Neglect maxing out your bank cards, listed here are some straightforward methods anybody can use to optimize your credit score rating.

Most of those methods can be utilized by those that have each good and very bad credit.

I like to recommend that you simply attempt to do as many as potential on an ongoing foundation.

5 Amazingly Easy Credit score Optimization Strategies

Listed below are 5 easy methods that you should utilize to optimize your credit score rating:

1. Restrict Exhausting Inquires to No Extra Than 2 Throughout a 2 Yr Interval

There are two varieties of credit score inquiries which may present up in your credit score report. One can negatively have an effect on your credit score rating, and one doesn’t.

- Gentle Inquiry: Any such inquiry is not going to negatively have an effect on your credit score rating so that you shouldn’t fear about these. Examples of soppy inquiries are once you verify your credit score report, an employer pulls your credit score report, or once you use a credit score monitoring service.

- Exhausting Inquiry: Any such inquiry can affect your credit score rating (however not at all times). Examples of laborious inquiries are once you apply for a bank card, a automotive mortgage, and many others.

The principle factor to remember relating to credit score inquiries is {that a} laborious inquiry means you’re making use of for credit score, whereas a tender inquiry is solely you (or another person) your credit score report for causes aside from loaning you cash.

So, what number of inquiries is simply too many? As a basic rule, it is best to preserve laborious inquiries below 2 throughout any given two yr interval. Exhausting inquiries fall off your credit score report after two years.

This principally tells lenders that you simply aren’t actively in search of a bunch of credit score. You might begin to see your credit score rating negatively affected when you hit three or extra laborious inquiries.

Having greater than two laborious inquiries gained’t kill your credit score rating, however it would seemingly take a number of factors off.

2. Hold a Combination of Credit score Account Sorts

There are 4 sorts of credit score accounts in your credit score report and the kind of account determines how a lot of an affect it has in your credit score rating.

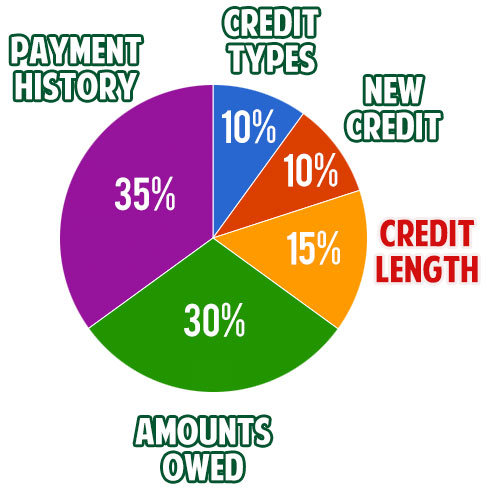

I put collectively the graphic beneath to indicate you which ones sorts matter essentially the most:

It’s greatest to maintain a combination of all these account sorts. It doesn’t imply that it is best to shut your retail playing cards, it merely signifies that an actual property mortgage will greater than seemingly have an even bigger affect in your credit score rating than a retail card or bank card.

3. Use Credit score Utilization Ratios to Your Benefit

Maxing out your bank cards will kill your credit score rating actually quick. Credit score vs. Debt ratios are one thing individuals usually overlook.

Most individuals assume that their credit score rating isn’t impacted until they’re late on a cost.

This isn’t true! In truth, I might recommend holding every bank card below 25% utilization. In different phrases, don’t cost up greater than 25% of your out there credit score on any explicit card.

In case you have already charged greater than 25%, paying it all the way down to below 25% can considerably improve your rating. I’ve written a complete article about credit score utilization that it is best to take a look at if you wish to perceive it extra in depth.

4. Open at Least One Main Credit score Card

This one can typically be troublesome for individuals who have very bad credit, nevertheless it must be one thing you’re employed in direction of in the long term.

Since main bank card firms normally require respectable credit score to approve you for considered one of their bank cards, having one (or a number of) reveals that they belief you.

It will positively have an effect on your credit score rating. Once more, you probably have very bad credit, merely preserve this in thoughts and work in direction of attending to the purpose the place you will get accepted for a Visa or Mastercard.

I also needs to point out that if you happen to don’t have any credit score, typically main bank card firms will approve you. Contemplate this your trial interval and don’t screw it up 🙂

5. Develop Your Credit score Historical past by Conserving Previous Accounts Open

A mistake that I see individuals do many times (and one I did myself, truly) is shut outdated accounts pondering that it’ll enhance their credit score rating.

An individual normally does this as a result of the outdated account has a late cost or one thing. The reality is, this isn’t going to make the late cost “go away” –it would nonetheless be there.

What you’ll do by closing an outdated account is to cease constructing historical past for that account.

There are a number of components used to calculate your credit score rating (see chart beneath), and your credit score size makes up a good portion: 15%.

By holding outdated accounts open, the account continues to construct credit score historical past and this can be a good factor! In the long term, your credit score rating will normally profit.

Optimize Your Credit score Report

Lastly, you also needs to at all times spend a while cleansing up your credit score report by eradicating any collections or late funds. I like to recommend getting adverse entries eliminated slightly than wait 7 years for them to robotically fall off.

This manner you don’t have to fret about them affecting your skill to get a mortgage.

I recommend you take a look at Lexington Legislation Credit score Restore. They’ll take away the adverse objects. Give them a name at 1-844-764-9809 or Try their web site.