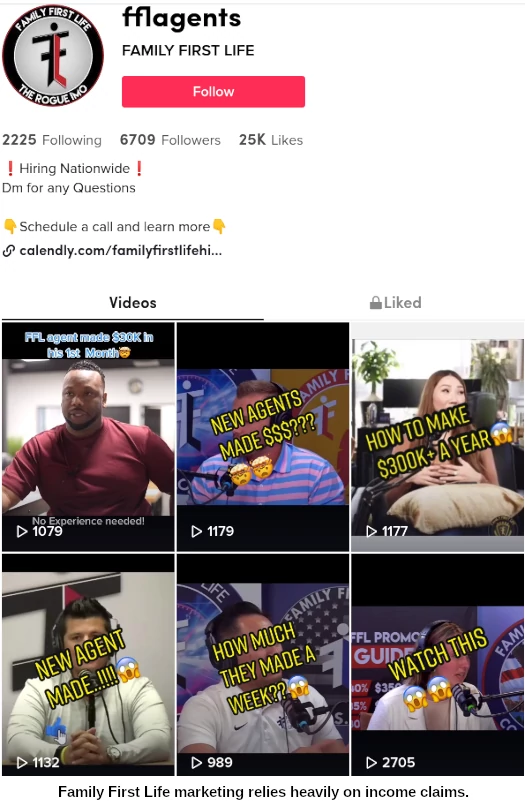

Apparently it is a profitable advertising technique, with Meaike boasting Household First Life associates have entry to “tons of of 1000’s of leads”.

[9:02] We get tens of millions (of leads). I imply we are able to produce leads like we couldn’t rent… if 100 thousand folks watched this and everyone joined and everyone offered, we’d have sufficient leads.

Meaike claims these are heat leads, i.e. the “leads got here to us”.

Connected to that is what the corporate refers to as “aggressive compensation”, topping out at 140% per coverage. Household First Life claims the “common paycheck per coverage is $675”, which is “effectively above the trade common”.

What Household First Life comes down as an MLM alternative is whether or not you may capitalize on the leads supplied. Or get your downline to.

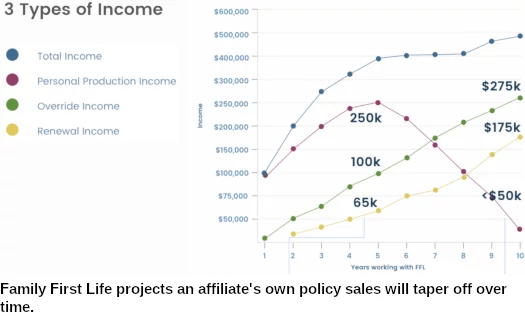

Certainly private coverage gross sales will solely get you thus far. If you wish to max out Household First Life’s compensation plan you’re going to must construct a downline.

That is an MLM firm in any case in order that’s not a adverse.

Theoretically Household First Life can wade into pyramid scheme territory, if the vast majority of coverage holders are associates.

Given the corporate pushes the “purchase leads, promote to leads” advertising so closely, I don’t assume that’s the case. Hell given the required coverage quantity it’d be a hefty problem even in case you tried.

What I can’t attest to and even gauge is the standard of Household First Life’s leads (supplied by undisclosed third-parties).

And this leads us right into a entice you must very a lot concentrate on. With Meaike speaking up supplied leads up the wazoo, this units the stage for “it’s not us, it’s you”.

Whereas that may very effectively be true in some instances (promoting life insurance coverage isn’t going to be for everybody), it can also entice folks in an limitless cycle of shopping for leads that don’t go wherever (for no matter purpose).

Signing up for Household First Life won’t price something however shopping for leads does. And that’s a monetary entice to be careful for.

Primarily based on what you’re comfy spending (no matter you do don’t go into debt shopping for leads), set particular lead buy objectives for just a few months and follow them.

See the place you’re at then and consider. If the leads aren’t changing, don’t get slowed down on assigning blame. It might be you, it might be the leads. It might be each.

Reduce your losses and transfer on.

Falling into the “if I simply purchase just a few extra leads I’d make a sale” entice, is the most important monetary threat with respect to Household First Life as an MLM alternative.

For sure in case you’re not comfy with shopping for leads and following up on them, Household First Life isn’t for you. That’s their enterprise mannequin, there’s no altering it.

One thing else to bear in mind is a 140% fee doesn’t come out of nowhere. You’re banking in your purchasers to maintain their insurance policies for over a yr.

If that doesn’t occur, you’re on the hook for a clawback (bear in mind, that 75% fee is paid out upfront).

Personally I’d wish to see some transparency with respect to Household First Life’s compensation plan on their web site. I get insurance coverage is sophisticated however even some fundamentals would go a protracted away.

As an example how this results in confusion, the compensation instance supplied on Household First Life’s web site particulars at 90% fee.

In a September 2020 Household First Life advertising video, Meaike positively rubbished this quantity.

[0:31] I didn’t need anyone to be at forty, fifty, sixty, seventy, eighty % compensation, ninety % compensation.

I don’t care the place you go however in case you’re at that compensation you must give up.

Possibly that’s not the message you need to be placing on the market, when 90% is the solely fee instance your organization web site offers.

One factor Household First Life do extraordinarily effectively is upkeep of their YouTube channel. It’s filled with content material and precise coaching.

On the very least have a run by it earlier than committing to something. It ought to provide you with a way of what the corporate tradition is about.

I actually assume there’s a missed alternative to combine numerous what’s hidden away there on Household First Life’s web site.

Lastly one very last thing to be careful for is an affiliate trying to recruit you, hoping you and others recruited will do all of the work.

There’s no minimal private coverage quantity necessities throughout Household First Life’s higher ranks.

Be certain whoever you join below is definitely producing private coverage quantity every month, or you may be becoming a member of a lifeless finish.

For reference, Shawn Meaike claims Household First Life’s common private month-to-month coverage quantity is $9200 (September 2020).

Broadly talking, insurance coverage MLMs are sophisticated and there’s loads to digest. Take your time.

[ad_2]

Supply hyperlink