[ad_1]

AuBit operates within the cryptocurrency MLM area of interest.

AuBit operates within the cryptocurrency MLM area of interest.

The corporate is headed by two CEOs; Sadie Hutton and Graham Doggart. Mark Kearns works as AuBit’s Chief Operation Officer.

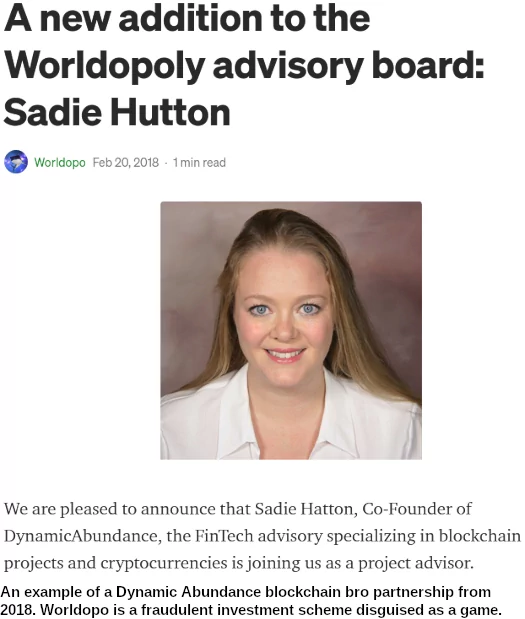

Hutton, Doggart and Kearns co-founded Dynamic Abundance in 2012.

Dynamic Abundance claims to supply “fintech advisory” and “strategic providers”.

Though Dynamic Abundance’s web site continues to be up, the corporate seems to be defunct as of 2018.

As per their respective LinkedIn profiles, Kearns Hutton and Doggart are based mostly out of Malta.

Malta is a scam-friendly jurisdiction with little to no lively MLM regulation.

Regardless of its house owners representing they’re based mostly out of Malta, Aubit supplies a company tackle in Seychelles on its web site.

Not withstanding Seychelles being one other scam-friendly jurisdiction with little to no lively MLM regulation, the supplied tackle belongs to a number of companies.

A 3rd company tackle for AuBit Worldwide is supplied on AuBit’s web site linked “authorized doc”.

That is one other digital tackle within the Cayman Islands – one more scam-friendly jurisdiction with no lively MLM regulation.

Using digital addresses suggests AuBit exists, if in any respect, in Seychelles and the Cayman Islands in identify solely.

Apparently sufficient AuBit’s personal LinkedIn profile states the corporate has been in operation since 2017. This aligns with AuBit’s web site area, which was first registered in October, 2017.

No matter AuBit’s preliminary incarnation was, it seems to have collapsed.

In February 2021 Sadie Hutton printed an article on Medium detailing AuBit’s “relaunch”.

This evaluate is predicated on that relaunch providing.

Learn on for a full evaluate of AuBit’s MLM alternative.

AuBit’s Merchandise

AuBit has no retailable services or products.

Associates are solely capable of market AuBit affiliate membership itself.

AuBit’s Compensation Plan

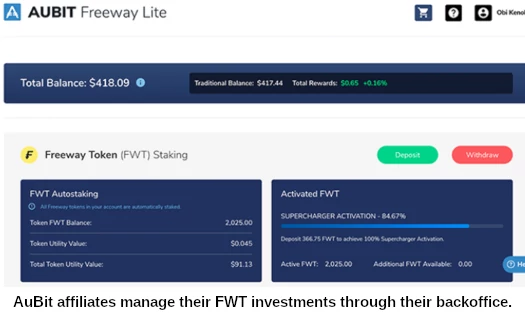

AuBit associates put money into the corporate’s personal Freeway token.

AuBit associates put money into the corporate’s personal Freeway token.

As soon as invested in, Freeway tokens are parked in AuBit on the promise of assured annual returns.

- AuBitised Bitcoin Supercharger – 33% annual ROI

- AuBitised Ethereum SuperCharger – 20% annual ROI

- AuBitised Binance Coin SuperCharger – 20% annual ROI

- AuBitised USD Supercharger – 43% annual ROI

- AuBitised Eurosmith Supercharger – 43% annual ROI

- AuBitised Gold Supercharger – 20% annual ROI

- AuBitised ADA Supercharger – 20% annual ROI

- AuBitised DOT Supercharger – 20% annual ROI

AuBit additionally claims to supply non-supercharged funding plans. No particular particulars are supplied.

Regardless of the names, AuBit’s funding plans don’t have anything to do with their namesakes.

These base merchandise simulate the efficiency of Bitcoin, Ethereum, and BNB respectively plus incremental progress in quantity via AuBit income rewards.

AuBit arbitrarily determines ROI percentages.

Word that AuBit expenses a “buy-in charge” on every funding however doesn’t disclose the charge quantity.

The MLM aspect of Aubit pays on funds invested by recruited associates.

Referral Commissions

AuBit pays a ten% referral fee on returns earned by personally recruited associates.

Referral commissions are paid in Freeway tokens.

Residual Commissions

AuBit’s pays a 2.5% fee on returns earned by an affiliate’s whole downline.

This downline is tracked by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned instantly underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel staff.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

AuBit’s advertising and marketing states the two.5% residual fee is paid on the “whole group”.

Becoming a member of AuBit

AuBit affiliate membership seems to be free.

Minimal and most funding quantities, if any, should not supplied.

Conclusion

AuBit is the end result of years of failed blockchain bro challenge involvement by its founders.

With Dynamic Abundance having run its course and gone nowhere, Sadie Hutton, Graham Doggart and Mark Kearns have launched their very own “no danger” blockchain bro scheme.

The AuBit Freeway is a model new asset administration platform that gives a brand new path to the world’s prime funding merchandise not beforehand obtainable.

The platform rewards customers with redistributed revenues for better whole returns with no further danger.

In actuality AuBit is your typical MLM crypto Ponzi scheme.

Aubit associates put money into funding plans via the corporate’s personal Freeway tokens.

Freeway token (FWT) was launched in late 2020 by AuBit. It’s publicly tradeable however realistically holds no worth outdoors of AuBit’s funding scheme.

Stated funding scheme sees associates park FWT with the corporate in numerous staking plans.

These plans, as detailed within the compensation part above, assure annual returns.

AuBit represents it generates exterior income via ‘little-known however highly-powerful income and cash-flow producing sources.’

That is blockchain bro waffle for crypto buying and selling, the ruse of alternative adopted by MLM crypto Ponzi schemes.

AuBit’s income comes from the buying and selling of its personal funding in quant-trading methods.

Freeway has a number of income sources together with charges, the quant-trading of its personal funds, the expansion of its personal property that develop on each commerce, and extra.

There isn’t a proof of AuBit commerce being engaged in buying and selling. Neither is there any verifiable proof of AuBit utilizing exterior income of any type to pay affiliate withdrawals.

Being a passive funding alternative, AuBit’s scheme constitutes a securities providing.

This requires it to register with monetary regulators in each jurisdiction is solicits funding in.

This legally required registration would additionally see AuBit file periodic audited monetary reviews.

These reviews are the one means for customers to confirm AuBit isn’t simply recycling invested funds.

Each the selection to commit securities fraud and failing to supply audited monetary reviews lends itself to AuBit working as a Ponzi scheme.

Conscious that the US is the highest regulator of securities fraud on the planet, up till not too long ago AuBit was cautious about overtly soliciting funding from US residents.

On August twenty eighth AuBit uploaded a video to YouTube titled “Freeway Lite US: OPEN NOW“:

Within the video Sadie Hutton reveals AuBit is now soliciting funding from US residents and residents.

For some cause that is going down on the secondary AuBit area “freewaylite.us”:

Within the video Hutton goes on to the touch on regulatory necessities;

[0:50] The timeline for entry to Freeway Lite US has been affected by the newest US authorized recommendation.

Which means there are important further necessities for the automated and freely accessible system, which embrace a devoted US Telegram group and customer support staff.

Simply so we’re clear, there’s nothing about having to have a Telegram group or customer support within the Securities and Alternate Act.

In the event that they have been truly severe about satisfying regulatory necessities within the US, step one is registering AuBit and its executives with the SEC.

A search of the SEC’s public Edgar database reveals neither AuBit or its executives are registered with the SEC.

Because of this within the US and in every single place else on the earth, AuBit has and continues to commit securities fraud.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new invesmtent.

It will starve AuBit of ROI income, ultimately prompting a collapse.

With respect to AuBit, the corporate states returns ‘may very well be lowered at any time, and even eliminated fully.’

That will probably be your first signal of a collapse, alongside withdrawal points.

The maths behind Ponzi schemes ensures that once they collapse, the vast majority of members lose cash.

[ad_2]

Supply hyperlink