In the event you had been denied a checking account or your financial institution closed your account, it may be because of a ChexSystems report. ChexSystems is utilized by many banks and credit score unions to blacklist prospects who’ve made banking errors like bounced checks, extreme returned checks, non-sufficient fund (NSF) expenses, or too many transfers or withdrawals. Being on the blacklist could make opening a checking account tough for 5 years.

Fortuitously, there are banks that don’t use ChexSystems in any respect.

These “No ChexSystems Banks” supply all of the providers you want with surprisingly excessive acceptance charges. CreditInfoCenter.com has helped hundreds of individuals discover these banks primarily based on acceptance charges, checking account options and advantages, and the accounts with the bottom charges. You’ll be able to open an account immediately!

What are the Finest Banks That Don’t Use ChexSystems?

Open an account immediately!

Discovered Enterprise Banking | Our Favourite Enterprise Account

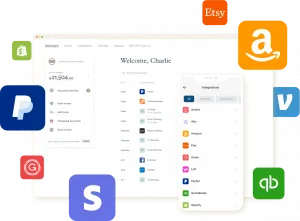

One of many greatest challenges for small companies, entrepreneurs, and gig employees is discovering the appropriate checking account for his or her rising enterprise.

One of many greatest challenges for small companies, entrepreneurs, and gig employees is discovering the appropriate checking account for his or her rising enterprise.

The Discovered Enterprise Banking Account solves that drawback by simplifying your monetary journey. Accessible solely to sole proprietors and single-owner companies, the sign-up course of takes only some minutes. There’s no credit score verify or ChexSystems.

Discovered Enterprise Banking at a Look

- No opening deposit required

- No minimal steadiness

- No required month-to-month charges

- Free limitless ACH funds

- Free limitless invoicing

- Free cellular verify deposits

- Free built-in expense administration instruments

- Settle for financial institution transfers and card funds

- Simply hook up with Quickbooks, Stripe, Venmo, PayPal, Etsy, and so forth.

- Receives a commission as much as 2 days early with direct deposit1

- Ship cash to anybody throughout the U.S. utilizing their telephone quantity or e mail handle

- Deposit money at over 79,000 places

- Entry your account on-line or on the free app

- Discovered’s core options are free. In addition they supply a paid product, FoundPlus

Quick Approval Course of

Time is cash and Discovered respects each. Apply for your online business account on-line and the streamlined approval course of ensures you’re up and working rapidly. No prolonged paperwork wanted to get swift entry to your monetary hub.

Straightforward Bookkeeping and Tax Administration Instruments

Managing your online business funds shouldn’t be a headache. You get intuitive instruments equivalent to automated expense monitoring, receipt seize, limitless {custom} invoices, and the flexibility to handle 1099 contractor funds. Plus, you get the flexibility to auto-save for tax funds and routinely generate tax kinds.

No Hidden Charges, No Surprises

Say goodbye to sudden expenses. Discovered.com believes in transparency. They’ve stripped away pointless charges, leaving you with an easy banking expertise. No hidden prices—simply readability and peace of thoughts.

Discovered is a monetary know-how firm, not a financial institution. Enterprise banking providers are offered by Piermont Financial institution, Member FDIC.2

Open a Discovered account now!

Chime | Our High Decide

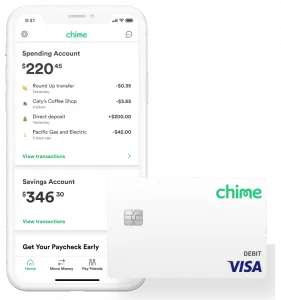

Chime® is a fast-growing internet-only monetary firm and considered one of our prime picks for a second probability checking account.

Chime® is a fast-growing internet-only monetary firm and considered one of our prime picks for a second probability checking account.

And, better of all, Chime accepts nearly all prospects who apply. Even if in case you have dangerous or poor credit score or have been blacklisted by ChexSystems or the credit score bureaus.

Options embody cellular deposits, direct deposit, on-line invoice cost, NO month-to-month or annual charges, NO overdrafts charges1, NO credit score verify, and NO CheckSystems. Opening an account is tremendous simple. It takes about 2 minutes and also you don’t should make an preliminary deposit. Right here’s what we like:

No Month-to-month Charges

For the previous couple of years, Chime’s enormous development has come on the expense of the massive banks and their outrageous charges. And it’s probably the greatest options of a Chime account. There aren’t any month-to-month or annual service expenses, no minimal steadiness requirement, no international transaction charges, no charges at over 60,000 ATMs2, and no charges for cellular and on-line invoice pay.

Deposit Money for FREE at Over 8,500 Walgreens

Getting access to a bodily location for money deposits is vital to Chime members. And now it’s simple. All you need to do is go right into a Walgreens retailer, hand the cashier the money you need to deposit alongside along with your Chime card, and the deposit will present up in your account instantly. This presents Chime members extra walk-in places than some other financial institution within the U.S. With over 78% of the nation inside 5 miles of a Walgreens, this can be a vital profit for hundreds of thousands.3

Good Know-how

Not like large banks, Chime was created through the smartphone period and, subsequently, options an app that’s greater than only a manner for patrons to evaluate their financial institution accounts.

You’ll be able to switch funds to family and friends, Chime members or not… and so they can declare their cash immediately4 with none extra apps. The Chime app additionally has a sequence of notifications you can activate or flip off so that you keep in full management. Misplaced or misplaced your card? You’ll be able to instantaneously flip off your card utilizing the app. No surprise over 300,000 prospects have given the app a 5-star evaluate.

Prospects First

Chime was one of many first to supply a “spherical up” possibility. In the event you use your Chime card on a purchase order of $10.65, Chime provides you the choice of routinely rounding as much as $11.00 and placing the remaining $.35 in your free Chime financial savings account. And that provides up over time! Plus, Chime pays 0.50% Annual Proportion Yield (APY)5 in curiosity on that financial savings account.

In the event you use direct deposit along with your Chime account, you may get your paycheck as much as 2 days early6. And Chime is simply saying no to large financial institution NSF expenses with a fee-free overdraft program as much as $200. Lastly, Chime only recently launched their Credit score Builder bank card with no curiosity and no annual payment. We don’t assume there may be one other firm innovating for his or her prospects like Chime.

Get a Chime Account At the moment!

U.S. Financial institution | Earn Up To $700 Money Bonus

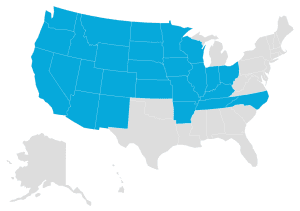

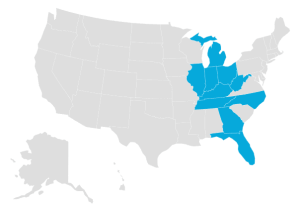

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches positioned in 26 states largely positioned within the west and midwest.

U.S. Financial institution is the fifth largest financial institution within the nation with nearly all of its 2,000+ branches positioned in 26 states largely positioned within the west and midwest.

You’ll be able to earn as much as $700 whenever you open a brand new U.S. Financial institution Neatly® Checking account and a Commonplace Financial savings account and full qualifying actions. The supply is topic to sure phrases and limitations and is legitimate by June 27, 2024. Member FDIC. Supply is probably not out there for those who dwell outdoors of the U.S. Financial institution footprint or will not be an present shopper of U.S. Financial institution or State Farm.

U.S. Financial institution Neatly® Checking at a Look

- A U.S. Financial institution Visa debit card

- On-line banking and invoice pay

- Cell banking and cellular verify deposit

- Ship cash with Zelle®

- 24/7 buyer assist

- No NSF expenses for overdraft balances underneath $50

- Entry to U.S. Financial institution Good Rewards® to reap extra advantages

- No charges at U.S. Financial institution ATMs

- No surcharge charges at 40,000 MoneyPass ATMs

States The place U.S. Financial institution is Accessible

In the event you dwell in one of many following 26 states the place this account is offered, you possibly can apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

In the event you dwell in one of many following 26 states the place this account is offered, you possibly can apply on-line: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Account Particulars and Prices

To get an account, you’ll must make a gap deposit of $25. The month-to-month service payment is $6.95 however could be waived for those who keep a minimal steadiness of $1,500 or by having a mixed month-to-month direct deposit totaling $1,000. You may as well keep away from the month-to-month payment in case you are 24 and underneath, 65 and over, or a member of the navy (should self-disclose) or qualify for one of many 4 Good Rewards® tiers (Major, Plus, Premium, or Pinnacle).

Banking Made Straightforward

The U.S. Financial institution Neatly® Checking account comes with probably the greatest cellular apps available on the market. Over a million prospects have given the app an general score of 5 stars. You’ll be able to handle your whole account from a pc or your smartphone.

And there’s extra to U.S. Financial institution than an impressive smartphone app: 24/7 customer support, Zelle® prompt transfers, free budgeting and automatic instruments, overdraft leniency, and Good Rewards®. Maybe that’s why U.S. Financial institution repeatedly makes the record of probably the greatest banks within the nation.

Open an account immediately!

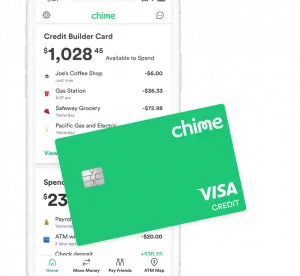

Present | Construct Credit score Whereas You Financial institution

Present presents an revolutionary account to customers who need all of it with out the prices and hassles.

Present presents an revolutionary account to customers who need all of it with out the prices and hassles.

The Present Construct account works identical to a checking account but additionally helps you construct credit score each time you utilize the cardboard. Signal-up takes about 2 minutes and Present has extraordinarily excessive acceptance charges.

Present at a Look

- NO credit score verify

- NO minimal steadiness

- NO deposit required to open an account

- NO charges at over 40,000 ATMs within the U.S.

- Get your paycheck as much as 2 days early with direct deposit

- Earn 4.0% APY in your steadiness as much as $6,000 with direct deposit; earn 0.25% APY with out

- Earn factors for limitless cashback at taking part retailers

- Ship cash immediately at no cost

- A sublime however easy smartphone app

- 24/7 member assist

- FDIC insured account as much as $250,000

Swipe The Card and Construct Credit score

Utilizing your Present Construct account to BUILD your credit score is easy. Right here’s the way it works:

- You add cash to your account

- Swipe your card to make purchases, pay payments, or get cash from an ATM machine

- The funds in your account pay for these transactions

- Present experiences your cost to construct your credit score historical past

Present Works Laborious for You

Present presents a extremely distinctive service it calls Fuel Maintain Removals. What’s a fuel maintain? Some fuel stations might apply a maintain from $50 to $100 whenever you use your card to pump fuel. In the event you solely pumped $10 of fuel, however the fuel station locations a $100 maintain in your funds, you received’t have entry to the $90 distinction for as much as 3 enterprise days! The Present Construct card will instantly refund the maintain so you’ve got entry to all of your funds. We haven’t discovered that profit wherever within the market.

We love the options, we love the smartphone app, and we love Present. That makes us assume you’ll love them too.

Get a Present Account Now!

Chase Safe Banking | $100 New Account Bonus

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account may be a superb match for a second probability checking account.

Most individuals know Chase and with over 15,000 ATMs and 4,700 branches throughout the nation, the Chase Safe Banking account may be a superb match for a second probability checking account.

Chase Safe Banking at a Look

- NO credit score verify

- NO ChexSystems

- NO minimal deposit to open

- NO overdraft charges

- FREE entry to over 15,000 Chase ATMs

- FREE Chase On-lineSM Invoice Pay

- FREE cash orders and cashier’s checks

- Rapidly ship and obtain cash with Zelle®

- Paper checks will not be provided with the account

Incomes the $100 Bonus

To earn the $100 bonus, you’ll want to finish 10 qualifying transactions inside 60 days of account enrollment. Qualifying transactions embody debit card purchases, on-line invoice funds, Chase QuickDepositSM, utilizing Zelle®, or receiving ACH credit.

What to Know In regards to the Approval Course of

Chase Safe Banking is the one account provided by Chase that doesn’t use ChexSystems however does use Early Warning Companies (EWS). Moreover, for those who’ve had an account closed by Chase previously, your software is not going to be accepted. Previous account closures can embody missteps equivalent to non-payment of charges, extreme overdrafts, or suspected fraud.

Charges

Chase doesn’t supply overdraft providers with this account as you possibly can solely spend the cash you’ve got out there. You also needs to know that utilizing non-Chase ATMs can value from $3.00 to $5.00 per transaction. Surcharges from the ATM proprietor/community might apply.

Chase Safe Banking carries a $4.95 month-to-month service payment, however it may be waived when you’ve got digital deposits made into the account totaling $250 or extra throughout every month-to-month assertion interval.

Different Account Options

Chase Safe Banking presents a number of different options we like. This consists of:

- Zero Legal responsibility Safety. Get reimbursed for unauthorized debit card transactions when reported promptly.

- Budgeting Instruments. Handle your spending and get day by day spending insights with Snapshot within the Chase Cell® app.

- Credit score and Id Monitoring. Observe your credit score rating, get a customized motion plan offered by Experian™ to assist enhance your rating and obtain identification monitoring at no cost by Chase Credit score Journey®.

- Early Direct Deposit. Get that “simply paid” feeling as much as two enterprise days sooner with early direct deposit.

In the event you’ve needed to financial institution with Chase and questioned for those who’d qualify, we predict you’ll be pleased with the Chase Safe Banking account.

Get a Chase Account Now!

Fifth Third Financial institution | Get $200 Bonus

The Momentum® Checking account from Fifth Third Financial institution presents a really engaging new account bonus. And with no month-to-month upkeep payment, no minimal deposit, and no minimal steadiness required, banking is easy.

The Momentum® Checking account from Fifth Third Financial institution presents a really engaging new account bonus. And with no month-to-month upkeep payment, no minimal deposit, and no minimal steadiness required, banking is easy.

Fifth Third Momentum® Checking at a Look

- No preliminary deposit required

- No minimal steadiness required

- No month-to-month upkeep charges

- Ship and obtain cash with Zelle®

- Additional Time overdraft avoidance

- Cell alerts for transactions

- Receives a commission as much as 2 days early whenever you enroll in Early Pay

- Entry to greater than 40,000 fee-free ATMs nationwide

- 1,200 department places

- Get pleasure from limitless verify writing

- Cell and on-line invoice pay and verify deposit

Keep away from Overdraft Charges

Fifth Third has an “Additional Time” overdraft characteristic the place they supply an additional day for patrons to cowl any overdraft purchases which have hit their account. This characteristic gives you with some further time to keep away from overdraft charges and handle your account successfully.

Financial institution a $200 Bonus

Fifth Third will add $200 to your account whenever you make direct deposits totaling $500 or extra inside 90 days of opening your new account. Qualifying direct deposits embody payroll, pension, or authorities funds equivalent to Social Safety. To obtain the money bonus, your checking account have to be open and in good standing. Supply ends June 30, 2024. Member FDIC.

States The place Fifth Third Financial institution is Accessible

You’ll be able to apply on-line for those who dwell in one of many following 11 states: Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, South Carolina, Tennessee, or West Virginia.

Paycheck Advances By way of MyAdvance

MyAdvance is a money advance service provided by Fifth Third Momentum that lets you borrow a sure sum of money towards your upcoming direct deposit. The charges for this service are primarily based in your account’s age, and the quantity you borrow might be deducted out of your subsequent direct deposit. This could be a helpful possibility for overlaying sudden bills rapidly and simply.

Opening a Fifth Third Momentum® Checking account is simple and takes only some minutes. The mix of on-line banking instruments, checking account options, and department places makes this a robust alternative.

Open an account immediately!

SoFi Checking & Financial savings | Earn a $325 Welcome Bonus

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

The SoFi Checking & Financial savings account is obtainable by SoFi Financial institution. It’s a checking AND financial savings account and we love that. Plus, they don’t use ChexSystems or your credit score report back to approve accounts.

SoFi Checking & Financial savings at a Look

- FREE SoFi debit MasterCard

- FREE smartphone app. Handle your account on-line, too

- No opening deposit required

- No month-to-month minimal steadiness requirement

- No month-to-month upkeep charges

- No charges at 55,000+ ATMs

- Receives a commission as much as two days early with direct deposit

The way to Earn the $325 Bonus

As quickly as you get your SoFi Checking & Financial savings account and deposit $10 or extra, you’ll earn $25. While you arrange direct deposit from an employer, SoFi will credit score your account as much as an extra $300 (relying on the quantity of your direct deposit).

Utilizing the SoFi direct deposit possibility unlocks extra advantages, too. First, for those who overspend a bit, SoFi will cowl as much as $50 with no overdraft charges. Second, you’ll obtain a a lot greater curiosity quantity of 4.60% APY on financial savings account balances and .50% APY on checking account balances. In the event you resolve to not make the most of direct deposit, you’ll obtain 1.20% APY on financial savings balances.

The sign-up course of can take lower than 60 seconds. With over 6 million members, SoFi is a financial institution you possibly can depend on!

SoFi has been nice! The account was simple to open and I bought my debit card a number of days later. The smartphone app is simple to make use of and I can verify every part from my pc, too. SoFi appears to be the proper financial institution.

Claire M., SoFi Buyer

Get a SoFi Account Now!

Improve Rewards Checking Plus

Improve is a digital banking platform offering a variety of monetary providers, together with checking accounts, private loans, and bank cards with out annual charges.

Improve is a digital banking platform offering a variety of monetary providers, together with checking accounts, private loans, and bank cards with out annual charges.

Improve Rewards Checking Plus at a Look

- As much as 2% money again on purchases

- NO opening deposit required

- NO month-to-month upkeep charges

- NO minimal steadiness requirement

- NO NSF or overdraft charges

- Receives a commission as much as 2 days early with direct deposit

- 10%-20% decrease rates of interest on loans & bank cards by Improve

- Earn as much as 5.21% APY with a free Efficiency Financial savings Account

- FDIC insured account as much as $250,000

Incomes 2% Money Again

The Improve Rewards Checking Plus allows you to earn 2% money again rewards with debit card purchases. Eligible bills embody:

- Comfort and drug shops

- Fuel stations

- Month-to-month subscriptions, together with streaming providers

- Eating places

- Utilities and cellphone providers

All different purchases will earn 1% money again. To earn the reward your account have to be “energetic”. An energetic account is one which has a month-to-month direct deposit of $1,000 or extra.

However for those who select to not or can’t meet the month-to-month direct deposit requirement, the account cashback program is lowered from 2% to 1%. In our view, that’s nonetheless a really robust providing with only a few charges.

Shoppers Love Improve

Managing your transactions is easy, facilitated by both an intuitive on-line dashboard or the handy Improve cellular app, out there for each iOS (4.8 out of 5 score) and Android (4.7 out of 5 score) customers. You’ll even have free entry to your credit score rating and might be notified of any adjustments.

Not solely is the Improve Rewards Checking Plus considered one of our favorites, however the account additionally has very excessive approval charges.

Get an Improve Account Now!

GO2bank

One vital disadvantage to many online-only financial institution accounts is that they don’t have any strategy to settle for money deposits. However GO2bank accepts money deposits at over 90,000 Inexperienced Dot places nationwide. Nevertheless, taking part retailers might cost you a payment.

In the event you direct deposit over $500, your month-to-month upkeep payment of $5.00 is waived. And, they provide a fairly candy overdraft safety program, nevertheless it has a gotcha cost of $15 for those who don’t change the funds inside 24 hours.

Account-holders will recognize the flexibility to price range their cash with the assistance of a cellular app, budgeting instruments, and a financial savings vault. Actually, they pay 1% on all cash within the saving vault as much as $5,000.

Get a GO2bank account

mph.financial institution Recent Account

It’s a tall order to “Make Individuals Blissful” on the subject of banking, however that’s the said mission behind mph.financial institution.

It’s a tall order to “Make Individuals Blissful” on the subject of banking, however that’s the said mission behind mph.financial institution.

Powered by Liberty Financial savings Financial institution (established in 1889!), the mph.financial institution Recent account does use ChexSystems, however so long as you don’t have greater than 3 charge-offs totaling $1,000 or experiences of fraud approval charges are very excessive. Charges for the account embody a $9 month-to-month service payment and a $10 overdraft payment.

mph.financial institution Recent Account at a Look

- $0 preliminary deposit to open account

- Ship and obtain cash with Zelle®

- Entry your account along with your telephone or pc

- When coupled with a free financial savings account, earn as much as 5.00% APY

- Non-obligatory skill to spherical up expenses and stash the money into financial savings

- Receives a commission as much as 2 days early with direct deposit

- Entry to over 55,000 fee-free ATMs

Apply for a Recent Account At the moment!

What’s ChexSystems?

Most customers aren’t aware of ChexSystems till they’re denied a brand new checking account or a service provider declines to simply accept their verify. Briefly, ChexSystems is a client reporting company (CRA) that tracks your checking and financial savings account exercise.

Its enterprise is fairly easy. Banks contribute knowledge about all of their checking account prospects. For client accounts, the social safety quantity is the important thing identifier. Banks additionally contribute details about the well being of those accounts. If a client has bounced a number of checks or has unpaid charges, the financial institution can even report that data to ChexSystems.

Then ChexSystems creates an aggregated database not solely from the financial institution in our instance however from greater than 80% of all remaining banks and credit score unions. ChexSystems holds this data on over 300 million folks and corporations!

When you have unfavourable marks entered by a financial institution, that data is offered to EVERY financial institution and credit score union that subscribes to the ChexSystems database. And all any financial institution or credit score union wants with the intention to verify your banking historical past is your social safety quantity. A social safety quantity is required to arrange a checking account.

What causes folks to get reported to ChexSystems?

Individuals get reported to ChexSystems after they have issues with their financial institution accounts, equivalent to:

- Bouncing checks or having inadequate funds to cowl transactions.

- Not paying overdraft charges or different account charges.

- Misusing or abusing their accounts, equivalent to utilizing them for fraud or unlawful actions.

- Having their accounts closed by the financial institution for unfavourable causes.

Can I dispute gadgets on my ChexSystems report?

Sure, you possibly can dispute gadgets in your ChexSystems report if in case you have issues about their accuracy. Underneath the Honest Credit score Reporting Act (FCRA), as a client, you’ve got the appropriate to problem any data that’s incorrect or incomplete in your credit score experiences, together with these from ChexSystems.

Nevertheless, it’s vital to notice that disputing ChexSystems experiences can typically be a difficult course of, particularly if the knowledge in your document is correct. For instance, for those who had been added to ChexSystems because of a minor infraction equivalent to failing to pay a small overdraft payment, merely requesting the removing of the document is probably not ample to get it expunged out of your report.

It’s important to needless to say ChexSystems is just not essentially involved with equity or the relevance or forex of the knowledge it holds. If a document is on file, it usually stays there for a interval of 5 years from the date of the infraction except your dispute is profitable.

Subsequently, when you can dispute gadgets in your ChexSystems report, it is very important collect proof and current a robust case to assist your declare. This will likely contain offering documentation or proof that the knowledge is inaccurate or incomplete.

To provoke a dispute with ChexSystems, comply with these steps:

- Contact ChexSystems: Attain out to ChexSystems and request a free copy of your ChexSystems report. This report will give you detailed data relating to your banking historical past and any unfavourable data.

- Overview the report: Fastidiously evaluate the report for any inaccuracies or incomplete data which may be harming your banking historical past. Make a remark of those faulty data or incomplete data.

- Collect proof: Acquire all crucial proof that helps your dispute. This may embody financial institution statements, receipts, or some other related paperwork that show the inaccuracy or incompleteness of the knowledge.

- Draft a dispute letter: Write a proper letter to ChexSystems, clearly outlining your dispute and supporting it with the gathered proof. Clarify why you imagine the knowledge is inaccurate or incomplete and supply any extra related particulars. Make a copy of this letter on your data.

- Submit the dispute: Ship the dispute letter to ChexSystems by licensed mail with return receipt requested. This ensures proof of supply and provides you a document of the dispute being initiated.

- Preserve data: Hold copies of all paperwork, together with the dispute letter, supporting proof, and any communication obtained from ChexSystems. These data might be essential all through the dispute course of.

- Look ahead to a response: ChexSystems is required to analyze your dispute inside 30 days of receiving your letter. They are going to then give you a written report detailing their findings.

- Overview ChexSystems’ response: Fastidiously evaluate the response offered by ChexSystems. In the event that they agree that the knowledge is inaccurate or incomplete, they are going to right or take away the document out of your report. In the event that they disagree along with your dispute, you’ve got the choice so as to add a press release to your report explaining your aspect of the story.

- Apply for a non-ChexSystems account: Whatever the consequence, it’s advisable to contemplate making use of for a non-ChexSystems checking account whereas ready for the dispute course of to resolve. It will guarantee you’ve got a functioning checking account throughout this time. Take into account that the dispute course of could be time-consuming and will take a number of weeks and even months earlier than your document is cleared.

By following these steps, you possibly can provoke a dispute with ChexSystems and work in direction of resolving any inaccuracies or incomplete data in your report.

What’s the distinction between banks that don’t use ChexSystems and second probability banking?

The distinction between banks that don’t use ChexSystems and second probability banking lies primarily of their method to reviewing a person’s ChexSystems document when making use of for a checking account.

Banks That Don’t Use ChexSystems:

While you apply for a checking account at these banks, your ChexSystems document is not going to be checked. Which means they don’t contemplate any unfavourable historical past or points you might have had with earlier financial institution accounts when deciding whether or not to approve your software. Often, these banks have low or no steadiness necessities, although they might require month-to-month upkeep charges. Nevertheless, you possibly can nonetheless take pleasure in typical banking providers like on-line banking and invoice pay. Overdraft safety may be provided.

Second Likelihood Checking Account:

Alternatively, second probability banking includes a extra thorough analysis of your ChexSystems document. Usually, these banks will evaluate your historical past with earlier financial institution accounts, which can embody any overdrafts, bounced checks, or account closures. Whereas some upkeep charges could also be required, second probability banking additionally gives a possibility for people to rebuild their banking historical past and regain belief. Which means as you identify a constructive observe document with a second probability account, chances are you’ll ultimately be eligible for an everyday checking account. It’s value noting that as a result of second probability banks do verify your ChexSystems report, they could have extra necessities. As an illustration, they might ask you to finish a private finance class.

Each banks that don’t use ChexSystems and second probability banking supply people the flexibility to renew important banking actions equivalent to writing checks and utilizing a debit card for purchases. Whereas there could also be minor distinctions between the 2, each choices function options for folks with a less-than-perfect banking historical past.

What number of banks and credit score unions within the US use ChexSystems?

In response to eFunds, ChexSystems is utilized by greater than 9,000 banks throughout the USA for screening functions. These banks collectively function over 100,000 branches nationwide. Impressively, the variety of banks using ChexSystems accounts for greater than 80% of all monetary establishments within the nation.

Do banks and credit score unions typically evaluate credit score experiences when deciding whether or not to approve a checking account?

Sure, when people apply for a checking account, it’s attainable for sure banks and credit score unions to judge their credit score report by accessing data from main credit score bureaus like Equifax, Experian, or TransUnion. The aim of this evaluation is to help within the decision-making course of relating to the approval of the checking account software and to doubtlessly set up particular situations, equivalent to figuring out deposit limits, minimal steadiness necessities, or relevant charges. Whereas it isn’t a widespread follow, it’s value noting that some monetary establishments might select to contemplate a potential buyer’s credit score historical past as a part of their general analysis course of.

Do non-ChexSystems banks nonetheless evaluate different data like TeleCheck or Early Warning Companies?

Sure, some non-ChexSystems banks might certainly evaluate different data, equivalent to these maintained by TeleCheck or Early Warning Companies (EWS). You will need to observe that being listed with both TeleCheck or EWS would possibly end result within the rejection of a checking account software, even when the applicant doesn’t have any points with ChexSystems. Nevertheless, it’s value mentioning that there are banks that don’t reference any of those extra techniques. Subsequently, it’s attainable for people to have a document with ChexSystems however not with EWS or TeleCheck.

One of the best second probability banks by state

Most main banks aren’t no ChexSystems banks or supply second probability checking, however many group banks and credit score unions have them underneath numerous names, equivalent to “Alternative Checking” and “Recent Begin Checking.”

Our editorial employees frequently updates the record of banks providing no ChexSystems and second probability checking in each state. Right here’s an outline of those accounts and the place you will discover them at branches in your space. Click on in your state to get the great record!

Prepared for Your Second Likelihood?

In the event you’ve skilled points with below-average credit, checking account points, or bounced checks, CreditInfoCenter may also help you get again on observe towards a wholesome monetary future. Our purpose is to information you thru the complicated monetary roadmap to search out the banks or credit score unions that may greatest meet your wants.

The overwhelming majority of the time, you may get a checking account with ALL the options and advantages you want with no charges, minimums, or restrictions. We’re glad you discovered us. Now, allow us to show you how to discover the appropriate monetary associate for you.

Chime is a monetary know-how firm, not a financial institution. Banking providers and debit card issued by The Bancorp Financial institution, N.A. or Stride Financial institution, N.A.; Members FDIC. Credit score Builder card issued by Stride Financial institution, N.A.

1Eligibility necessities apply. Overdraft solely applies to debit card purchases and money withdrawals. Limits begin at $20 and could also be elevated as much as $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal charges might apply besides at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Money deposit or different third-party charges might apply.

3Early entry to direct deposit funds depends upon the timing of the submission of the cost file from the payer. We usually make these funds out there on the day the cost file is obtained, which can be as much as 2 days sooner than the scheduled cost date.

4Prospects are restricted to 3 $1,000 money deposits at Walgreens every day and $10,000 every month.

5Typically prompt transfers could be delayed. The recipient should use a legitimate debit card to say funds. As soon as you might be accepted for a Chime Checking Account, see your issuing financial institution’s Deposit Account Settlement for full Pay Anybody Transfers particulars. Please see the again of your Chime debit card on your issuing financial institution. See Phrases and Situations.

6The Annual Proportion Yield (“APY”) for the Chime Financial savings Account is variable and will change at any time. The disclosed APY is efficient as of September 20, 2023. No minimal steadiness required. Will need to have $0.01 in financial savings to earn curiosity.

7Early entry to direct deposit funds depends upon the timing of the submission of the cost file from the payer. We usually make these funds out there on the day the cost file is obtained, which can be as much as 2 days sooner than the scheduled cost date.

1Direct deposit funds could also be out there to be used for as much as two days earlier than the scheduled cost date. Early availability is just not assured.

2Discovered is a monetary know-how firm, not a financial institution. Enterprise banking providers are offered by Piermont Financial institution, Member FDIC. The funds in your account are FDIC-insured as much as $250,000 per depositor for every account possession class. The Discovered Mastercard Enterprise debit card is issued by Piermont Financial institution pursuant to a license from Mastercard Inc. and could also be used in all places Mastercard debit playing cards are accepted.

1Household Accounts: Activated, personalised card required. Different charges apply to the extra account. Members of the family age 13 years and over are eligible. Restrict 4 playing cards per account. See Deposit Account Settlement for particulars.

2Money again, as much as $75 per yr, is credited to card steadiness at finish of reward yr and is topic to profitable activation and different eligibility necessities. Redeem rewards utilizing our web site or app. You’ll earn money again of three p.c (3%) on qualifying purchases made at Walmart.com and within the Walmart app utilizing your card or your card quantity, two p.c (2%) at Walmart gas stations, and one p.c (1%) on qualifying purchases at Walmart shops in the USA (much less returns and credit) posted to your Card throughout every reward yr. Grocery supply and pickup purchases made on Walmart.com or the Walmart app earn 1%. For the needs of money again rewards, a “reward yr” is twelve (12) month-to-month durations during which you’ve got paid your month-to-month payment or had it waived. See account settlement for particulars.

3Curiosity is paid yearly on every enrollment anniversary primarily based on the typical day by day steadiness of the prior one year, as much as a most common day by day steadiness of $1,000, if the account is in good standing and has a constructive steadiness. 2.00% Annual Proportion Yield might change at any time earlier than or after account is opened. Annual Proportion Yield is correct as of 5/15/23.

4Direct Deposit: Early availability of direct deposit depends upon timing of payroll’s cost directions and fraud prevention restrictions might apply. As such, the supply or timing of early direct deposit might range from pay interval to pay interval. Be certain the identify and social safety quantity on file along with your employer or advantages supplier matches what’s in your Walmart MoneyCard account precisely. We won’t be able to deposit your cost if we’re unable to match recipients.

5Choose-in required. $15 payment might apply to every eligible buy transaction that brings your account unfavourable. Steadiness have to be delivered to at the least $0 inside 24 hours of authorization of the primary transaction that overdraws your account to keep away from the payment. We require instant cost of every overdraft and overdraft payment. Overdrafts paid at our discretion, and we don’t assure that we are going to authorize and pay any transaction. Study extra about overdraft safety.

6No month-to-month payment with qualifying direct deposit, in any other case $5.94 a month. Waived when $500+ is loaded within the earlier month-to-month interval. First month-to-month payment happens upon first use, the day after card activation or 90 days after card buy, whichever is earlier.

Need to earn money again on Walmart purchases – as much as $75 every year? You then would possibly love the Walmart MoneyCard.

Need to earn money again on Walmart purchases – as much as $75 every year? You then would possibly love the Walmart MoneyCard.

Lili was custom-made for freelancers and unbiased contractors who’re working as sole proprietors and single-member LLCs and we actually like their providing. Lili goals to approve most accounts inside 2-3 days, however some accounts are accepted in 2-3 hours.

Lili was custom-made for freelancers and unbiased contractors who’re working as sole proprietors and single-member LLCs and we actually like their providing. Lili goals to approve most accounts inside 2-3 days, however some accounts are accepted in 2-3 hours.

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. In the event you don’t qualify for a standard account, the Go Additional account will show you how to get there in as little as 12 months. We contemplate this a low-cost second probability checking. So long as you make a complete deposit of $500 for the month, decide to obtain eStatements and make 15 month-to-month transactions, the $9.95 upkeep payment is waived.

Go Farther from GTE Monetary helps put you on the trail to a greater checking account. In the event you don’t qualify for a standard account, the Go Additional account will show you how to get there in as little as 12 months. We contemplate this a low-cost second probability checking. So long as you make a complete deposit of $500 for the month, decide to obtain eStatements and make 15 month-to-month transactions, the $9.95 upkeep payment is waived.

Acorns is making a reputation as a spot to speculate cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. That makes Acorns one other of our favourite financial institution accounts. As an organization constructed to compete with the most important banks, Acorns presents some extraordinary advantages.

Acorns is making a reputation as a spot to speculate cash for the long run, however what we actually like is that they provide each checking and financial savings accounts. That makes Acorns one other of our favourite financial institution accounts. As an organization constructed to compete with the most important banks, Acorns presents some extraordinary advantages.

Wells Fargo not too long ago modified the Alternative Checking account to Clear Entry Banking. And we like one change, specifically. Wells Fargo has finished away with overdraft and non-sufficient funds (NSF) charges.

Wells Fargo not too long ago modified the Alternative Checking account to Clear Entry Banking. And we like one change, specifically. Wells Fargo has finished away with overdraft and non-sufficient funds (NSF) charges.

The BMO Good Cash checking account may be an ideal match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.

The BMO Good Cash checking account may be an ideal match so long as you don’t have any earlier incidences of fraud in your ChexSystems report. Approval is instant and the method takes about 5 minutes.

Regardless of your banking previous, Navy Federal Credit score Union presents conventional checking for all members throughout the US. With no evaluate necessities of your banking historical past, NFCU is a wonderful alternative for energetic obligation or retired US navy, relations and authorities contractors. There are two banking selections to select from: Lively Responsibility Checking and Free eChecking.

Regardless of your banking previous, Navy Federal Credit score Union presents conventional checking for all members throughout the US. With no evaluate necessities of your banking historical past, NFCU is a wonderful alternative for energetic obligation or retired US navy, relations and authorities contractors. There are two banking selections to select from: Lively Responsibility Checking and Free eChecking.

Varo Financial institution is one other internet-only financial institution with providers primarily based on their cellular apps for Apple and Android units. Varo doesn’t cost charges at 55,000+ Allpoint ATMs and presents robust budgeting instruments and computerized financial savings packages.

Varo Financial institution is one other internet-only financial institution with providers primarily based on their cellular apps for Apple and Android units. Varo doesn’t cost charges at 55,000+ Allpoint ATMs and presents robust budgeting instruments and computerized financial savings packages.

Ally Financial institution has been one of the crucial extremely rated on-line banks for the previous a number of years. It’s not as a result of they’ve probably the most options, however as a result of they persistently make their prospects delighted with the options the financial institution presents.

Ally Financial institution has been one of the crucial extremely rated on-line banks for the previous a number of years. It’s not as a result of they’ve probably the most options, however as a result of they persistently make their prospects delighted with the options the financial institution presents.

The Citi® Entry Checking account is a stable possibility for those who’ve been blacklisted by ChexSystems or Early Warning Programs. So long as you haven’t been flagged for fraudulent conduct and don’t owe Citibank an impressive quantity, approval charges for this account are good.

The Citi® Entry Checking account is a stable possibility for those who’ve been blacklisted by ChexSystems or Early Warning Programs. So long as you haven’t been flagged for fraudulent conduct and don’t owe Citibank an impressive quantity, approval charges for this account are good.

The Capital One 360 Checking Account makes use of a proprietary approval course of that doesn’t embody ChexSystems and may be a stable possibility for many who have had previous monetary challenges.

The Capital One 360 Checking Account makes use of a proprietary approval course of that doesn’t embody ChexSystems and may be a stable possibility for many who have had previous monetary challenges.

United Financial institution doesn’t use ChexSystems or a credit score report whenever you apply for his or her Important Checking account.

United Financial institution doesn’t use ChexSystems or a credit score report whenever you apply for his or her Important Checking account.